1. The Only Number that Mattered to the Market in 2020

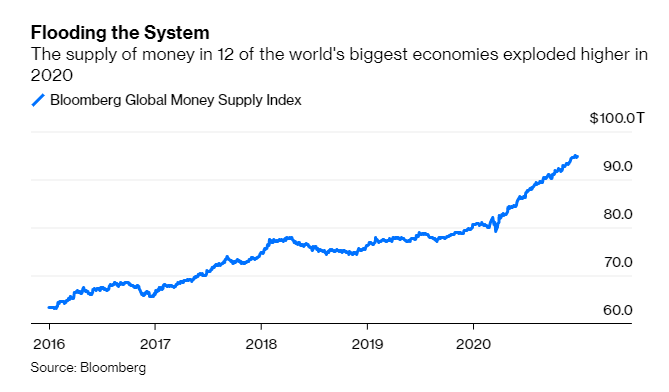

The answer is much simpler and comes down to one number: $14 trillion. That’s the amount by which the aggregate money supply has increased this year in the U.S., China, euro zone, Japan and eight other developed economies. To put the surge in perspective, the jump to $94.8 trillion exceeds all other years in data going back to 2003 and blows away the previous record increase of $8.38 trillion in 2017, according to data compiled by Bloomberg

Only One Number Mattered to Global Markets in 2020-The remarkable rally in risk assets this year comes down to one thing. Ask global central bankers what it is. By Robert Burgess

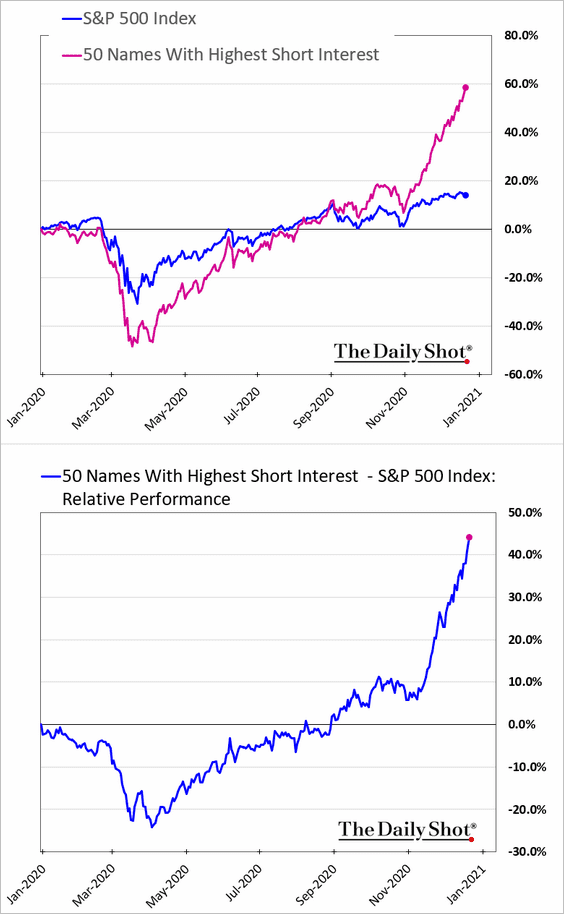

2. Most Shorted Stocks in S&P Huge Outperformance Since November.

The Daily Shot

https://dailyshotbrief.com/the-daily-shot-brief-december-23rd-2020/

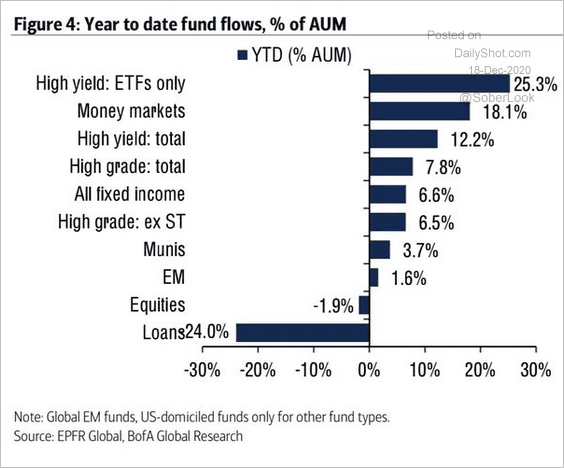

3. High Yield and Money Market Funds Lead Inflows for the Year.

https://dailyshotbrief.com/the-daily-shot-brief-december-18th-2020/

4. China Tech…Alibaba and Tencent Lose $250B Market Cap in 2 Months.

5. Small Cap Rally 100% Off Lows.

Small-cap investors have gotten an early Christmas present this year as just this week, the Russell 2000’s rally off its closing low in March topped 100%. In the history of the Russell 2000, there has only been one other time where the index rallied more than 100% from a low within a year or less and only one other time where the rally topped 90%. The biggest rally within a year of a closing low was in the period ending June 1983 while the 90%+ rally was in the period ending in March 2010 coming out of the financial crisis.

Bespoke Investment Group

6. Mark Cuban on the “Stay Private” Movement.

BLOG MAVERICK-Unfortunately the momentum of the “Stay Private” movement is devastating our economy.

Here is how:

1. Hundreds of Billions of dollars from investors , from mom and pops to huge funds, are tied up in private companies and returning nothing. That capital is dead money. It doesn’t matter what it is marked to on their books. It is dead. It can not be reinvested anywhere. That hurts our economy.

- We aren’t talking about dead money for a few weeks or months, we are talking YEARS. Ok, maybe not just years, maybe a DECADE or more in some cases.

- The balance sheets of probably 80pct of those investors is massively overstated because those private companies can’t or won’t go public. That creates its own potential issues. Because of the uncertain liquidity of those hundreds of billions of dollars, the remaining liquid assets of those investors is placed far more conservatively.

2. Not only is that money dead to investors, it is dead to employees of those private companies. Sure, some of the hottest companies that find raising their 4th or 5th round easy may return some to key employees, but those companies total how many, 10, out of how many tens of thousands of private companies that have raised capital ? And even then its only upper management. The rest of the poor people working for those companies are most likely to stay that way. Poor.

3. The dead money tied up in stock owned by anyone not in top management is one key reason that income inequality continues to get worse. Lets do some guessing with math.

- Lets say that like in 1998, 300 operating companies went public. And let’s make a guess that each of those 300 companies, had 200 employees that had vested stock options. That is 60k employees with stock in a newly public company. If the average value of that stock at IPO was $25,000, that is $1,500,000,000 increase in liquid net-worth to everyday Americans in a single year . If the majority of those companies continue to grow, then the value accrued to paid by the hour and salaried admins, analysts, security guards, receptionists, etc will enable them to participate in the same wealth creation that the One Percent does. That is of no small importance

- As a point of reference, here is an article that says that more than half of America has a net worth of less than 25k. So by working for a company that goes public, you immediately increase your chances of having a net-worth greater than half the country. To me, that is a big deal.

- Replicate the wealth impact each year and we can do more for the net-worth of hard-working Americans than any government policy or tax change. Nothing else can add thousands of people a year to the roles of the Top 50pct’ers like a revitalized IPO market.

4. When private companies can’t or won’t go public, they become easy pickings for their competitors to buy them.

- In my not so humble opinion, this is the ultimate productivity and investment killer in the USA today.

- One of the reasons today’s 3700 public companies hoard cash is because they know that rather than investing in uncertain R&D and productivity enhancements to protect them against the “Innovators Dilemma”, upstart companies that could disrupt them and their industries, they can simply buy those companies. They recognize that the current conventional wisdom for those disrupters is to stay private. Which means that with just a minuscule number of exceptions, their investors will be crying for them to be acquired. Why would a company invest in the uncertainty of R&D and other innovative organic options when there are hundred of billions of dollars of dead money tied up in ground breaking companies, all looking for liquidity ? In this age of stay private, it makes no sense to build when you can buy.

- When you buy, you not only have far greater value certainty vs R&D, but you also eliminate a competitor. And you may get the additional benefit of paying for the entire investment through job cuts

- It is undeniably destructive to our economy and future when many of our most innovative and exciting companies are bought by their competition. It is a “Precognitive Anti-Trust Violation” I know that sounds laughable in so many ways. But at its heart, it’s true. It’s also incredibly destructive to our standing in the world and our economy.

5. Some may say that this is all wrong because there isn’t a market for IPOs. There will never be a world where 300 companies go public. They will point to january of 2016 , which had no IPOs as proof of just how impossible an IPO market revitalization will be. I will tell you that the lack of IPOs is more a reflection of the intent of today’s entrepreneurs. This market is DYING for growth companies. There are so few growth stories that companies with 250 BILLION dollar market caps are looked at as growth companies. If Entrepreneurs made going public a goal again and had their IPOs while they were in an accelerating growth period rather than 10 years into their business cycle and only when their investors demanded it, I know I would be all over buying their IPOs and so would other investors.

If you have gotten this far into my long-winded diatribe, thank you. Let me be clear, I’m not religious about any of this. I believe it. I’m investing in trying to fix it. But like everything else, I am putting it out in public in order to “check my hole card” and get feedback from everyone so I can get a little bit smarter about the whole thing.

7. Internet Connected Healthcare Monitoring Devices.

House calls are coming to health care-Capital Group

The world’s attention has been focused on the speed of COVID vaccine development. But advances in medical technology and shifts in consumer behavior are converging to improve outcomes for patients, drive down medical costs and generate opportunity for companies. “There’s never been a more exciting time in health care,” Wolf says.

Consider the recent spike in demand for online doctor visits. The service has been available for a few years, but its adoption was limited prior to the pandemic. “Telemedicine was already a wave, but COVID and relaxed rules by regulators turned it into a tsunami,” Wolf adds.

What’s more, advances in home diagnostics — including continuous glucose monitors and insulin pumps for diabetes, as well as wearable monitors that track irregular heartbeats and other signs of heart disease — are allowing doctors to monitor patients remotely.

“We’re still in the early stages of cost-efficient devices that can send a variety of health-related metrics to physicians or assist the patient in managing their own care,” Wolf notes.

A range of companies could address the rising demand for remote monitoring, including DexCom, ResMed, Insulet, Tandem, iRhythm and Abbott Laboratories. It also includes telemedicine services like those offered by Teladoc and UnitedHealth.

U.S. outlook: The future is here, and it’s digital

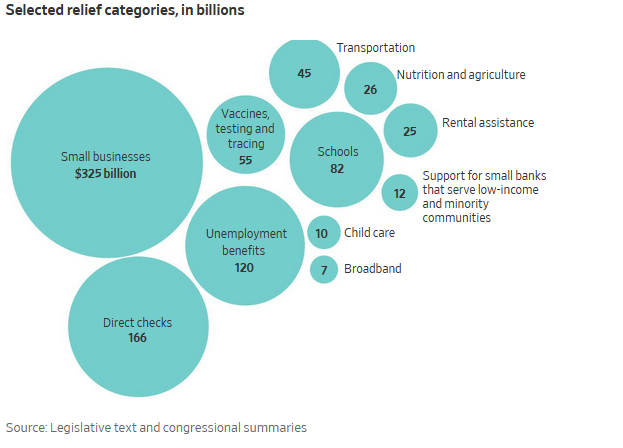

8. WSJ with a good breakdown on What’s in the $900 Billion Covid-19 Relief Bill

9. Feeling Depressed? Bacteria in Your Gut May Be to Blame

New studies point to the trillions of organisms in the human microbiome as playing an unexpepected–WSJ

Bacteroides, here seen in a colored scanning electron micrograph, are the most common bacteria found in the human intestinal tract.

Until now, though, no one has been able to single out specific species of microbes linked to a mental illness. This month, an international research team for the first time identified dozens of species of gut microbes involved in depression by comparing patients diagnosed with the disorder to healthy people. These 47 species are a tiny fraction of the gut’s microbial diversity, which includes other single-celled organisms, thousands of virus species and fungi.

The new research by neuroscientist Peng Xie at China’s First Affiliated Hospital of Chongqing Medical University and colleagues reveals a potential mechanism for a mental illness that affects an estimated 350 million people world-wide, several experts said. The research was published in the journal Science Advances.

Scientists are rushing to discover how such microbes interact with the human central nervous system, what signals they send to the brain and how that alters a person’s behavior or risk of mental illness, in hopes of new treatments and diets for maladies of the mind.

“The big race is on to understand what role all these play in various brain diseases,” said Emeran Mayer, a medical psychologist at the University of California, Los Angeles who studies the brain and gut microbiome and has written “The Mind-Gut Connection.” He adds, “if you already have genetic risk factors for Parkinson’s disease or Alzheimer’s or major depression, this is a factor that could push it over the edge into a disease.”

Not so many years ago, the only microbes that attracted medical attention were germs that caused infections and diseases.

But indiscriminate use of antibiotics and other sanitation measures eliminated the harm that bacteria cause at the expense of the protection they can provide. Unintended health consequences ranged from increases in liver disease, Type 2 diabetes and asthma to preterm birth and antibiotic-associated diarrhea, according to a 2019 review in the Journal of Experimental Medicine and many other microbiology studies.

During the past decade, advances in low-cost, high-speed gene sequencing machines allowed researchers to study millions of microorganisms that normally can’t be grown in a laboratory. In these studies, researchers can determine whether genetic material belongs to bacteria though a biomarker called the 16s ribosomal RNA gene, which turns up only in microbes.

Microbiologists calculate that the human gut contains more than 100 trillion microorganisms. Together they weigh about 5 pounds—about as much as a big mango and slightly more than the human brain, according to the European Society for Neurogastroenterology and Motility.As a result, the study of the microbiome is one of the hottest new fields in medicine, with more than 15,000 scientific papers published last year alone. “There is a lot of excitement in the field of psychiatry now about this,” said John Cryan at the University College Cork in Ireland, who studies the microbiome and the neurobiology of stress.

Moreover, where the human genome carries some 22,000 protein-coding genes, researchers estimate that the human microbiome contributes some eight million unique protein-coding genes, or 360 times more bacterial genes than human genes, according to the National Institutes of Health’s Human Microbiome Project.

These microbes appear especially adaptable to changes in the environment, diet and the biochemistry of emotion. While no one yet knows exactly why, patients with various psychiatric disorders including depression, bipolar disorder, schizophrenia and autism-spectrum disorder have significant disruptions in the composition of their gut microbiome.

The microbes appear to be in almost constant communication with the brain directly by affecting nerve signals and indirectly through chemicals absorbed into the bloodstream, said Dr. Gilbert, who also is scientific adviser for a small microbiome company called Holobiome in Cambridge, Mass., that seeks new ways to treat depression, insomnia and other ailments.

Some common gut bacteria, for example, help generate neurotransmitters such as serotonin, which affects neural activity related to mood and memory. It’s commonly used to treat depression. Others make an amino acid called gamma-aminobutyric acid that naturally blocks some brain signals. It’s used in medication to relieve anxiety and improve mood.

“The bacteria are hijacking parts of systems within the body that we know are affecting emotional regulation,” Dr. Cryan said. “This has led us to the idea that by targeting microbes in the gut, we can have behavioral effects that are going to have impact on overall well-being.”

Write to Robert Lee Hotz at lee.hotz@wsj.com

10. Here’s How to Tell If Someone Is a Toxic Person in the First 5 Minutes

If your new acquaintance does any of these things, you should probably stay away.

BY MINDA ZETLIN, CO-AUTHOR, THE GEEK GAP@MINDAZETLIN

You know how damaging it can be to have a toxic person in your workplace, or in your life. Unfortunately, most of them don’t come with warning labels the way toxic chemicals do. Many of them seem very likable at first. After all, most toxic people are good manipulators, so getting you to like them is part of their toolkit.

Is there a way to tell early on–ideally the first time you meet–that someone will turn out to be a toxic person? While there’s no foolproof method to tell right away if a new friend or colleague will be a drag on your energy, mood, or productivity, there are some early warning signs many toxic people display. If you encounter any of these when meeting someone for the first time–and especially if you encounter several of them–proceed with caution:

1. They badmouth someone else.

I once went for an interview at a company where the CEO told me about the deficiencies he saw in his second-in-command. That seemed like a big red flag to me, and I was right–I tried working there on a part-time basis for a couple of months but quickly left when the CEO proved much too toxic to work with. If someone you meet criticizes or complains about a third party who isn’t present, that may be a sign that you’re dealing with a toxic person–and when you’re not around they’ll say bad stuff about you. (The exception is when the comment makes sense in context, for instance if someone criticizes the Democratic candidate when you’re at a Republican fundraiser.)

2. They complain.

Most toxic people are championship-level complainers. Listening to them gripe can be bad for your mood, your productivity, and maybe even your health. Plus, if you’re like many people, you’re in danger of getting sucked in, trying to fix whatever they’re unhappy about. That’s almost always a losing proposition. So if someone starts off your acquaintance with a lot of complaining, think hard about whether you want that person and their many dissatisfactions in your life.

3. They ask for special treatment.

You know who I mean. The person who expects you to accept their submission even though it’s a day or two past the deadline. The person who absolutely must get into your event for free even though everyone else is paying admission. If someone asks you for a special favor when you’ve only just met, just imagine what they’ll ask for once they get to know you better.

4. They boast.

If you’re meeting someone for a (formal or informal) job interview, it’s natural for them to talk about their accomplishments. In other situations, someone who bends your ear for five minutes about how successful their last project was or how high their revenue is trying too hard to influence your thinking. Be wary.

5. They put you on the defensive.

Sometimes this happens so subtly that you can’t even say for sure how it was done. But you suddenly feel the need to explain to this person you’ve barely met why you made the choices you did, or why your organization isn’t so bad after all. Someone who makes you feel like you have to constantly defend yourself, your company, or your beliefs is going to be exhausting to spend time with.

6. They make you work to please them.

This happens to me all the time, and I bet it happens to you, too. Someone tells you they just can’t find the app they need for what they want to do. Or they’ve put together a proposal, but it just isn’t quite right. Or all their hopes ride on their child getting into that one special school. Before you know it, you’re trying to write an app for them, or seeking out inside tips to improve their proposal, or calling all your friends to see if anyone you know happens to know someone on the admissions committee for the school they want.

Stop right there. Anyone who has you tying yourself in knots to help them when you’ve only just met will only manipulate you into greater and greater efforts as time goes on. And you already know they’re extremely difficult to please.

7. They don’t show interest in your concerns.

You’ve just had a 10-minute conversation with a new acquaintance and you already know where they grew up, that they got divorced six months ago, and that they just landed a promotion. Meantime, they don’t even know where you work or what you do for a living.

Someone who expects you to be interested in every aspect of their life but has zero curiosity about yours is highly likely to be a toxic person. Be on your guard.

8. They don’t make you feel good.

Do a gut check. How do you feel after talking with this person? How would you feel at the prospect of, say, spending an hour with them over lunch or coffee? If spending time with someone makes you tense or unhappy, there’s a decent chance that this is a toxic person. So if you feel negative, it’s worth trying to figure out why. Maybe this is someone from a different culture, or you feel intimidated by their intelligence or success, in which case you should probably try to overcome your resistance. But it could also be that this is a toxic person, and you should follow your instincts when they tell you to walk away.

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.