1. Put/Call Ratio at Extreme Levels.

Seeking Alpha

Put. Call. Ratio. Thanks to @ThinkTankCharts for an update on one of our favorite charts – the equity put-call ratio on the S&P 500. This is a red flag if there ever was one. The indicator is back at its June 8 level – beyond extreme. Traders are holding considerably more calls than puts right now, indicative of a frothy market with little concern for downside protection. Corrective price moves can happen fast, and capitulation may come quicker.

ThinkTankCharts provides nice context here – major market bottoms are noted when the put-call ratio spikes, but you can also see when the ratio bottomed as the SPX peaked earlier this year. The June 8 spike down is also evident. Is it different this time? There does not appear to by any good reason why it should be different now.

Bottom line: The bells and whistles should be going off when investors see this chart. It is a huge short-term risk flag being waved. Sticking with the components/theme of this chart, maybe now is the time to consider picking up a little insurance by way of put options to mitigate the risk.

Weekly S&P 500 ChartStorm – ‘What If’ https://seekingalpha.com/article/4359263-weekly-s-and-p-500-chartstorm-what-if

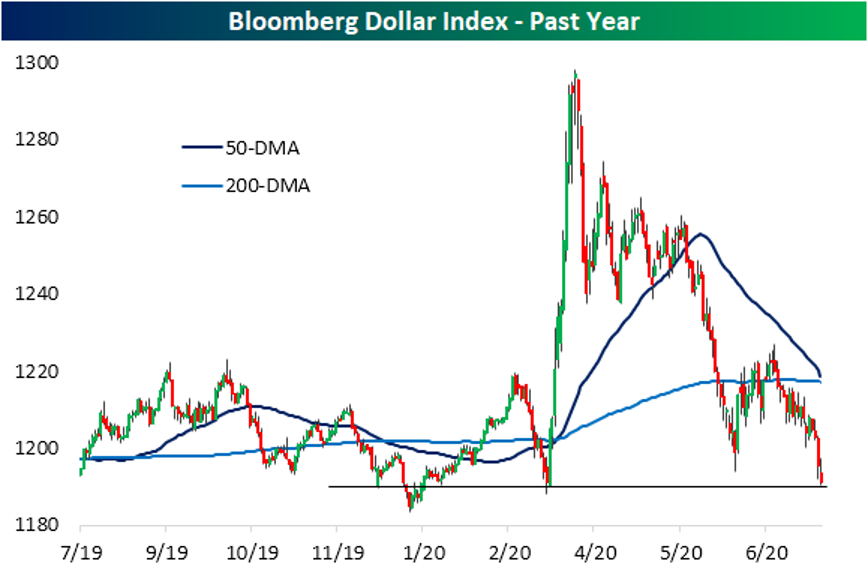

2.Downed Dollar…More on Dollar Technical Weakness.

Bespoke Investment Group

Falling another 0.35% today, the Bloomberg US Dollar Index is notching its fourth consecutive day with a decline. Over the past four days, the greenback has fallen 1.38% which was the worst four-day stretch since the first days of June. Not only is that resulting in the US Dollar Index reaching extremely oversold levels as it currently sits 2.25% from its 50-DMA, but it also now sits at a critical technical level. Before rocketing up to a record high on March 23rd, on March 9th the dollar index found a bottom at 1190.98. That is around similar levels to the mid-December 2019 and just above December 31st, 2019 lows. With today’s decline, the dollar index has now dropped 8.17% from the March high, marking a full round trip from its pre-COVID spike. Click here to view Bespoke’s premium membership options for our best research available.

https://www.bespokepremium.com/interactive/posts/think-big-blog/downed-dollar

3. In Theory …Weak Dollar Good for Emerging Markets.

Emerging markets dollar denominated debt gets cheaper and exports increase with weak dollar……This Chart is comparing Emerging Markets (EEM) vs. U.S. Dollar (UUP)…50 day thru 200 day to upside …see purple arrow.

4. Retailers on Track to Close 25,000 Stores in 2020…..Retail Trade 5.5% of U.S. GDP.

WSJ–Retailers will likely decide to close as many as 25,000 U.S. stores in 2020, which would be a record, and more than double the 9,832 stores that closed last year, according to global market-research firm Coresight Research. So far this year, major U.S. chains have announced more than 5,400 permanent closures.

Retail Carnage Deepens as Pandemic’s Impact Exceeds Forecasts-Chapter 11 filings by major retailers in 2020 have already surpassed last year’s total and show no sign of letting up

Percentage added to the Gross Domestic Product (GDP) of the United States of America in 2019, by industry(as a percentage of GDP)

Erin Duffie-Statista

https://www.statista.com/statistics/248004/percentage-added-to-the-us-gdp-by-industry/

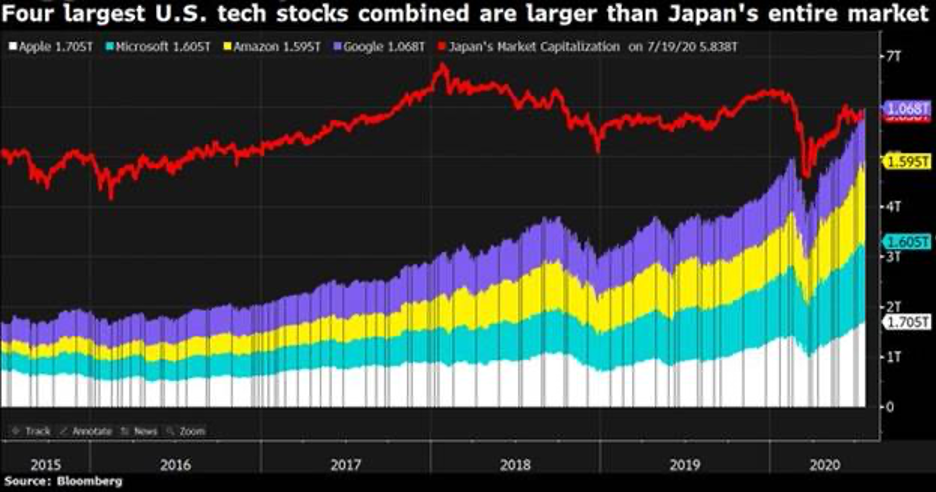

5. Four Stocks Bigger than Japan…..Apple, Amazon, Microsoft and Google are Now Third Biggest Stock Market in the World.

Apple, Amazon, Microsoft and Google combined are now bigger than Japan’s Entire Stock Market. In other words, these 4 alone would be enough to create the world’s third biggest stock market (behind the U.S. and China). Dave Lutz Jones Trading

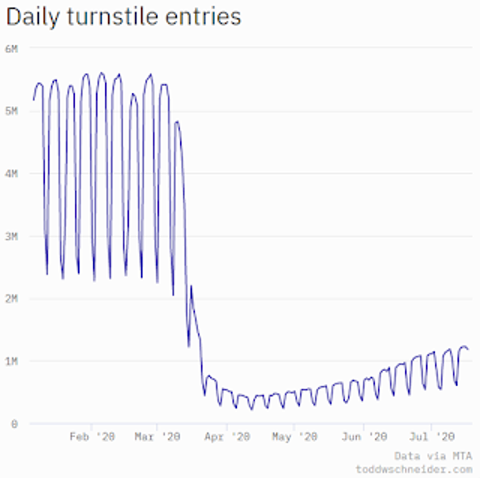

6. New York City Subway Usage

by Calculated Risk on 7/21/2020 03:19:00 PM Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

He has graphs for each borough, and links to all the data sources.

He notes: “Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings”

https://www.calculatedriskblog.com/2020/07/new-york-city-subway-usage.html

7. People are Living A lot Longer Versus Corporations Dying A lot Faster.

The Evolution of Corporate Versus Human Life Spans.

https://www.linkedin.com/in/callum-thomas-4990063/

8. Scott Galloway on Future of U.S. University.

USS UniversityScott Galloway @profgalloway

Our fumbling, incompetent response to the pandemic continues. In six weeks, a key component of our society is in line to become the next vector of contagion: higher education. Right now half of colleges and universities plan to offer in-person classes, something resembling a normal college experience, this fall. This cannot happen. In-person classes should be minimal, ideally none.

The economic circumstances for many of these schools are dire, and administrators will need imagination — and taxpayer dollars — to avoid burning the village to save it. Per current plans, hundreds of colleges will perish.

There is a dangerous conflation of the discussion about K-12 and university reopenings. The two are starkly different. There are strong reasons to reopen K-12, and there are stronger reasons to keep universities shuttered. University leadership needs to evolve from denial (“It’s business as usual”) past bargaining (“We’ll have a hybrid model with some classes in person”) to citizenship (“We are the warriors against this virus, not its enablers”).

Think about this. Next month, as currently envisioned, 2,800+ cruise ships retrofitted with white boards and a younger cohort will set sail in the midst of a raging pandemic. The density and socialization on these cruise ships could render college towns across America the next virus hot spots.

Why are administrators putting the lives of faculty, staff, students, and our broader populace at risk?

The ugly truth is many college presidents believe they have no choice. College is an expensive operation with a relatively inflexible cost structure. Tenure and union contracts render the largest cost (faculty and administrator salaries) near immovable objects. The average salary of a full professor (before benefits and admin support costs) is $104,820, though some make much more, and roughly 50% of full-time faculty have tenure. While some universities enjoy revenue streams from technology transfer, hospitals, returns on multibillion dollar endowments, and public funding, the bulk of colleges have become tuition dependent. If students don’t return in the fall, many colleges will have to take drastic action that could have serious long-term impacts on their ability to fulfill their missions.

That gruesome calculus has resulted in a tsunami of denial.

Universities owning up to the truth have one thing in common: they can afford to. Harvard, Yale, and the Cal State system have announced they will hold most or all classes online. The elite schools’ endowments and waiting lists make them largely bullet proof, and more resilient to economic shock than most countries — Harvard’s endowment is greater than the GDP of Latvia. At the other end of the prestige pole, Cal State’s reasonable $6,000 annual tuition and 85% off-campus population mean the value proposition, and underlying economic model, remain largely intact even if schooling moves online.

Who Thrives, Survives, Struggles, or Perishes?

Over the last month, we assembled a worksheet that looks at the immunities and comorbidities of 436 universities included in US News and World Report’s Top National College Rankings. This dataset compiles numbers from the Integrated Postsecondary Education Data System (IPEDS) maintained by the US Department of Education, US News & World Report, Google Keyword Planner, Niche.com’s Student Life Scores, and the Center on Education & the Workforce. This dataset should not be taken as peer-reviewed or final. It’s a working document that seeks to analyze and understand the US college and university landscape and to help universities craft solutions.

We plotted each university across two axes (four quadrants):

- Value: (Credential * Experience * Education) / Tuition.

- Vulnerability: (Endowment / Student and % International Students). Low endowment and dependence on full-tuition international students make a university vulnerable to Covid shock, as they may decide to sit this semester/year out. Consumers generally don’t like to pay the rack rate at a hotel whose general manager harasses them and is a bigot. But I digress.

Quadrants:

- Thrive: The elite schools and those that offer strong value have an opportunity to emerge stronger as they consolidate the market, double down on exclusivity, and/or embrace big and small tech to increase the value via a decrease in cost per student.

- Survive: Schools that will see demand destruction and lower revenue, but will be fine, as they have the brand equity, credential-to-cost ratio, and/or endowments to weather the storm.

- Struggle: Tier-2 schools with one or more comorbidities, such as high admit rates (anemic waiting lists), high tuition, or scant endowments.

- Perish: Sodium pentathol cocktail of high admit rates, high tuition, low endowments, dependence on international students, and weak brand equity

9. A Third of U.S. Museums May Not Survive Without Financial Relief

- Barrons–By Abby Schultz

The Petersen Automotive Museum in Los Angeles reopened briefly before California Gov. Gavin Newsom ordered indoor operations for restaurants, zoos, museums and several other sectors to close again in response to a spike in Covid-19 cases this month.

AFP via Getty Images

A third of U.S. museum directors said in a survey released Wednesday that they may not survive another 16 months without “additional financial relief,” while 16% view their institutions at “significant risk of permanent closure” as a result of financial losses incurred throughout the coronavirus pandemic.

The responses from 760 U.S. museum directors surveyed by an outside firm for the American Alliance of Museums (AAM) confirms what the alliance had feared as museums were forced to close to prevent the spread of Covid-19, and as most expect to experience reduced numbers of visitors once they do reopen.

Laura Lott, AAM’s president and CEO wasn’t surprised by the survey results, but “seeing the actual numbers from the directors themselves” was difficult.

“It’s a gut-wrenching prospect that we, as a country, would lose up to a third of these institutions,” Lott says.

Most of the museums teetering on closing won’t be well-known institutions in major cities. But one surprise in the data, Lott says, is that to some extent, the risks are spread “across all types, sizes, and locations.”

The greatest risks, however, are to children’s and science museums, which were more “in the 40% to 50% range of being at significant risk of not reopening or not being sure how they are going to make it through,” Lott says.

These museums rely more on ticket sales and other forms of earned revenue, and often, unlike art museums, don’t have big endowments or access to large philanthropic donations. They also usually don’t have government-backing, as is the case with many history museums, and are dependent on tactile, interactive exhibits that some states are prohibiting, she says.

“Museums, particularly in smaller communities, are part of the educational infrastructure,” Lott says. “At a time when we need more resources, the prospect of losing them is quite devastating.”

The survey of museum directors (30% of which were history or historical society museums and 20% of which were art museums) also revealed that 87% of museums have 12 months or less of operating reserves left, and 56% have less than six months of reserves.

Of those surveyed, 44% had furloughed or laid off staff, and 41% expected that they will have a reduced staff when they reopen. The research was conducted by Dynamic Benchmarking, a New Hampshire-based firm, at no charge to AAM.

When the museums that were surveyed do reopen, 64% expect they will have to cut back on educational services, programming, and other public services to reduce costs.

While the results are dire, the situation may even be worse than depicted as most museums surveyed at the time (84%) expected to reopen by the end of this month. Since it was conducted, however, cases of Covid-19 have surged across the country, causing many museums that had opened to close, and others to delay their

“If we were to go back and ask about target dates and reopenings, it would be a totally different picture,” Lott says.

According to AAM’s data, museums nationally have been losing a collective $33 million a day from coronavirus-related closures, or about $1 billion a month. As a result, the organization has been lobbying Congress for a total of $6 billion in funding for museums to cover costs for the rest of the year, which include retrofitting their institutions to ensure visitors and staff are safe.

The bottom line: museums are facing “less revenue and more expenses,” she says.

Included in the AAM’s $6 billion request is renewal of the Paycheck Protection Program (PPP), which has been a lifeline for many institutions with fewer than 500 employees. But the AAM also wants it to cover museums and other nonprofits with larger payrolls, since many institutions bring on part-time and temporary staff throughout the year.

The organization also is asking Congress to provide museums and other nonprofits with access to the Federal Reserve Main Street Lending program.

10. Ten Powerful Habits That Will Help You Become the Best Version of Yourself

Get the toxicity out of your life.

BY QUORA

What are some habits that are good to get into? originally appeared on Quora – the place to gain and share knowledge, empowering people to learn from others and better understand the world.

Answer by Nelson Wang, founder of www.CEOLifestyle.io, on Quora:

These are my top 10 habits I’ve developed over the last 33 years after studying entrepreneurs, executives from Fortune 1000 companies, and my own personal experiences:

- Every morning, make a list of the 3 most important things you have to do for the day that will make the largest impact. This helps to cut out the noise and forces you to prioritize. For example, the top 3 things on my list today were to host a training, attend two executive meetings and write 2 articles. I completed all 3. #Priorities

- Use the 10 years test – When you run into tough situations, often times it will seem like a disaster. Many years ago, I made a mistake at work and my boss was incredibly upset with me. I immediately became really disappointed in myself and moped around for two days. Fast forward many years later to today and it turns out it was a just a slight bump in the road in my life. It’s such a small issue that I don’t even remember exactly what happened anymore! You know what does bother me though? I could have spent those two days creating something or helping others in their lives instead of moping. So when you run into tough situations, instead of panicking, ask yourself, will this matter in 10 days? 10 months? 10 years? Chances are it won’t. Don’t sweat the small stuff and keep you eye on the big picture.

- Learn one new thing a day – It could be a list of new habits (wink wink), a new language, a skill or insight. Push yourself to grow every single day. For example, today I hopped on a call with a the creator of a TV show and learned about the entertainment industry. If you improved just a little bit every single day, think of how that effect compounds over a year. The impact becomes dramatic over time.

- Watch a thought leader on Youtube every week – A lot of my friends and gurus recommend reading every day to learn. I like reading, but I tend to learn better through visuals. That’s why I like to watch a thought leader discuss their learnings and insights on Youtube instead. Here’s one of my favorite videos when I need a little bit of inspiration. I find it to be a great way to supplement my learning. #GetInspired

- Batch your emails. It’s easy to get distracted as a thousand emails hit your inbox throughout the day. Instead of checking each one as it comes in, batch it and check the batch every 3 hours if you can. Usually if it’s something urgent someone will Gchat, Slack, Sype, text or call you.

- Drink a green smoothie every morning – It’s quick, easy and healthy for you. Who wants to chew vegetables for hours during breakfast anyway? This is such an awesome way to get a lot of your vegetables and fruit servings every day. I’ve been doing it for years. I even pack a blender in my suitcase for my work trips (true story). Pro tip: freeze your fruits and vegetables so they last longer. Plus, it gives your smoothie a nice texture (especially if you add bananas!).

- Work out in the morning – It’s so simple but it’s so effective. Your energy will be much better or the rest of the day and your health will be better for it. I aim to run 2-3 miles a day followed by circuit training. I’m not perfect, but on the days that I do it, I feel like a completely new person. Speaking of good morning habits…

- Practice gratitude – Every morning (or night), tell yourself 3 things that you’re grateful for that day. It will make you feel much happier. Another way to do this is to write it on post its and to put it into a mason jar. Anytime you’re feeling down or stuck, just take out one of the post it notes and read it. I call it the jar of awesomeness. I have one sitting on my kitchen island now.

- Build a “feel good” crew – Spend time with friends and family that lift you up and inspire you to live the best life possible. Have someone negative in your life? Don’t spend time with them. Get the toxicity out of your life! Be around people that bring out the best in you and help you shine.

- Have a bias towards experimenting – A lot of times we don’t know what the right answer is. What’s the best way to find out? Experiment. Test your ideas and have a bias towards taking actions to find out what will work. For example, I wanted to launch a consulting service helping people to launch their business ideas but had no idea how to do it. So what did I do? I started writing content around the subject, built a landing page and hosted 1:1 consulting calls. Guess what happened? I just got a verbal today for my 6th client for a $2,000 engagement. Know how many tries it took me? Too many to count. I had to constantly test different ideas on the way to finding the success that I’ve found today. When in doubt, have a bias towards action and experimentation. Here’s the good news, you don’t have to go through all the failed experiments I went through! I wrote a free guide for you here on how to land your first 3 clients.

This question originally appeared on Quora – the place to gain and share knowledge, empowering people to learn from others and better understand the world. You can follow Quora on Twitter, Facebook, and Google+. More questions:https://www.inc.com/quora/10-powerful-habits-that-will-help-you-become-best-version-of-yourself.html?cid=sf01003&sr_share=facebook

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.