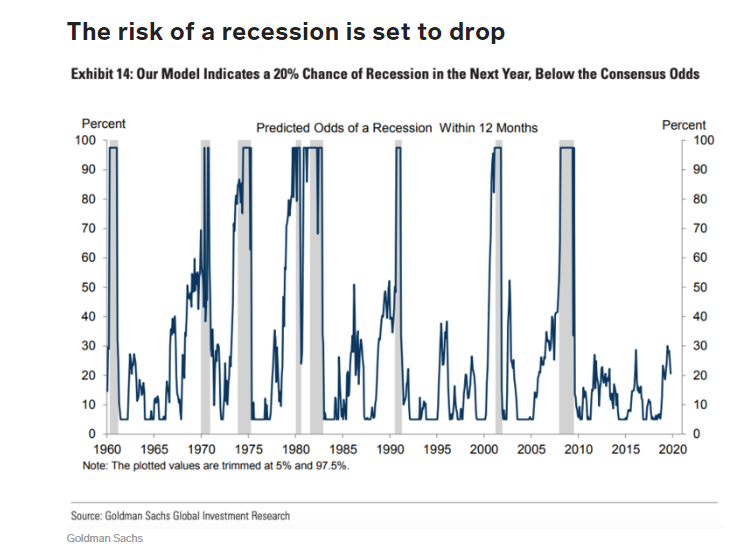

1.Goldman Recession Indicator.

After delivering three interest-rate cuts this year, the Federal Reserve seemed to indicate that it “would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” As a result of this, the bank expects fund rates to remain unchanged in 2020.

Earlier this year, the bank’s economists put the risk of a US recession within the next 12 months at one in three. Now it’s cut the chances to one in five.

“The current expansion is now the longest in US business cycle records dating to the 1850s, and some recession fears may simply reflect an instinctive sense that its time is nearly up,” the economists said.

“This has not been an unreasonable thought historically, as the two usual late-cycle risks-inflationary overheating and financial imbalances-often did grow over time. But so far both risks look limited,” they added.

Low recession risk, faster growth, and

unemployment at a 70-year low — here are Goldman Sachs’ predictions for the US

economy in 2020–Yusuf Khan