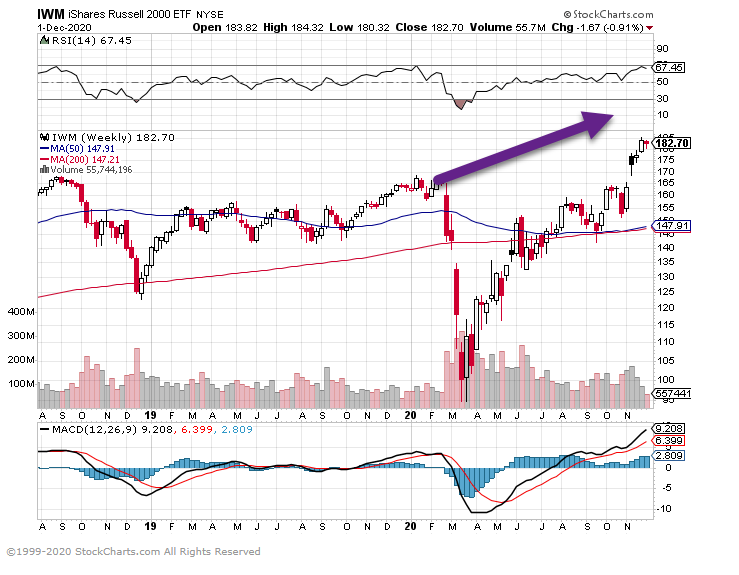

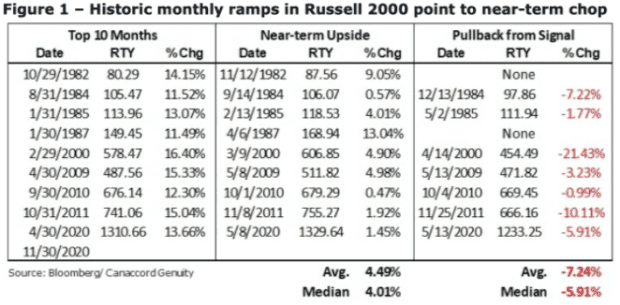

1. Russell 2000 just had its best month ever … November’s 18.3% gain eclipsed prior record of 16.4% set in February 2000

2. Historical Look at Small Cap Returns Following Record Months.

And while December is historically a strong month for equities, the strength of those November gains suggests a note of caution would be in order, analysts said.

Dwyer said that when it came to the small-caps, a look back at the data found a monthly gain of 11.5% or more for the Russell 2000 was typically followed by a retracement of near-term gains. That means investors could have bought it cheaper over the coming weeks or months, with the index seeing a median drop of 5.9% from the monthly close (see table below).

The stock market saw a historic November rally — here’s why that might not bode well for December By William Watts

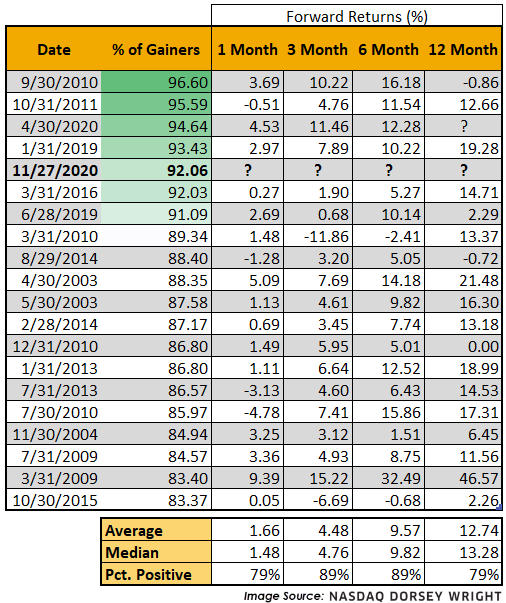

3. Market Breadth Widening…..464 stocks in the S&P 500, or about 92%, posted gains in the month of November

Whether talking internationally or domestically, market breadth is widening. On the continued news of vaccine developments and subsiding political uncertainty, broad equity market benchmarks have rallied, to the point where the Dow just closed its best month since January of 1987 and the S&P 500 since April of this year. However, differing from April, the latest rally has been widespread. As of Friday (11/27), 464 stocks in the S&P 500, or about 92%, posted gains in the month of November. In the past 20+ years, the percentage of S&P 500 stocks with positive monthly returns has only eclipsed 90% on seven occasions, two of which belong to 2020 (April and November). Historically, these instances have occurred during strong market environments and signaled favorable returns ahead for the index, as shown below.

Nasdaq Dorsey Wright www.dorseywright.com

4. Will Big 5 Stocks Give Up Lead? Big 5 stocks include Alphabet, Amazon, Apple, Facebook, and Microsoft

Schwab-Liz Ann Sonders

Much attention, rightly so, has been on the “big 5” largest stocks (by market capitalization) in the S&P 500 vs. the “other 495” stocks. The chart below shows the spread between the performance of the two cohorts; which hit a peak of 62 percentage points on September 2, 2020. At that point, the big 5 were up about 65% on average year-to-date; while the other 495 were up only 3% over the same period.

Big 5’s Reign Over?

Source: Charles Schwab, Bloomberg, as of 11/27/2020. Big 5 stocks include Alphabet, Amazon, Apple, Facebook, and Microsoft. Past performance is no guarantee of future results.

Because the big 5 represented nearly 25% of the cap-weighted S&P 500 at that time, their hefty outperformance lifted the overall index; while the vast majority of companies remained in the doldrums. That, in fact, is somewhat reflective on an economy that had a small handful of “thrivers” during the pandemic; while the majority of companies and industries were in a very beleaguered state. Fast forward to today; and looking ahead, that peak in outperformance on September 2 has been followed by a series of massive rotations into other areas of the market outside of the thrivers. The rotations have had many flavors: including from growth to value, from large cap to small cap, from defensives to cyclicals, from stay-at-home stocks to get-out-and-about stocks, and from leaders to laggards.

https://www.schwab.com/resource-center/insights/content/2021-us-market-outlook-reaching-better-days

5. Treasury Yield Spike Risks Sparking Domino Effect Across Markets

1 / 5

Treasury Yield Spike Risks Sparking Domino Effect Across Markets

Ruth Carson and Joanna Ossinge, Wed, December 2, 2020, 12:45 AM EST

(Bloomberg) — One of the year’s biggest spikes in Treasury yields has investors mapping out the impact of rising rates on markets ranging from stocks to corporate bonds.

Renewed optimism about U.S. stimulus talks pushed the benchmark 10-year yield to a high of 0.94% on Tuesday, a move which if continued could spark a domino effect across risk assets trading at all-time highs thanks to low interest rates. At issue is whether the jump in yields is accompanied by an economic recovery and moderate levels of inflation that would allow the Federal Reserve to keep rates low.

So far it seems investors are positioning for that scenario, with the Treasury curve — often a gauge of growth expectations — steepening overnight and U.S. stocks rallying to a fresh record. Ten-year breakevens — a measure of the market’s inflation expectations — rose to their highest level since May 2019.

“A range of 1% to 2% is certainly possible and it would have wide implications across everything from emerging Asian currencies to commodities,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore. “It’s likely a matter of when — not if — yields will climb.”

Benchmark yields have tripled from their March lows on bets of a global economic recovery and a “return to normal” from the pandemic with the help of vaccines. A Bank of America survey last month found a record 73% of investors expected a steeper yield curve.

Here’s a look at what higher Treasury yields could mean for various asset classes:

https://finance.yahoo.com/news/treasury-yield-spike-risks-sparking-020135208.html

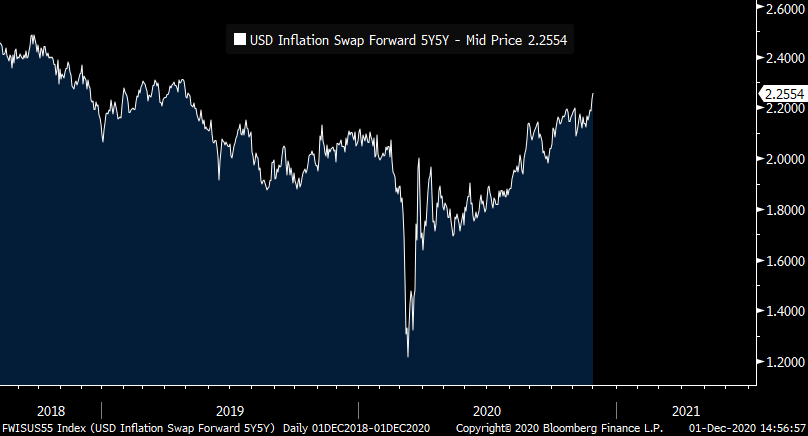

6. U.S. 5 Year Inflation Break-Even 2.20%…Highest in Two Years.

Cullen Roche and Joe Weisenthal liked·

US 5Y5Y inflation breakevens through 2.20% today, highest in nearly two years. Have been more cynical of the reflation narrative, but hard to argue with this kind of move.

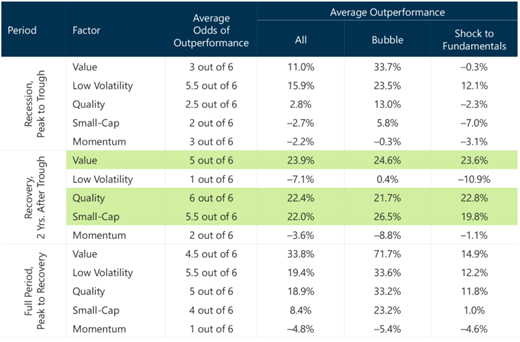

7. Value Performance In Recessions And Recoveries Could Be A Guide To The Future

Summary

Small-cap deep-value stocks tend to suffer the worst in recessions, as macro-economic contractions hit smaller, cyclical firms harder and as financial market volatility tends to cause flight from illiquid assets.

Small-cap deep-value portfolios tend to perform the best coming out of recessions as the economy recovers and liquidity flows back.

The most significant – and surprising – reason that value stocks outperform coming out of recessions is high earnings growth rates: growth rates that often exceed the growth in more expensive, glamour stocks.

Investors who can keep their heads when everyone about them is losing theirs can exploit simple predictable rules to make outsized returns–and have the confidence that the probability of achieving these higher returns is higher in times of crises than otherwise.

Given the dramatic underperformance of value stocks since 2017, it’s understandable that many have abandoned the strategy, believing the premium has vanished. It even led Ted Aronson, founder of AJO Partners, a highly regarded quantitative value manager with assets under management in excess of $28 billion at the end of 2016, to close up shop and return the remaining $10 billion of assets to shareholders. With that said, observers of market history know that value has faced similar death sentences previously, only to undergo a rapid reincarnation and deliver spectacular returns.

Thanks to a paper by Research Affiliates, we can review the performance of factor-based portfolios in recessions and recoveries.

Strategy Performance in Recessions and Recoveries (US 1963-2019)

8. “Absolutely Crazy” – Sub-Zero Freezer Demand Erupts Ahead Of Vaccine Distribution

by Tyler Durden Demand for sub-zero freezers has erupted over the last month following encouraging COVID-19 vaccine developments from Pfizer and the German firm BioNTech.

The Pfizer-BioNTech vaccine has to be stored at -70 degrees Celsius – standard commercial freezers don’t get that cold – forcing many hospital systems across the country to panic buy these special freezers from refrigerator-maker So-Low Environmental Equipment.

Dean Hensler, vice president of So-Low, told CNBC’s Squawk on the Street that “right now we are out of everything.”

Hensler said the anticipation of coronavirus vaccine distribution had unleashed a massive buying wave of ultra-cold freezers by hospital systems that plan on storing then distributing the vaccine.

Last week, Pfizer-BioNTech filed for emergency use authorization with the FDA for approval – a meeting had been scheduled for Dec. 8, 9, and 10 – Pfizer CEO Albert Bourla said the first doses of the vaccine could be shipped out within hours of the EUA approval.

Reuters quoted President Trump on Thursday evening, saying the vaccine could begin delivery as soon as next week.

The largest hurdle for a nationwide vaccine rollout is the expanding need for cold storage.

“We had heard that the Pfizer was going to have to be stored at minus 70. We took it upon ourselves to say, ‘Hey, listen, we’ve got to do something about this,'” Hensler said.

“Our phones started ringing off the hook the day it … got out to the public. That inventory we had built was gone like in three weeks, so now we’re building everything per order,” he said. “We’re running about six to eight weeks on delivery right now. It’s been crazy. It’s been crazy.”

“We’re going to work Friday after Thanksgiving,” Hensler said. The way the company sees it, he said, “The quicker we can get freezers out, the more people can get vaccinated, and we can get back to the old normal, rather than this new normal.”

Earlier this week, UPS announced it would produce thousands of pounds of dry ice per day and provide cold storage facilities and transportation for COVID-19 vaccines.

9. The rise of military space powers

Miriam Kramer, author of Space

Illustration: Aïda Amer/Axios

Nations around the world are shoring up their defensive and offensive capabilities in space — for today’s wars and tomorrow’s.

Why it matters: Using space as a warfighting domain opens up new avenues for technologically advanced nations to dominate their enemies. But it can also make those countries more vulnerable to attack in novelways.

- “Space has already been weaponized by just about any definition,” Todd Harrison of the Center for Strategic & International Studies told me, citing work his organization has done to quantify the problem. “The question is, ‘How are we going to respond?'”

Driving the news: From anti-satellite tests to establishing military branches dedicated to space, it is becoming an integral theater for militaries around the world.

- U.S. Space Command issued a rare statement in July calling out what it called an “anti-satellite weapons test”after a Russian satellite appeared to release a projectile near another Russian satellite.

- China reportedly has the technology to blind enemy satellites, according to a March 2020 report from CSIS.

- The U.S. and other nations rely on satellites to keep soldiers safe and get the lay of the land on the ground.

The state of play: More countries are relying on space in ways that benefit their societies, economies and militaries, so in some ways it’s logical for them to create tools to help ensure access to orbit,Victoria Samson of the Secure World Foundation told me.

- The Space Force — which will have its one-year anniversary this month — was created in part to deter nations that threaten the U.S. in space.

- “While we will extend and defend America’s competitive advantage in peacetime, the ultimate measure of our readiness is the ability to prevail should war initiate in, or extend to space,” Gen. John Raymond, the Space Force’s chief of space operations, wrote in a planning document in November.

- France and Japan have also recentlycreated their own military space divisions, showing how key space is becoming to military operations around the world today.

Yes, but: Some experts believe the U.S. is falling behind in efforts to secure its space infrastructure.

- While the U.S. is ahead of every other nation in its capabilities from orbit, the country’s national security satellite infrastructure — which depends on a relatively small number of extremely expensive spy satellites — is vulnerable to attack.

- China, for example, sees its stance toward national security space in part as a way to counteract U.S. supremacy in orbit, according to a report from the Defense Intelligence Agency.

The catch: While wealthy nations can use space to their advantage in a variety of ways, doing so also creates new vulnerabilities. Establishing infrastructure in space is expensive, but destroying it is relatively easy.

- So far, countries have largely steered clear of destroying enemy satellites in part because of the far-reaching geopolitical implications of that kind of attack. And creating more space junk affects everyone in orbit, not just your enemies.

- But some experts are concerned that could change if new norms aren’t established as nations work to build out military assets in orbit.

The bottom line: The future of warfighting will continue to rely on space as more nations recognize its importance as the highest ground.

https://www.axios.com/military-space-powers-770ad3ab-54ee-4387-adae-6e00bc69b099.html

10. Nine Easy Ways to Stay Mentally Sharp

By Mehmet Oz | August 15, 2016 | 1

One of the scariest aspects of aging is the realization that your brain can’t function as well as it used to—whether that means accidentally putting the car keys in the microwave or forgetting the name of a new grandchild, it can be daunting.

Most people will experience some form of “brain aging” in their life, ranging from fuzzy thinking to Alzheimer’s disease. Although some causes of memory loss are genetic, you can still improve your brain’s sharpness. The earlier you start, the better—just like losing weight, it is easier to prevent brain aging than reverse it. Here are nine ways you can stay mentally sharp:

Related: It Only Takes 5 Minutes a Day to Keep Your Brain Healthy

1. Avoid sugar.

While short-term increases in sugar can temporarily improve brain function, chronically elevated sugar levels will impede your memory. In one study, people had their sugar levels tested and were asked to memorize 15 words and then repeat them 30 minutes later. Those with higher blood sugar levels remembered, on average, two fewer words.

2. Get fishy.

Eat 18 ounces of salmon or another fatty fish each week or take DHA omega-3 supplements every day. A study showed that when individuals 55 and older who were starting to lose their memory ingested 900 mg of DHA omega-3 each day, their brains were about three years younger.

3. Manage stress.

Stress is one of the greatest causes of memory loss—brain inflammation caused by stress weakens old memories and makes new connections for establishing memories more difficult.

4. Have buddies.

Data shows friends do more than help you cope with your problems. They can also keep you motivated and hold you accountable for activities such as exercising or learning new skills together.

5. Work it out.

You should engage in physical activity for 45 minutes three times a week. New data suggests intense exercise for 20 seconds three times in a 10-minute period may be even better.

Related: Increase Your Activity; Increase Your Happiness

6. Don’t shortchange sleep.

When you’re busy, it’s easy to sacrifice ZZZs. But you need sleep because it primes your brain for optimal learning, problem-solving and memory retention.

7. Learn something new.

Although diet and exercise changes are important, learning a new skill, taking up a new hobby, playing video games or even trying to find a new route (without a GPS) to a place you regularly visit can also help minimize your risk for memory loss.

8. Get those vitamins.

Take in enough magnesium, folate and Vitamins B-12, B-6 and D-3. Magnesium ensures strong links between your brain cells, which can help you solve problems. Try eating brown rice, almonds, hazelnuts, spinach, shredded wheat, lima beans and bananas. Vitamin D-3 is also important—aim for 1,000 IU daily from a supplement until you have your number measured.

9. Avoid toxins.

These include tobacco, mercury and excessive alcohol, among others. Tobacco and other toxins such as mercury from swordfish and tuna can cause inflammation, which can impair your mood, memory and cognition.

Related: 4 Healthy Habits You Already Know but Aren’t Doing

This article originally appeared in the September 2016 issue of SUCCESS magazine.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.