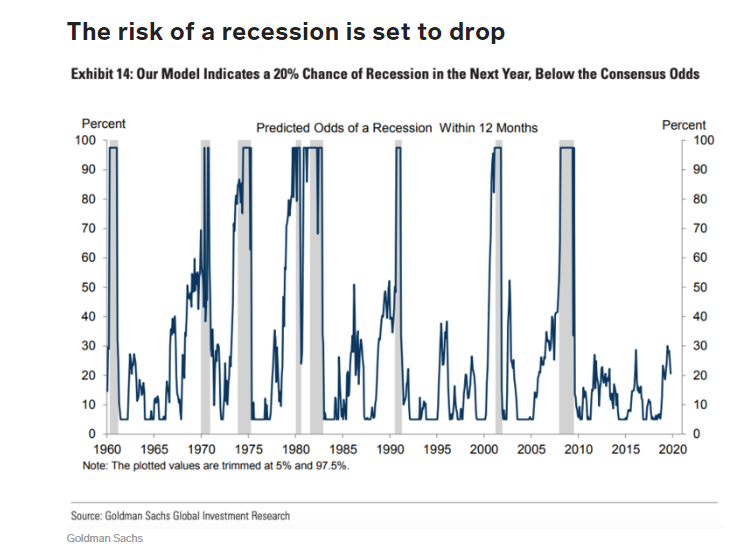

1.Goldman Recession Indicator.

After delivering three interest-rate cuts this year, the Federal Reserve seemed to indicate that it “would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” As a result of this, the bank expects fund rates to remain unchanged in 2020.

Earlier this year, the bank’s economists put the risk of a US recession within the next 12 months at one in three. Now it’s cut the chances to one in five.

“The current expansion is now the longest in US business cycle records dating to the 1850s, and some recession fears may simply reflect an instinctive sense that its time is nearly up,” the economists said.

“This has not been an unreasonable thought historically, as the two usual late-cycle risks-inflationary overheating and financial imbalances-often did grow over time. But so far both risks look limited,” they added.

Low recession risk, faster growth, and

unemployment at a 70-year low — here are Goldman Sachs’ predictions for the US

economy in 2020–Yusuf Khan

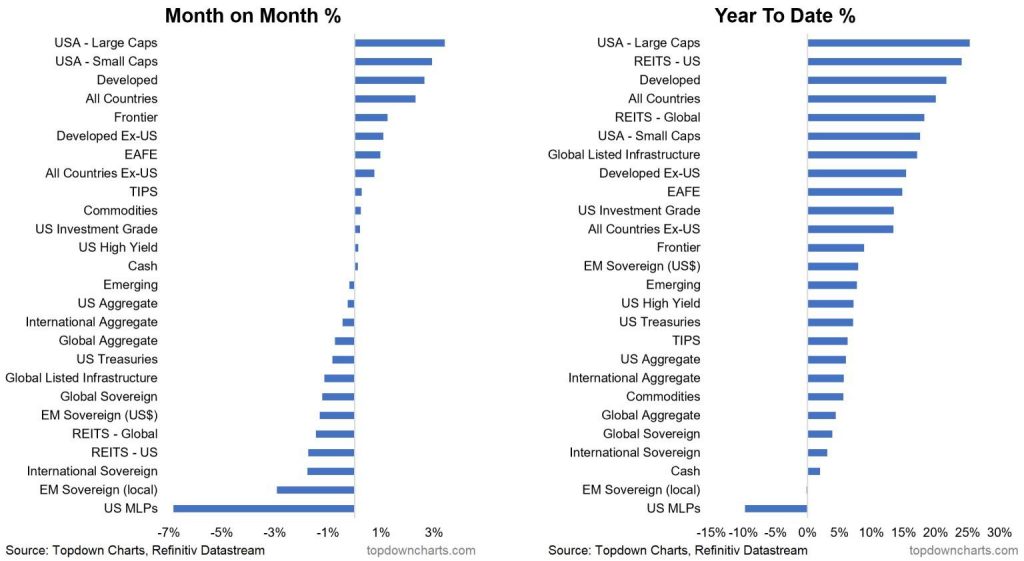

2.MLP’s Worst Performing Group YTD …..-7% in November.

MLPs break to new lows even with interest rates lower

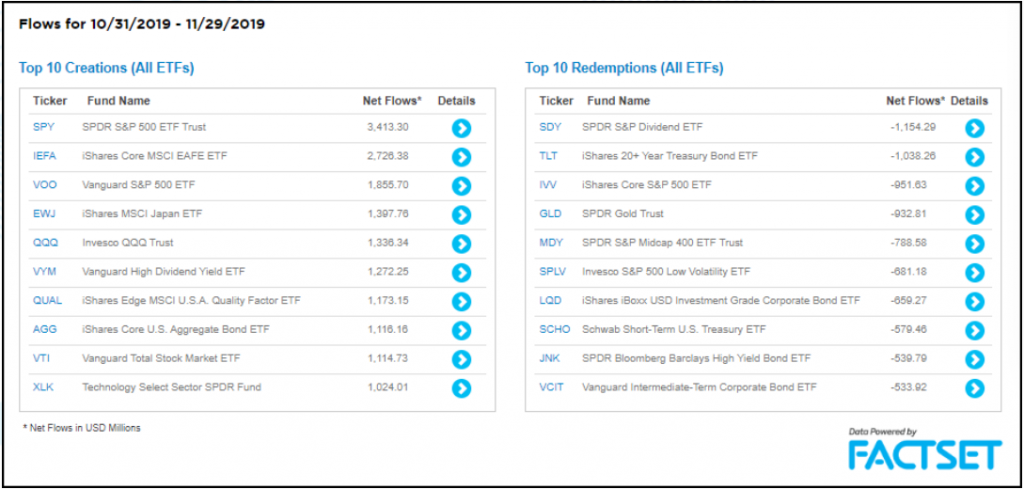

3.Where the Equity Money Flowed in the Last Month…..Withdrawls from Popular S&P Dividend and Low Volatility.

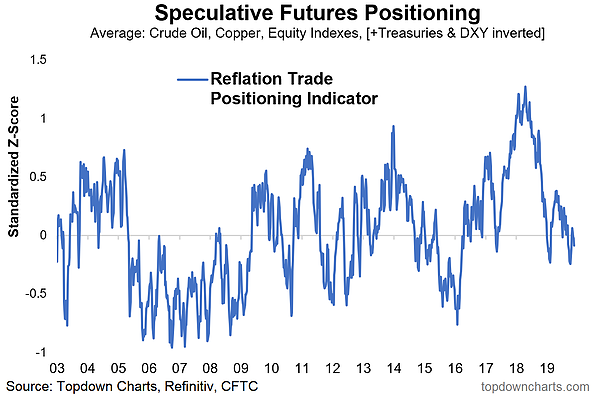

4.Never Saw This Indicator But Another Example Showing “Lack of Euphoria” in Speculation.

https://www.topdowncharts.com/reflatometer

5.The Huge Short I Have Been Showing in VIX Last Couple Weeks…First Down Days in Market Saw 51% VIX Spike.

Shorts will get hammered in next 5-10% pullback.

Charlie Biello Twitter

Found at Abnormal Returns www.abnormalreturns.com

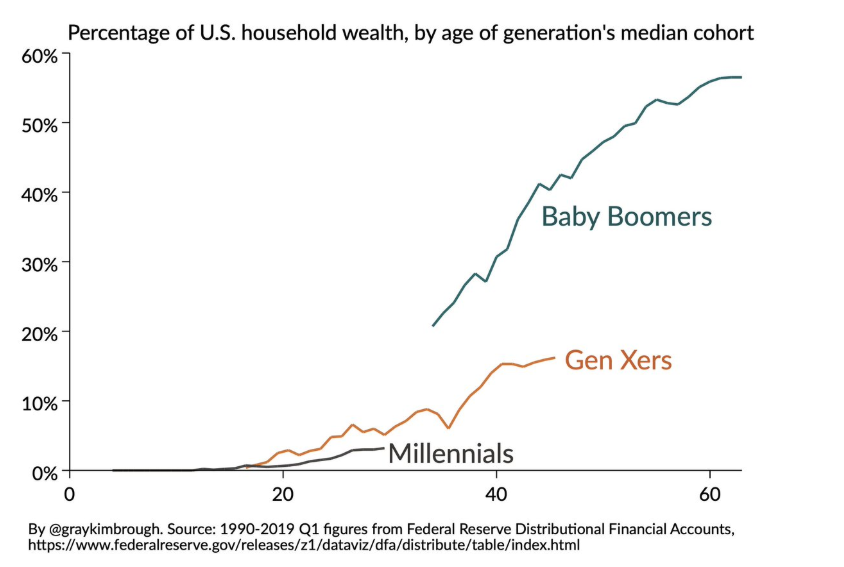

6.Huge Wealth Gap Between When Boomers Were 35 in 1990 and Millennials Today.

While many are cognizant of the existence of the wealth gap between baby boomers and millennials, it can be hard to picture its size. However, a macroeconomist has illustrated the extremity of the problem: To match boomers’ percentage of wealth held when they were 35, millennials would need to multiply the percentage they hold sevenfold.

Gray Kimbrough, a senior economist with the Federal Housing Finance Agency and an adjunct lecturer at American University, created a chart using data from the Federal Reserve to track the share of national wealth held by each generation according to their median cohort age; Kimbrough’s findings were featured in a Washington Post op-ed.

According to Kimbrough, by the time the median baby boomer was 35 in 1990, they collectively owned 21% of the nation’s wealth. Generation X (defined as those born between 1965 and 1980) collectively owned only 9% in 2008, the year in which the median member of that generation turned 35. It will still be several years before the median millennial reaches 35, but currently millennials hold only 3.2% of the nation’s wealth.

In the Post article, Christopher Ingraham notes several significant caveats to consider; for example, in 1990, boomers were about 31% of the country’s population, while in 2008, members of the Gen X generation accounted for only 22% of the nation’s population, concluding that boomers and Gen Xers had a 0.68 and 0.41 wealth-to-population ratio, respectively. Ingraham also acknowledges that the greatest gaps in wealth disparity exist within generations, with wealth being “highly concentrated among the richest members of each cohort.”

Illustrating the Wealth Gap Between Boomers and Millennials

Economist Gray Kimbrough found that baby boomers collectively owned 21% of the nation’s wealth in 1990, when the median boomer was 35 years old.

Patrick Donachie | Dec 04, 2019

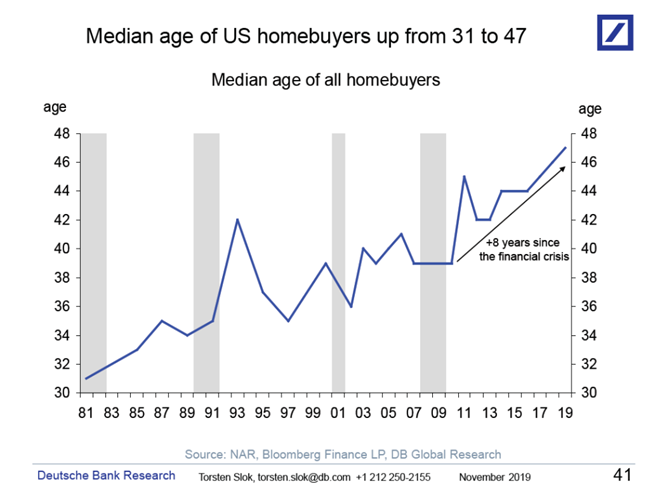

7. The Median Age of US Homebuyers in 1981 was 31. Today it is 47

The median age of US homebuyers in 1981 was 31. Today it is 47, see chart below and here. The rise since the financial crisis is particularly noteworthy. This is driven by an aging population, affordability, higher student debt levels, and tighter mortgage lending standards for young people and individuals with lower credit scores. All these forces have also contributed to lower levels of residential mobility, see also our chart from last week.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

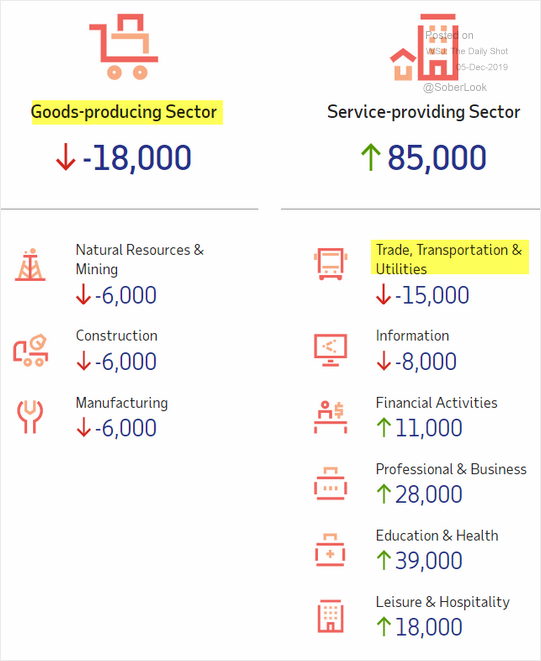

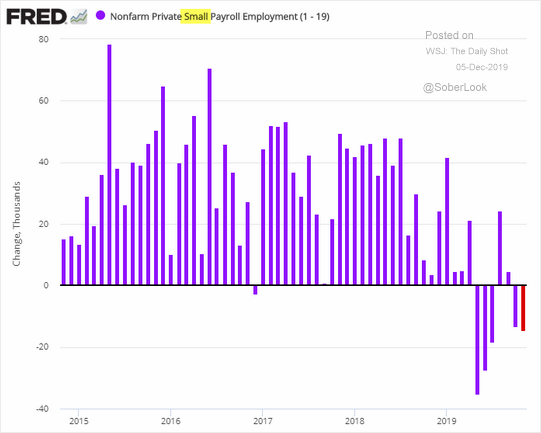

8.Small Business Hiring Slows…..Service Sector Adding Jobs…Goods Producing Sector Losing Jobs.

Here is the ADP summary showing goods-producing industries shedding jobs.

Source: ADP; Read full article

THE DAILY SHOT

https://blogs.wsj.com/dailyshot/2019/12/05/the-daily-shot-goods-producing-sectors-are-shedding-jobs/

9.Content Wars Continued…APPLE TV Paying $25 Million for Documentary.

Billie Eilish Lands Massive Payday for Apple TV+ Documentary

Billie Eilish

Multiple sources say Apple is paying $25 million for the project about the 17-year-old musician.

Billie Eilish’s big 2019 is culminating as she nears a deal with Apple TV+ for a documentary that comes with a $25 million price tag, according to multiple sources.

The film, which has already been shot, was directed by R.J. Cutler and produced in collaboration with Eilish’s label, Interscope Records, for a budget that one source pegs as being between $1 million and $2 million. It is expected to follow the 17-year-old singer-songwriter in the wake of the release of her debut album, When We All Fall Asleep, Where Do We Go?, in March of this year. Cutler was granted deep access to Eilish’s private moments with family and behind-the-scenes of her public appearances.

The doc, which was shopped to multiple distributors, comes as Eilish, who was named Apple Music’s artist of the year, is set to headline the streaming service’s first-ever Apple Music Awards on Wednesday at the Steve Jobs Theater in Cupertino, California. The project will be available through entertainment platform Apple TV+ instead of Apple Music, which has previously released documentary projects like Taylor Swift’s The 1989 World Tour (Live) and Ed Sheeran’s Songwriter. It signals a blurring of the lines between the $10-per-month music streaming service and the $5-per-month film and TV offering.

Eilish, who previously had developed a cult following online, broke out this year with the release of her first full-length album. Written with her brother, Finneas, When We All Fall, Where Do We Go? was the most-played album on both Apple Music and Spotify in 2019 and earned two Grammy nominations.

The documentary, which is expected to premiere in 2020, will join a small but growing roster of unscripted films from Apple TV+, including The Elephant Queen, which is currently streaming, and upcoming projects from Oprah Winfrey including Toxic Labor and an unnamed project about sexual misconduct in the music industry.

An Apple spokeswoman declined to comment.

Dec. 4, 6:28 p.m. Updated with additional information about the project.

10.LinkedIn Founder Reid Hoffman Says Leaders Must Set a Drumbeat for Their Organizations. Here’s How to Do Just That

These are the five cadences leaders should set for their organization.

By Scott MautzKeynote speaker and author, ‘Find the Fire’ and ‘Make It Matter’@scott_mautz

One of the most important jobs of a leader is to set the vision and strategy, and to provide a path for others to follow. But there’s a not-so-obvious role the leader plays thereafter. Once these things are set, people don’t just follow blindly. It requires a pulse, or an ethos that keeps things moving, one that the leader sets, according to LinkedIn founder Reid Hoffman.

As Hoffman said on a recent episode of his Masters of Scale podcast, “Every leader has to create a drumbeat for their company.” It drives the rhythm of the company and helps define how employees should follow and act in the day-to-day business.

I think Hoffman is exactly right, and it got me thinking. Leaders set the rhythm for others to follow in multiple ways, whether they realize it or not. With over three decades of successful leadership experience, I can tell you these are the five most important cadences that leaders set–pick up on these tempos and you’ll be a better leader in no time.

1. The interpersonal rhythm.

The leader sets the rhythm and tone for how people in the organization interact with one another. Temperamental leaders who explode in meetings and berate people on a regular basis or leaders who treat their group as a silo and won’t cooperate with other parts of the organization will produce employees who think it’s okay to do the same.

Leaders who listen intently, show respect, openly collaborate, and operate with unswerving integrity will also produce copycat behaviors of a much better kind. One of the best leaders I ever worked for heavily influenced the positive tone with which everyone treated one another. When you’re a leader, how you interact with others matters as you operate in a fish bowl, where your moves are watched and magnified.

2. The decision-making rhythm.

If you’re an indecisive leader who changes his or her mind, waits to collect data on everything, and regularly undoes past decisions, your people will suffer and will likely be just as indecisive.

Without a tempo of fast, yet appropriately informed decision-making, including a willingness to take risks and move forward at times without all the information, an organization will plod along far too slowly. Productivity will sputter and employees will grow increasingly frustrated and likely burn out.

3. The recognition rhythm.

By this I mean how often, in what scenarios, and with what magnitude does the leader recognize and reward employees for their efforts and outcomes? I’ve been in organizations where the rhythm of rewarding was steady, producing a positive undertone that good work gets recognized and providing motivational fuel to spur the expenditure of discretionary energy. I’ve also been in the opposite situation, in organizations where recognition was rare and muted when it occurred.

Leaders who recognize and reward yield organizations that recognize and reward. The opposite, even more so, as it creates an unfortunate “one less thing to worry about” mindset.

4. The workflow rhythm.

The leader sets the rhythm for how work gets done in the workplace. Does he or she call a lot of meetings, require a lot of updates, and set a “command and control” tone? Is empowerment modeled or missing? Remote work embraced or face time forced? Is there a lot of rework and wasted effort spurred on by the leader, or not?

I always tried to set a rhythm of just getting things done, letting the people flow to the work and vice versa, enabling people to do what they were hired to do. It’s important to be mindful of the workflow rhythm you’re setting because so much of success (or failure) depends on it. You can have the greatest vision and strategies in the world, but if your organization doesn’t flow well to what needs to be done to achieve it all, you’ll fail.

5. The reactive rhythm.

I don’t mean this in the bad sense of the term to be reactive (versus proactive). You can’t be proactive about or predict everything; an organization must be able to react quickly to changes in the industry, competitive environment, or overall landscape. And no one sets the pace of the reactionary time more than the leader.

Being complacent and slow to react in the face of environmental shifts can doom a company. When the leader reacts with urgency (to the right things), it sets an important pulse throughout the company that urgency must follow urgency.

So Reid Hoffman is right, the leader must set the drumbeat for the organization. Pick up on these cadences and you’ll set a tempo of triumph.

PUBLISHED ON: DEC 4, 2019

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.