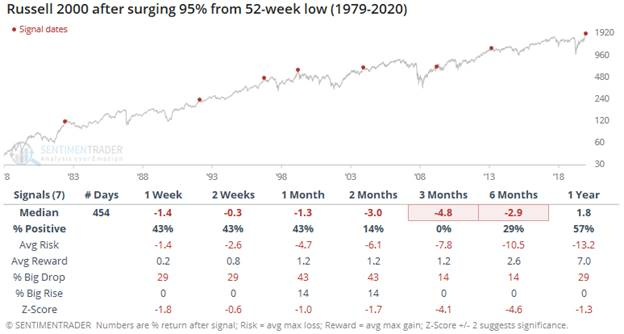

1. What Happens After 95% Surge Off Lows in Small Cap

That said, SentimenTrader notes a surge of 95% off a low has preceded losses in the small-cap index over the next 3 months every time

That said, SentimenTrader notes a surge of 95% off a low has preceded losses in the small-cap index over the next 3 months every time

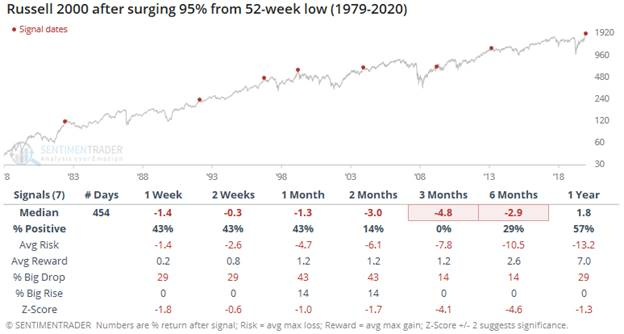

The Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-december-15th-2020/

Continue readingThe rise in corporate debt lately has been matched by an ever greater rise in corporate liquid assets.

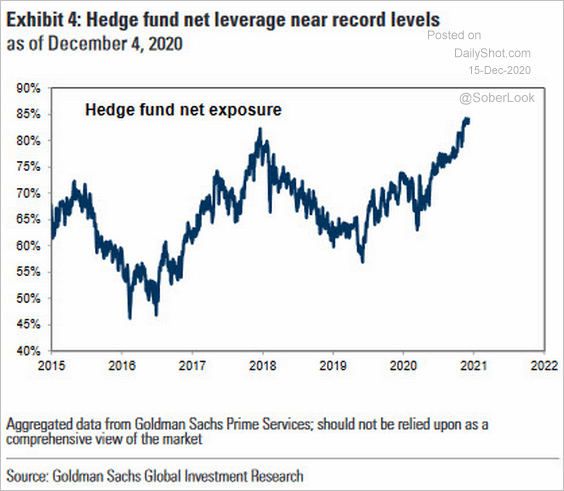

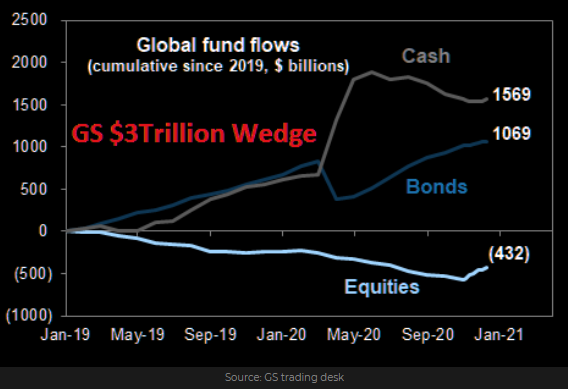

Global Equities logged +$133B worth of inflows over the past 5 weeks. This is the largest 5 week period on record by ~30% – GS Traders note January is right around the corner and this is when 37% of the YEARLY rebalances takes place. Potentially as much as $100bn of equity inflow is a guesstimate.

From Dave Lutz at Jones Trading

Continue readingIt’s not just the U.S. IPO market that is hot…International.