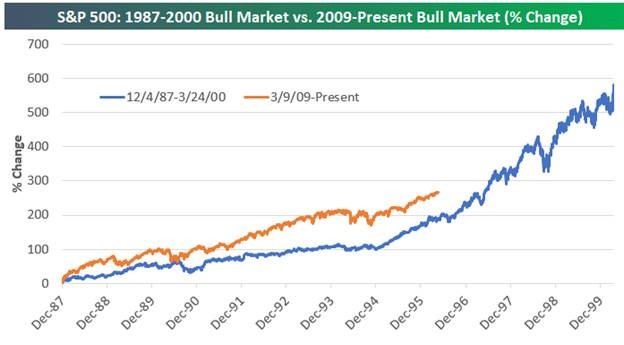

1. 2017 vs. 1999

The market is fundamentally expensive but it’s not 1999 yet.

https://www.bespokepremium.com/think-big-blog/

See my blog post on comparisons to 1999

This long-running hot streak in the tech sector has led to forecasts of another 1999 bubble. It has sparked future doom from a host of soothsayers, who have been waiting for their gloomy predictions to come true since the global financial crisis ended in 2009. Since the crisis, today’s Wall Street Masters of the Universe are not the traders popularized in Michael Lewis’s original book “Liars Poker.” Nor are they the superstar investment bankers of the Internet boom. Instead, they’re a bunch of unknown hedge fund managers that predicted a crash in 2008 and made a fortune in its aftermath. Since that event, headline grabbers on Wall Street have shifted from tireless cheerleaders of the rising bull market to pessimists predicting the next crash.

https://matttopley.com/category/quarterly/

2.VIX POP Finally Happens…Up 68% for the Week.

The CBOE Volatility Index VIX, +41.67% is up more than 45% on Thursday and has advanced 68% since the start of the week. Although the so-called VIX at 16.16 remains shy of its historical average of 20, the move from recent historic lows has been substantial.

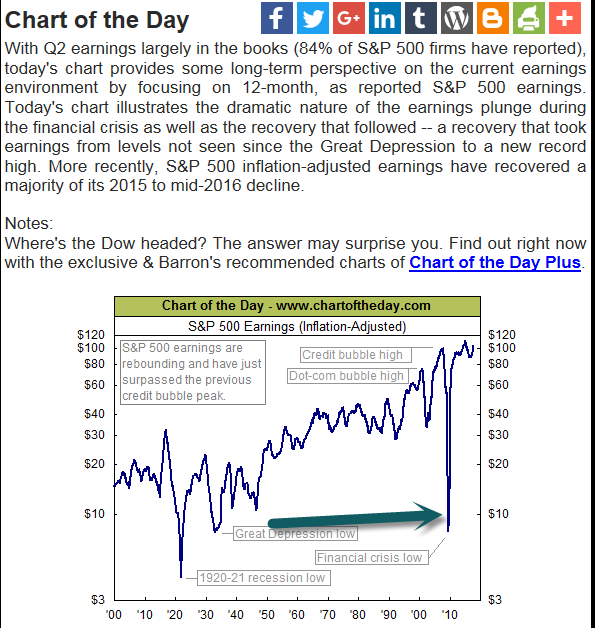

3. 84% of Earnings In….Maintaining Valuations Will Depend on Earnings Growth

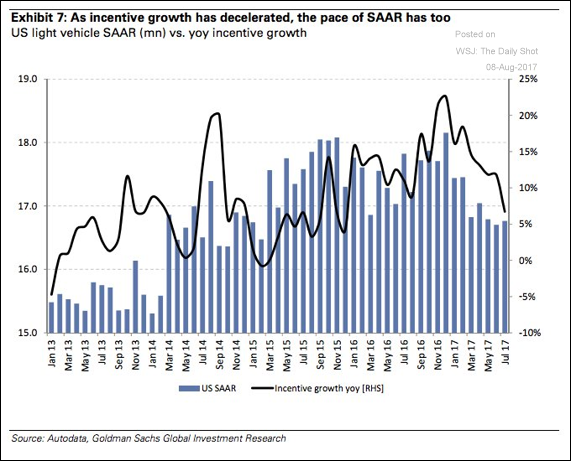

4.As Car Incentives Decreases, Sales Fall Off.

Source: Goldman Sachs, @joshdigga

5.Why Now’s The Time For Int’l ETFs

August 10, 2017

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today’s article is by Dustin Blodgett, a portfolio specialist and member of the Investment Committee at Accuvest Global Advisors in Walnut Creek, California.

More often than not, advisors and clients move too slowly in increasing allocations away from the U.S., thus missing out on much of the international rebounds that have occurred throughout history.

This is largely due to home-country bias and not feeling as comfortable with having exposures to countries and companies with which investors aren’t as familiar.

However, half of the investment opportunity set resides outside of the U.S. (looking at market cap), and the need for advisors to help navigate their clients beyond the border for investing is increasingly important.

Below are three reasons now is the time to increase you International allocations.

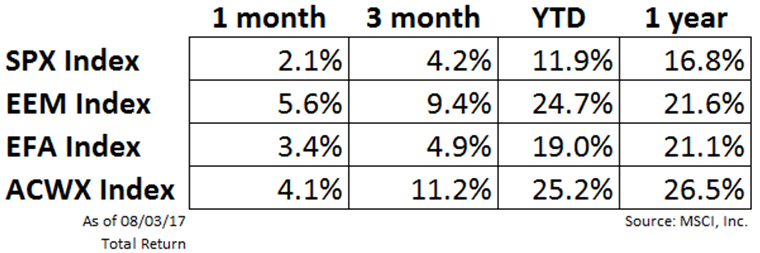

1. YTD Performance

Through July 31, 2017, YTD returns show that international markets, both developed and emerging, have outpaced the U.S. market. Emerging markets have more than doubled the return of the S&P 500.

History suggests this international outperformance period will last approximately 47 months on average, adding over 80% more return than that of the U.S.

http://www.etf.com/sections/etf-strategist-corner/time-intl-opportunities

6. 3 Things I’ve Learned Since the Financial Crisis

Pragmatic Capitalism

Capital for Living a More Practical Life

A great thing about financial panics is that they teach you a lot about yourself and test the boundaries of existing thought which exposes the world to yearn for new understandings. The Great Financial Crisis was one of the most educational periods in finance and economics in modern times. But it’s funny to look back on the world because, as the old saying goes, the more things change the more they remain the same. While there was so much to learn from this period I am not so sure that we’ve actually digested all of those lessons. But I know my views have certainly evolved and changed over this period so here’s some of my big takeaways from the post-crisis period. They might not change your mind, but maybe they’ll challenge them a little bit:

1. Learn to be voraciously open-minded. People are more interested in confirming what they already know than they are in learning something that forces them to admit they were wrong. Learning is hard. Assuming you already know everything is much easier. Therefore, when confronted with a big problem the path of least resistance is to fall back on what you think you already know. This is just good old Dunning Kruger (most people think they’re better at things than they really are) and confirmation bias at work. The crisis taught me that I know a lot less than I thought. Around 2010/2011 I got so fed up with the pessimism, politics and biases that I decided to make a concerted effort to be more objective. I decided that I would learn how the system actually works and form an objective view and model that tries to make unbiased and objective determinations. I went through a great evolution in thought during this time and I even promoted some theories that I later learned were wrong (like Modern Monetary Theory). But the key to all of this evolution and learning was recognizing that I knew less than I thought and that my previous views had been wrong. The crisis taught me that no one has all the right answers in finance and economics and that you need to be voraciously open-minded to competing views. Being an independent thinker, avoiding cult-like groups (sorry in advance – Bogleheads, MMT, Austrian Economics, etc) and always asking yourself if you could be wrong, are essential to becoming an objective critical analyst.

2. Emotional biases will destroy your portfolio and your economic understandings.The one thing I’ve seen over and over again since the crisis is the destruction of emotional biases. This is particularly pervasive in political groups where emotions (mainly fear) can trigger strong biases. I’ve busted a ton of economic and finance myths over the last 10 years (see the biggest myths in economics here and the biggest myths in investing here). And I’d argue that most of them stem from some deeply emotional bias. People either have an irrational fear of the financial markets based on biased misunderstandings or they have strong political biases that corrupt their ability to think about economics objectively. When it comes to economics and finance you need to check your emotions and politics at the door.

3. Perfect is the enemy of the good. The financial crisis led to a voracious appetite to better understand our monetary world. And while this learning was good, it could also be destructive. For instance, I found myself watching financial TV every day during the crisis only to realize over time that none of that was helping me learn. It was mostly just filling my brain with things I didn’t need to know and exposing me to emotional short-termism. I turned off the TV 5 years ago and I’ve learned infinitely more since. But this is just one example of how trying to learn too much can be destructive. The reality is, you don’t need to know everything and you won’t ever know everything. The monetary system is too complex and too dynamic for you to understand it all. So it’s better to understand enough that you can be competent, but not so much that you become a danger to yourself. More importantly, in portfolio management the pursuit of perfection is a pitfall in that the grass will always look greener elsewhere. There’s a certain freedom and comfort in knowing that you have a good understanding, a good process and that you don’t need to chase the very best investments or the absolute perfect economic theory. This sort of reverse Dunning Kruger mentality will likely result in better decision making and outcomes over time.

http://www.pragcap.com/3-things-ive-learned-since-the-financial-crisis/

Cullen ROche

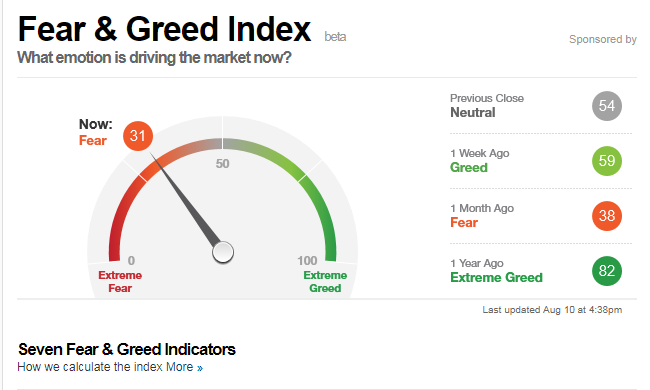

7.The Fear and Greed Index Goes from Greed to Fear in One Week.

8.If Your Focus Is Misplaced…I May Be At Fault

AUGUST 2, 2017 BY DAN SOLIN

I’ve written a number of books and thousands of blogs about investing. While I hope I’ve helped you achieve your financial goals, there are times when I wonder if I’m leading you astray.

I know a lot of financially successful people who are miserably unhappy. In fact, Pew Research has found only one-third of all Americans are “very happy.”

Should the focus be shifted from increasing your net worth to achieving personal happiness? Are these two goals inconsistent?

Let’s start with achieving happiness. Here’s what works:

Do something for others: Impacting others in a positive way – and sometimes just showing empathy – is a surefire way to increase your level of happiness.

Focus on relationships: Having positive relationships with others will give you enhanced well-being. “Others” includes not just friends and family but everyone with whom you come into contact every day. When you make their life better with a kind gesture, you improve yours as well.

Pursue your passions: It doesn’t matter if your passion is gardening, fishing, tennis or painting. People who allocate time to pursue their passion are generally happier than those who don’t.

Go outside: There’s ample evidence simply spending more time outdoors will benefit you.

Make health a priority: Health and happiness are related. Did you know factors you can control are estimated to account for as much as 80-90 percent of all cancers? Diet alone can account for 35 percent.

Meditate: More than 600 studies demonstrate those who meditate have more empathy, are in better health, have greater analytical abilities, are more creative, have less pain, and are much calmer and happier than those who don’t.

Happiness and success go hand-in-hand. Happy people are more likely to be successful; not the other way around.

If you’ve engaged in activities that have increased your level of happiness, let me know what’s worked for you.