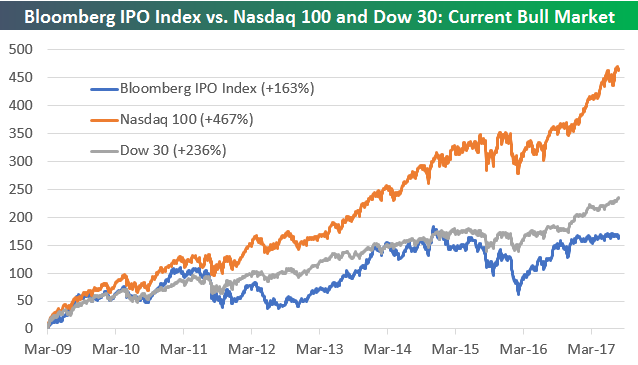

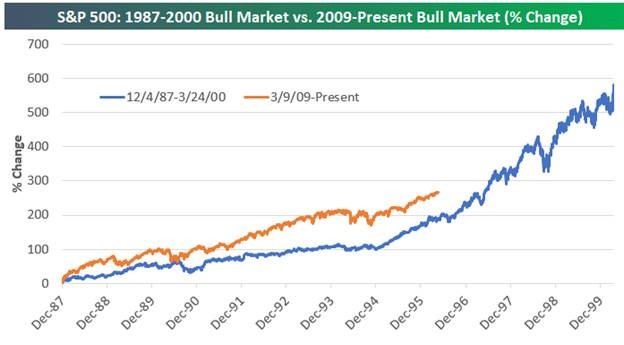

1. 2017 vs. 1999

The market is fundamentally expensive but it’s not 1999 yet.

https://www.bespokepremium.com/think-big-blog/

See my blog post on comparisons to 1999

This long-running hot streak in the tech sector has led to forecasts of another 1999 bubble. It has sparked future doom from a host of soothsayers, who have been waiting for their gloomy predictions to come true since the global financial crisis ended in 2009. Since the crisis, today’s Wall Street Masters of the Universe are not the traders popularized in Michael Lewis’s original book “Liars Poker.” Nor are they the superstar investment bankers of the Internet boom. Instead, they’re a bunch of unknown hedge fund managers that predicted a crash in 2008 and made a fortune in its aftermath. Since that event, headline grabbers on Wall Street have shifted from tireless cheerleaders of the rising bull market to pessimists predicting the next crash.