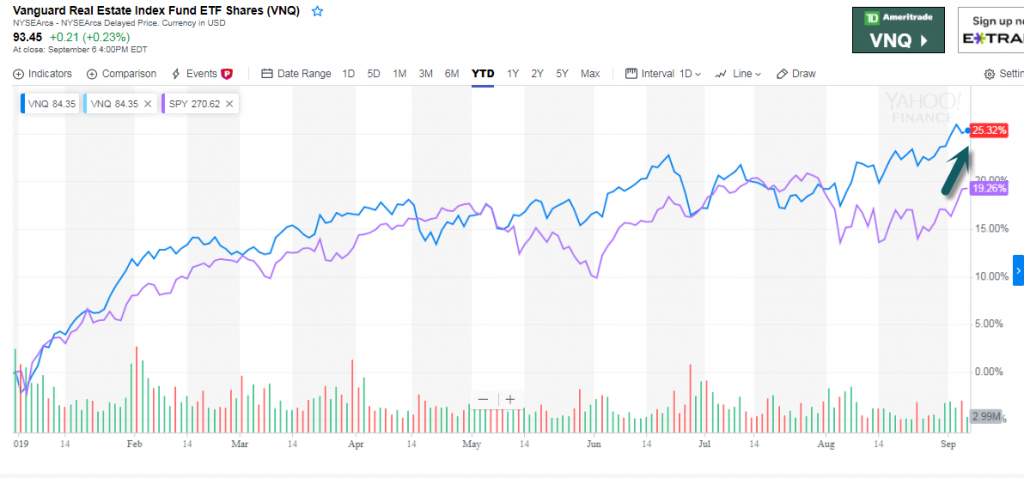

1.REIT Index +25% vs. S&P +19%

VNQ vs. S&P

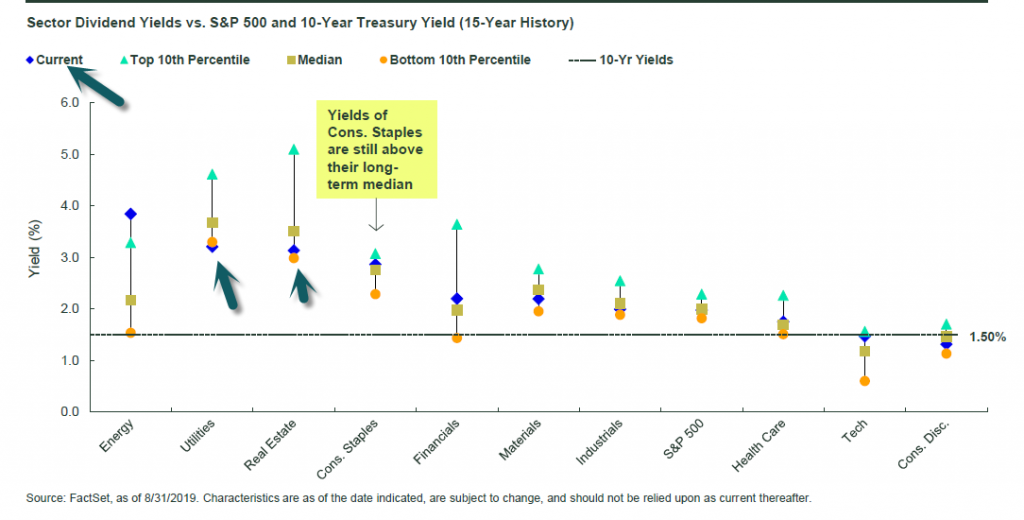

2.Spreads Between REIT and Utility Yields and 10 Yr. Treasury Yield at 15 Year Low.

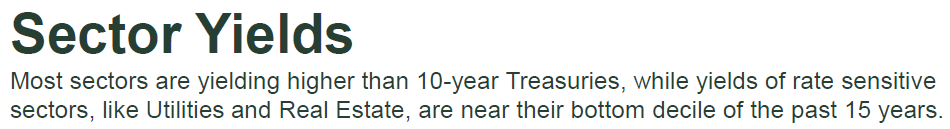

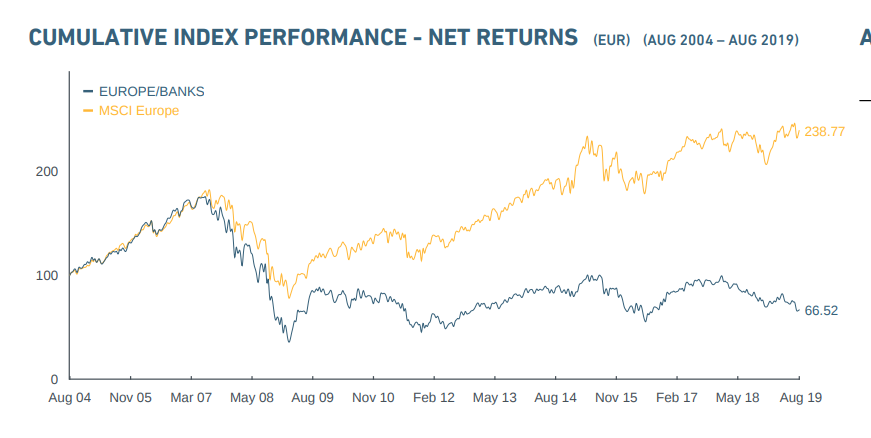

3.Euro Banks Index 10 Years Net Negative Returns….Below 2008-2009 Lows.

An index of European bank stocks has fallen almost 60% since early 2018, and stands below 2008-09 levels. Japan’s bank-stock index is down more than 40%, and U.S. banks trade at levels of almost two years ago, notwithstanding an estimated $100 billion of stock buybacks in the past two to three years.

https://www.msci.com/documents/10199/e72ea9be-ae79-4bb5-8ce0-054d4f371549

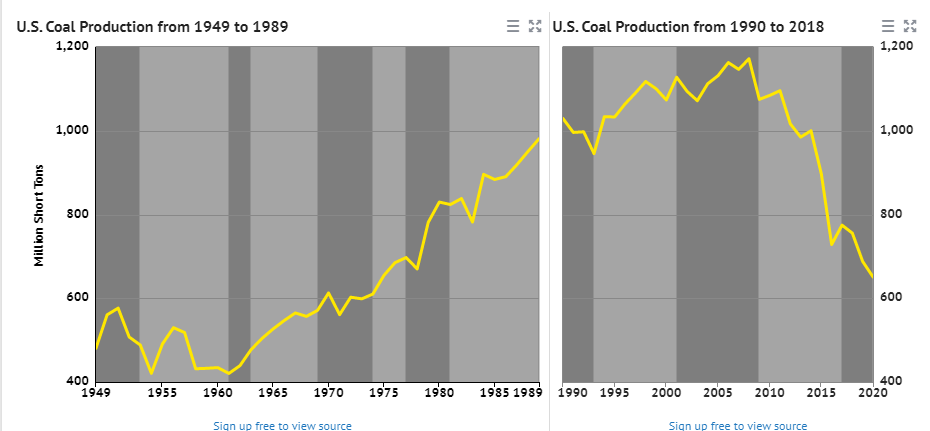

4.Coal ETF Breaks Below 3 Year Lows.

KOL-Coal ETF

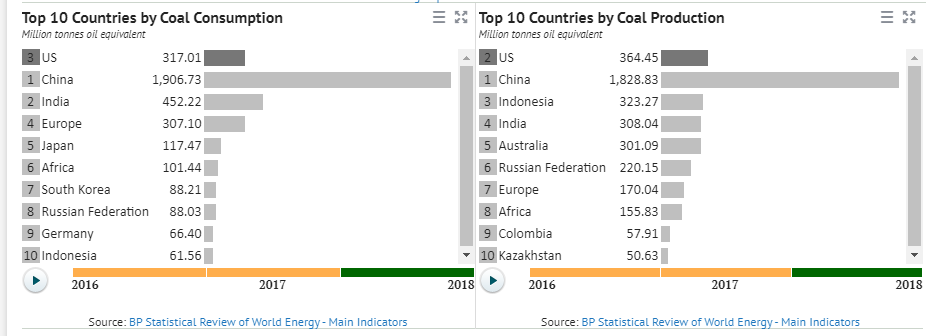

U.S. Coal Production 1990-2018

https://knoema.com/infographics/qmfwmqc/united-states-coal-revival-or-decline

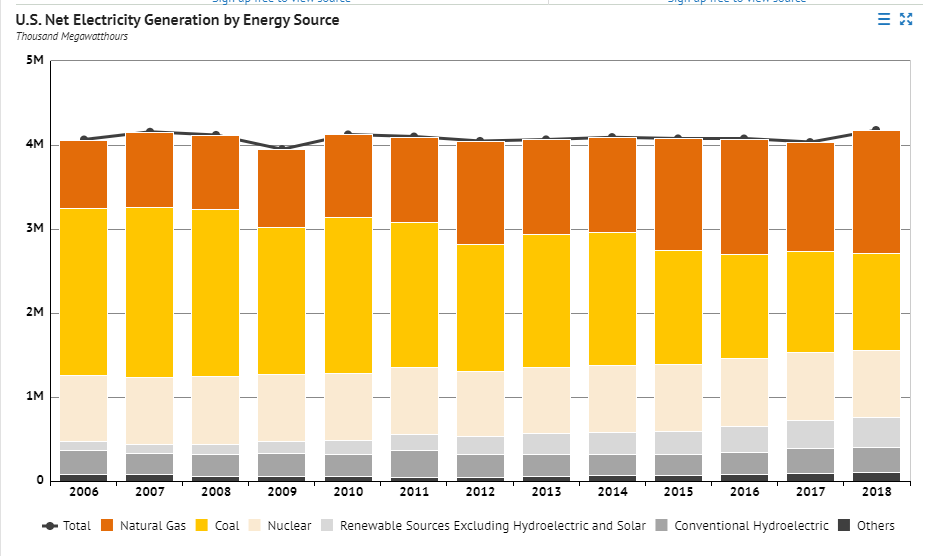

5.Coal Shrinking But Still #2 Electricity Source.

https://knoema.com/infographics/qmfwmqc/united-states-coal-revival-or-decline

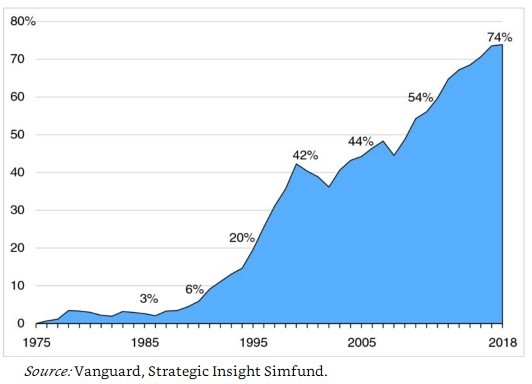

6.Vanguard Manages $1 Trillion in Active Funds…10 Years Ago They Managed More Active than Passive

Yes, index funds are free-riders but so what? Cliff Asness wrote a wonderful piece for Bloomberg a few years ago about the idea of index investors being free riders:

The use of price signals by those who played no role in setting them may be capitalism’s most important feature. That most of us and most of our dollars don’t have to pick stocks, or to price air conditioners, is a great benefit and taking advantage of it makes us honest smart capitalists, not commissars.”

Yes, index investors are free riders, but this is the way most markets work. We don’t go to the grocery store to bid on prices of oranges against one another to set an equilibrium. The market does that for us.

Do you really think every investor in the market has the ability to accurately set prices?

There’s room for both. It’s also worth pointing out the success of indexing doesn’t mean all active management is useless or bad. In fact, Vanguard itself still has a ton of money in active funds. Here’s the breakdown of assets in index funds for the firm (also from Bogle’s book):

The trend is easy to spot but the firm still has more than $1 trillion in actively managed funds. They just happen to manage their active funds using strategies that employ low turnover, long holding periods, and lower than average fees.

Won’t it be a net positive for the end investor that indexing will force the asset management industry to adapt?

Debunking the Silly “Passive is a Bubble” Myth by Ben Carlson

https://awealthofcommonsense.com/2019/09/debunking-the-silly-passive-is-a-bubble-myth/

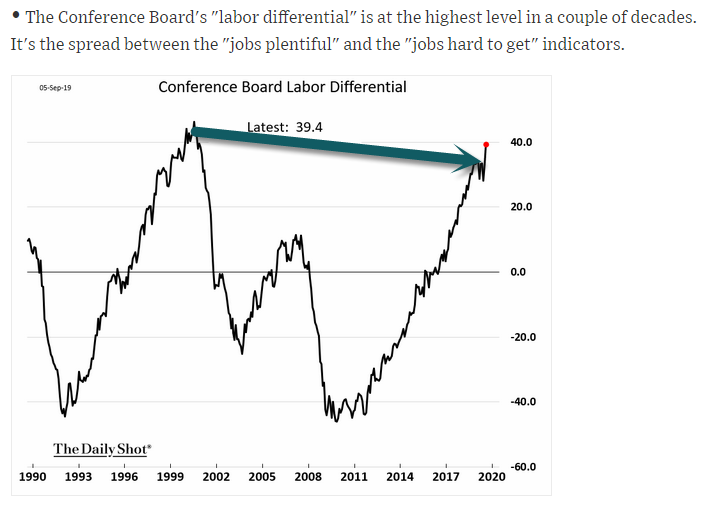

7.Difference Between “jobs plentiful” and “jobs hard to get” up to 1999 Levels

The Daily Shot-WSJ

https://blogs.wsj.com/dailyshot/2019/09/06/the-daily-shot-container-shipping-costs-take-a-wild-ride/

8.Goldman Sachs analyzed 4,481 IPOs over 25 years and concluded that these 5 attributes can make or break a newly public company

Daniel Strauss

Sep. 8, 2019, 08:11 AM

Hollis Johnson/Business Insider

The public markets have seen a long-awaited influx of initial public offerings this year.

While many IPOs are outperforming the market, some of the most high-profile new listings such as Uber and Lyft have struggled.

Goldman Sachs analyzed 4,481 IPOs over 25 years and determined the five attributes that are a key to a successful IPO.

Visit the Markets Insider homepage for more stories.

2019 has been a monster year for initial public offerings.

Darlings of Silicon Valley such as Uber, Lyft, and Pinterest have entered the public markets after years of raising private capital.

The broader IPO market is also outperforming most of the major stock indexes. The Renaissance IPO ETF, which tracks the performance of new listings, has climbed more than 33% since the beginning of the year. Comparatively, the S&P 500 has risen about 19%.

But some of the most closely followed public offerings are struggling. Uber and Lyft have both dipped below their offering prices. Investors have begun to question the rising costs of their business models, and whether or not they can ever achieve sustainable profitability.

The same questions are being asked about upcoming public offerings from Peloton and WeWork. Many of the venture-backed startups that are approaching the public markets are pursuing new, unproven business models. That can make it difficult for investors to predict the success of a particular IPO.

Goldman Sachs analyzed more than 4,400 IPOs over 25 years and determined the most important attributes that can determine the success of recent public offering.

Here are the five key factors the firm says can make or break an IPO:

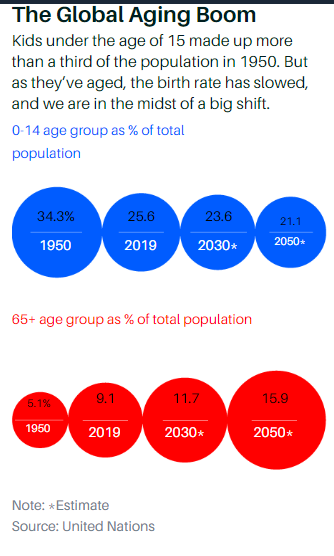

9.65+ Population Explosion is Global

By 2030, 360 million Chinese—more than currently live in the U.S.—will be older than 60.

What Americans Can Learn From the Rest of the World About Retirement-Barrons By Reshma Kapadia

10.6 Ways to Diffuse Workplace Conflict

by Early To Rise | Oct 24, 2017 | Articles, Lifestyle, Motivation, Productivity, Self-Improvement, Skill Development, Work

FROM EARLY TO RISE

Does this sound familiar?

By many measures, you’re a successful start-up. You have fewer than 10 employees, but you’ve been hiring fairly steadily since you launched a year or so ago. If you’re not making a profit, you’re at least breaking even—which is better than most one-year-old startups can say.

But not all things are going well. You don’t yet have the money for a dedicated human resources manager, so personnel administration is spread among the team. Most of the time, the honor system works for things like PTO, and job reviews are handled when you have a spare hour—though seldom at regular intervals.

Still, there are no team complaints and, therefore, little reason to change.

Then, you hit a snag. A conflict erupts between two of your employees. Arguments mount and tensions escalate until both of them come to you separately with the same concern: “So-and-so is disrupting the work environment and antagonizing me. Can you address this?”

You’re the CEO, CFO, COO, and Marketing Director all rolled into one. You don’t have time to deal with human resource conflicts. What do you do?

1. Make time for your team

You may think you hold a lot of flags as the owner of your own company, but what’s more important than the team that makes your success possible? Your commitment is, first and foremost, to their success. So, make time to deal with this.

Ideally, you have built in meetings scheduled with your team—such as weekly staff meetings or monthly check-ins. If this is not a good time to address tensions, then schedule a group meeting with the concerned employees for an hour, or with each one for half an hour.

2. Ask your employees to define the problem

You weren’t trained as an HR rep, so you may think your role in conflict resolution is limited. But that’s not true. Most of what you need to do is guide the employees to their own resolution, and that starts with defining the problem. This is often best done in separate meetings with each employee involved, but can be done in a group meeting as well, depending on the severity/nature of the conflict.

Let everyone clearly express—constructively and without antagonizing others—what they see as the core problem. Step in to moderate as needed and ask for clarification. Specifics are important, so be sure you get the details of what’s ACTUALLY happening and not what employees THINK is happening.

3. Encourage your employees to resolve the problem on their own

In most cases, this works well. Resolution can happen when you’re present (if time allows), or it can be done on the employees’ own time. But if each employee fully understands the nature of the problem, then finding a resolution will be easier.

Suggest that they meet together offsite over lunch, or in a neutral space like the office conference room. Nobody should have a “home field” advantage in these discussions.

Encourage them to reference the standing employee handbook if there is question about office policy.

Also, set parameters. If the concerned employees can’t come to a resolution in a set amount of time (~30 minutes), then tell them to bring the issue back to you with a CLEAR explanation of WHY they could not reach a resolution. The collaboration required to define the continuing disagreement is a not-so-subtle way of encouraging positive interaction.

Finally, insist on diplomacy and civility. Remind each individual that they are a professional, and that as a representative of your company, you expect them to act accordingly—communicating clearly but diplomatically while always respecting fellow employees.

4. If the conflict comes back to you, make a quick decision

Pushing the conflict off on to other employees or stalling is not good leadership. At this point in the resolution process, you should know exactly what’s going on and how best to resolve it.

Take action quickly, communicate it clearly, and model the same diplomacy and respect you ask of your employees. Once a resolution has been reached, make it known that future disruptive conflict will have consequences.

Remember: A strong leader sees all sides of a conflict before making a decision, is conscious of his/her bias in reaching a resolution, and respects the individuals concerned. Knowing all variables and the desired end point will go a long way to facilitating an effective, positive resolution.

5. Document the conflict and resolution

He said-she said banter can haunt you as a busy CEO, so don’t let it. Record your interactions in conflict resolution situations so you can always point to concrete evidence of employee interactions and actions taken toward resolution. Store these in employee files for ongoing reference.

6. Maintain ongoing communication training with your employees, and model that communication for your team

Communications training doesn’t have to be drawn out. It can be as simple as a 5-minute, quick-hit tip or story offered during weekly staff meetings. MindTools offers some dynamic (and short) games that you can use to promote positive work interaction.

Let your employees know your communication expectations, and model that behavior yourself. If you’re not living up to those expectations, invite them to call you out—in a diplomatic way that encourages constructive communication in tense situations. The same should also be true of your employees; consequences should be clearly defined and guidelines enforced for improper communication.