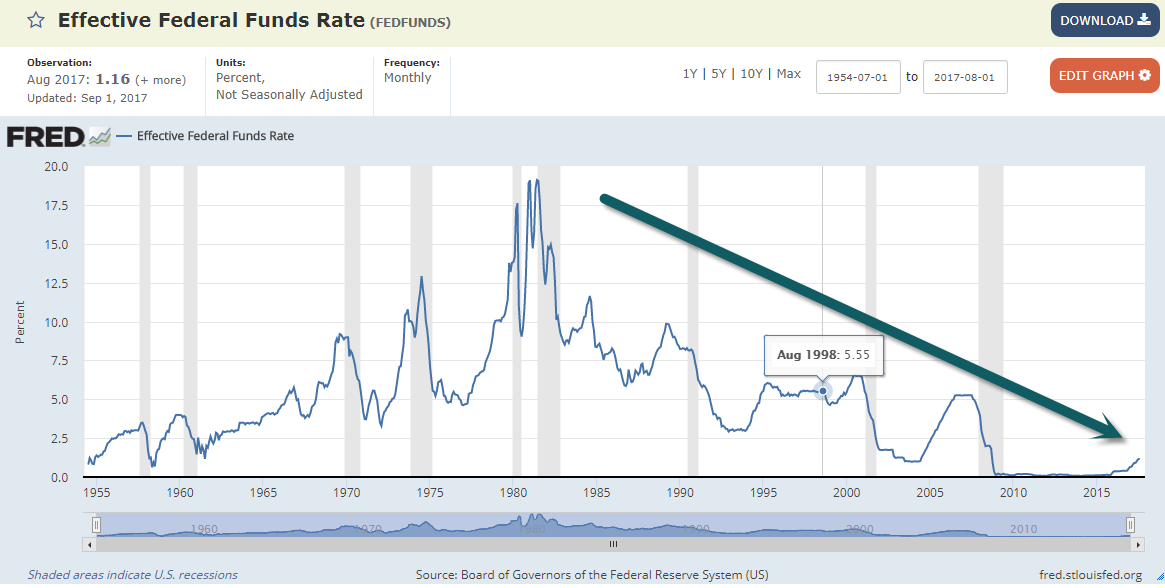

1.Tipping Point for Fed Funds Rate???

Wells Fargo comments in Barrons

Looking back over six decades, the Wells Fargo team found that the tipping point came when the fed-funds rate exceeded the 10-year Treasury yield’s cyclical low. This has predicted every recession since 1955, with an average lead time of 17 months—producing a significantly earlier warning signal than waiting for the yield curve actually to invert.

What about the current cycle? The 10-year Treasury’s low yield was 1.36%, touched on July 5, 2016. An increase in the fed-funds rate to 1.5%, which the Wells Fargo economists expect at the December FOMC meeting, would trigger the recession early-warning signal. Specifically, their research puts a 69.2% probability of a downturn within 17 months after that.

http://www.barrons.com/articles/trump-and-the-art-of-the-deficit-1504932418

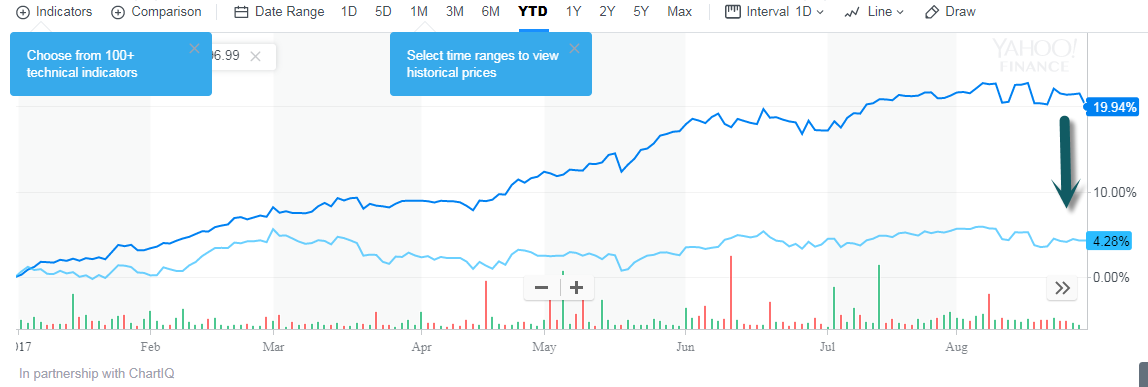

IAT-breaks 200day back to June lows.

IAT-breaks 200day back to June lows.