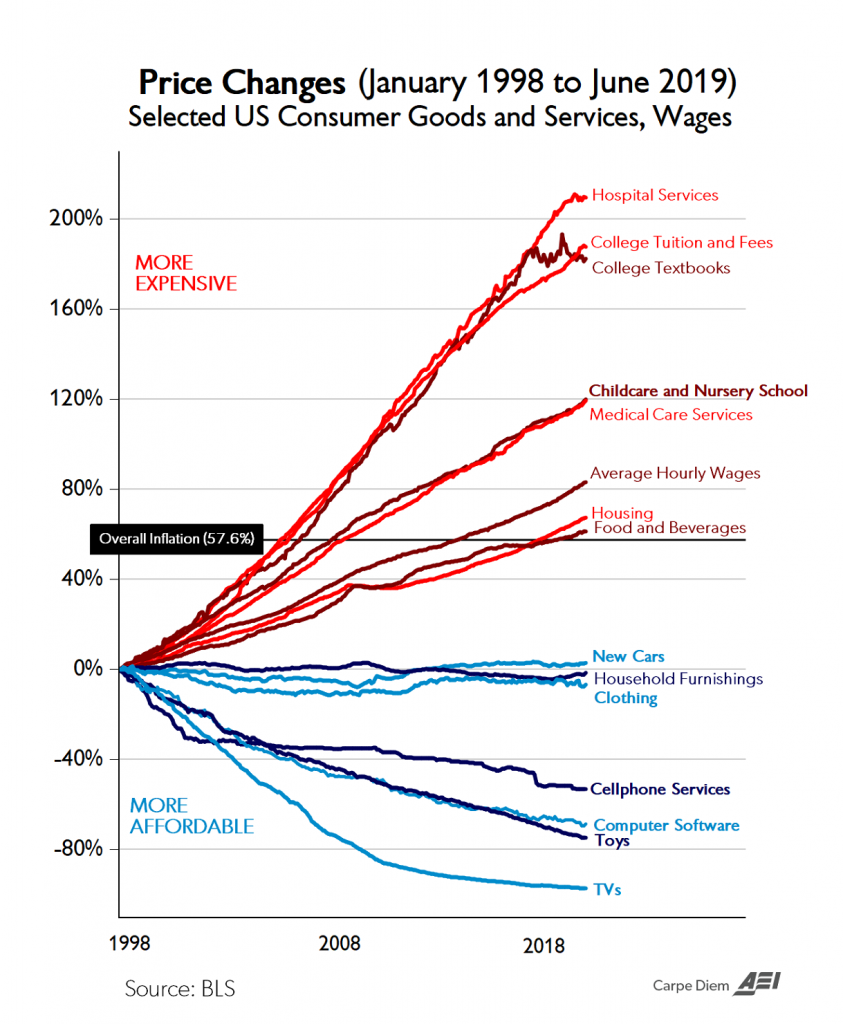

1.Chart of the Century

AEIdeas Mark J. Perry@Mark_J_Perry

Found at https://www.morningbrew.com/

2.IPO Market on Watch as Peloton Closes Down on Opening Day.

https://www.cnbc.com/quotes/?symbol=pton&qsearchterm=pton

Endeavor Pulls IPO After Peloton’s Poor Debut

Entertainment company was expected to begin trading Friday; Peloton slides in first day of trading

By

Maureen Farrell, Corrie Driebusch, Miriam Gottfried and Allison Prang

Updated Sept. 26, 2019 7:01 pm ET

The IPO market took another hit Thursday as Endeavor Group Holdings Inc. yanked its planned offering, and Peloton Interactive Inc.’s shares skidded on their first day of trading.

IPO ETF-14% off highs

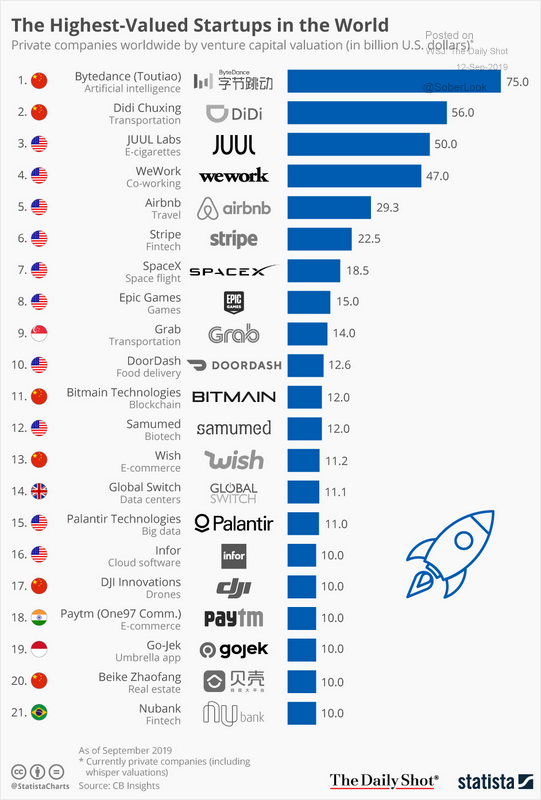

3.The Highest Valued Startups in the World.

https://www.linkedin.com/in/donsteinbrugge/

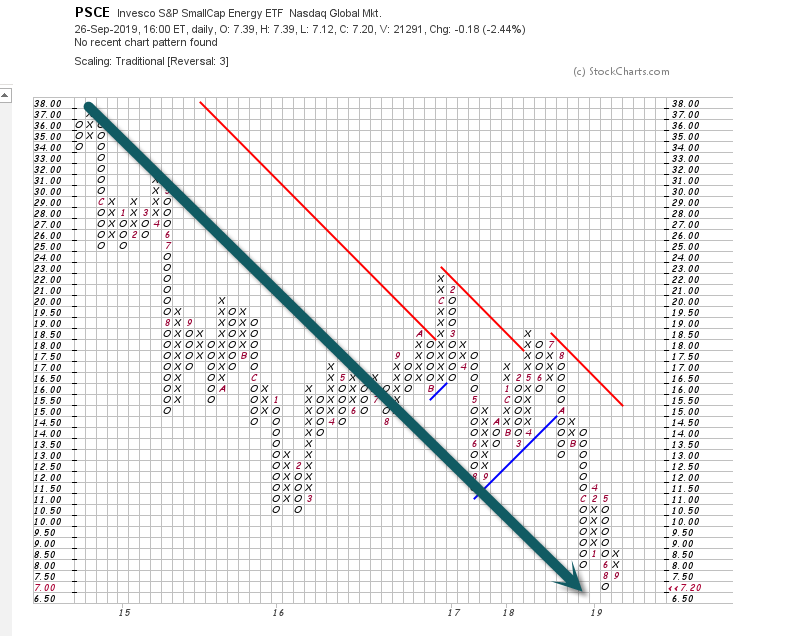

4.Insiders Are Buying Energy Stocks on the Cheap

By

Wall Street has rarely been this bearish on energy stocks. The sector makes up its smallest percentage of the S&P 500 index in at least 40 years, at less than 5%. J.P. Morgan analyst Dubravko Lakos-Bujas calls the situation “extreme,” noting that “small-cap E&Ps [are] trading below book value and at price levels seen almost 25 years ago,” as “institutional investors have abandoned the sector.”

At the same time, insiders—sometimes called “the smart money”—and the companies themselves are loading up on the shares, a bullish sign.

“In contrast, corporate sentiment is bullish with insider purchases rising to cycle highs and shareholder return at about 6% with stronger buyback announcements and higher dividends,” Lakos-Bujas wrote.

“We believe favorable technicals, improving fundamentals with stabilizing business cycle, and ongoing geopolitical tensions in the Middle East could help redirect flows into this universally hated and cheap sector,” he wrote.

Oil investors have been particularly concerned about global demand, which is expected to stagnate next year as economies around the world slump. But J.P. Morgan is more bullish on the global economy, given low interest rates and other factors.

“With renewed synchronized global monetary easing and stimulus underway, liquidity conditions are starting to improve, which often leads to actual economic growth by about six months,” Lakos-Bujas wrote.

He’s also optimistic that “trade tensions should ease” with U.S. elections approaching.

Given all that, Lakos-Bujas recommends that investors buy energy stocks, and particularly explorers and producers. The note doesn’t mention specific names, but exchange-traded funds that play the industry include SPDR S&P Oil & Gas Exploration & Production (ticker: XOP) and iShares U.S. Oil & Gas Exploration & Production (IEO).

The SPDR ETF was down 3% on Thursday, as the Dow fell 0.2%.

Write to Avi Salzman at avi.salzman@barrons.com

PSCE-Small Cap Energy 600…$37 to $7

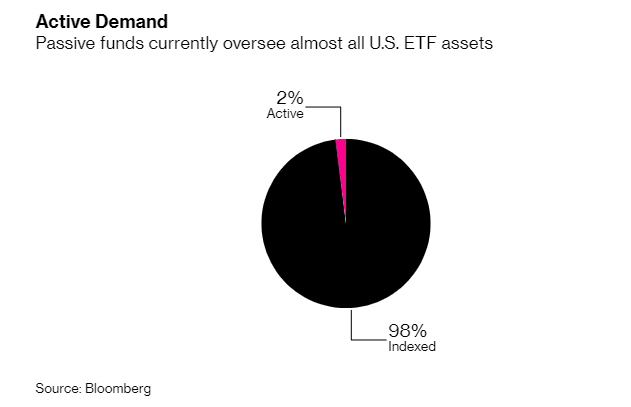

5.Invesco Offering First Active ETFs that Conceal Holdings.

Invesco Seeks SEC Nod for ETF Designed to Thwart Copycats

By

The firm wants to keep portfolio holdings confidential

Products would be actively run, like most mutual funds

Invesco Ltd. wants to start a new type of exchange-traded fund that conceals its portfolio.

The actively-managed ETFs would rely on Invesco’s own, proprietary design, according to regulatory filings from the $1.2 trillion money manager. Unlike conventional ETFs, which mostly track an index and publish a full list of assets every day, these funds would keep some of their holdings hidden to protect their strategies from copycats.

6..Berkshire Is Getting Ready for the Next Crash?

Building cash reserves and moving away from securities purchases suggests that Warren Buffett sees trouble ahead

September 26, 2019 | About: BRK.A +0% BRK.B +0%

Investors and economists have many tools and rules for measuring the temperature of the overall market. One method is to take the ratio of the total market capitalization of all U.S. stocks to U.S. gross domestic product. This particular method has come to be known as the Buffett Indicator, in honor of its leading exponent, Warren Buffett (Trades, Portfolio) of Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B).

For years, Buffett has sung its praises as a simple tool for measuring the relative valuation of the stock market compared to the broader economy:

“It is probably the best single measure of where valuations stand at any given moment.”

As we discussed in a recent research note, the Buffett Indicator has been giving the danger signal for some time. Yet, despite having first flashed a warning in 2013, Buffett remained unperturbed for years, continuing to buy stocks and advise others to do likewise.

Buffett’s longtime optimism may at last be turning. With Berkshire hoarding cash amidst growing global economic turmoil, it appears the Oracle of Omaha sees danger ahead and is getting ready for the deluge.

That was then

Despite the Buffett Indicator signaling an increasingly overheated stock market, Buffett kept on buying stocks. In a Bloomberg interview on Aug. 30, 2018, Buffett was asked about his famous indicator. Despite hitting near-historic levels, the guru did not appear worried:

“I’m buying stocks, but I’m not buying them because I think they’re going to go up next year. I’m buying them because I think they’ll be worth quite a bit more money 10 years or 20 years from now. And I don’t know whether they’re gonna go up or down tomorrow, next week, or next month, or next year. I do know they’re good businesses…We keep buying as long as we find something that’s attractive to us. An attractive business at a reasonable price. And I love it if it’s at a really juicy price, but I still keep buying.”

More recently, in his annual letter to shareholders in February, Buffett signaled that Berkshire would likely continue buying stocks throughout 2019:

“In the years ahead, we hope to move much of our excess liquidity into businesses that Berkshire will permanently own. The immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects. That disappointing reality means that 2019 will likely see us again expanding our holdings of marketable equities. We continue, nevertheless, to hope for an elephant-sized acquisition.”

This is now

Things appear to have changed in Berkshire World in recent months. As we discussed in a recent research note, the insurance conglomerate has moved away from its stock-buying pattern, instead opting to hold unprecedented amounts of cash. Buffett always wants to put his money to work. The float created by Berkshire’s stellar insurance business – and by several other lucrative operating companies across the sprawling conglomerate – has been put to work buying stocks and, whenever possible, buying whole companies.

While Buffett lamented the dearth of acquisition opportunities in his most recent annual letter, he had not lost hope. Given the increasingly shaky macroeconomic environment at home and abroad, it is not terribly surprising that the investor has opted to keep his powder dry. Berkshire likes to own companies where possible. Thus, a stock market correction, or even a recession, could create a perfect opportunity for Buffett to pounce on targets that may currently be trading a bit too richly.

In many ways, that patience is one of Buffett’s strongest advantages. Because he runs Berkshire like a family business rather than as, say, a hedge fund or private equity fund, he does not feel the same pressure to make acquisitions. He can afford to be patient:

“The stock market is a no-called-strike game. You don’t have to swing at everything – you can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling, ‘Swing, you bum!’”

Pitches are flying, but Buffett is not swinging yet.

What comes next

Berkshire is perfectly poised to take advantage of a recession to its benefit. Investors hoping for a return to Berkshire’s glory days may not have long to wait. The conglomerate’s best years have been during times of panic, when Buffett had the resources to scoop up opportunities and benefit from the better information afforded to strategic partners, rather than exterior analysis.

In a follow-up research note, we will discuss how Buffett may put Berkshire’s dry powder to good use in the coming years.

The Oracle of Omaha prophesies trouble ahead. We consider that a warning worth heeding.

Disclosure: No positions.

https://www.gurufocus.com/news/952838/berkshire-is-getting-ready-for-the-next-crash-

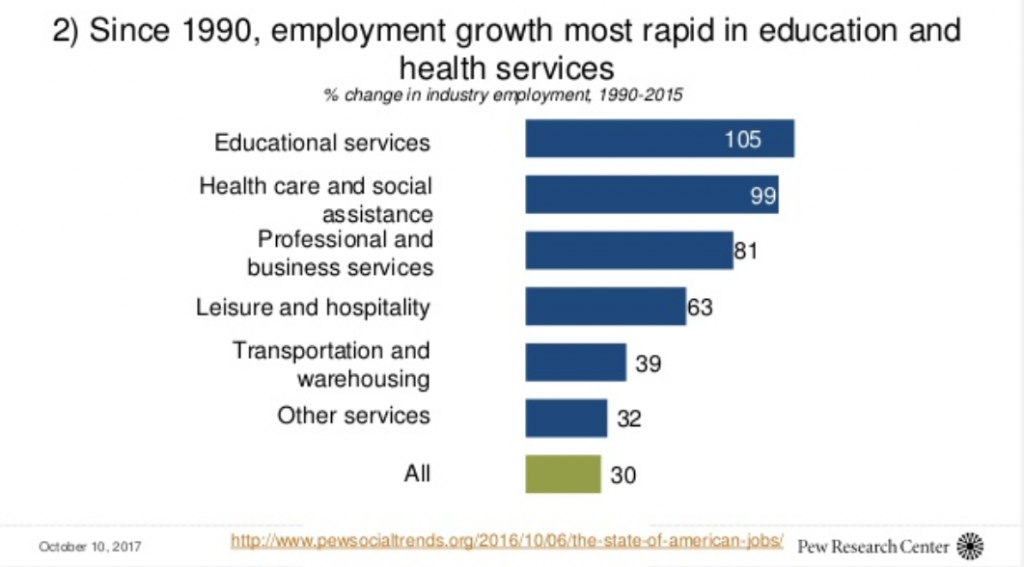

7.Since 1990 Employment Growth Led by Education and Health.

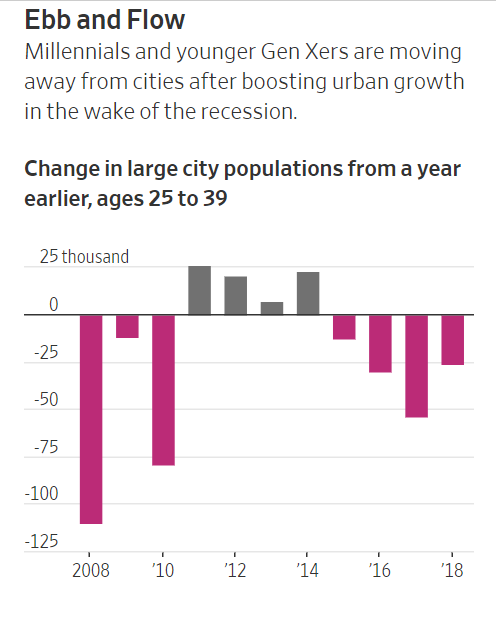

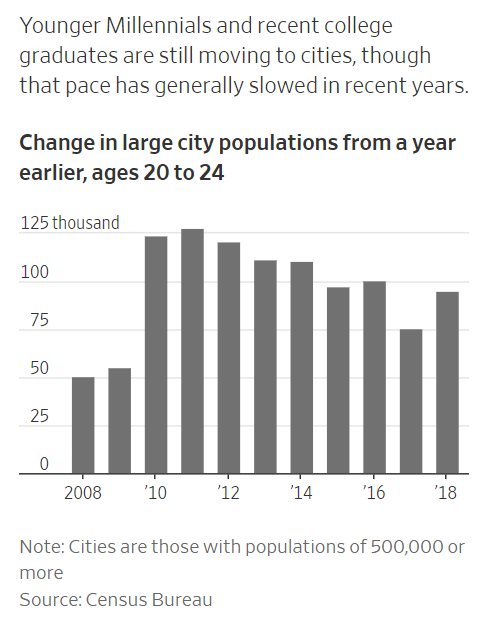

8.Millennials Continue to Leave Big Cities

Census figures show smaller drop in young urban residents than previous years, but many still leaving for cheaper housing, better schools

9.The Full Official Trailer fort “The Irishman” is Out.

10. Billionaire Ray Dalio says this outlook will help you achieve your dreams

Published Thu, Sep 26 2019 2:10 PM EDT

Ray Dalio, founder of investment firm Bridgewater Associates, speaking at the WEF in Davos, Switzerland on Jan. 22, 2019.

Adam Galica | CNBC

It’s often argued that some people are dreamers while others are realists. But hedge-fund billionaire Ray Dalio believes that you need both qualities to be successful.

In fact, Dalio says all dreamers need a healthy dose of realism to help them achieve their dreams. “Being hyperrealistic will help you choose your dreams wisely and then achieve them,” Dalio wrote in a Facebook post on Thursday.

Dalio is the founder of the world’s largest hedge fund, Bridgewater Associates, which manages roughly $160 billion in assets.

In that social-media post, Dalio touts the importance of balancing realism and idealism by pursuing your dreams while also being as realistic as possible about the best ways to achieve them.

“Understanding, accepting and working with reality is both practical and beautiful,” Dalio writes on Facebook. “I have become so much of a hyperrealist that I’ve learned to appreciate the beauty of all realities, even harsh ones, and have come to despise impractical idealism.”

By “impractical idealism,” Dalio is referring to the way of thinking that’s mostly associated with dreamers who either never follow through and pursue their lofty ideals, or who do so in impractical, or unrealistic, ways. (For instance, an impractical idealist could be more likely to spend more time daydreaming about success than actually working to achieve their goals.)

Top of Form

Bottom of Form

But Dalio isn’t against dreaming at all, he asserts. “Don’t get me wrong: I believe in making dreams happen,” the billionaire writes on Facebook. “To me, there’s nothing better in life than doing that. The pursuit of dreams is what gives life its flavor.

“My point is that people who create great things aren’t idle dreamers: They are totally grounded in reality,” he says.

A 2018 Psychology Today article notes that dreaming about success is more effective when a person also imagines the realistic obstacles they’ll face on the path to their dreams. “Successful goal pursuits require figuring out which wishes are desirable and feasible and which ones to let go,” Shahram Heshmat, an associate professor emeritus at the University of Illinois at Springfield, writes in the article.

legacy he wants to leave behind

Dalio’s post is part of a series of the “Principles” he regularly posts on social media, many of which stem from his 2017 book, “Principles: Life & Work,” in which the billionaire shares his insights into leadership and success.

Dalio is far from the only business leader who believes that success requires a mix of idealism and practicality.

In 2016, Apple CEO Tim Cook discussed the characteristics he looks for in Apple employees, and one of them is “agitated idealism.” Cook describes the characteristic this way: “We look for people who won’t accept the status quo, people who aren’t satisfied with the way things are, that really want to change the world and sort of put all of themselves into doing it,” Cook said at the time.

At the same time, Cook added that Apple looks for employees who are “wicked smart” and have “grit and determination.” In other words, the ability to dream about changing the world is essential for success at the tech giant, but so is the ability to bear down and get to work on achieving those goals.

Don’t Miss:

https://www.cnbc.com/2019/09/26/ray-dalio-says-this-outlook-will-help-you-achieve-your-dreams.html