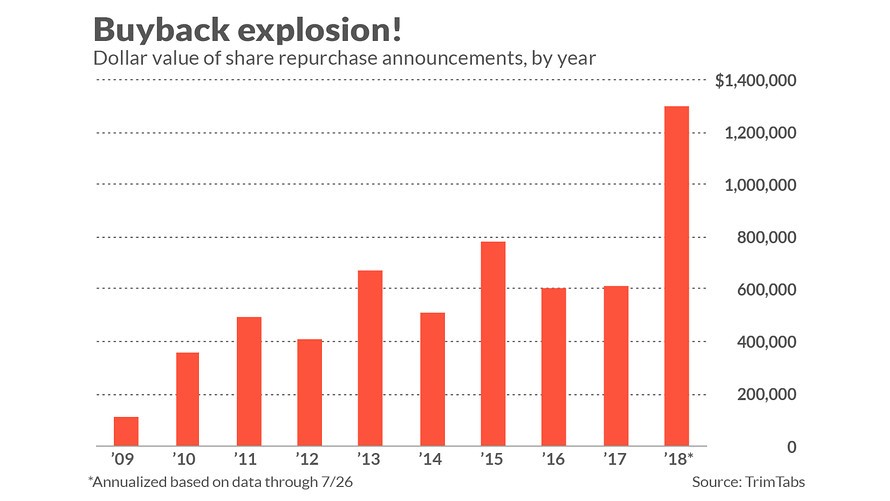

1.As Expected….Buyback Explosion Post Tax Cut.

You will notice that this new quarterly record was nearly double that previous one. Corporations aren’t just gradually ramping up their repurchases; they’re falling over themselves to do so.

But is total buyback activity a good stock market indicator? In the 1980s and 1990s, at least, it was. In those decades, a number of academic studies found, the stock of the average company that announced a new buyback company proceeded to significantly outperform the market over several years following that announcement.

Since then, the situation has changed. One recent study, for example, found no outperformance from buyback activity over the decade through 2012 — that the stock of the average company announcing a buyback performed no better than the S&P 500 SPX, -0.58% after that repurchase program was announced.

Opinion: Stock buybacks are no reason to buy a stock

Share repurchases once signaled confidence, but now just substitute for dividends

https://www.marketwatch.com/story/stock-buybacks-are-no-reason-to-buy-a-stock-2018-07-31

PKW-Buyback ETF Still Below Peaks

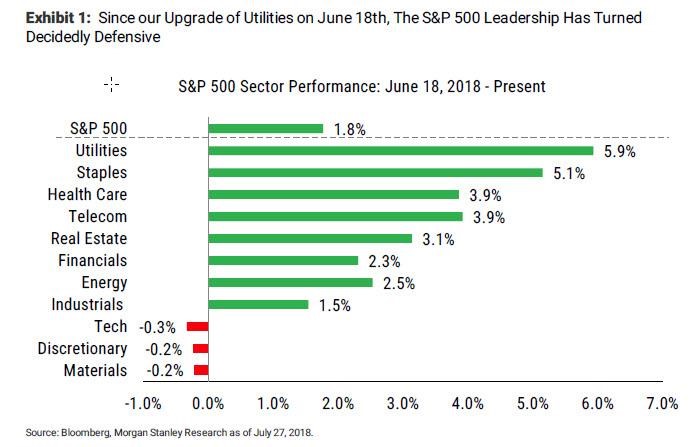

2.Since Mid-June Defensives in the Lead.

From ZeroHedge

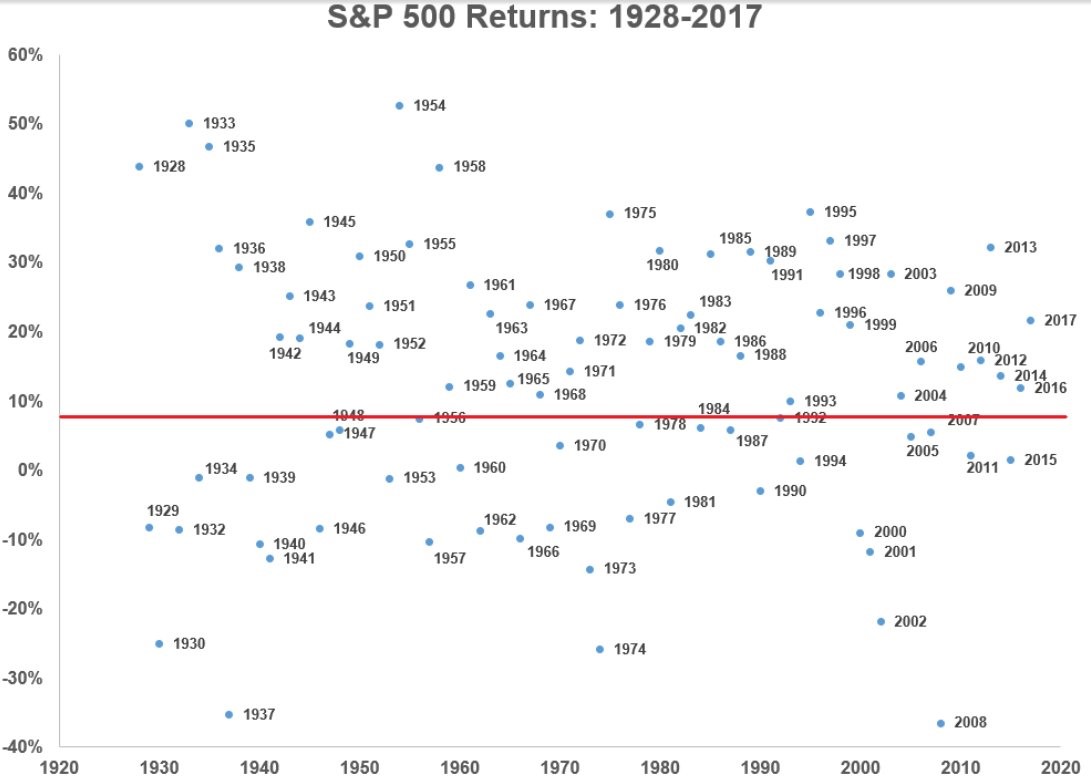

3.In Case You Were Wondering Why It’s So Hard to Predict Stock Market Returns.

Interesting….2002 was worse than 2000 and 2001….1937 was worse than 1929 and 1930…..Let’s Hope 2008 was generational low.

Ben Carlson Twitter.

https://twitter.com/awealthofcs

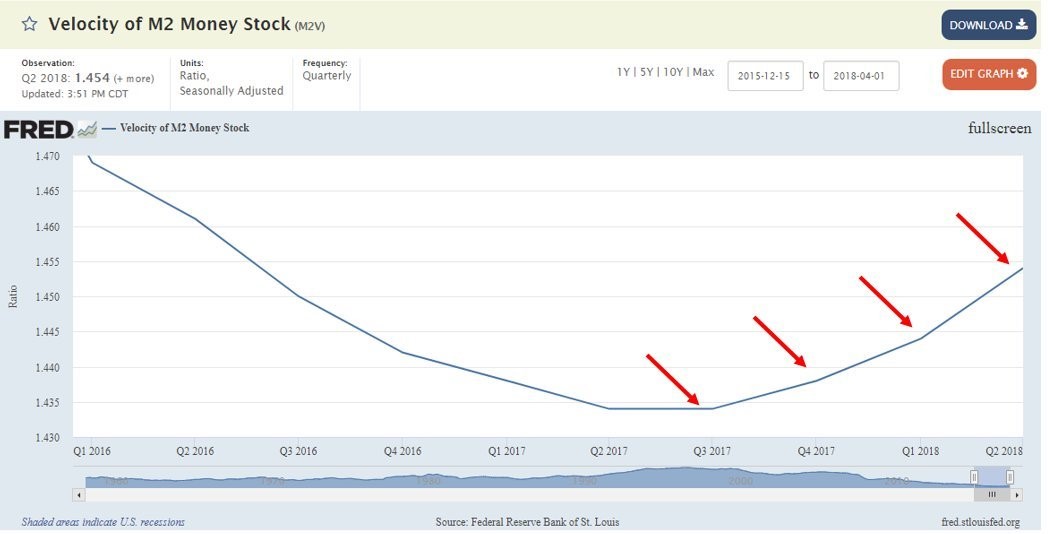

4.Velocity of Money Rising

Above my pay grade but a favorite bear argument during this massive bull market was velocity of money was not rising.

Velocity of Money

What is the ‘Velocity of Money’

The velocity of money is the rate at which money is exchanged from one transaction to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which people spend money. The velocity of money is usually measured as a ratio of gross national product (GNP) to a country’s total supply of money.

Velocity is important for measuring the rate at which money in circulation is used for purchasing goods and services, as this helps investors gauge how robust the economy is, and is a key input in the determination of an economy’s inflation calculation.

Read more: Velocity Of Money https://www.investopedia.com/terms/v/velocity.asp#ixzz5MpR2npf9

Follow us: Investopedia on Facebook

http://worldoutofwhack.com/2018/07/30/charts-that-matter-vol-13-2/

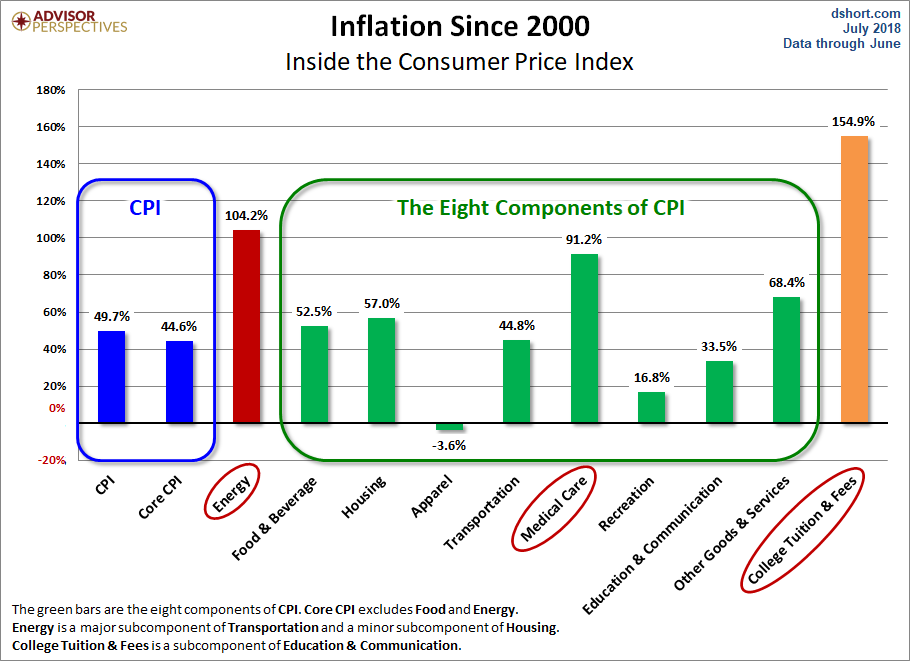

5.Inside the Consumer Price Index Since 2000

I show this updated chart a couple times a year.

The chart below offers a comparison of the broader aggregate category of energy inflation since 2000, based on categories within Consumer Price Index (commentary here).

by Jill Mislinski,

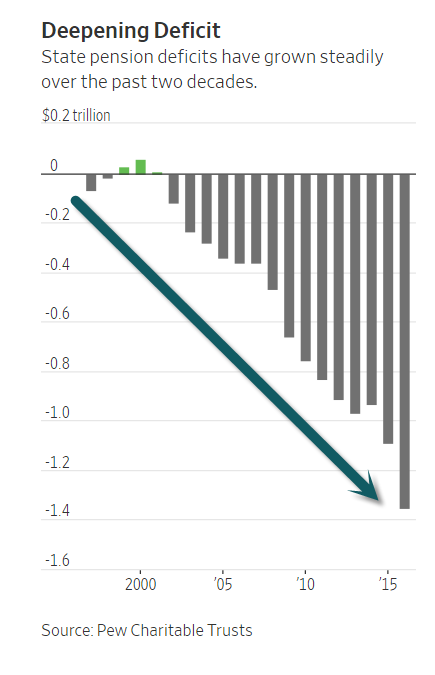

6.State Pensions Short $5 Trillion.

For the past century, a public pension was an ironclad promise. Whatever else happened, retired policemen and firefighters and teachers would be paid.

That is no longer the case.

Many cities and states can no longer afford the unsustainable retirement promises made to millions of public workers over many years. By one estimate they are short $5 trillion, an amount that is roughly equal to the output of the world’s third-largest economy.

Sarah Krouse-WSJ

The Pension Hole for U.S. Cities and States Is the Size of Japan’s Economy

Many retirement funds could face insolvency unless governments increase taxes, divert funds or persuade workers to relinquish money they are owed

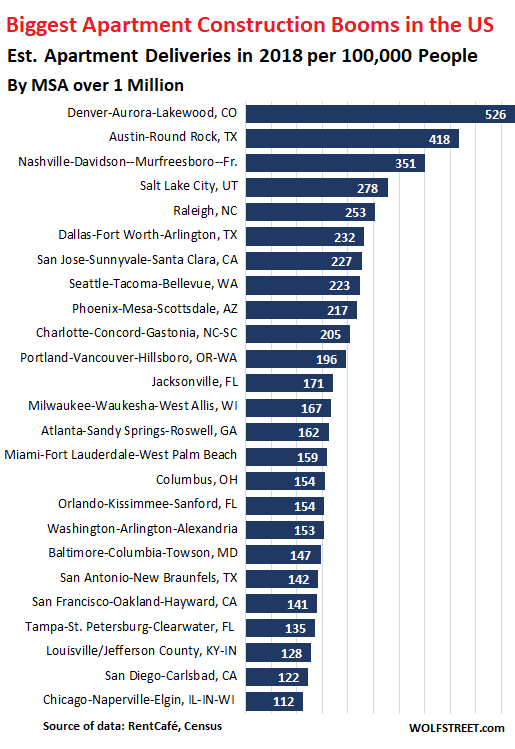

7. Top Apartment Construction Boom Towns.

The chart below shows only metros with a population of over 1 million, sorted by apartment deliveries per 100,000 inhabitants. This is my list of the 25 biggest apartment-construction booms.

- New York metro disappears from this list, with only 98 apartments to be delivered per 100,000 inhabitants

- Denver metro is by far #1 with 526 apartments to be delivered per 100,000 inhabitants

- Austin metro is #2 with 418 apartments to be delivered per 100,000 inhabitants.

- Seattle metro, the often-cited queen of the apartment construction boom, is #8.

- The five-county San Francisco metro is #21.

WOLF STREET

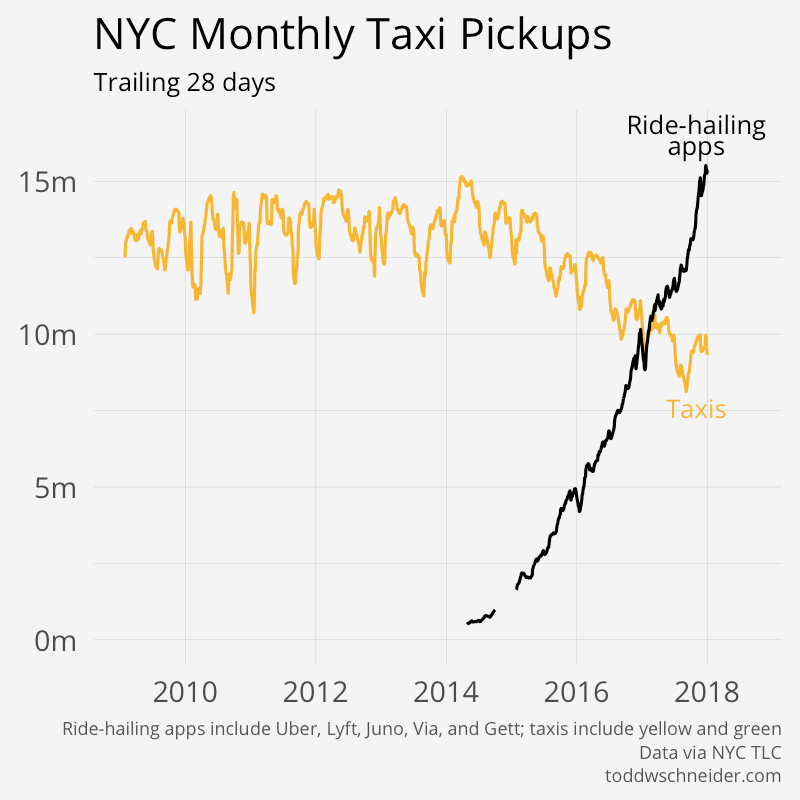

8. Ride Hailing transported 2.61 billion passengers in 2017, a 37 percent increase from 1.90 billion in 2016.

Key findings:

Key findings:

TRIPS, USERS AND USAGE

- TNCs transported 2.61 billion passengers in 2017, a 37 percent increase from 1.90 billion in 2016.

- Combined TNC and taxi ridership is likely to surpass local bus ridership in the U.S. by the end of this year, making them among the largest urban transportation providers.

- 70 percent of Uber and Lyft trips are in nine large, densely-populated metropolitan areas (Boston, Chicago, Los Angeles, Miami, New York, Philadelphia, San Francisco, Seattle and Washington DC.)

- TNCs account for 90 percent of TNC/taxi trips in eight of these nine large metro areas (New York is the exception), but taxis serve slightly more passengers than TNCs in suburban and rural areas.

- TNC customers are predominantly affluent, well-educated and skew younger.

ROLE IN URBAN MOBILITY

- TNCs added 5.7 billion miles of driving in the nation’s nine largest metro areas at the same time that car ownership grew more rapidly than the population.

- About 60 percent of TNC users in large, dense cities would have taken public transportation, walked, biked or not made the trip if TNCs had not been available for the trip, while 40 percent would have used their own car or a taxi.

TNCs are not generally competitive with personal autos on the core mode-choice drivers of speed, convenience or comfort. TNCs are used instead of personal autos mainly when parking is expensive or difficult to find and to avoid drinking and driving

http://www.schallerconsult.com/rideservices/automobility.htm

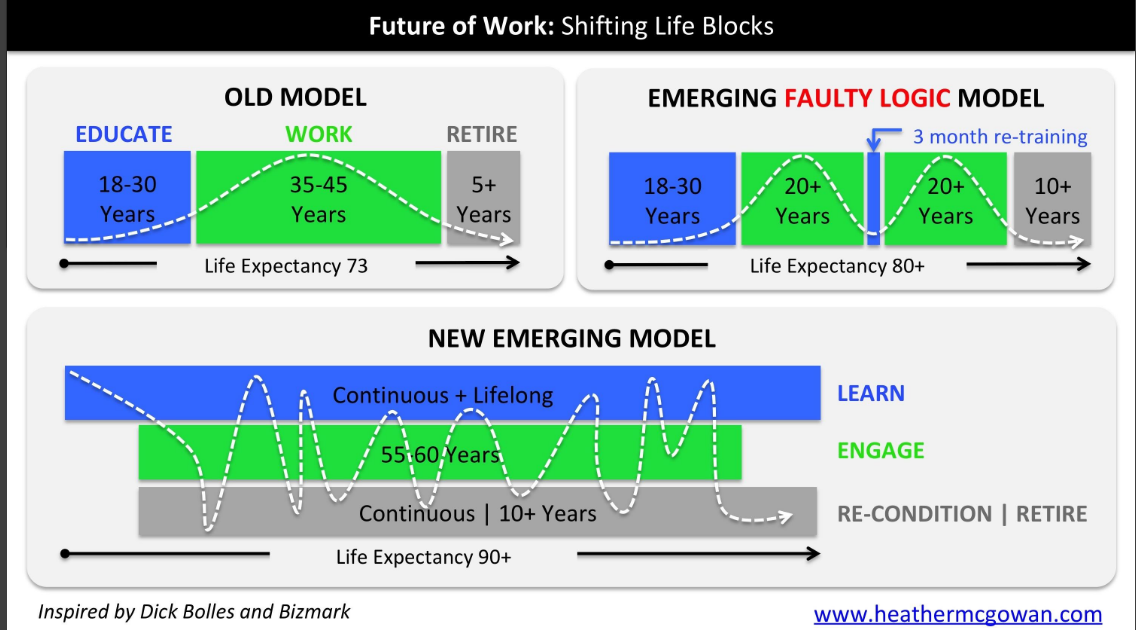

9.Future of Work…Lifelong Learning.

10.Choose Growth Over Comfort—Your Success Depends on It

June 1, 2018/Margie Warrell/No Comments

On my 10th birthday, my dad, a dairy farmer, scrambled together enough money to buy me a horse. I’d been pleading for a pony, but I think he figured getting me a full brown horse, albeit it one that was very long in the tooth, would allow me to get a little bit more use out of him.

I remember looking up at him, 14 hands high, and feeling very intimidated. Wow. How was I ever going to get all the way up there? How was I ever going to learn to ride such a big horse? But I was determined to figure it out, and so every morning before going off to school, I’d head out to the paddock and saddle him up.

In the beginning, I was quite terrified, but over time, I became more confident and eventually became the local barrel-racing queen (well, I like to think I was anyway). Those years of learning to ride my first horse, and then later my second (which we won in a raffle!), taught me some valuable lessons for life. The first and most important was that growth and comfort can’t ride the same horse.

Ginny Rometty, CEO of IBM, said something similar while reflecting on her own career: “Growth and comfort do not coexist.” Whether you’re stepping into a bigger role at work, learning a new skill, pursuing a goal or making a change, you can’t grow into the person you want to be unless you’re first willing to get uncomfortable.

Related: Why Stepping Outside Your Comfort Zone Is Worth It—Even When It’s Uncomfortable

Since my childhood growing up in rural Australia, I’ve taken countless steps outside my comfort zone. Each one has reinforced the universal truth, that what we yearn for most often lies on the other side of what scares us most. It requires allowing ourselves to be vulnerable to rejection, to losing face or falling short.

“Life’s magic happens outside your comfort zone” may be a popular catchphrase, but that does not negate its truth. Which begs the question: Why do so many people tiptoe through life, spending their best years in the confines of a shrinking comfort zone?

The answer is simple.

We’re wired for safety, security and social approval, not for risking it. We may live in modern, urban times, but we still inhabit brains that were wired for long ago, when not being hyper-alert to potential threats led to certain death.

This is why in today’s 24/7 culture of fear, we must be extra vigilant to keep our innate desire to protect ourselves from situations that make us feel uncomfortable from keeping us from stepping into situations that will enable us to grow. Because you know what else? Comfort doesn’t stay comfortable forever. Sticking with the comfort of the status quo may provide a short-term sense of security, but spend too much time in your comfort zone and your muscles for life will gradually wither.

All too often, I encounter people who’ve lost all confidence in themselves because each time they’ve had the choice to do the brave thing over the easy thing, they’ve opted for the latter. In the process, they’ve inadvertently deprived themselves of opportunities to learn new skills, cultivate their talents, hone their strengths, expand their capacity, reinforce their value and build their “muscles for life.”

Take a moment to think of what you are most proud of in your life to date. I’ll guarantee you that it won’t be something that was easy or didn’t stretch you. In fact, it’s likely something that challenged and stretched you in many new ways. That’s how life works. We don’t grow from the times life is easy and everything goes according to plan. Rather, we grow when we are stretched, when we have to adapt to change or we’re thrown a curveball that requires us to dig deep. I mean, just imagine the growth you’d have missed out on had everything you’d ever done or wanted gone exactly to plan? Certainly not half the person you are!

Likewise, if you look ahead to the future, I can guarantee that achieving what you want most and creating a life that is rich in meaning, connection and contribution will require you to choose growth over comfort and trade the safety of the familiar for the uncertainty of the new.

To embolden you to embrace discomfort as a prerequisite for real success, I encourage you to create a vision for your future that really inspires you—one that connects you to a cause bigger than protecting your ego or social approval. Too often our ego’s desire to look goodkeeps us from doing good!

Leaving your comfort zone requires courage. So unless you’re clear about why you need to put yourself “out there” where the fainthearted don’t dare to go, you’ll never ever accomplish what you’re capable of doing—and what the world needs you to do—and you are guaranteed to go to your grave with the song still in you.

And if there’s one thing I know for sure, it’s that you don’t want to do that.

Nelson Mandela once said, “There is no passion to be found playing small—in settling for a life that is less than the one you are capable of living.”

You know in your heart of hearts where you’ve been settling, selling yourself short and, in the process, cutting yourself off from the possibilities that inspire you most deeply.

As I wrote in Brave, it is never too late to become the person you most aspire to become. So take a deep breath—inhale faith, exhale fear—and connect with that bold vision that tugs at your heart, however daunting the gap it creates between where you are now and where you want to be.

Then make the brave decision that the time has come for you to take your first bold step toward the biggest future you have imagined, however far off the beaten and comfortable path that may take you.

Trust yourself, and have faith that you have everything—and I mean everything—it takes to meet whatever challenges arise on the path ahead.

Magic awaits.

https://www.success.com/choose-growth-over-comfort-your-success-depends-on-it/