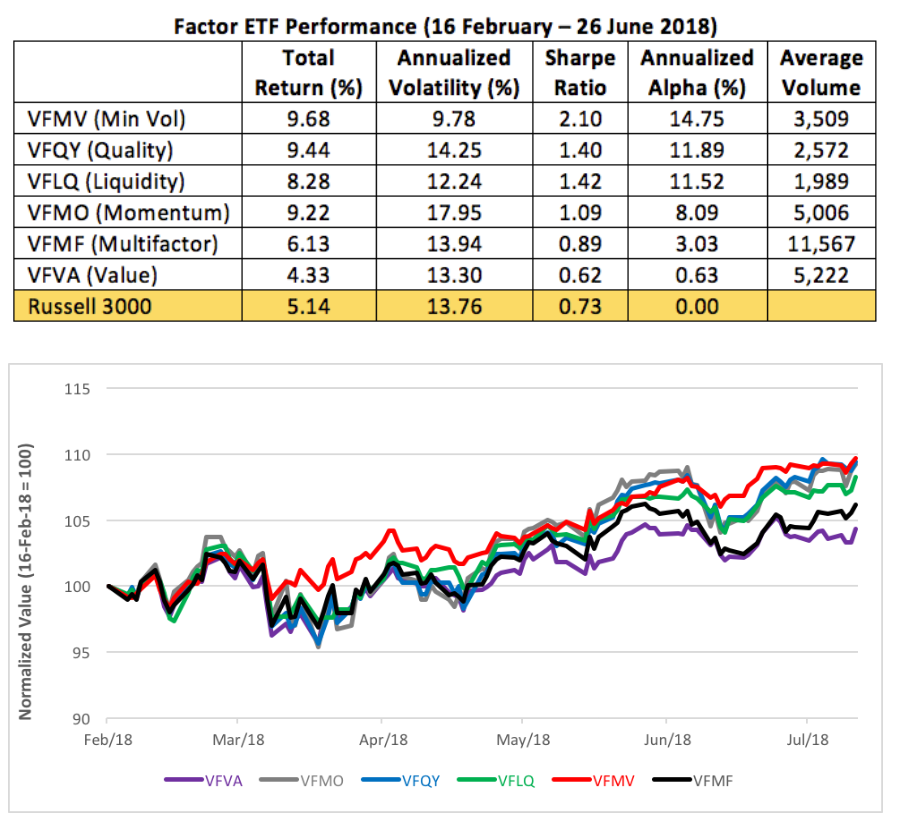

1.Factor Leadership…Min Vol Reappears as Leader.

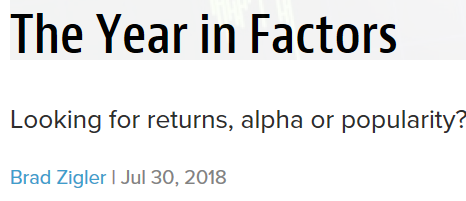

2.Tech Leading Momentum Run….Massive Gap in Earnings Per Share Less Tech.

The reason for that is the same one Nomura discussed on Friday: “the most important trade of the past decade is now reversing” namely the reversal of the growth/value which has also commingled with the “momentum trade”, abd which means that the growth/tech “market leadership” that defined the market for the past decade is now gone at least for the time being.

Zero Hedge

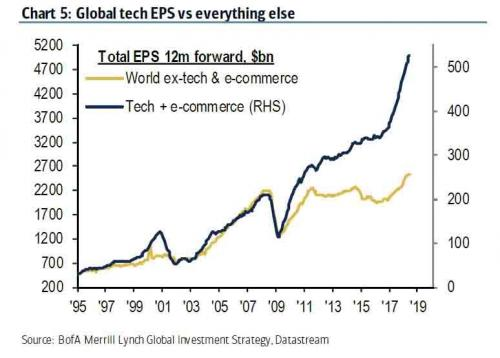

3.Record 8Th Straight Quarter of Year Over Year Acceleration in GDP Growth.

CHART OF THE DAY: Growth? This Isn’t Where You Get Bullish

Keith McCullough

Editor’s Note: Below is a brief excerpt and chart from today’s Early Look written by Hedgeye CEO Keith McCullough. Click here to learn more.

| That’s one way to think about why you’re hearing about this record 8th straight quarter of year-over-year #acceleration in US GDP Growth being “sustainable.” For the likes of Steve Mnuchin and Larry Kudlow, there’s job security to think about!

At one point yesterday, Mnuchin said that “we can only predict out a couple of years.” Really Steve? I would absolutely love to audit your predictive tracking algorithms to hold you to account on that. After having had a US GDP forecast above Wall Street’s going all the way back to the 2H of 2016, we’re now below consensus for the next 2 quarters at +2.44% and +1.10%, respectively. If we’re right, Q2’s #PeakCycle GDP report will appear unsustainable. |

4.We Shall See Regarding the Shift from Growth to Value…TBD.

The stock market just experienced the most seismic shift from growth to value since Lehman Brothers, says Nomura

Published: Aug 1, 2018 12:26 p.m. ET

Will value overtake growth By

Some of the most popular bets in the U.S. stock market have gotten pummeled in recent days, leading one analyst on Wall Street to declare it one of the biggest rotations from growth stocks into value stocks since the aftermath of the bankruptcy of Lehman Brothers back in mid September 2008.

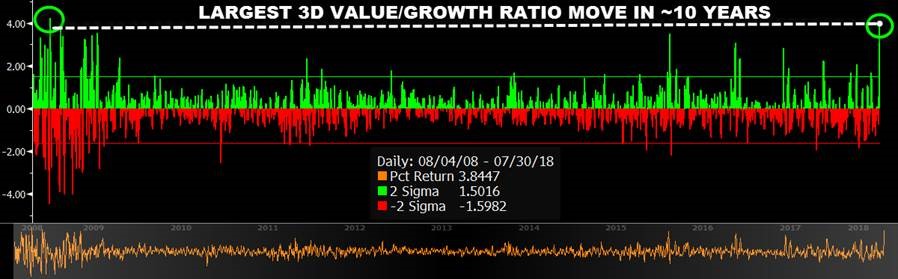

In a Tuesday research note, Charlie McElligott, head of cross-asset strategy at Nomura, said the “three-day move in U.S. ‘Value / Growth’ has been the largest since October 2008—a 4.3 standard deviation event relative to the returns of the past 10 year period…”

See the chart below which shows a growth/value ratio over the past decade:

Source: Bloomberg/Nomura

McElligott’s comments come after the Nasdaq Composite Index COMP, +0.32%booked a three-session tumble that drove the technology-tinged index to its lowest level in about three weeks—a recent unraveling sparked partly by disappointments in quarterly updates from key members of the so-called FAANG contingent. Those include Facebook Inc. FB, -0.42% Apple Inc. AAPL, +5.27% Amazon.com Inc. AMZN, +0.42% Netflix Inc. NFLX, +0.53% and Google Inc.-parent Alphabet Inc. GOOG, -0.07% GOOGL, +0.35%

Both Facebook and Netflix saw their shares fall into bear-market territory on Monday, defined by a decline of at least 20% from a recent peak, and nearly 40% of the S&P 500’s technology sector is in correction territory, typically characterized as a fall of at least 10% from a recent top.

What’s more, the NYSE FANG+ index NYFANG, -0.18% which comprises many of the aforementioned FAANG names as well as Twitter Inc. TWTR, -0.75% electric car maker Tesla Inc. TSLA, -0.41% Nvidia Corp. NVDA, +0.33% and Chinese e-commerce giant Alibaba Group Holding Ltd. BABA, -0.90% and Baidu Inc.BIDU, -6.95% fell into correction territory.

The index had enjoyed stellar performance, up 23.4% for the year, compared with a 2.8% gain for the Dow Jones Industrial Average DJIA, -0.25% so far in 2018, a rise of over the past seven months of 5.3% for the S&P 500 index SPX, -0.15% and year-to-date return of about 11.1% for the Nasdaq.

Popular growth investing strategies, reflecting companies whose profits grow consistently and at faster clip than the overall market, have by far been the best performers in recent years, compared against traditional value investing, buying shares that are viewed as priced beneath their inherent value.

However, the stumbles in FAANG names have highlighted growth’s recent deterioration, with those large-capitalization tech and internet companies that have helped to push the broader market to new heights, losing some luster as investors fret about stock valuations and the outlook for economic growth in the ninth year of an economic expansion in the U.S., the second-longest on record.

So far this week, the S&P 500 Growth index SP500G, +0.24% is down 1.2%, while, the S&P 500 Value index SP500V, -0.55% is up 0.2% over the same period. To be sure, over the longer-term, growth has been a steady outperformer, gaining 9.4% year-to-date, compared against action in value names that have left the S&P 500 value index little changed.

In a Monday note, Morgan Stanley said the outperformance by growth had it poised for an eventual reversal, as MarketWatch’s Ryan Vlastelica writes.

It remains to be seen if the recent moves represent a sea change for a reemergence for value, which has been overshadowed by growth plays, or if moves of the past few days are a blip.

As McElligott writes: “The question now becomes whether value continue[s] to outperform growth if the tape turns to an outright ‘risk off’ one over the next few weeks of seasonal weakness, prior to commence of heavy (tech-led) buyback.”

Michael Antonelli, equity sales trader at R.W Baird & Co., said that although he sees some rotation from one segment of the market to another under way, he believes that it reflects investors selling winning bets, which happen to be shares of Facebook, Netflix and other growthy companies and moving into other sectors, rather than a more pronounced rotation out of growth to value.

“The rotation I think isn’t necessarily growth to value, it’s about selling the winners and that [happens to involve] growth stocks,” he told MarketWatch.

Only time will tell. However, so-called growth names were bouncing back higher again, with the Nasdaq rebounding on Tuesday to finish up 0.6% in Tuesday action, helping buoy the broad market.

My Quarterly Letter Below Focused on Growth vs. Value Spread.

There’s Still Time to Take the Road You’re on, but It’s No Guaranteed Stairway to Heaven

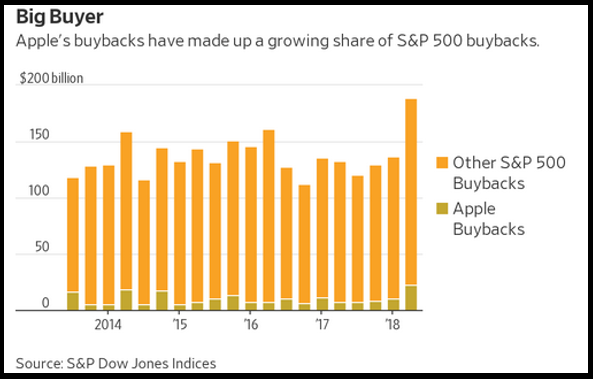

5.AAPL Purchased $20.8 Billion of its Own Stock in Second Quarter.

AAPL repurchased $20.8 billion of its stock in the year’s second quarter. That’s down from its record $22.8 billion worth of buybacks in the first quarter, but still ranks second-largest ever among S&P 500 companies, according to WSJ – That has made it an even larger presence in the stock market. Its first quarter repurchases made up 12% of S&P 500 buybacks. The Fruit is the #1 weight in SPY (3.9%) and QQQ (11.2%), and 148 ETFs have Apple within its Top 15 holdings

From Dave Lutz at Jones.

6.Has the Private Equity Boom Hit the Ceiling?

The US PE fundraising correction has begun

Kevin Dowd July 16, 2018

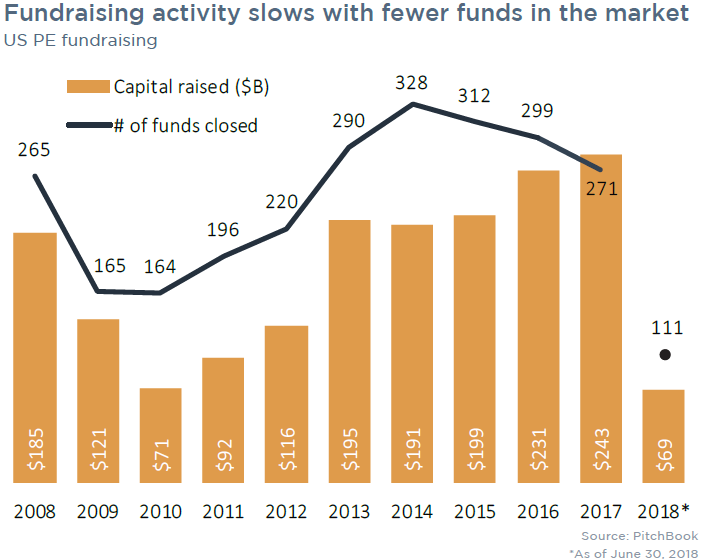

What goes up must come down. For private equity firms in the US, that means an eight-year gold rush for raising new cash may finally be coming to an end.

Between 2010 and 2017, the amount of capital US PE firms raised annually for new funds increased more than threefold, rising from just shy of $71 billion to last year’s figure of $243 billion—the highest total in a decade. But those investors closed only $69 billion worth of new funds during the first half of 2018, according to PitchBook’s latest US PE Breakdown, a far cry from 2017 and on pace for a six-year low.

It’s a similar story in terms of the number of new funds raised. Firms closed 111 vehicles during 1H, again on track for the lowest total in six years. But while the decline in the amount of cash raised is just beginning, the drop in the number of funds has been long underway, peaking in 2014 and falling each of the past three years:

The past half-decade, though, brought historic largesse. This year is also on pace to exceed annual fundraising totals for every year from 2009 to 2012. And you can only raise so much money: Across the industry, firms are sitting on pools of hundreds of billions of dollars in dry powder. It’s likely that the broad PE fundraising decline in the US during the first six months of 2018 is more of a market correction than a cause for panic.

https://pitchbook.com/news/articles/the-us-pe-fundraising-correction-has-begun

7.40% of Venture Capital From 2 Schools Harvard and Stanford.

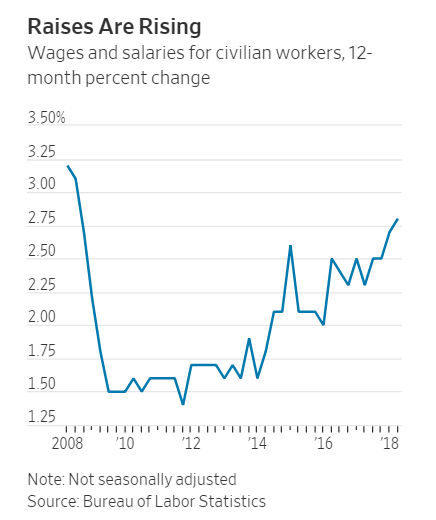

8.U.S. Workers Get Biggest Pay Increase in Nearly a Decade

Employment cost index, which measures wages and benefits, grew 2.8% in the 12 months to last month

By

By

Harriet Torry

https://www.wsj.com/articles/u-s-employment-costs-rose-in-the-second-quarter-1533040473?tesla=y

9.CLO’s Are Back? Only in America.

Wall Street Resurrects Another Financing Tool Killed By Crisis

July 31, 2018 • Adam Tempkin

Investors are breathing life back into a once-dead financing tool. The market for bundled loans used to fund riskier real-estate projects is on pace for a post-crisis record after all but disappearing during the 2008 crash.

Sales of commercial real estate collateralized loan obligations are expected to double from last year to as high as $20 billion this year, which would be the highest since 2007, according to industry analysts.

The renaissance of the so-called CRE CLOs — which are used to fund properties that don’t qualify for traditional financing, such as suburban office complexes, multi-family housing and malls that are in transition — is being hotly debated. Some investors like the better returns and protection from rising interest rates from the floating-rate securities, while others warn of the higher risk of defaults and looser underwriting standards.

“Right now there’s still decent discipline in the market — although there may be some outliers on certain deals — but there is always risk for any commercial real estate business plan,” said David Eyzenberg, president of the New York City-based commercial real estate investment banking firm Eyzenberg & Co. “With CRE CLOs, the cash flow that’s there today is almost irrelevant to what happens later.”

A smattering of CRE CLO deals started a comeback starting in late 2011, mostly with safer mortgages and a stable pool of assets. But this is the first year that the market has returned with relatively strong issuance. The revival joins other financing products that were popular before the crisis: synthetic collateralized debt obligations in Europe, collateralized fund obligations and private-label residential mortgage-backed securities.

The intense demand for the CLOs has cut costs for issuers, making them a cheaper source of financing compared with lines of credit from banks or more traditional lending. This has encouraged non-bank lenders and real-estate investment trusts to lend for the first time to troubled or developing properties.

A fiercely competitive commercial real estate lending market has also helped fuel growth, specifically the need for bridge loans to projects that may have lost tenants or need upgrades. There is now more money chasing fewer commercial real estate deals, creating increased competition between non-bank bridge lenders, traditional banks and CMBS conduits to offer cheaper financing.

“There’s a vacuum for properties that are more transitional, and this fills it,” said Edward Shugrue, chief executive officer of Talmage LLC, which invests in commercial real estate debt. “It’s not necessarily worse quality, but the cash flows are not as mature.”

Smaller REITs and debt funds such as LoanCore Capital and Money360, as well as industry behemoths such as Blackstone, which priced its first and the largest CLO since the crash in December, have rushed into the market.

A good example of that rush happened earlier this month. Investors snapped up a AAA rated piece of a CRE CLO with one of the tightest spreads over Libor seen in months, despite it being the most highly leveraged CRE CLO that Kroll Bond Rating Agency rated in the last year, according to the firm.

“Higher leverage implies lower borrower equity levels, greater default probability, and higher overall loss severity should a default occur,” Kroll analysts wrote in a note.

Still, many investors see these products as much safer than before the crisis because there are more protections built in and issuers have skin in the game.

Some of the crisis-era trades were called “kitchen-sink” deals, because all kinds of collateral, including the lowest-rated pieces of other deals, were thrown in, Shugrue said. The newer deals are different as they are mostly backed by first mortgages and issuers typically “eat their own cooking” by keeping a piece of the CLO, he said.

“The newer version is bread-and-butter collateral, and represents an ideal use of the structure to fund non-traditional lenders who have meaningful skin in the game,” said Shugrue.

This article was provided by Bloomberg News.

10. Never Punish Loyal Employees for being Honest

- Published on July 18, 2018

Author: The Future of Leadership: Rise of Automation, Robotics and Artificial Intelligence ? Keynote Speaker ?109 articles

My new boss told me to never be afraid to give feedback. The next Monday morning in a meeting, I happily shared my viewpoint on a new policy. Thereafter, I noticed my boss’s disposition towards me changed. He stopped talking to me. I was shunned. I even felt the effects of this in my monthly performance appraisal, where he noted, I was not supportive of the organization, and I needed to be a better team player. The picture was quite clear – truthful feedback was not appreciated.

Heather, a co-worker approached me and said, “You are new, honest feedback is just lip service, don’t fall for it.” I quickly learned loyalists and sycophants were appreciated, while realists were punished. They built a culture of “yes employees.” I knew I had so much to offer, yet I couldn’t. Six months later, my boss was fired. He made a mistake on a proposal that cost the company its biggest client. This could have been easily avoided if he had just asked for honest input.

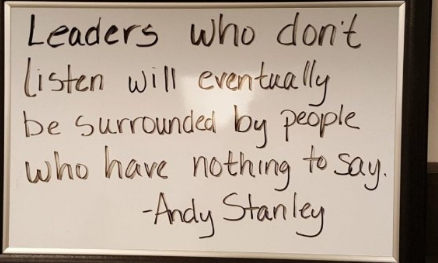

Listening is the most powerful skill a leader can master but it requires humility.

“The Emperor’s New Clothes” – Promoting honest feedback

Be Humble. Many people think humility is a weakness, but it actually takes strength. It makes you approachable. The more humble you are, the more team members would be motivated to share their suggestions and recommendations with you. One of the best employee engagement tools is transparency. To be transparent requires two-way communication, therefore, feedback from employees is important. Honesty creates a solid platform to building a relationship of trust and loyalty. Employees want to be heard and they want to be respected. Listening shows that you care. Additionally when you receive feedback, act upon it. This helps improve employee morale.

PRIDE – The ego must go. The ego blinds us with a false sense of indestructibility, clouds our judgement thus leading to poor decisions and a break down of relationships. It’s not about you. Build a strong team and surround yourself with smart, passionate and highly competent people. Researchers at the University of Michigan and Northwestern University’s Kellogg School of Management in Illinois in one research stated, “flattery and opinion conformity” makes leaders overconfident, resulting in “biased strategic decision making” and an overall disconnect from the execution on the ground.

Developing leadership skills is a lifetime project. It’s too easy, as a leader, to feel like you have to be the one who knows everything. Great leaders recognize that they need to keep learning. Leaders need to be willing to learn and be open to seeking input from both inside and outside their organizations. Feedback allows us and the organization to grow. Additionally, treat everyone you meet with respect, from the janitor to the CEO. Great business tips may come from the most unlikely sources.

” Listening is crucial to gaining a complete understanding of situations. Without this full understanding, one can easily waste everyone’s time by solving the wrong problem or merely addressing a symptom, rather than the root cause.”

Titans as Blackberry, Kodak and Nokia have paid the price for leaders who refused to listen. Their leaders operated in a bubble and engaged in group think. The greater your success, the more you need to stay in touch with fresh opinions and perspectives and welcome honest feedback. Raw truth is needed to make well-informed decisions and steer the organization in the right direction.

As a leader, your job is to encourage others around you to be open and honest without a negative consequence. When employees offer their ideas and differing opinions – be open-minded. Companies that remain strong in this competitive market, understand the need to embrace change and continuous improvement. More than ever, leaders will need to master the skill of “Lead with Listening.” The success of your business will depend on it!

https://www.linkedin.com/pulse/never-punish-loyal-employees-being-honest-brigette-hyacinth/