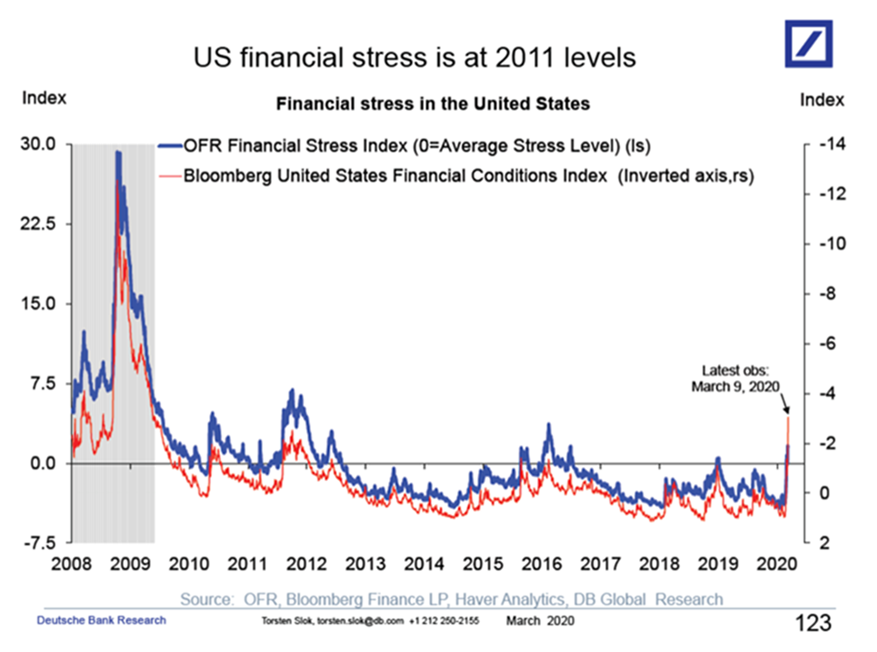

1.It’s Not 2008…U.S. Financial Stress at 2011 Levels.

A lot of my incoming client conversations today are about the key question: “How bad is it?”. In other words, what is the net impact on the economy and corporate earnings of lower rates and a lower dollar versus lower equities and wider credit spreads? Tick-by-tick measures of financial conditions show that financial conditions are currently as tight as they were during the euro crisis in 2011. In other words, any recession and slowdown in earnings associated with the ongoing moves in markets will not be as bad as during the financial crisis in 2008/2009, see chart below and here.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

2.PSCE-Small Cap Energy ETF $2.50 Last

PSCE ETF

3.1999 Internet Bubble Like Intra-Day Moves in Oil Stocks

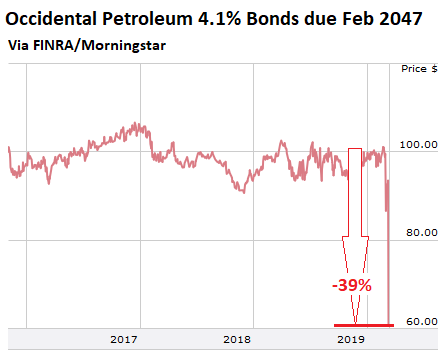

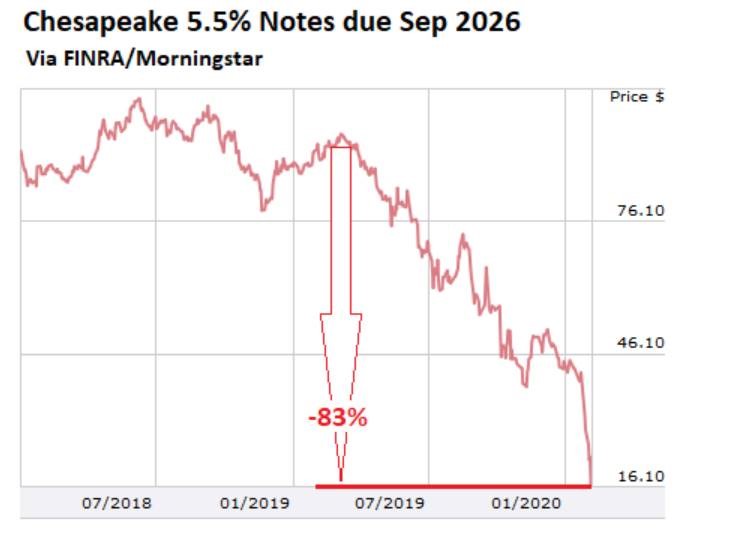

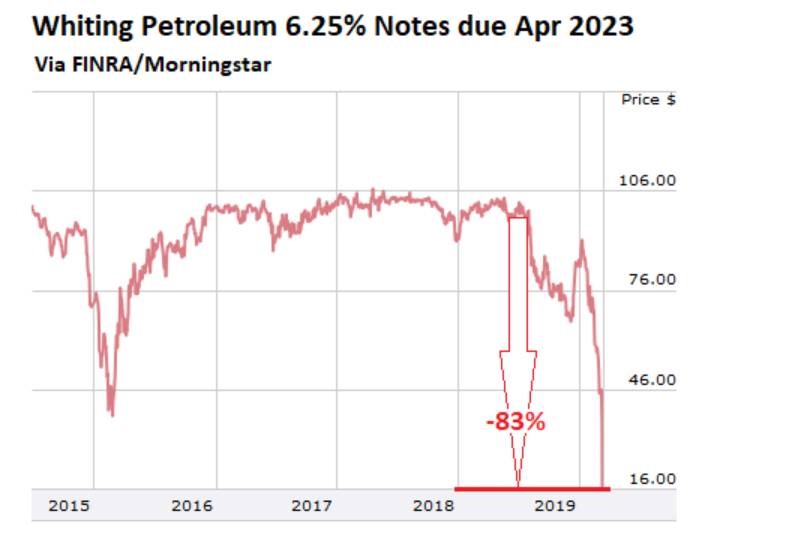

4.Bond Collapses in Energy Just as Bad.

Wolf Street

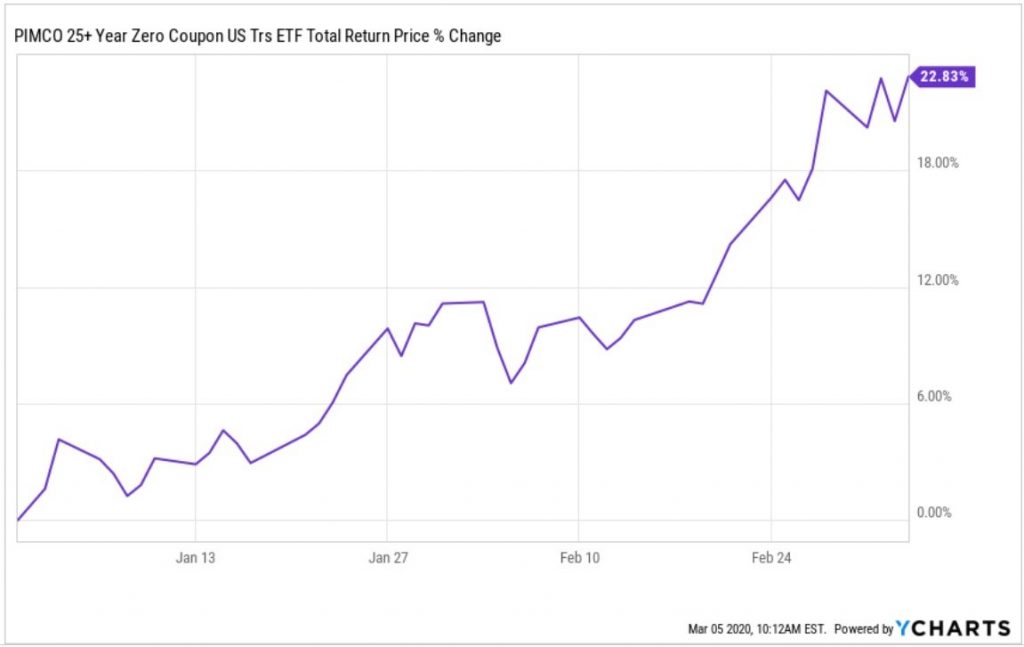

5.Pimco 25+ Zero Coupon Bond

Michael Batnick

https://twitter.com/michaelbatnick/status/1235584321555009536/photo/1

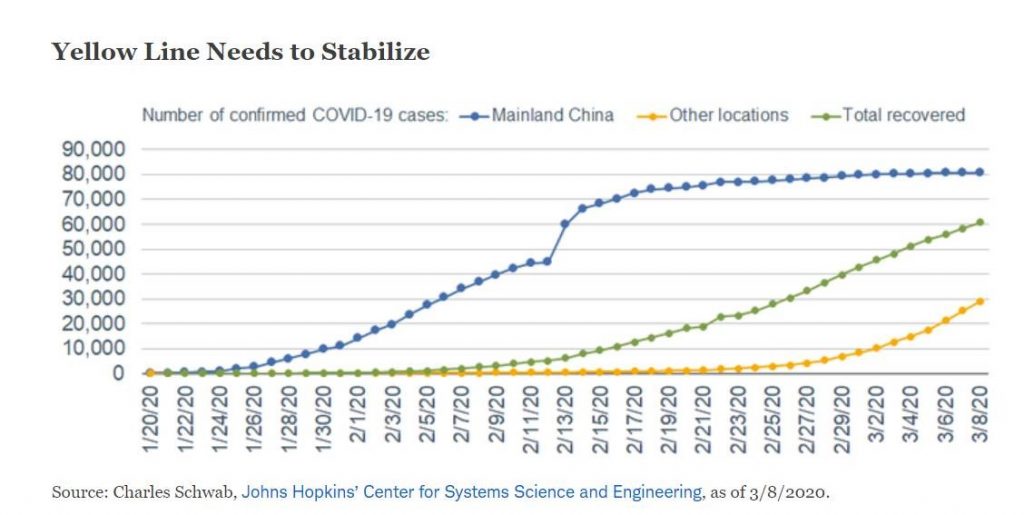

6.Yellow Line Needs to Stabilize.

Liz Ann Sonders-Schwab

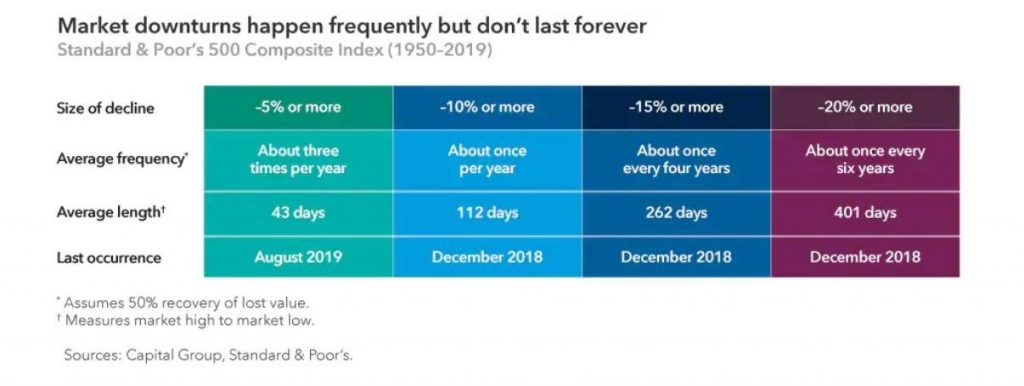

7.Grid on Downturns.

4 ways to stay calm when markets stumble-Capital Group

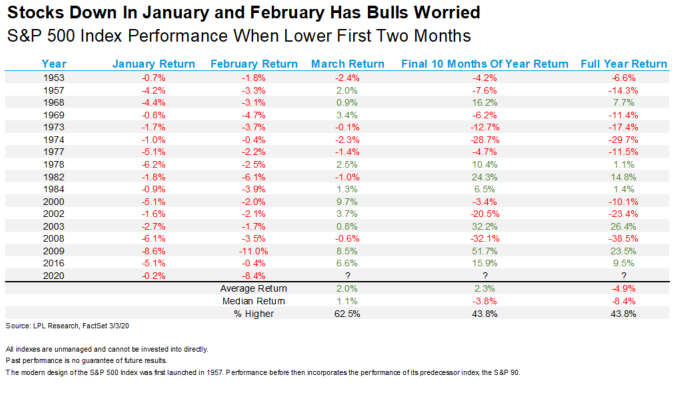

8.Down Jan and Feb History

LPL BLOG

The S&P 500 Index fell in January and February. This rare combo isn’t something the bulls wanted to see, as future returns can be quite depressing. “History tells us that bad things can happen after the first two months of the year are both red,” explained LPL Financial Senior Market Strategist Ryan Detrick. “This is only one warning sign, but it isn’t one to blindly ignore either.”

As shown in the LPL Chart of the Day, a bounce in March is quite possible for stocks after being down the first two months of the year; that’s the good news. The bad news? The final 10 months have been up only 2.3% on average, while the full year has been lower 4.9% on average. Compare that to when the first two months have been positive, the final 10 months have been up 12.2% on average and the full year has been up 19.8% on average.

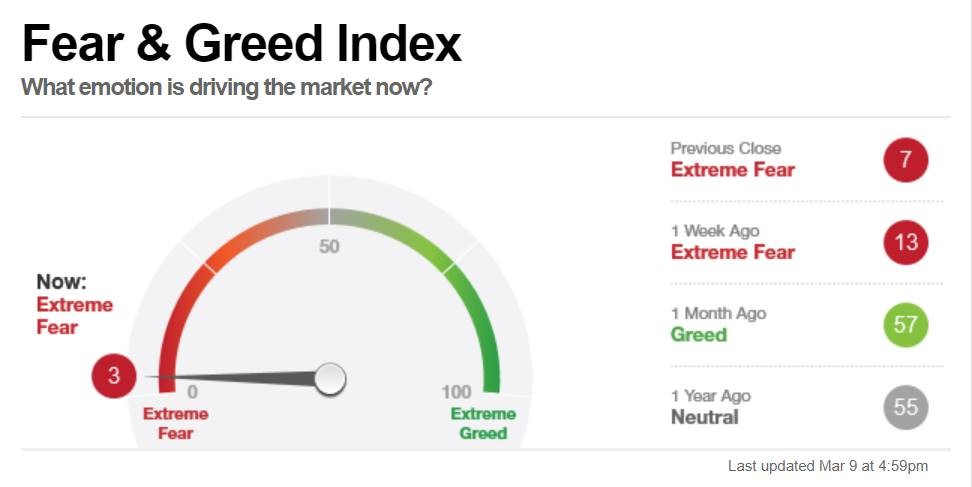

9.Fear and Greed Index Hits 3.

10. 3 Types of Exaggerated Thinking That Create Unnecessary Drama

Posted on December 23, 2013 by Steven

Handel

We all exaggerate sometimes. And it’s not always a bad thing, especially if

it’s just spicing up a story to a friend or making fun of a little thing that

happened to us on the way to work.

However, I often find that people who are the most stressed in life also have a strong tendency to exaggerate every little bad thing that happens to them. They can’t handle something without treating it like it’s the end of the world.

Of course, everyone experiences daily stress and frustrations, but when we exaggerate these bad experiences we often add unnecessary stress and drama to them that doesn’t have to be there.

Even if we think we are just being playful with our exaggerations, it’s still important to be mindful of them. You may think to yourself, “I’m just joking,” but if you say these things repeatedly then your mind begins to believe it at an unconscious level.

In today’s world, “exaggeration” seems to be an all-too-common response to our daily lives. People seem to enjoy turning ant hills into mountains, maybe even because they are addicted to their own problems and drama.

Here are 3 main ways your exaggerations can create unnecessary stress. Try to be more careful about these types of exaggerations in your own thoughts and speech.

Overgeneralizing

Overgeneralizing is when we overestimate the frequency that something happens to us.

For example, many times something bad will happen to someone – maybe they spill something on their shirt, or get rejected from a potential date, or lose their favorite pair of shoes – and they will think, “This always happens to me!”

Often, this is a type of exaggeration. Some people seem to only remember the times that something bad happened to them, but forget all the times something bad didn’t happen to them.

It’s important to avoid this kind of distorted thinking. When you find yourself thinking like this, try to take a step back and actively look for past events or situations that prove you wrong.

Is it really true that this “always” happens to you? Can you think of any time that things didn’t turn out that way? All it takes is one example to prove your exaggeration is misguided or incorrect.

Catastrophizing

Catastrophizing is when we overestimate the importance of something that happens to us.

In the heat of the moment, it can be really easy to feel like this one bad thing is going to change the course of our lives forever – or that it really is “the end of the world.” But often this isn’t the case.

What seems like a really big deal at the time is often a lot less significant when we look back on it days, weeks, or months later.

Signs of catastrophizing in your daily life include saying things like, “This is the worst day ever” or “I’ll never be happy again” or “I’m a complete loser who fails at everything.”

These are often exaggerations that don’t reflect the truth. And when you make things out to be worse than they really are, it makes the experience that much more stressful and painful.

For example, if you’re telling someone about something bad that happened to you earlier, and you exaggerate it to make it seem much worse, you are not only “re-living” the stressful experience, but also intensifying your memory of it.

Next thing you know, you tell the same story to 2-3 more people and a tiny stress that you could’ve just let go of in the moment has now transformed into something much bigger and stronger than it needs to be.

Don’t

get me wrong, bad things happen to people – but we need to learn to let go of

the small stuff and not have to create a tragedy out of every story. These type

of exaggerations can become unhealthy.

Jumping to conclusions

Jumping to conclusions is what happens when we overestimate our knowledge about a situation and make a snap judgment.

When we jump to conclusions, we often think we know a lot more about an event than we really do. This illusion of knowledge can end up giving us a wrong or misguided impression of a situation, because we usually don’t know all the relevant facts.

For example, our spouse comes home late one night, so we assume they must be cheating on us, without getting the full story.

Of course this type of over-reactive thinking can lead to a lot of unnecessary drama and stress. It often leads to us not only misreading a situation, but then acting in a way that only makes it worse.

Be careful when you find yourself making exaggerations like, “I’m 100% certain” or “I know as a matter of fact” or “There’s no way that happened” when the truth is you usually don’t know for sure what’s true.

Often it is better to suspend your judgement until you have enough facts and reasons to support it beyond a reasonable doubt. Snap judgements can be wrong and dangerous.

Stay updated on new articles and resources in psychology and self improvement:

https://www.theemotionmachine.com/3-types-of-exaggerations-that-create-unnecessary-drama/