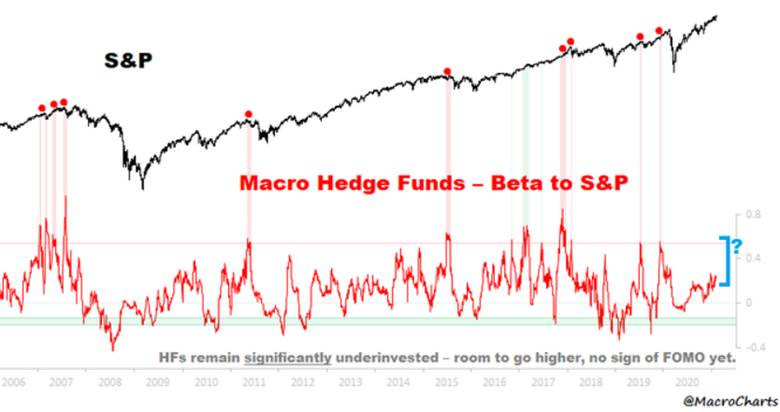

1. Macro Hedge Funds “Underinvested”

Dave Lutz at Jones Trading-Twits note on some measures Macro Hedge Funds are significantly underinvested. They’re usually “all-in” near Major tops – but right now, they have little interest in Stocks. If this rally keep going, it’s only a matter of time until FOMO kicks in.