1.Read of the Weekend…The Rescues Ruining Capitalism.

WSJ By Ruchir Sharma

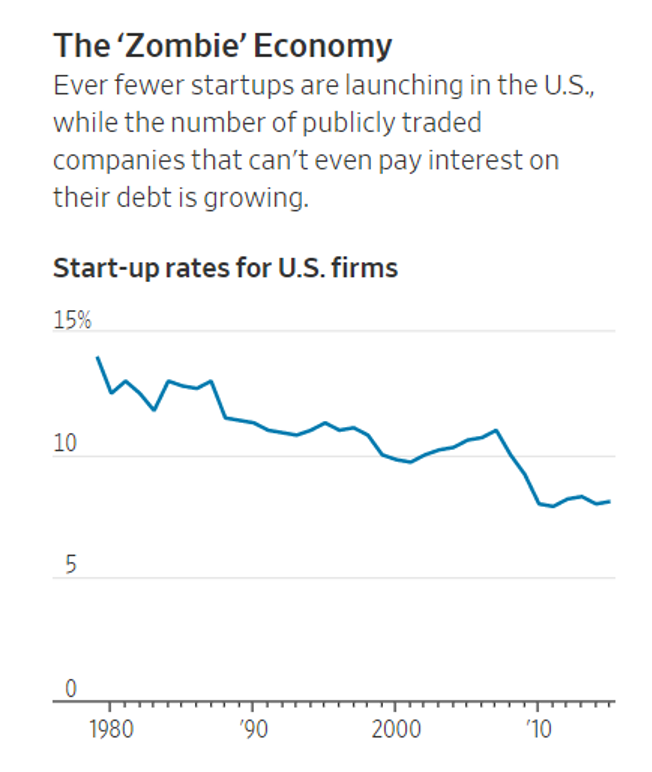

Modern society looks increasingly to government for protection from major crises, whether recessions, public-health disasters or, as today, a painful combination of both. Such rescues have their place, and few would deny that the Covid-19 pandemic called for dramatic intervention. But there is a downside to this reflex to intervene, which has become more automatic over the past four decades. Our growing intolerance for economic risk and loss is undermining the natural resilience of capitalism and now threatens its very survival.

The world economy went into this pandemic vulnerable to another financial crisis precisely because it had already become so fragile, so heavily dependent on constant government help. Governments have offered increasingly easy credit and generous bailouts not only to soften the impact of every crisis since the 1980s but also to try to boost growth during the good times.

The Rescues Ruining Capitalism

Easy money and constant stimulus have undermined the basic dynamics of the free market. We’ve paid the price in low growth and productivity, falling entrepreneurship and rising inequality.

https://www.wsj.com/articles/the-rescues-ruining-capitalism-11595603720

2. Distressed Credit Digest-Koyfin Research

by Rich Meatto

Distressed/High Yield Watchlist

Tracking 237 credits from 145 companies

Click here for the full watchlist

Top Movers for the Week

Bottom Movers for the Week

Highlights

‣ WeWork (WEWORK 7.875 25) traded higher by nearly 10 points to 58.50 yielding 22.5%. A WeWork chairman said it expects the company to be cash flow positive next year, a year ahead of schedule.

‣ Briggs and Stratton (BGG 6.875 20) senior notes traded lower by 20+ points as it is expected the company will seek a 363 sale of its business in bankruptcy later this week. If the reported stalking horse bid amount remains file, it would only over secured creditors, leaving the 6.875% notes nearly worthless.

‣ Carlson Travel (CTHM 6.75 23) traded higher by 22 points to 87.00 yielding 11.5%.

‣ Washington Prime Group (WPG 6.45 24) traded lower as Covid cases continue to rise, forcing weak traffic to malls. The bonds ended the week at a new all-time low of 45.00 yielding 31.5%.

‣ Tupperware Brands (TUP 4.75 21) continue to trade higher, ending the week up 15 points to 80.00. After a series of debt repurchases, the notes have risen from the low 30s in less than 8 weeks.

‣ California Resources entered into bankruptcy this past week with a plan to hand ownership over to its creditors. If approved, the plan will give secured lenders approximately 93% of the new reorganized company, while the second lien bondholders (CRC 8.00 22) will receive 7%. The second lien notes traded actively between 2.75 and 3.00 which is significantly lower from where it started 2020 (50.00).

Give me just a little more time

It has been a busy year for bankruptcies. Many of these businesses were on the fringe before the Covid pandemic. The extra disruption only exacerbated their leverage problems.

Yet, companies and their lenders are not rushing to file for bankruptcy so quick. Many skip their debt payments and utilize their right to the “grace period”. These period vary but usually give a company an extra 15-30 days before an default event could be triggered. If you are unfamiliar with term grace period, feel free to read more here.

The majority of time, companies that enter the grace period, end up not making their skipped payments. The time is usually spent as a period of negotiations with lenders. Large companies with complex capital structures can lead to expensive bankruptcy process.

Usually, the most important thing for a business entering into bankruptcy is to line up DIP financing. To speed up the bankruptcy process as well as ensure certain secured creditors see recovery value. The time spent during the grace period can also help complete any plans of reorganization or asset sales. If a company enters the process with a lending in place as well as plan agreed upon by the majority of creditors, it will lessen time in bankruptcy.

Here are a few companies that are currently in grace period and are expected to file within the next month.

Tailored Brands (TLRD)

https://www.koyfin.com/snapshot/s/TLRD

‣ On July 1st, the company skipped an interest payment on its 7.00% notes, entering into a 30-day grace period.

CBL & Associates (CBL)

https://www.koyfin.com/snapshot/s/CBL

‣ On June 1st, the company skipped an interest payment on its 2023 notes. Since then, lenders have extended its grace period twice as it is expected to enter bankruptcy later this week.

Lonestar Resources (LONE)

https://www.koyfin.com/snapshot/s/LONE

‣ On July 1st, the company skipped an interest payment on its 11.25% notes, entering into a 30-day grace period.

Denbury Resources (DNR)

https://www.koyfin.com/snapshot/s/DNR

‣ On June 30th, the company skipped an interest payment on its 6.375% notes, entering into a 30-day grace period.

Rose Resources (ROSE)

https://www.koyfin.com/snapshot/s/ROSE

‣ The lenders have a Restructuring Support Agreement (RSA) in place. The company is expected to file any day and exit bankruptcy within 3 months.

Chaparral Energy (CHAP)

https://www.koyfin.com/snapshot/s/CHAP

‣ On July 15th, the company skipped an interest payment on its 8.75% notes, entering into a 15-day grace period. The company last filed for bankruptcy back in 2016.

Briggs & Stratton (BGG)

https://www.koyfin.com/snapshot/s/BGG

‣ The company extended its previous 30-day grace period by a few more days as they continue to line up a 363 sale of the business within bankruptcy.

Noble Corp (NE)

https://www.koyfin.com/snapshot/s/NE

‣ On July 15th, the company skipped an interest payment on its 7.75% notes, entering into a 30-day grace period.

https://www.koyfin.com/research/2020/07/19/grace-period/

3. Zoom is Worth More Than Top 7 Airlines Combined.

Zoom is Now Worth More Than the World’s 7 Biggest Airlines

By Iman Ghosh

4. For Anyone Who Wants to Geek Out on 10x Sales Follow Up …Alpha Architect’s Got You Covered.

Buying Stocks Trading Above 10x Sales–A Good Idea?

By Jack Vogel, PhD|May 9th, 2019|Research Insights, Factor Investing, Value Investing Research

Early last week, Meb Faber included me on a conversation on buying stocks trading at 10x their company’s revenue (sales).

Is this a good idea and how did it do in the past?

Given that most “known” factors have underperformed over the past 10 years, I was interested in seeing if a somewhat “crazy” strategy 1–buying stocks trading above 10x sales–worked over the past 10 years.

Of course–it worked!

However, over the full sample period, this strategy underperformed the universe.

Needless to say, the results are interesting, especially after examining the current stocks that are trading above 10x revenue.

Below I outline the study, give the results, and look at a few names currently in the “above 10x” category.

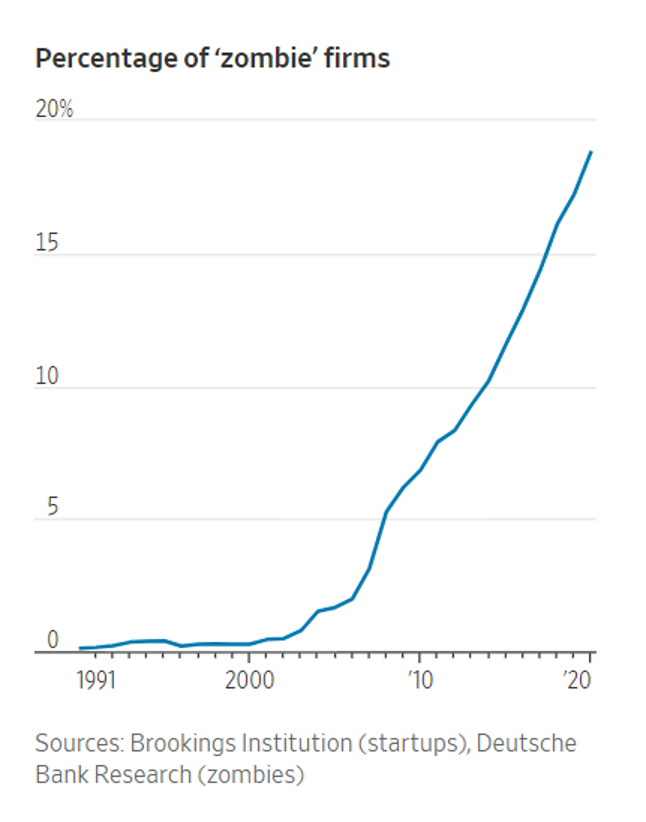

Overview and Universe Results

To test how well stocks trading above or below 10x revenue (sales) performed, I formed monthly portfolios examining companies trading above and below 10x revenue (sales). The universe, formed monthly, is the 1,500 largest U.S. stocks excluding REITs. 2 When forming the portfolios, the fundamental data is lagged to minimize look-ahead bias. 3 4 All data is from FactSet.

The full-time period is from 1/1/1990-3/31/2019.

Below shows the results of the Universe (value-weighted) compared to the Russell 1000 Index (R1K). All results are gross of any transaction costs and fees and reflect total returns, which include dividends.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Source Data: FactSet

The results above show that the universe is similar to the Russell 1000, with a 99.77% correlation. 5 In addition, the two portfolios have similar CAGRs, Sharpe Ratios, and Drawdowns.

So now that we have confidence in our universe, let’s examine the portfolios trading above and below 10x revenue.

The Results

Below we examine the results to stocks trading above and below 10x sales. Again, the portfolio is formed monthly and held for one month. The time period examined is again from 1/1/1990-3/31/2019. All results are gross of any transaction costs and fees and reflect total returns, which include dividends.

I examine 4 portfolios below:

- Stocks Trading Below 10x Revenue (Below 10x VW)

- Stocks Trading Above 10x Revenue (Above 10x VW)

- Universe

- Russell 1000 (R1K)

Here are the market-cap weighted (VW) results:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Source Data: FactSet

The results above highlight a few items:

- Over the entire time period, buying stocks trading above 10x Revenue was a bad idea!

- Over the past 10 years, buying stocks trading above 10x revenue beat the market! One can see this on the “10-year Annualized Return” row of the table. 6

- Buying stocks above 10x revenue resulted in an 81.37% maximum drawdown!

To take a deeper dive into point 3 above, I show the annual returns (2019 is until 3/31/19) for the portfolios below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Source Data: FactSet

As you can see, the large drawdown occurs in the Internet Bubble Crash (2000-2002) for stocks trading above 10x Revenue.

The results for equal-weighted portfolios are similar and are shown in the footnote below. 7

Full Read https://alphaarchitect.com/2019/05/09/buying-stocks-trading-above-10x-sales-a-good-idea/

5. High Growth Companies Increasingly Scarce….% of Companies with 5 Yr. Sales Growth > 15%

Pimco

6. The Last 12 Months Have Been the Strongest Sales for Home Builders Since 2010.

John Burns Real Estate

https://www.linkedin.com/in/johnburns7/

7. Pre-Covid the U.S. Hit Its Highest FICO Scores Ever….With Millennials Having Lowest Ages Ever to Reach 700 Score.

2019 Credit Review.

Entering 2019, the U.S. economy was in the midst of a government shutdown, battling a trade war and waiting to see whether interest rates would increase. Consistently sidestepping the persistent threat of recession each time it hit a bump, the economy remained strong.

Indeed, the U.S. economy exceeded expectations: Record job growth caused unemployment rates to drop to historic lows, while the stock market flexed throughout the year. Consumers, in return, showed their confidence as they continued to borrow and spend energetically, most recently evidenced by the strong 2019 holiday shopping season.

While it’s difficult to predict whether the economy will see continued growth this year, we can look back at 2019 to examine consumer credit behavior for clues on how Americans have responded to economic trends. The data also can reveal how consumers have rebounded from the Great Recession of 10 years ago and what their path might be going forward.

Our 2019 Consumer Credit Review analyzes FICO® Scores☉ and credit products nationwide to provide a scorecard of the 2019 U.S. consumer credit market, focusing on how it varies geographically, demographically and across different debt products. Read on for our insights and analysis.

Average U.S. FICO® Score Reaches an All-Time High

The average FICO® Score in the United States hit a record high of 703 in 2019, according to Experian data. That’s up from 701 in 2018 and up 14 points since 2010. That may seem surprising, but it shouldn’t be, as more people are monitoring their credit reports and credit scores using the wide array of available free solutions. In fact, 72% of consumers responding to a recent Experian study say their credit score is important or very important to them.

“We’ve seen the average FICO® Score of the U.S. population steadily increase each year since the Great Recession in the mid 2000s,” says Tom Quinn, vice president of scores at FICO. “The increase is being driven by changes in consumer credit behaviors. For example, the percent of the population with a 30-plus-day past-due [payment] reported in the last year has decreased by 22% between April 2009 and April 2019, and average credit card utilization has decreased by 28% during the same time period.”

Most Americans Have a FICO® Score Above 700

Today, 59% of Americans have a FICO® Score of 700 or higher—the biggest percentage ever seen at that level. A credit score of 700 or above is generally considered the marker of good credit by many lenders, who often view consumers with credit scores in this range as favorable borrowers. These borrowers may receive a wider variety of credit product offers, at better interest rates, than those with scores below 700. A score of 800 or higher is usually considered excellent.

“There is no big secret to having a good credit score,” says Rod Griffin, Experian’s director of consumer education and advocacy. “It’s a matter of self-discipline and consistency. If you are intentional with your bill payments and spending habits, you can make your credit work for you.”

Looking at the FICO® Score ranges, the percentages of U.S. consumers in each range did not change from 2018. Over the long term, however, the number of people with a very poor FICO® Score decreased 5 percentage points over 10 years.

Source: Experian

Analyzing the data further shows that 1.2% of Americans held a perfect FICO® Score in 2019, a figure that’s been growing.

The number of Americans with a perfect FICO® Score of 850 has increased by 63% in 10 years

“Americans are making better credit decisions, reflected by the 703 average FICO® Score in 2019, which is an indication of consumers being more educated on their credit,” says Shannon Lois, Experian’s head of analytics, consulting and operations. “Late-payment rates have decreased for several credit products this past decade. Credit card balances saw moderate growth over time along with overall consumer debt signaling healthy credit behavior that provides confidence to lenders.”

Millennials Are the Driving Force Behind Record FICO® Score Increases

Millennials, ages 24 to 39 in 2020, now outnumber baby boomers and are finally hitting their credit stride. Their economic emergence is reflected by a 25-point increase in average FICO® Score since 2012 (the earliest available Experian data)—the biggest increase of any generation. With an average FICO® Score of 668, millennials’ improving credit shows opportunity for reaching an average in the “good” FICO® Score range if growth trends continue.

Millennials’ average FICO® Score has increased 25 points since 2012

It’s an impressive boost for this generation of Americans, who are becoming an increasingly important factor in driving economic growth while also changing the narrative on credit and what the “appropriate” age should be for attaining certain credit milestones.

Average Age to Reach a 700 FICO® Score Is the Lowest Ever

The average age Americans are reaching a FICO® Score of 700 is the lowest it’s ever been, at 54. Since 2012, eight years have come off the average age, which was 62 nine years ago. That same trend carries over to the age a person reaches their peak FICO® Score age. In 2019, the average age a person’s FICO® Score peaked was 78, down 11 years from the average age of 89 that stood for five years from 2012 to 2016.

Let’s take a closer look at FICO® Scores around the country.

42 States Increased Their Average FICO® Score

Since 2018, 42 have states improved their average FICO® Score. Wisconsin recorded the biggest increase of seven points—more than double the next-highest increase—reaching an average FICO® Score of 725. Nine states saw no change to their average scores, while 34 states had an average FICO® Score of 700 or higher—the same amount in 2018.

Wisconsin’s seven-point increase over one year is especially impressive when taking a further look back at states’ average FICO® Scores. Over the past five years, 10 states improved their average credit scores by 10 or more points. Michigan and Nevada experienced the largest increase of any state over five years, at 13 points.

https://www.experian.com/blogs/ask-experian/consumer-credit-review/

8. Re-Purpsed Malls and Office Buildings….Vertical Farming?

Hydroponics and aeroponics are two major technologies which use less soil and water as compared to the conventional cultivation processes. The product market growth will also lead to rise in organic production and reduce the use of pesticides to ensure good health of the consumers.

Hydroponic technology is likely to hold a share of about 50% of the total North America vertical farming market by 2024 and the requirement of less space and soil as compared to other conventional cultivation processes will propel the segment’s industry growth. Aquaponics is a technology of aquaculture in which they use the waste produced by fish as a manure for the plants instead of chemical nutrients. Vertical farming market has two major applications out of which indoor application accounts for a substantial portion.

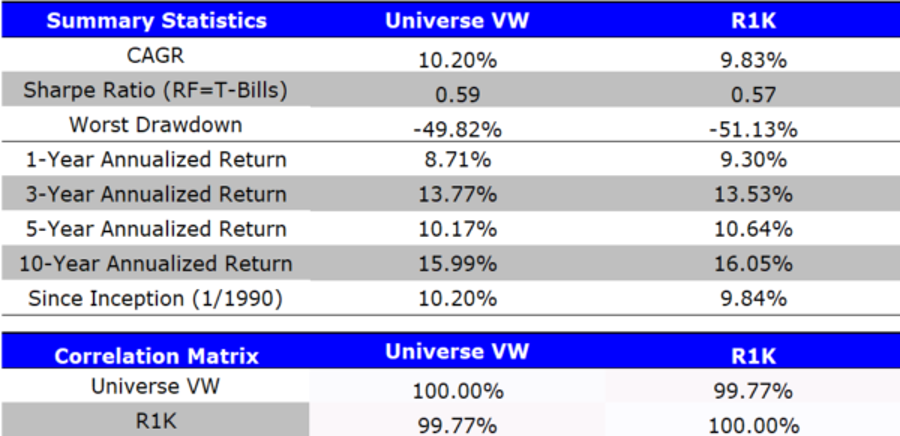

9. Egg Consumption On the Rise…Vital Farms Going Public.

For Eggs, Going Viral on Instagram Is Just the Start

The country’s largest producer of pasture-raised eggs, Vital Farms, has filed to go public on the Nasdaq. And investors could be lining up like it’s the omelet bar at a Princeton eating club.

That’s because this omelet bar is focused on ethically produced eggs and related products, which Vital Farms claims can command up to 3x the price of commodity eggs. Right now, the company says it only has 2% household penetration for its pasture-raised shell eggs.

More Vital signs:

- Revenue was $155 million for the 12 months ended March 31, 2020.

- The number of stores carrying its brands has grown to more than 13,000 from around 4,200 five years ago, reports Food Dive. It sells in supermarket giants like Kroger, Target, and Whole Foods.

- The company has raised at least $43 million from investors.

Zoom out: Whether it’s scrambled, fried, soft boiled, hard boiled, sunny side up, sunny side down (?), over easy, over medium, poached, deviled, angled, basted, or roasted on a spit over a campfire, Americans are eating way more eggs. We even have a chart to back that up.

10. Six Lessons You Can Learn from The King of the Jungle

Do you watch documentaries on lions? If yes, then you must have seen that they dominate their territory and are apex predators. Lions are among the strongest animals in the world, and no one dares to confront or challenge them. They are called ‘kings’ because they have a touch of royalty in everything they do. From eating habits where 20-25 royal members dine at the same to conquering huge lands. A lion always has a bold attitude and lives like a true ruler.

But their life is full of obstacles and problems. There is less space for errors, as one mistake may make them lose their life, reign, or offspring. Also, hunting is not an easy task; their success rate is only 17-19 percent. Compared to human beings their quandaries are bigger because they never get a second opportunity.

But, have you ever seen a depressed lion or one who wants to give up? They always struggle to hunt and rule lands, but they never quit. Sometimes they fail in hunting a zebra, a gazelle, and a wildebeest. But do they give up? No. They try hard and succeed in hunting.

So, what motivates them to not surrender to the harsh life? The answer is survival. The only thing that keeps them moving is survival. Many lions lose their reign, children, and queens to other lions, but they never give up on life.

Here are six life lessons from the king of the jungle:

1. Your goal is the only way to survive

Set a life goal and work hard to achieve it; consider that there are no alternatives. As lions are born to hunt and rule; acknowledge that you are born to accomplish your life goal. Consider your purpose and work as a source of motivation. They will keep you going through good and bad times because fame is temporary, but work pleasure and sense of achievement are permanent.

2. Fail and evolve

Lions fail eight out of ten times in hunting, but this makes them fine-tune their skills; thus, they can catch bigger prey to feed their family. Likewise, we should also embrace our failures and evolve each time we face them. We must study and analyze our failures and make sure to not repeat them. As Jack Ma has rightly said, “If the guy only checks himself, yeah, something wrong with me here, something wrong with me there. Then, this guy has hope.” Also, we must follow this law of nature: ‘Evolve and survive’ to achieve success in life.

“Everyone wants to eat, but few are willing to hunt.”

3. Focus is the key

When lions go on a hunt, they make less noise and focus on the prey. They always have an element of surprise and keep everything low to make their raid successful. Now imagine, if a lion makes noise, will they be able to hunt? The answer is no! So, what do we learn? Too much talking makes us lose focus. Don’t tell everyone about your goals and what you are doing, keep it low and completely focus on your aim.

4. Always trust each other

A pride of lions always back each other in good and bad times. Rather in tough phases as an individual they contribute more to the survival of the pride. We should also learn that strength is in the pack. It’s necessary to not break each other’s trust for a short-term gain. Also, we must support each other in overcoming tough problems and situations.

5. Survival is everything

Lions don’t harm anyone without any reason. But, when someone tries to mar their territory, life, and family, they leave no stone unturned in giving a tough fight. Likewise, we should concentrate on our own betterment. However, if someone is trying to ruin our career or life, then instead of getting disappointed we should fight back and overcome such smotherers.

“The world is a jungle. You either fight and dominate or hide and evaporate.”

6. Have fun in life

Lions go through a harsh life filled with everyday challenges. But they don’t let them ruin their daily moments. They always enjoy every minute with their pride members. They play with each other and take care of everyone. You should also make sure to relish each moment of your life. Leave your stress and worries in your workplace, and when you are at home, relish the time with your family.

Lions teach us to dominate problems in life and live like a true winner. As someone has rightly said, “If size really mattered, the elephant would be king of the jungle.” Similarly, every animal’s life is full of struggle, and we can learn a lot from them to become successful and prosperous in our own lives. So next time you watch a documentary on lions, try to learn from them.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.