1. Vanguard vs. The World

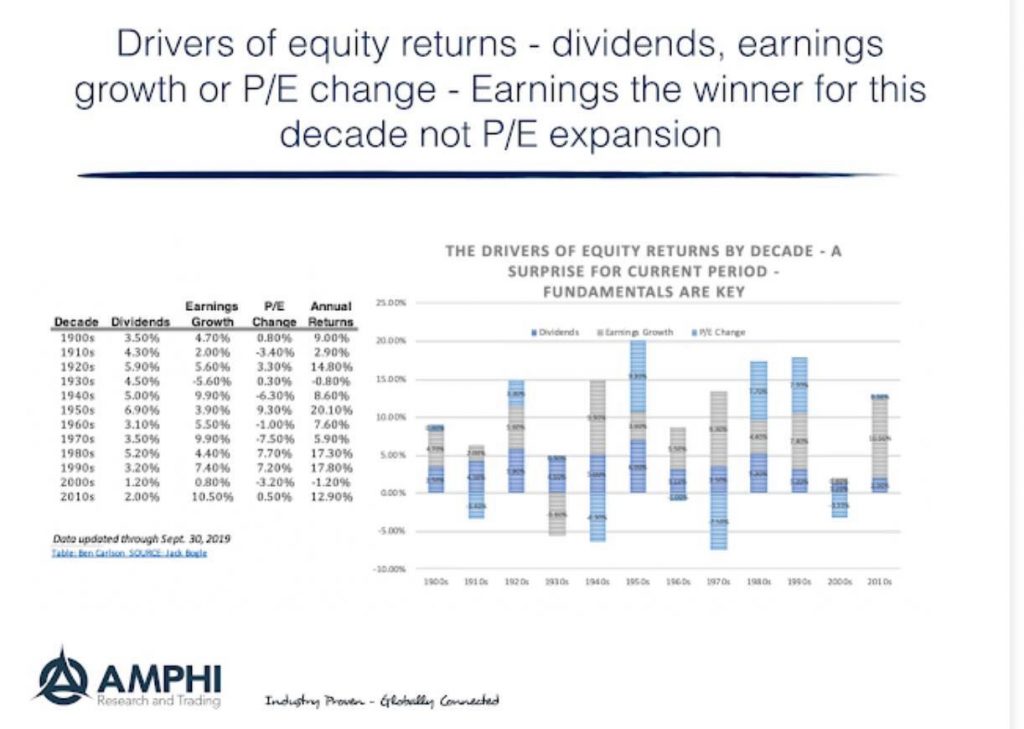

https://mrzepczynski.blogspot.com/2019/11/the-drivers-of-equity-return-by-decade.html

Found at Abnormal Returns www.abnormalreturns.com

Continue readingKEY POINTS

The record-breaking rally has brought the S&P 500′s return this year to nearly 25%, and if the gains hold up for the rest of the year, the market could have more room to run in 2020 if history is any guide.

Going back to 1928, there have been 17 occasions when the S&P 500 has scored an annual gain bigger or equal to 25%. And 71% of the time, the S&P 500 is positive in the following year with an average gain of 7%, a CNBC analysis using FactSet data found.

The S&P 500 was up 24.5% for the year through Friday’s close. Futures were pointing to some more gains on Monday.

The average is skewed by a 36% loss in 1936 around the Great Depression. Looking at the average performance in the “modern” era from 1950 forward, the average annual performance is a gain of 11.25% for the S&P 500 after a banner year.

The S&P 500 has only had five negative years following a 25% annual return since 1928.

Wall Street strategists and investors have said it’s all coming down to President Donald Trump and the China trade war if the market can close out the year with solid gains. The market has been moving on any development in the U.S.-China trade war for nearly two years.

Optimism on a trade resolution has risen recently after the two countries reached a truce and started working up a so-called phase one deal. White House economic advisor Larry Kudlow said the two countries were “getting close” to reaching a trade deal, sending stocks to new all-time highs.

To be sure, next year could be unpredictable due to the upcoming presidential election. Wall Street is already worried about the ascent of Massachusetts senator Elizabeth Warren and her wealth tax proposals. Notable investors including billionaire Paul Tudor Jones and longtime investor Leon Cooperman have warned of a market correction, should Warren take the White House.

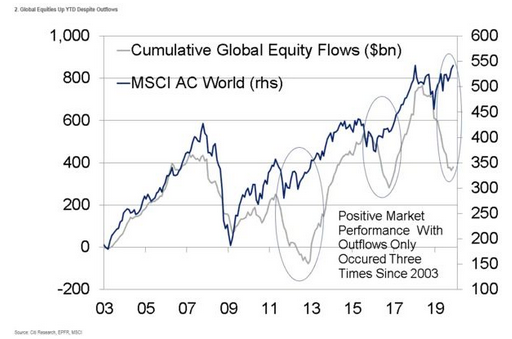

Continue readingThat said, Citi Says Next Leg in Bull Market Coming as Outflows Turn Around – Investors have sold a net $230 billion in shares this year amid a 20% rise in a gauge of global stocks – That has only happened twice before and when the trend reversed, inflows helped spur another 20% gain over the next year, they said. “November is on track to be the first month of inflows into emerging and developed market equities funds in two years,” the Citi team wrote. “If they continue, this could add further momentum to the rally.”

From Dave Lutz at Jones Trading

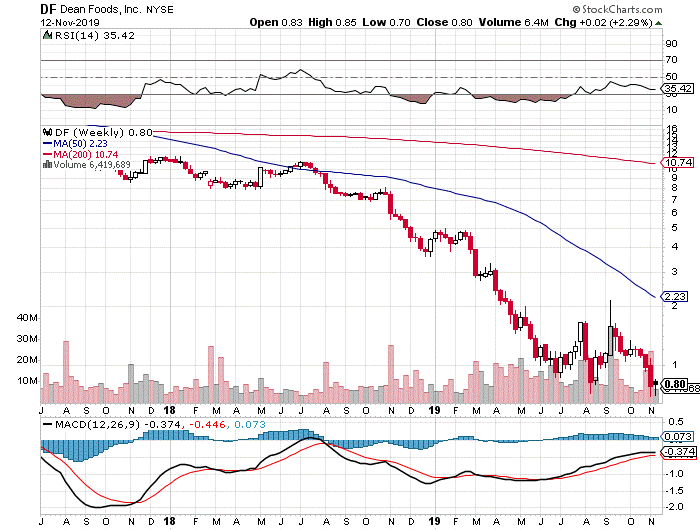

Continue readingAnd the company’s deeply distressed 6.5% bonds maturing in March 2023 recently traded at 15.5 cents on the dollar to yield 87.6%, according to IHS Markit. The spread is 8,584 basis points above comparable Treasury yields.

No. 1 milk company declares bankruptcy amid drop in demand

By MICHELLE CHAPMAN and DEE-ANN DURBINyesterday