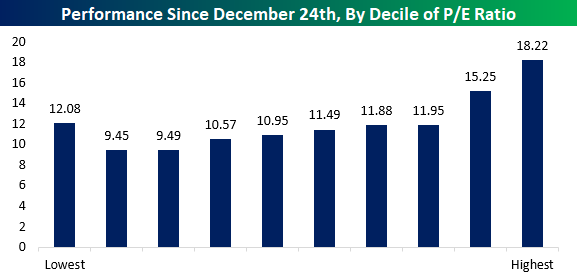

1.Performance Based on Valuations Since Dec. 24th Lows.

Bespoke

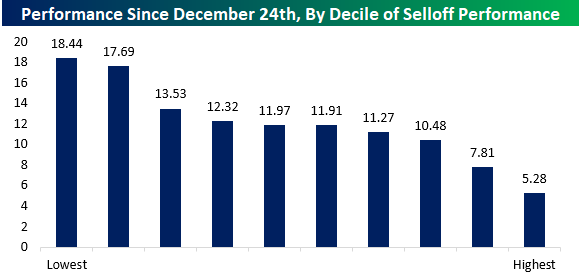

The first chart below shows the performance of S&P 500 stocks based on their valuations as of 12/24 with the most attractively valued (lowest P/E ratios) stocks to the left and the most expensive (highest P/E ratios) on the right. The best performing decile by far was the one containing the stocks with the highest P/E ratios, and for the most part, performance steadily declined as you moved left towards the more attractively valued stocks. The second chart shows performance since the lows based on stocks grouped according to how they performed during the market decline. Here, the best-performing stocks were the ones that were originally down the most, while the worst performing stocks were the ones that held up the best during the decline.

In both cases, these performance results make perfect sense. During market sell-offs, as investors become more risk averse it is typical to see stocks with the most aggressive valuations sell-off the hardest while more reasonably priced stocks hold up better. However, when the market turns around and investors become less risk-averse, they flock to the more aggressive high growth/high valuation stocks. Likewise, when the market shifts its tone from a defensive posture (during a sell-off) to a more offensive tone (rally) it is only natural that the stocks that held up the best during the defensive phase (like Utilities) underperform during the next more aggressive phase. Anything else would be contrary to the norm.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.