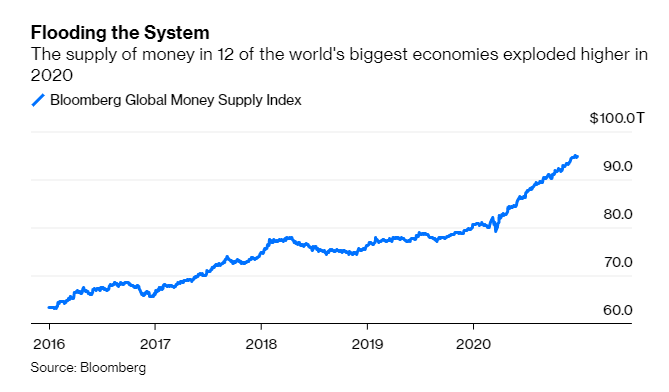

1. The Only Number that Mattered to the Market in 2020

The answer is much simpler and comes down to one number: $14 trillion. That’s the amount by which the aggregate money supply has increased this year in the U.S., China, euro zone, Japan and eight other developed economies. To put the surge in perspective, the jump to $94.8 trillion exceeds all other years in data going back to 2003 and blows away the previous record increase of $8.38 trillion in 2017, according to data compiled by Bloomberg