1.Thursday NYSE Down Volume Hit 80%

Every Time The Market Finished Higher 12 mos. Out

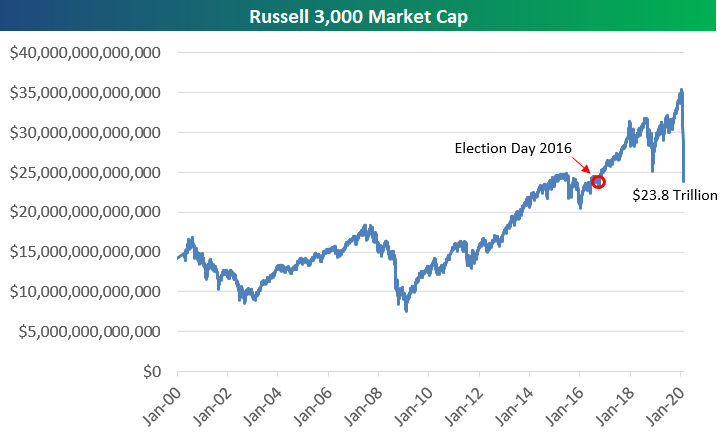

2. Selloff Erases All of US Market Cap Gains Since Election Day 2016

Bespoke

With the US stock market down nearly 7% yet again today, the total market cap of US companies as measured by the Russell 3,000 has fallen $11.5 trillion in less than a month. On February 19th, total US market cap was just over $35 trillion. It’s at $23.8 trillion as of this morning.

What makes this drop even more noteworthy is that $23.8 trillion was the market cap of US companies on Election Day 2016. At this point in time, all of the market cap gains seen since President Trump’s election victory have been wiped out. Visit our membership options page to learn more about Bespoke’s research.

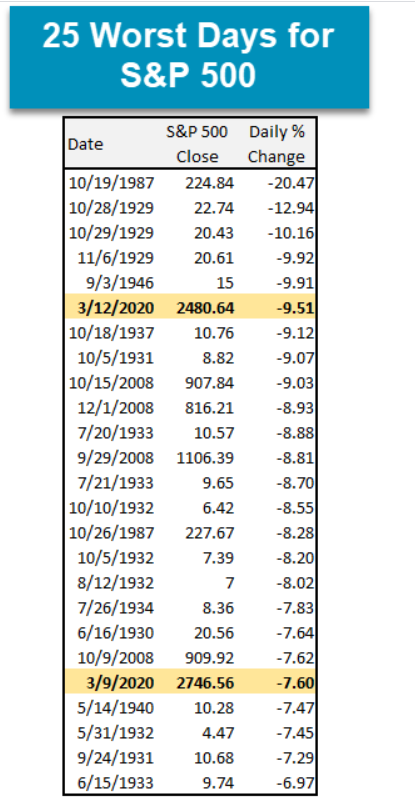

3.Two of the Worst Days Ever for S&P Corona Virus.

Nasdaq Dorsey Wright

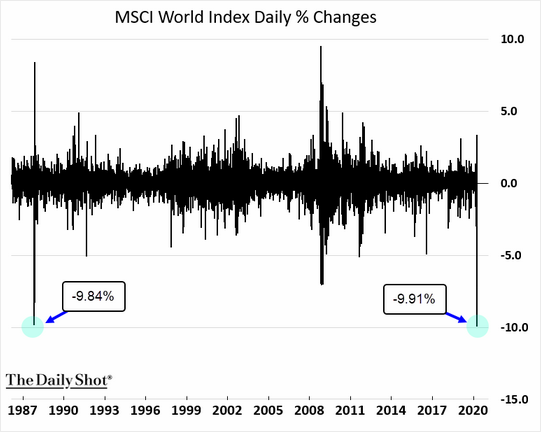

4.International Markets Have Worst Day Ever Including 2008 Crisis.

MSCI World Index Record Down Day

https://blogs.wsj.com/dailyshot/

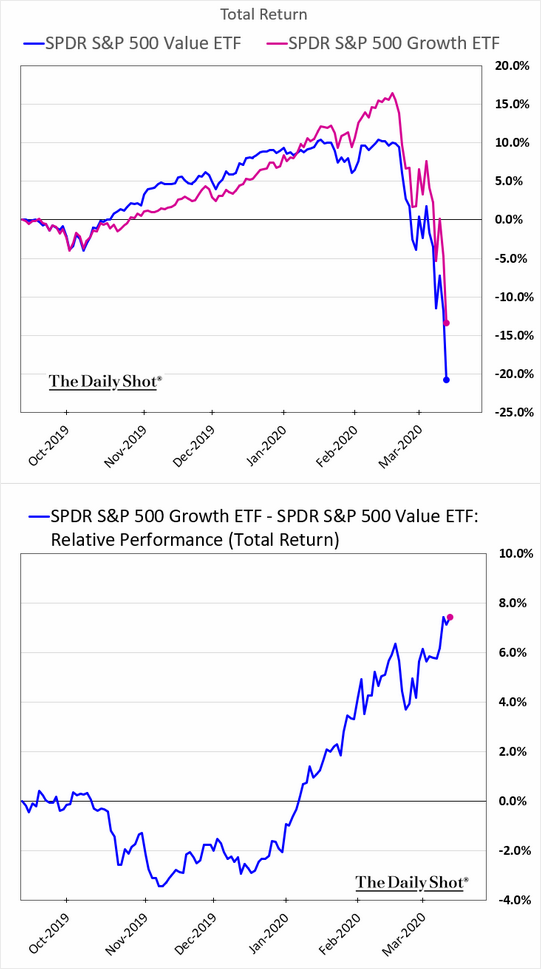

5.Growth Still Outperformed Value in Corona Virus Pullback

https://blogs.wsj.com/dailyshot/

6.Black Swan Versus Imbalance in Economy.

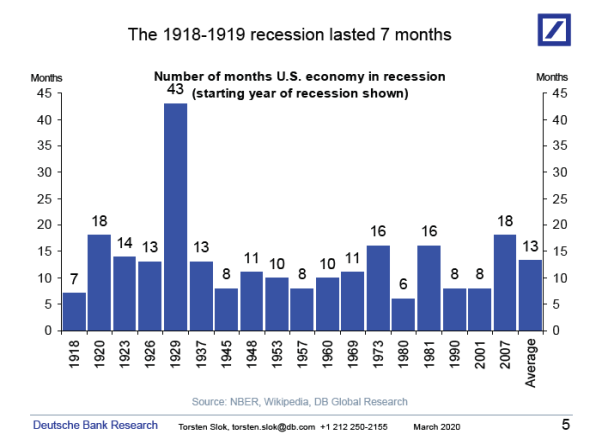

Normally recessions are triggered by too big imbalances in the economy such as too much investment in housing (2008), IT (2001), or commercial real estate (1990). As a result, the duration of a recession normally depends on how long time it takes to correct the imbalances causing the recession. The current slowdown is not driven by an endogenous build-up of an imbalance in the economy but rather by an exogenous shock that literally came out of the blue. This argues for the current slowdown to be short and deep. This is also what we saw during the pandemic flu in 1918-1919, where the recession lasted only seven months, and this was even in a situation where the second wave of infections in the fall of 1918 was more deadly than the first. During the 1918-1919 pandemic flu, 5% of the world population died, and 1/3 got infected. For more see chart below and here and here.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

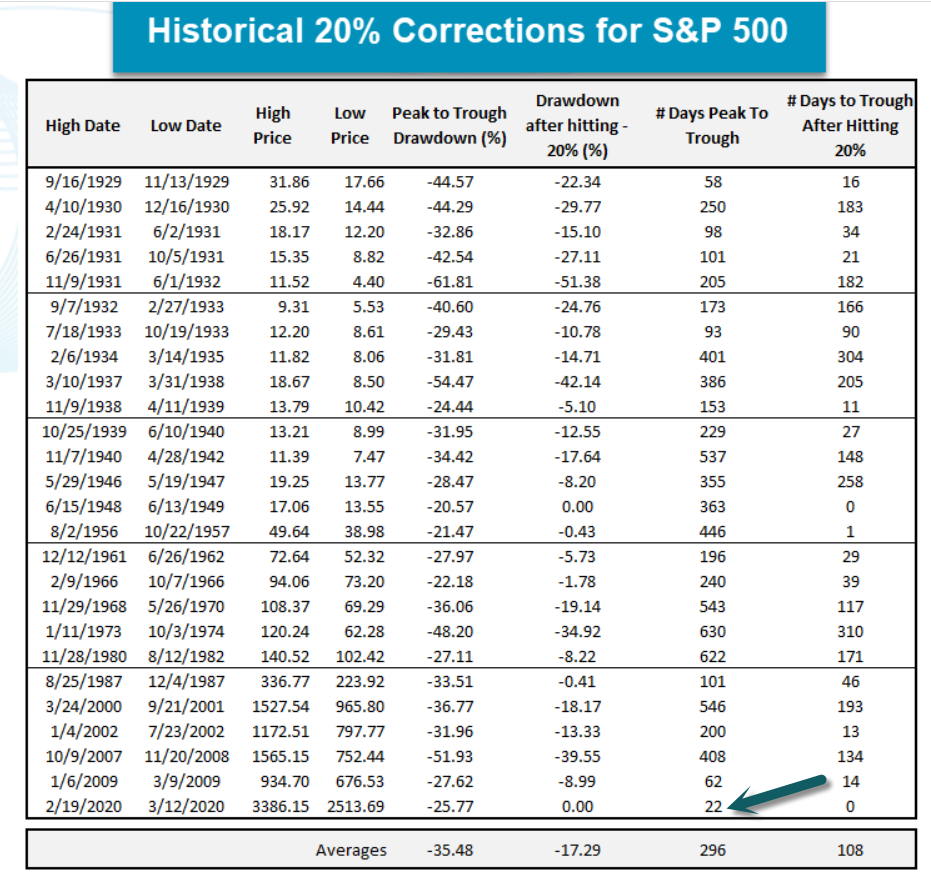

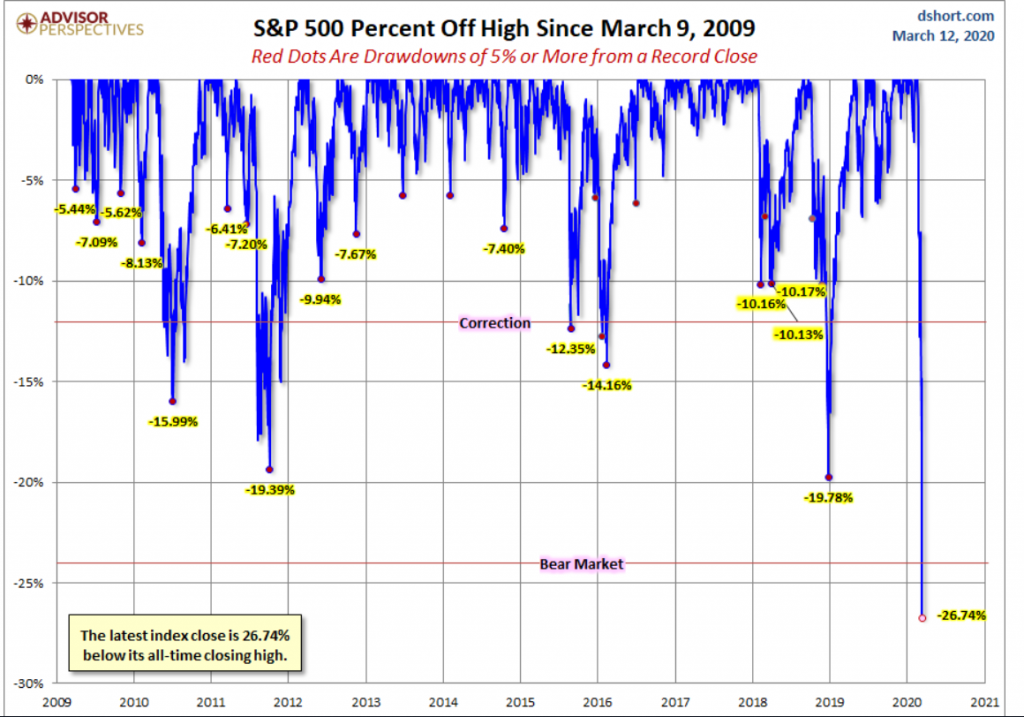

7. Pullbacks During 11 Year Bull….Corona Virus Hits Bear Level.

S&P 500 Snapshot: Officially a Bear Market–by Jill Mislinski, 3/12/20

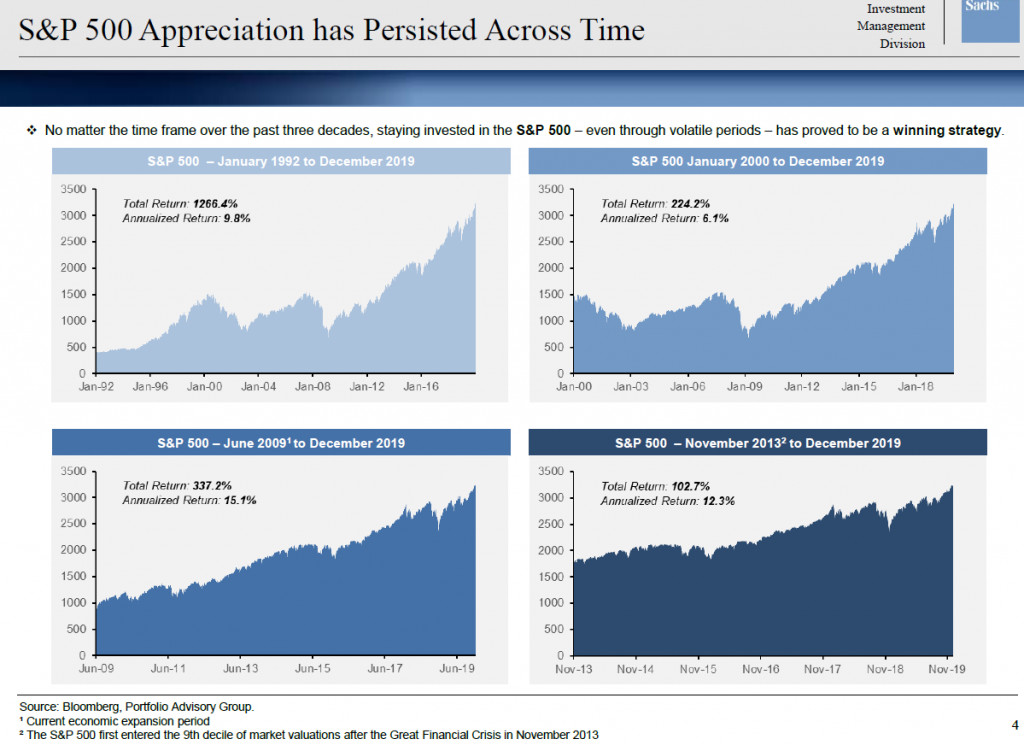

8. S&P Appreciation Persisted Across Time.

9.Why the U.S. Doesn’t Have Enough Hospital Beds

Sometimes too much efficiency can be a bad thing. By Stephen Mihm

Hospitals often speak of what’s called “surge capacity” — the ability to absorb a sudden influx of patients because of a terrorist attack, a natural disaster, or even, yes, a pandemic. Given the possible influx of patients sickened by the new coronavirus, how much of a surge can U.S. hospitals accommodate?

Not as much as you might think. For years, cost-conscious hospitals have emulated the lean, just-in-time principles that have revolutionized manufacturing. The result has been a health-care system that is far more efficient, but unprepared to handle a sudden influx of seriously ill patients.

Over the first half the 20th century, hospitals expanded, adding beds at a steady clip. By the late 1950s, the United States had approximately nine hospital beds for every 1,000 people. Many of these beds went unused in normal times, but came in handy during periods of extreme stress.

For example, in the winter of 1957 and 1958, an epidemic of influenza swept the country. This was the worst outbreak since the famous pandemic of 1918, but hospitals managed to absorb the surge without any problems. Even in New York City, which was harder hit than most, hospitals coped with the increased demand, adding a few extra beds. The epidemic came and went with little damage. Hospitals didn’t overflow with patients. Things kept running.

In the 1960s and 1970s, hospitals expanded their facilities, thanks to government subsidies that encouraged capital spending. This eventually created a surplus of hospital beds at precisely the moment when growing concern over medical costs began to fuel a search for ways to limit hospital stays or eliminate them altogether.

The turning point came in 1983, when Congress transformed how Medicare reimbursed hospitals. Up to this point, the government had followed a fee-for-service arrangement. If a Medicare patient occupied a bed, the hospital could bill the government for whatever services the patient incurred. If anything, this arrangement gave hospitals an incentive to be inefficient, keeping patients in beds longer than necessary.

By contrast, under the new system introduced that year, a patient’s particular diagnosis was translated into a flat payment for their entire hospital visit. This unleashed market forces on hospitals as they began billing by the case, not by the day.

Its effects can be glimpsed in the data on occupancy rates in the nation’s hospitals. From 1945 to 1983, hospitals in the United States kept approximately 75% of beds in use, leaving a quarter ready for unanticipated surges. But after Congress acted, occupancy rates began to plunge, reaching 65% within two years and bottoming out at around 60% the following decade.

Hospitals began consolidating and cutting capacity, just as Congress intended. The rise of managed care and other cost-conscious models also moved much of the business of delivering health care out of hospitals and into doctors’ offices and other settings.

As the need for hospital care declined, the number of beds per capita declined, too. By the early 1990s, the number of beds per 1,000 population had fallen by 50% from its peak. Over the next decade, a growing number of analysts began to worry about the unthinkable: a future shortage of hospital beds. The aging of the larger population — especially baby boomers — looked particularly worrisome.

Yet little changed. Worse, there were growing signs of strain on emergency rooms and intensive care units. Between 1997 and 2004 alone, 12% of the nation’s 24-hour emergency departments closed entirely. They weren’t profitable, particularly given that many of the people who showed up in them lacked insurance to pay for the visit.

This translated into increased pressure on the remaining ERs. Indeed, statistics show that emergency-department diversions — when hospitals nudge ambulances to take patients elsewhere — began increasing at this time. So, too, did the number of Americans seeking care from emergency rooms.

Increasingly crowded waiting rooms meant longer waits. This in turn led more patients to leave without being seen at all. In California alone, for example, the number of visitors to emergency departments who left against medical advice shot upward by 57% from 2012 to 2017.

For hospitals struggling to cut costs, the idea of adding beds — particularly expensive ICU beds — wasn’t particularly appealing. True, some hospitals added critical care beds, but this barely kept up with population growth and demand. In fact, studies over past 20 years have highlighted that while the system can handle normal levels of patient admissions, it’s ill-prepared to handle something like a pandemic.

But the problems beget by decades of cost-cutting and razor-thin margins don’t end with the availability of beds and emergency-room care. They extend to the most basic materials used in hospitals.

Since 2000, a growing number of health-care providers adopted the just-in-time inventory methods pioneered by auto manufacturers. Industry publications and academic articles alike have touted the cost savings that could come from pursuing this approach. In 2015, for example, a supply chain manager at Chicago’s Mercy Hospital told reporters, “It’s our job to make sure clinicians have what they need when they need it, but we must also make sure we don’t have too many dollars tied up in inventory.” Mercy proceeded to cut its on-hand inventory by 50%.

This included the equipment most critical for handling a pandemic, such as respirators. Michael Osterholm, an infectious disease expert who has long warned that the U.S. is unready to handle the influx of patients caused by an outbreak, recently noted: “No health care organization has gone out and stockpiled lots of personal protective equipment. They have always bought it on a just-in-time basis.”

Again, keeping costs to a minimum is laudable in normal times, even necessary. The same can be said for all the other cost-cutting measures unleashed on hospitals in recent decades. And yet, it may have set us up for disaster.

In the end, the pandemic may do more than kill people and sow chaos. It may do something more shocking still: destroy the quaint belief that market forces can cure all that ails us.

10.The Opposite of Fear

March 12, 2020

Based on what I’ve been seeing regarding people’s reactions to the unfolding coronavirus situation, many seem to be trying to keep themselves out of fear mode.

Instead of fear, they suggest to adopt a mode of thinking and being they typically describe with words like optimism or love.

Stay positive. Don’t be afraid. Don’t panic. Turn towards love.

Yet when you look at their responses and attitudes, what they’re really doing is one of more of these:

- Hoping that everything will be okay

- Guessing

- Waiting

- Ignoring or downplaying risks

- Making claims based on mathematical ignorance

- Reposting debunked memes

- Trying to encourage others not to fear

- Stocking up on food and toilet paper

- Sanitizing their hands like a Golgafrinchan phone

Is this really the opposite of fear though? Is this even moving away from fear all that much?

I’d say that the opposite of fear is more likely to include actions such as these:

- Seeking to understand the situation more accurately

- Gathering facts, details, and relevant predictive information

- Assessing risks

- Making rational predictions based on relevant models and data

- Identifying, defining, and prioritizing problems

- Devising solutions to problems

- Implementing solutions and lifestyle adjustments

- Sharing facts, details, and actionable info with others

- Asking questions to increase understanding

- Cooperating with others to identify, prioritize, and solve problems

- Coordinating with others to implement solutions

- Monitoring changes to the dynamic situation

Many people are doing a bit from both lists, which is to be expected. We have our rational side and our irrational aspects.

Is it really helpful though to focus on fear as one of the main problems though? Is this actually helping much?

When you think that you need to overcome fear first, does it help you behave more rationally? Does it lead to assessing risks and solving problems?

Or does trying to not be afraid lead you towards some form of distraction or other behaviors that delay or subvert more rational behaviors?

I think it’s hard for our characters to really grasp what the opposite of fear is supposed to look like, especially in terms of actions. When we tell ourselves not to be afraid, what do we actually do? What does doing “not afraid” actually look like? That isn’t so clear.

It appears that doing “not afraid” often looks like inviting other people to stop being afraid and to start loving and helping and supporting each other.

We’re all in this together. Don’t be a hoarder. Stay calm. And there will be rainbows and unicorns again… but unfortunately no leprechauns since St. Patrick’s Day parades are canceled.

The “don’t be afraid” admonition is one of those lines of thinking that sounds good at first, but it tends to fizzle into actions that don’t necessarily help that much. It’s not so terrible to remind ourselves not to be afraid and to turn towards love, but then where we take this beyond sharing platitudes and memes? The energy of this idea tends to fizzle out pretty quickly.

Reminding people not to fear probably might help a little bit, but it’s probably better at attracting likes and one-line comments than really moving the needle forward for most people.

Lately I’ve been finding that what moves the needle forward more than “let’s not be afraid” reminders is sharing detailed and rational info that helps people better understand how to frame this situation, what we can reasonably expect next, and why certain actions are rational right now, such as Tomas Pueyo’s coronavirus article that I’ve been referring many friends to, or Sébastien Night’s coronavirus article for the entrepreneurial perspective.

It’s good to want to move away from fear, but I think we can do better than suggesting that the opposite of fear is love and squishiness. I think we’re better of framing the opposite of fear as rational investigation, risk assessment, and problem-solving.

Given the egregious leadership vacancy at the federal level in the USA right now, we’re going to have to pick up the slack ourselves to make up for those shortcomings as best we can. Reminding each other to embrace love instead of fear is okay now and then, but let’s be sure to embrace, encourage, and demonstrate rational action to identify and reduce our risks as well.

Receive Steve’s new articles by email.