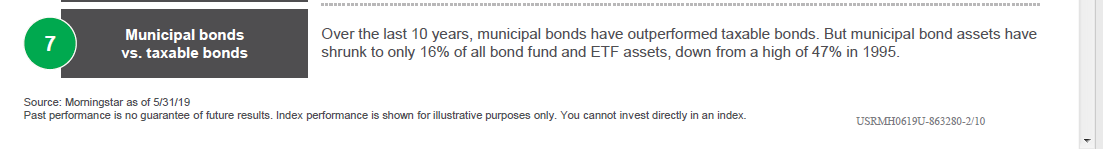

1.Muni Bond Assets Shrink to 16% of Overall Bond Market vs. 47% in 1995

Blackrock Stat

https://www.blackrockblog.com/

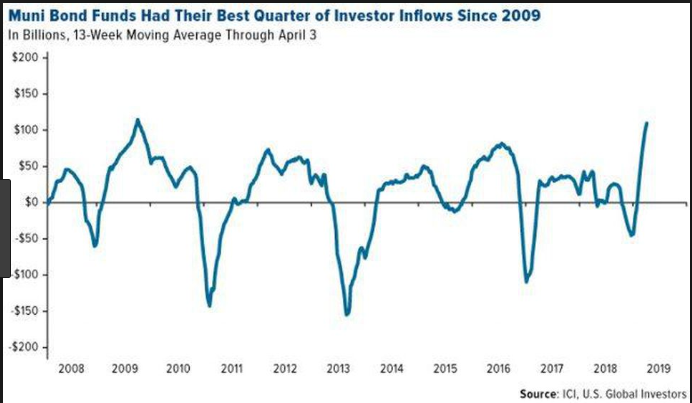

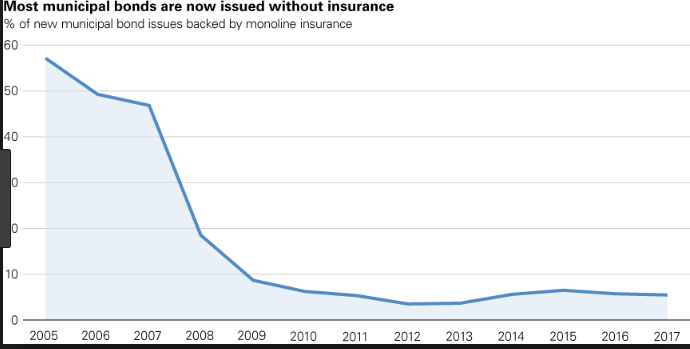

2.Muni Bonds Used to be Issued with Insurance.

The municipal bond market has evolved significantly over the last decade. Historically, many municipal bonds were backed by insurance, which resulted in AAA credit ratings and a high correlation to US government bonds. Today, few municipal bonds are backed by insurance, increasing the diversity of municipal bond credit ratings while reducing their correlation to government bonds.

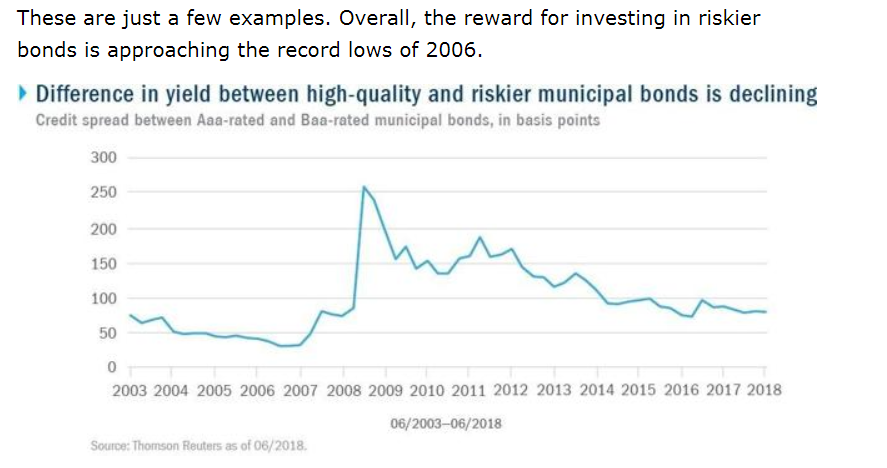

3.Spreads Between High Quality Munis and Riskier Bonds Shrinking.

Investing In Munis When Risk Isn’t Paying Well

https://seekingalpha.com/article/4205448-investing-munis-risk-paying-well?page=2

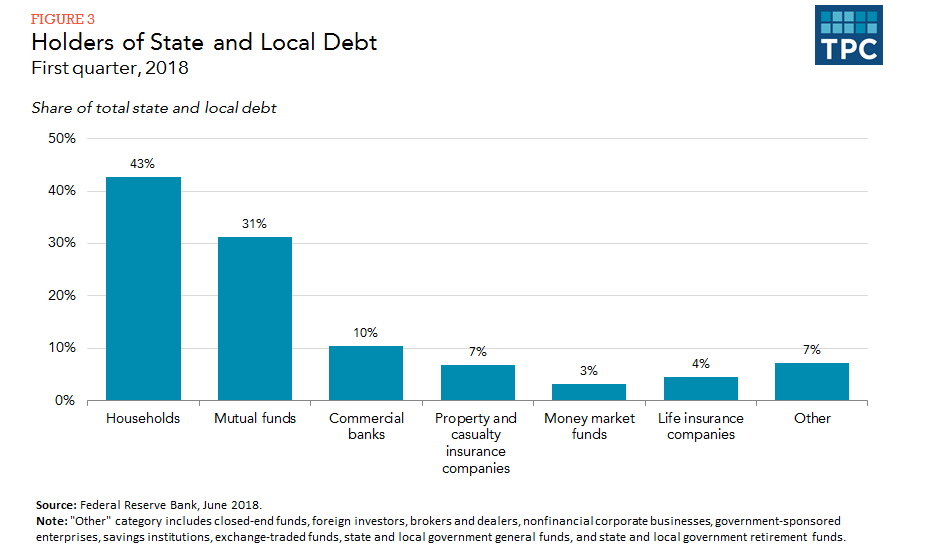

https://www.taxpolicycenter.org/briefing-book/what-are-municipal-bonds-and-how-are-they-used

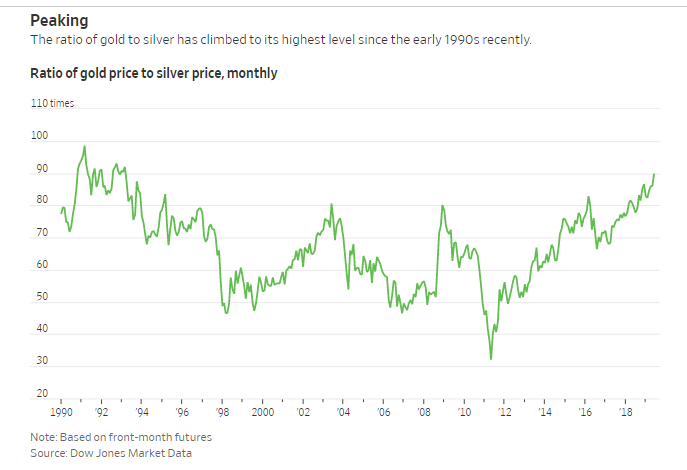

4.The Ratio of Gold to Silver Climbs to Highest Level Since 1993

In Silver’s Slide, Another Sign of Global-Growth Worries

Silver has fallen nearly 6% this year; gold-to-silver ratio has climbed to its highest point since March 1993

By Amrith Ramkumar

https://www.wsj.com/articles/in-silvers-slide-another-sign-of-global-growth-worries-11559499172?mod=itp_wsj&ru=yahoo

This chart is Silver vs. Dollar …breaks to new lows

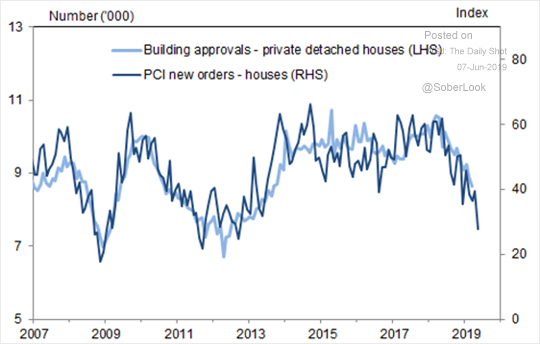

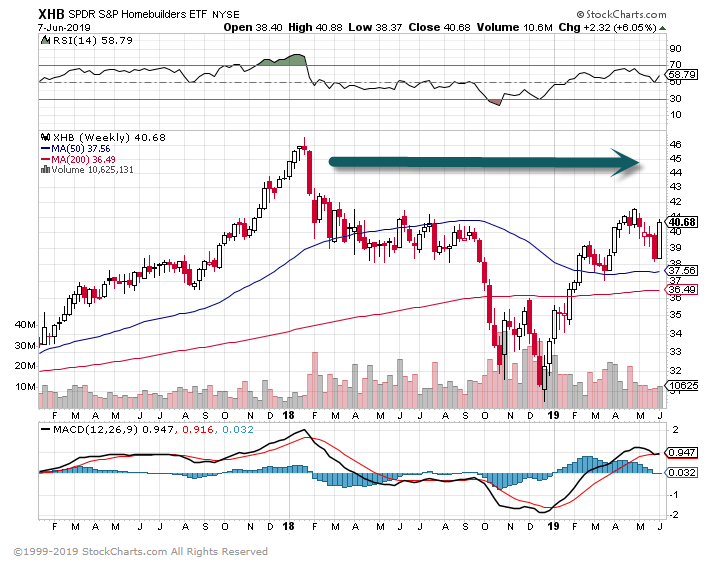

5.Declining New Home Orders.

The Daily Shot

Declining orders for new homes don’t bode well for the sector.

Homebuilder Chart

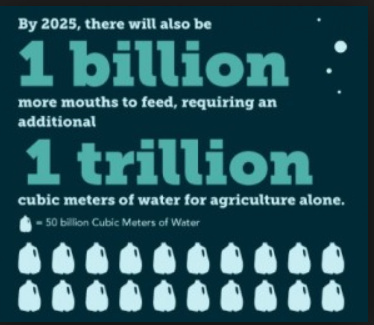

6.Global Water Needs Grow

https://www.seametrics.com/blog/water-crisis-things-you-should-know/

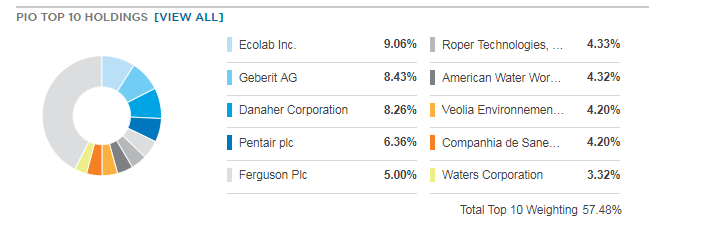

Global Water ETF-PIO

PIO TOP HOLDINGS

https://www.etf.com/PIO#overview

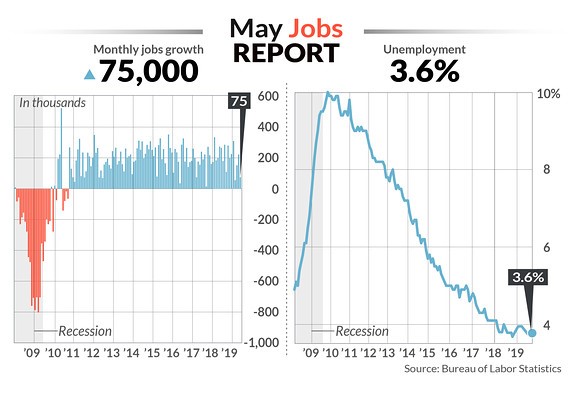

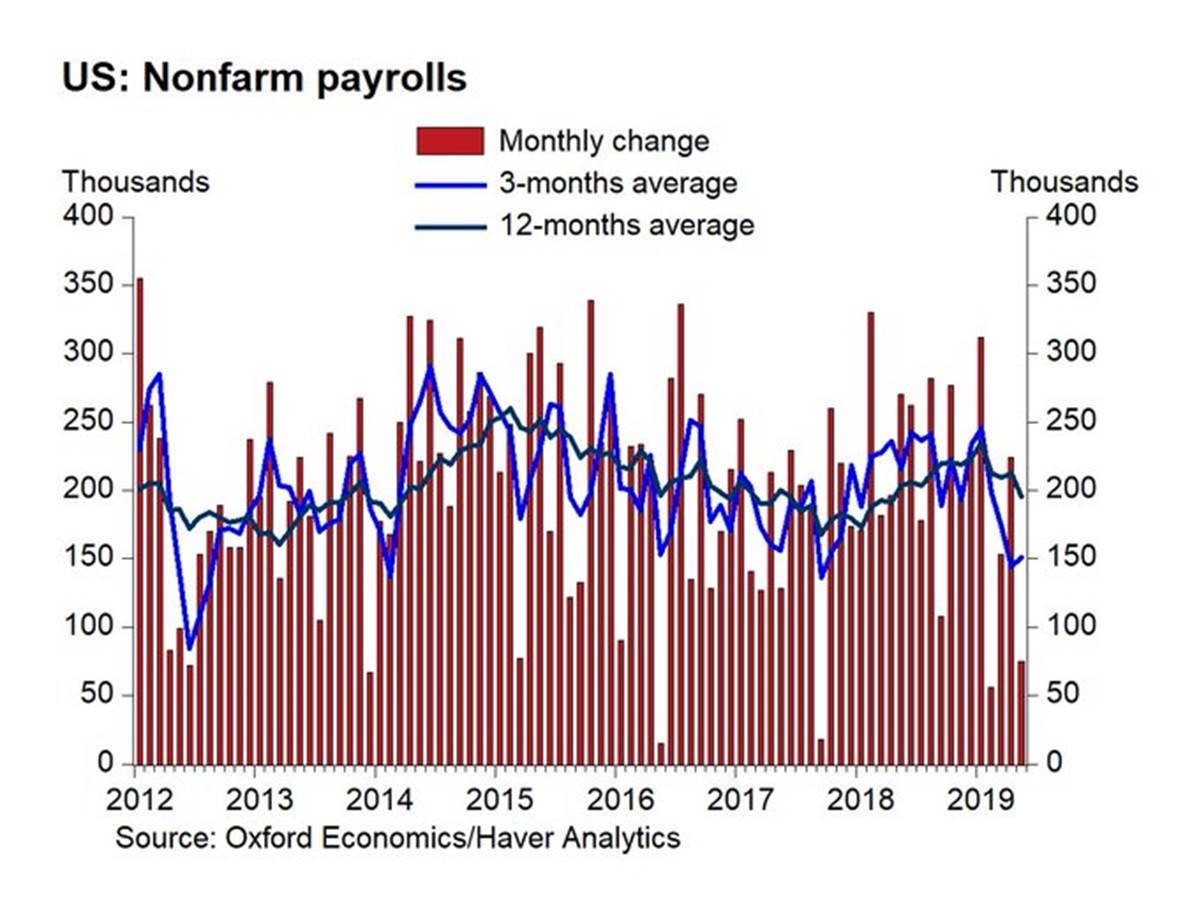

7.Wage Growth Tame in Jobs Report.

‘Disappointing’ jobs report pressures Fed to act, economists say

Interest-rate cut probabilities stay ‘high’ after report ByROBERTSCHROEDER

Economists said the May jobs report didn’t offer much in the way of good news but that it increased bets the Federal Reserve would cut interest rates before the year is over.

The U.S. created only 75,000 new jobs in May and employment gains in the prior two months were scaled back, offering more evidence that the economy is slowing. The unemployment rate was flat at 3.6%. The increase in new jobs was way below the 185,000 MarketWatch forecast

U.S. stock futures DJIA, +1.16% pivoted higher after the report was released.

Greg Daco, chief U.S. economist at Oxford Economics, called the overall report “disappointing.”

US #jobsreport: disappointing +75k jobs May:

– large downward net revisions -75k

– 12-mo avg still strong 196k

– 3-mo avg points to cooling labor market 151k

– #unemployment rate stable 3.6% (50yr low)

– labor force part 62.8%

– wages +0.2% & cools to 3.1% y/y (but still >3%)

Liz Ann Sonders, chief investment strategist at Charles Schwab & Co., said the report “keeps [interest] rate cut probabilities high.”

Weak jobs, consistent with @ADP: 75k nonfarm payrolls in May (retail biggest loser); both April & March revised down for total of 75k; UR steady at 3.6%; AHE +0.2% … keeps rate cut probabilities high

- “NFP came in quite a bit weaker than expectations (we’re missing the 1-handle here), confirming what we saw in the ADP data earlier this week. A quick glance across the various industries shows that the weakness was widespread as well. AHE was also a bit soft, decelerating to 3.1% YoY. There were also downward revisions to last month as well. Unfortunately, there isn’t anything particularly encouraging in this survey.” — Thomas Simons, senior vice president, fixed income economics, Jefferies LLC.

- Martha Gimbel, research director of Indeed.com, said it’s “frustrating” that wage growth isn’t continuing to pick up. The 12-month rate of hourly wage gains slowed to 3.1% from 3.2%.

Frustrating that wage growth is not continuing to pick up – one would expect it to continue to accelerate at this point in this cycle

- “This report, combined with nerves around tariffs, will be enough to force a rate cut from the Fed in either June or July. Whether that is enough to satisfy markets will depend largely on how trade policies evolve.” — Curt Long, chief economist of the National Association of Federally Insured Credit Unions.

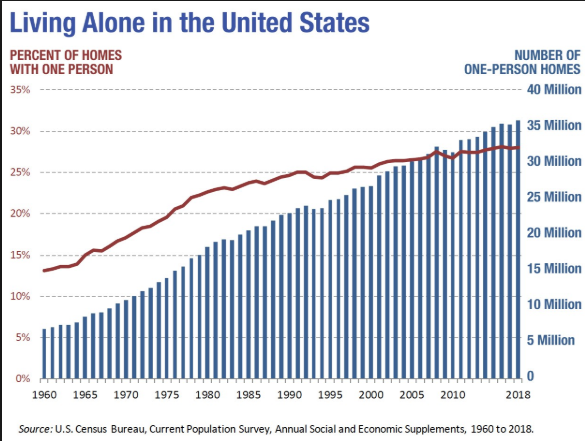

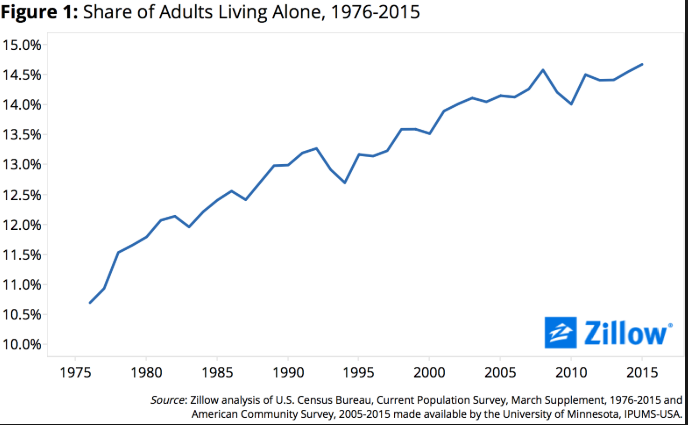

8.Increase in Americans Living Alone.

https://medium.com/invisible-illness/the-deadliness-of-loneliness-21e6ecaa3bdd

https://www.zillow.com/research/americans-living-alone-12639/

9.Read of the Weekend…What Happens if Yields Shot to 4%?

If the bulls have momentum, they lack a margin of safety. Even a 4% yield (never mind a 14% yield) would wreak havoc on a government-bond portfolio. As it is, Germany’s 10-year Bond yields minus 23 basis points and commands a price of almost 105. If yields shot to 4%, that safe haven would suffer a 33% loss of principal. Britain’s 10-year gilt yields 86 basis points and changes hands at a price of 107. Lift that yield to 4% (a future Prime Minister Jeremy Corbyn might do it all himself) and you are staring at a 24% drawdown in price. Here in America, the same hypothetical yield upsurge would cost you 15% of your principal.

Could it happen? Only consider what people of a certain age have already seen: unprecedented extremes in interest rates, the invention of radical monetary policy, the Republican Party’s embrace of the essential tenets of modern monetary theory, the Fed’s shift from the Volcker-era doctrine of killing inflation to the post-Ben Bernanke program of nurturing that former scourge, and the shriveling of real yields almost to the vanishing point.

Lower and lower interest rates for ever and ever? It generally doesn’t work that way.

James Grant is founder and editor of Grant’s Interest Rate Observer. Sample a free issue or subscribe here. His new book, Bagehot: The Life and Times of the Greatest Victorian, will be published in July.

Jim Grant: Low Interest Rates Forever? Don’t Get Used to That Idea

By James Grant

https://www.barrons.com/articles/jim-grant-low-interest-rates-forever-dont-count-on-it-51559904301?mod=hp_DAY_5

10.10 Self-Improvement Musts

The world’s shortest course in self-help.– Marty Nemko Ph.D.

Some people who want self-improvement prefer deep dives into a particular technique. Others prefer quick-and-dirty. This article is for the latter.

As I think back on my 5,500 career and personal coachingclients, I believe these 10 items are most central to self-improvement:

- Put in the time. There’s no substitute for time-on-task. “Working smarter” takes you only so far and, chances are, if you’re reading an article on self-improvement, you’re probably already working as smart as you can yet still feel the need to significantly improve. Whether it’s building on a strength or remediating a weakness, your choice is to push harder or to be satisfied with modest growth. I don’t necessarily criticize the latter: It’s called “satisficing” and it can be a wise approach. Perhaps your time could be better spent getting better at something else, taking care of necessities, or simply having fun.

- Avoid time-sucks. That is what enables people to put in the time without working too many hours. Accomplishers avoid such time-sucks as excessive TV watching, chatting, clothes shopping when you already have more than enough clothes, video-game playing, time-consuming sportslike golf, and going to a second cousin twice-removed’s third wedding in Kalamazoo.

- Focus on what you can control. Successful people spend little time jawboning about their illness, politics, or people they can’t stand. They focus on what’s in their sphere of influence.

- In our ever more complicated world, it’s ever more difficult to be good enough as a generalist. You need to be at least relatively expert in some niche. For example, the generic marriage-and-family therapist could well be beset by the imposter syndrome because there’s so much science and especially art to marriage-and-family counseling. Unless you’re unusually brilliant and hard-working, it’s wiser to specialize in something: for example, interracial couples, transgendercouples, intellectually gifted children, physically abusive parents, men with stay-at-home wives, etc.

- Take low-risk actions. Excessive rumination can lead to more fearand less accomplishment. So after a modest amount of reflection and perhaps research, follow that widely-agreed-on key to success: Ready, FIRE, Aim! That is, it’s far easier to revise your way to excellence than to think it up in the abstract. You need the feedback of empiricism to adjust what you’re doing. I like to invoke the metaphor of the person who’d like to sail from San Francisco to Hawaii. Yes, s/he should plan, but after just moderate planning, s/he’d be wise to set sail. On encountering the winds, the weather, s/he can adjust the plan. S/he’ll likely get to Hawaii far faster than would the excessive planner.

- Hang with people who bring out the best in you. Whether it’s a boss, romantic partner, platonic friend, or activity partner, some people bring out the best in us while others drag us down. Of course, you can’t always control who’s in your life but, when you have discretion, spend time with those who help you flower.

- Take the time to find a fine mentor(s.) A generous person who is successful and ethical in what you’re trying to develop or who is an all-around winner, is a treasure, and usually having such a mentor is requisite to success for all but the most gifted people. How to find a fine mentor? Ask a question of one or more respected people. If s/he responds and responds well, offer to be of help in any way you can. After a while, if you do your part and you’re lucky, your mentor will offer more help, become your cheerleader and champion, and be willing to open crucial doors for you.

- Chart your progress. That can be as simple as, next to your desk, hanging a hand-drawn thermometer with milestones on the side, like nonprofits when they’re trying to raise money. Or give yourself a daily letter grade A to F. Keep that grade to yourself or share it with your social-media friends or real friends.

- Look inward. My unsuccessful clients tend to blame their setbacks mostly on externalities: their boss, the economy, their race, their gender, etc. In contrast, my successful clients mainly look inward to see what, if anything, they need to do differently, for example, acquire a new skill, upgrade their attitude, slow or stop their substance abuse, revise their job target upward, downward, sideways, or to a new career that’s more aligned with their natural abilities.

- Resolve to rebound. You’ve heard it before but it’s true: Even highly successful people fail. The difference between them and other people is that successful people tend to force themselves, yes force themselves, to rebound, not wallow. They see if there’s a lesson to be learned from the failure and then resolve to succeed at something at least as big. At the risk of being personal, when I was let go as a columnist in the San Francisco Chronicle, after an hour—yes just an hour—of feeling outraged, I channeled the anger. I said, “I’ll show them. I’ll go national! That very day, I sent clips to 10 national publications and since then, I’ve written a lot for such publications as TIME, The Atlantic, and yes, Psychology Today.

I read this aloud on YouTube.

https://www.psychologytoday.com/us/blog/how-do-life/201906/10-self-improvement-musts