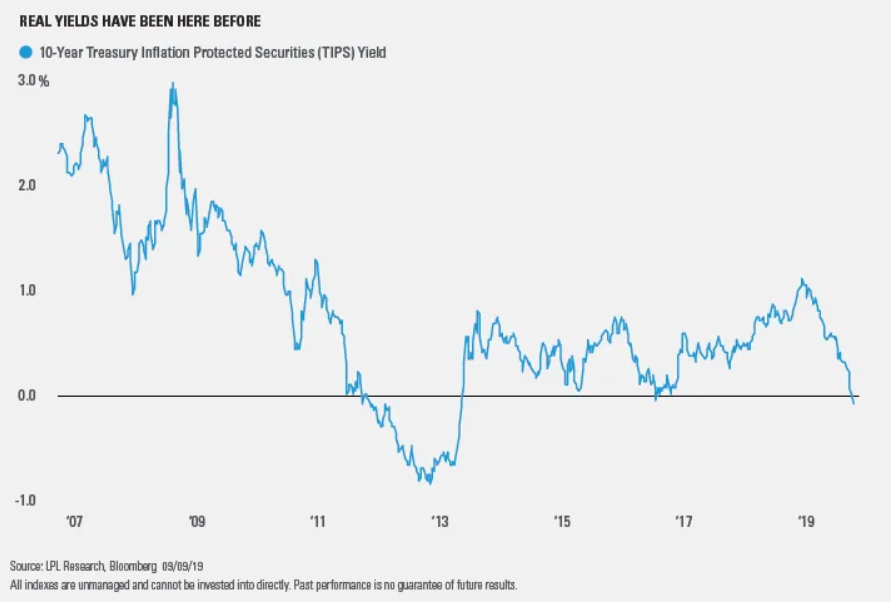

1.Real Yields (inflation adjusted) Go Negative.

Prior forays into negative territory during this cycle (in 2011, 2012, 2013, and 2016) have accompanied signs of slowing, but have also reflected the broader interest rate environment. Slower global growth, increasingly accommodative central banks, and some flight to safety due to trade uncertainty have all conspired to push rates lower.

The expected inflation rate implied by 10-year TIPS sits at about 1.5%, low historically but still higher than the cycle low and well above the near 0% hit in the heart of the last recession. Slower growth has minimized inflationary pressure, but over the last three months we have seen a modest pickup in inflation and wages.

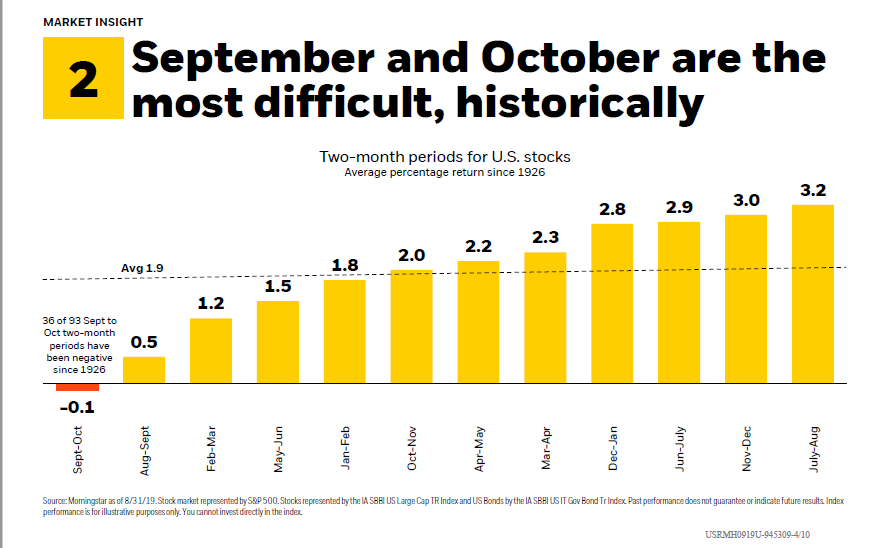

2.Sept./Oct. Combo Monthly Return History.

BLACKROCK

3. Commodity Index Broke Thru Dec. 2019 Lows…..Touching on 2017 Lows.

CRB-Commodity Index-Showing Zero Inflation

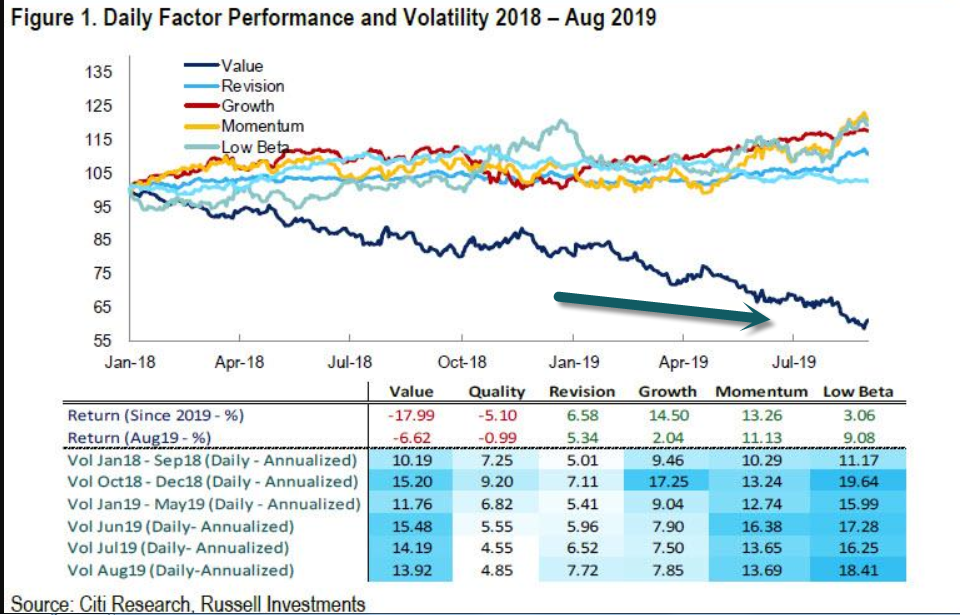

4.Another Look at Momentum/Value Trade….Look at Dramatic Fall Off of Value Verse Other Factors in Last 18 Months.

Value Starting Reversion to the Mean Trade ?

Kolanovic: What Just Happened “Has Only Occurred On Two Days In History”by Tyler Durden

https://www.zerohedge.com/markets/kolanovic-what-just-happened-has-only-occurred-two-days-history

5.Why do complexity and length sell when simplicity and brevity will do?

A few reasons.

1. Simplicity feels like an easy walk. Complexity feels like mental CrossFit.

If the reps don’t hurt when you’re exercising, you’re not really exercising. Pain is the sign of progress that tells you you’re paying the unavoidable cost of admission. Short and simple communication is different. Richard Feynman and Stephen Hawking could teach math with simple language that didn’t hurt your head, not because they dumbed down the topics but because they knew how to get from A to Z in as few steps as possible. An effective rule of thumb doesn’t bypass complexity; It wraps things you don’t understand into things you do, like a baseball player who – by keeping a ball level in his gaze – knows where the ball will land as well as a physicist calculating the ball’s flight with precision.

The problem with simplicity is that the reps don’t hurt, so you don’t feel like you’re getting a mental workout. It can create a preference for laborious learning that students are actually OK with because it feels like a cognitive bench press, with all the assumed benefits.

2. Length is often the only thing that can signal effort and thoughtfulness.

The U.S. constitution is 7,591 words. A typical business management book covering a single topic is perhaps 250 pages, or something like 65,000 words.

The funny thing is the average reader does not come close to finishing most books they buy. Even among bestsellers, average readers quit after a few dozen pages. Length, then, has to serve a purpose other than providing more material. My theory is that length indicates the author has spent more time thinking about a topic than you have, which can be the only data point signaling they might have insight you don’t. It doesn’t mean their thinking is right. And you may get enough of their thinking after two chapters. But the purpose of chapters 3-16 is often to show the author has done so much work that chapters 1 and 2 might have some insight. Same for research reports and white papers.

3. Things you don’t understand create a mystique around people who do.

If you say something I didn’t know but can understand I might think you’re smart. If you say something I can’t understand I might think you have an ability to think about a topic in ways I can’t, which is a whole different species of admiration. When you understand things I don’t I have a hard time judging the limits of your knowledge in that field, which makes me more prone to taking your views at face value.

4. Complexity gives a comforting impression of control, while simplicity is hard to distinguish from cluelessness.

In most fields a handful of variables dictate the majority of outcomes. But only paying attention to those few variables can feel like you’re leaving too much of the outcome to fate. The more knobs you can fiddle with – the 100-tab spreadsheet, or the Big Data analysis – the more control you feel you have over the situation, if only because the impression of knowledge increases. The flip side is that only paying attention to a few variables while ignoring the majority of others can make you look ignorant. If a client says, “What about this, what’s happening here?” and you respond, “Oh, I have no idea, I don’t even look at that,” the odds that you’ll sound uninformed are greater than the odds you’ll sound like you’ve mastered simplicity.

Williston once recognized that no body part, once lost to evolution, will ever come back. New organs can arise, and those that remain adapt and change. But once nature finds a way to do more with less, the cast is set, you’re never going back. “A characteristic once lost is lost forever,” he wrote.

Complexity Sells

Aug 20, 2019 by Morgan Housel

https://www.collaborativefund.com/blog/why-complexity-sells/

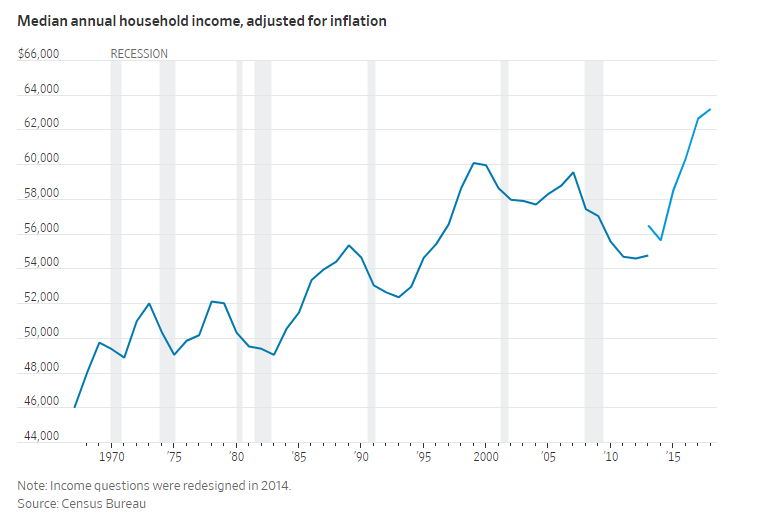

6.U.S. Median Household Income Flat for 1yr.

WSJ

WASHINGTON—American incomes remained essentially flat in 2018 after three straight years of growth, according to Census Bureau figures released Tuesday that offer a broad look at U.S. households’ financial well-being.

Median household income was $63,179 in 2018, an uptick of 0.9% that census officials said isn’t statistically significant from the prior year based on figures adjusted for inflation. The poverty rate in 2018 was 11.8%, a decrease of a half percentage point from 2017, marking the fourth consecutive annual decline in the national poverty rate. It was the first time the official poverty rate fell significantly below its level at the start of the recession in 2007.

Median U.S. Household Income Showed No Growth in 2018

Median income was $63,179, essentially flat from a year earlier after three years of increases

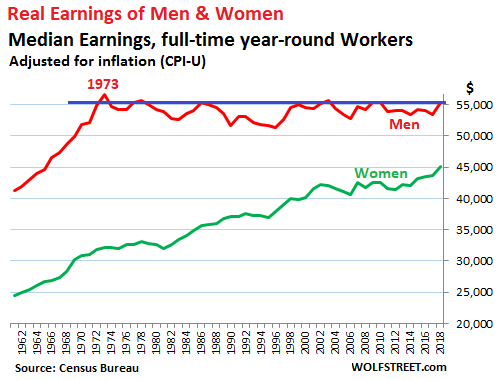

7.Men’s “Real” Earnings Below 1973 Level: Census Bureau

by Wolf Richter • Sep 10, 2019 • 164 Comments • Email to a friend

Top 20% households made out like bandits, bottom 40% got crushed.

The median earnings of men working full time year-round in 2018 ticked up to $55,291. Adjusted for inflation, this was below the amount they earned in 1973, according to the annual data trove released by the Census Bureautoday. In other words, there has been a “real” income decline for men over the past four-plus decades!

Women have seen a lot of progress in their real earnings, but they started out much lower, and they still haven’t caught up with men – whose earnings are sitting ducks. The median earnings of women working full-time year-round in 2018 ticked up to $45,097, a new record. Since 1973, women’s earnings adjusted for inflation have surged by 40%. The female-to-male earnings ratio hit a record in 2018 of 81.6%, up from 56.6% in 1973:

Read Full Story

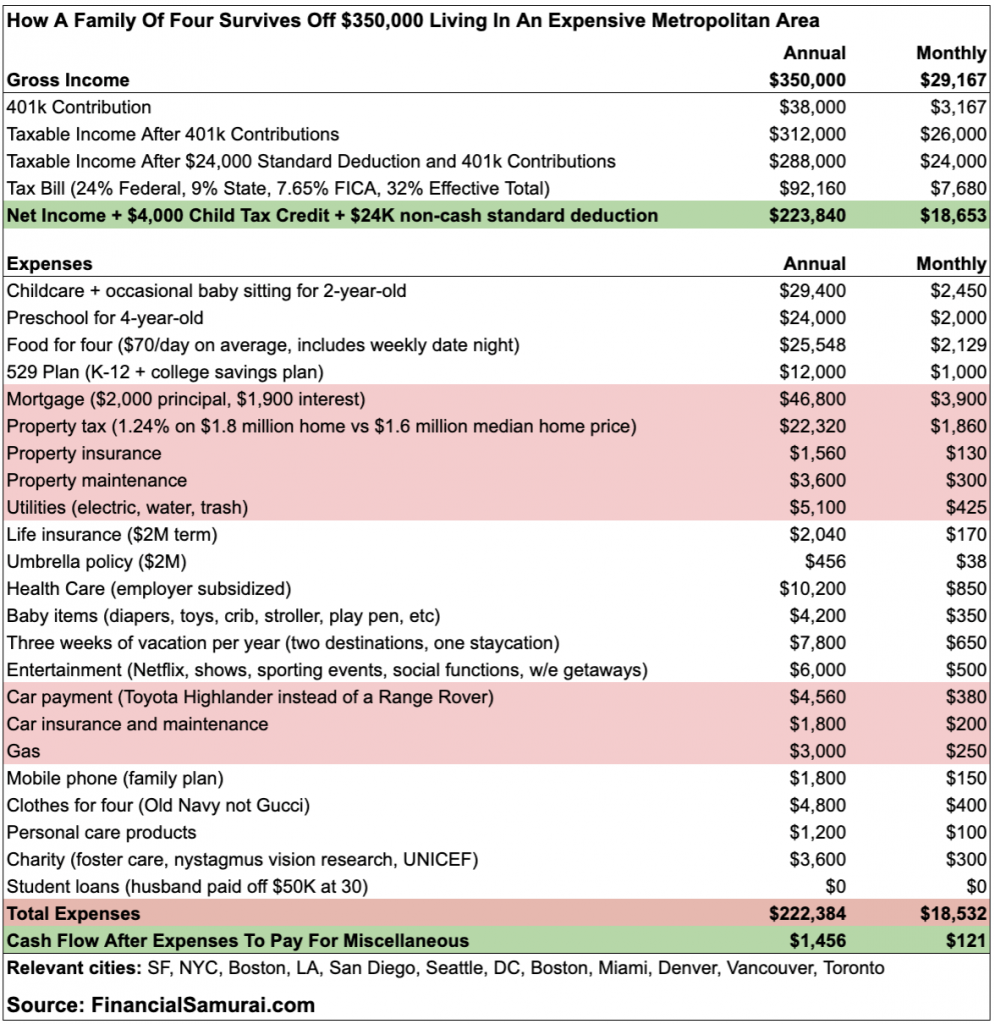

8.Big City Middle-Class Budget

Living a middle-class lifestyle on $350,000 a year

Below is an example budget of a dual-income household with two kids. The budget has been vetted by thousands of readers on my personal finance website, Financial Samurai, who also raise families in expensive cities like San Francisco, Los Angeles, New York, Boston and Washington, D.C.

Gross income review

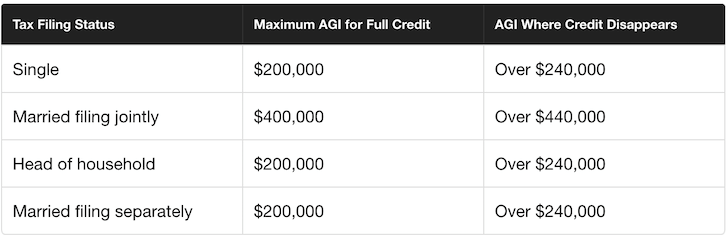

In order to make $350,000 a year, both parents must be working. In this example, each parent puts away $19,000 in their respective 401(k)s for a combined $38,000 a year. After getting their standard $24,000 deduction, they pay $92,160 in total taxes and are left with $221,840.

Because this couple earns less than $400,000, they can receive a tax credit of $2,000 per child. Since they have two children, they get a $4,000 credit.

Expenses review

- Childcare: $2,450 per month. There’s no getting around this expense when both parents are working. Their childcare center costs $2,200 a month for full-time care. The couple then spends an extra $250 a month for some babysitting help.

- Preschool: $2,000 per month. The second child goes to preschool full-time. The $2,000 per month does not include the suggested $3,000 per child donation the school asks each year to help fund new construction. The parents’ ultimate plan is to send both children to private grade school, which costs about $35,000 from K-8 and about $45,000 from 9-12.

- Food: $2,129 per month. It makes little sense to spend hours cooking when you’re already tired and want to reserve your remaining energy for taking care of your kids. The budget includes expenses like groceries, eating out and food delivery.

- Mortgage: $3,900 per month. This amount isn’t bad for a $900,000 mortgage with a 3.25% interest rate; $2,000 out of the $3,900 goes toward paying down principal and building net worth. Therefore, this couple is adding $24,000 a year in forced savings to their annual 401(k) savings.

It now costs $350,000 a year to live a middle-class lifestyle in a big city—here’s a sad breakdown of why

- Published 6 Hours AgoUpdated 3 Hours Ago

- Sam Dogen, Contributor@FINANCIALSAMURA

9.U.S. Poverty Rate Hits Lowest Level Since 2001

New data from the Census Bureau shows poverty has continued to decline, even as household incomes have been more stagnant.

By Gaby Galvin, Staff Writer Sept. 10, 2019, at 2:18 p.m.

Poverty Rate Hits Lowest Level Since 2001

More

Although the poverty rate fell last year, the median household income in 2018 wasn’t statistically different from 1999.(BRETT ZIEGLER FOR USN&WR)

MEDIAN HOUSEHOLD INCOME in the U.S. stalled in 2018, even as median earnings rose and the poverty rate fell to its lowest level in nearly two decades, according to new data released by the U.S. Census Bureau.

The median household income was $63,179 last year, statistically insignificant from the median of $62,626 in 2017. The share of people who had no health insurance also rose for the first time in about a decade, even as workers’ median earnings increased 3.4% and an additional 2.3 million people became full-time, year-round workers.

“We have found quite a big increase in full-time, year-round work that would tend to bring up incomes for working people,” Trudi Renwick, an assistant division chief at the Census Bureau, said Tuesday in a call with reporters.

However, after adjusting for changes to the agency’s data collection and analysis methods, Renwick said the median household income in 2018 was “not statistically different from either 2007, the year before the most recent recession, or 1999, which is (the) peak income year in our historical timesets.”

The poverty rate was 11.8% in 2018, its lowest mark since 2001 and the first time the rate has been significantly lower than it was in 2007, the new data shows. Across the U.S., there were 1.4 million fewer people living in poverty last year than in 2017, but recovery has been sluggish in some parts of the country. The South was the only region not to see its poverty rate fall between 2017 and 2018.

Meanwhile, the supplemental poverty rate – which considers the effect of public programs like refundable tax credits and the Supplemental Nutrition Assistance Program and serves as a broader indicator of the nation’s economic well-being – was 13.1% last year, not significantly different from 2017, the new data shows. Sixteen states and the District of Columbia saw supplemental poverty measures higher than their official poverty rates.

The new data indicates that in 2018, Social Security “continued to be the most important anti-poverty program, moving 27.3 million individuals out of poverty,” according to the Census Bureau.

Health insurance coverage trends also shifted between 2017 and 2018, with the uninsured rate rising from 7.9% to 8.5% for the first year-over-year increase since 2009, according to the Census Bureau. That uptick was largely driven by a decline in public health coverage for low-income people, with Medicaid enrollment falling 0.7 percentage points to 17.9% in 2018.

Most people get their health insurance through their employers, and roughly two-thirds of people were privately insured in 2018. The share of people insured through Medicare – which primarily covers adults 65 and older and disabled people – rose by 0.4 percentage points to 17.8%, due in large part to the country’s aging population.

In all, there were 27.5 million people – including about 4.3 million children – who lacked health insurance for the entirety of 2018.

“Health insurance coverage is affected by a variety of different factors, including changing economic conditions, shifts in the demographic composition of the population, as well as policy changes at the state and federal level,” said Laryssa Mykyta, chief of the Census Bureau’s Health and Disability Statistics Branch.

10.How I Thrive: Top CEO Robert Glazer on “Time Blocking” and Other Tips for Success

The CEO of Acceleration Partners and forthcoming author reveals his time-tested tips for success.

By

Alexandra Hayes, Multimedia Reporter

Instead of offering a cash bonus to one of his top-performing employees, Robert Glazer sent her and her daughter to Greece. It’s part of a wish-granting system that Glazer, who was ranked #2 on Glassdoor’s list of “Top CEOs of Small and Medium Companies in the U.S.” in 2018, has implemented at his company, performance marketing agency Acceleration Partners, as a more meaningful, end-of-year incentive than traditional bonuses. “She had spoken about how her grandmother lived in Greece but had only met her daughter once, and she regretted that they hadn’t spent more time together,” Glazer explains to Thrive. The initiative is one of the many ways Glazer invests in his employees. “It’s about finding out what’s important to people, and then giving them something that reflects that.”

Glazer’s human-centric approach to leadership is highlighted in his forthcoming book, Elevate: Push Beyond Your Limits and Unlock Success in Yourself and Others, which provides readers with a framework to achieve their greatest potential. Each chapter — which have titles like “Build Your Intellectual Capacity” and “Build a Better Path — are complete with action steps (much like Microsteps!) to help readers get started. “For me, frameworks are always helpful to improve in a lot of areas of life,” he says. “Even if it’s just one percent better, the cumulative effect of that improvement will make a huge impact two years down the line.”

Below and in Glazer’s “How I Thrive” video, he shares tips on productivity, managing stress, and dealing with micromanagement.

You’ve mastered some of the rules of effective management. What advice do you have for new managers?

A lot of new managers are used to doing and controlling. They have a hard time letting go of the reigns. So one of the things I always tell new managers, and this was true for me, is that things will never be 100 percent how you want them to be. You need to be comfortable with it being 85 percent how you want it. Also, I think a lot of new managers try to delegate, and then they say, “everyone did it wrong,” or “that’s not how I would have done it.” They need to spend a little more time upfront, explaining how they’d like things to be done.

What should an employee do if they feel they’re being unfairly micromanaged?

Micromanagement is debilitating. It’s the thing that exhausts people the most. But I think they need to understand the “why.” We [at Acceleration Partners] really push on understanding the “why” and maybe saying to the manager, “Hey, you’re very involved in this. Help me understand why. Am I doing a bad job, am I not doing it how you would like it?” The person should really always dig in. When you ask “why” one, two, or three times in a discussion, you really get down to a totally different level with the other person. And they may have a very vulnerable and authentic moment, and say something like, “I’m sorry, I’m just not good at letting go, and I didn’t know that it was bothering you this much.”

Your company is entirely remote. What tips do you have for people who worry about staying connected while working remotely?

First, if you would much prefer to work in an office, and that’s how you get your energy and you’re very extroverted in that way, then I probably would do that. Second, if you want to work remote, I think that you should plan intentionally. Maybe you want to go to a class in the middle of the day, maybe you join the gym, maybe you’re able to join a group, or a hobby or running club. You can definitely get your socialization in other ways if you plan for it. And look, there are some people who try working remotely and they say, “it’s not for me.” But overwhelmingly, people have been surprised by how much they actually prefer it. A lot of businesses just operate in a meeting culture: you go to work, you meet with people all day, and at the end, people are like, “I’m not sure what I actually got done.”

What are your tips for hiring the right people?

Good hiring is really a combination of aptitude and attitude. So first and foremost, it’s: Does this person have and live our company’s core values? If they don’t, it’s just not going to work. And then second: Can they do the job? Do they have the aptitude? Our interviews are really split up into a lot of questions and discussions, trying to figure out whether they meet our core values, and then we usually have some work or exercise that really mimics the type of work that they’re going to do. For example, we ask people in the client service space to edit something, and a lot of people come back and say “it wasn’t enough time,” and that they didn’t understand it, and all this stuff. They’re saying they want another chance. And our answer is like, “That is exactly the work that you’re going to have, and the other five people that did it aced it.” So it’s probably just — it’s not any judgment — but there are certain environments and roles that are just better for different people.

What are your tips for dealing with stress?

I’m a big fan of having a morning routine and being intentional with that. Not looking at technology, focusing on what you’re going to do for the day and your priorities. I think meditation is hugely helpful. Scheduling in breaks, and putting them in your calendar. Like, “hey, it’s 1:00, I’m going outside for 15 minutes.” There’s a lot of science around that, about air and rest. And I also think you need a wind-down time at the end of the night. You need to close the technology down, leave it downstairs, give yourself a window before you go to bed to sort of relax and unwind and focus on the stuff that’s important to you and that brings you energy. If you’re doing stuff all day that drains your energy, it’s definitely going to hurt your stress levels. And I think there’s a lot of science around exercise, too. Strenuous exercise, getting outside, I think all of that helps you manage stress.

Do you have any productivity hacks?

I think one of the most powerful ways to get things done is this concept of “time blocking.” It’s where you purposely block off [on your calendar] the time that you want to spend on team meetings, exercise, thinking time, writing time. You’re designing your life in terms of how you want to spend it. You will never have free time but you can schedule free time. I have a coach that works with me on this. People reach out and say, “Hey, can you chat tomorrow at 2:00?” Often times the answer is “no,” and it’s because I have done time blocking, even if that time is just dedicated to rest. I time block my schedule four to six weeks ahead. “Here’s what I want to do for meetings, here’s what I want to do for exercise, here’s what I want to do for the other stuff. Here’s my actual thinking and working time.” We all have something in our company we call “GSD”, which is “get shit done” time. You’ll see that in people’s calendars and you know it doesn’t mean “hey, you can have this time from me,” it means, “hey, I’m actually doing the stuff that I needed to deliver to everyone.”

— Published on September 10, 2019https://thriveglobal.com/stories/top-rated-ceo-robert-glazer-tips-success-time-blocking/