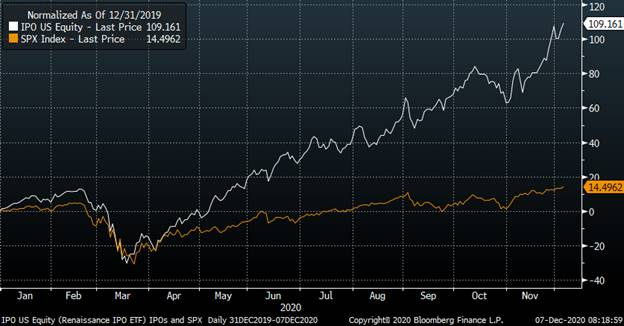

1. IPO ETF is +100% 2020.

December is set to be the busiest year-end on record for initial public offerings in the U.S., with DoorDash Inc. and Airbnb Inc. ready to start trading this week in long-awaited listings – The two startups, which are aiming to raise a combined $6.2 billion at the top-end of their price ranges, will propel the month’s IPO volume to all-time high, surpassing the $8.3 billion mark set in December of both 2001 and 2003. DoorDash upped the price range for its stock in a Friday filing, while Airbnb plans to boost the proposed price range of its initial public offering to between $56 and $60 a share. The IPO ETF is a double in 2020!