1.Current Weight of Top 5 Stocks in S&P Actually Lower Than Long-Term Average.

Counter Argument to 5 Stocks Providing Most of the Performance

Are Only a Few Stocks Really Leading Us Higher?

Posted by lplresearch

One of the more popular narratives we’ve heard this year is that only a few large stocks are pulling the overall market higher. We don’t agree with this assessment, and have cited several metrics over the last few months that showed market participation has been broad and eventual new highs in the S&P 500 Index were likely. Remember, when more stocks are moving higher, the bull market’s momentum increases.

Below are a few reasons why we still see broad participation and a continuation of the bull market:

- The Advance/Decline (A/D) lines for the NYSE and S&P 500 both closed at all-time highs last week.

- The Dow A/D line made new highs earlier this week.

- The Value Line Geometric Index is less than 2% from its all-time high. This index equally weights all stocks and is a good gauge for how the median stock is performing.

- The Technology Equal Weight Index made a new high last week.

- The Nasdaq 100 Equal Weight Index made a new all-time high last week.

“The one constant that has suggested higher equity prices this year has been market breadth. Tariffs, tweets, and rate worries might be in the headlines, but we’ve been comforted by the fact that many market measures of breadth have suggested eventual new highs and we are happy to report this is still the case today,” explained LPL Research Senior Market Strategist Ryan Detrick.

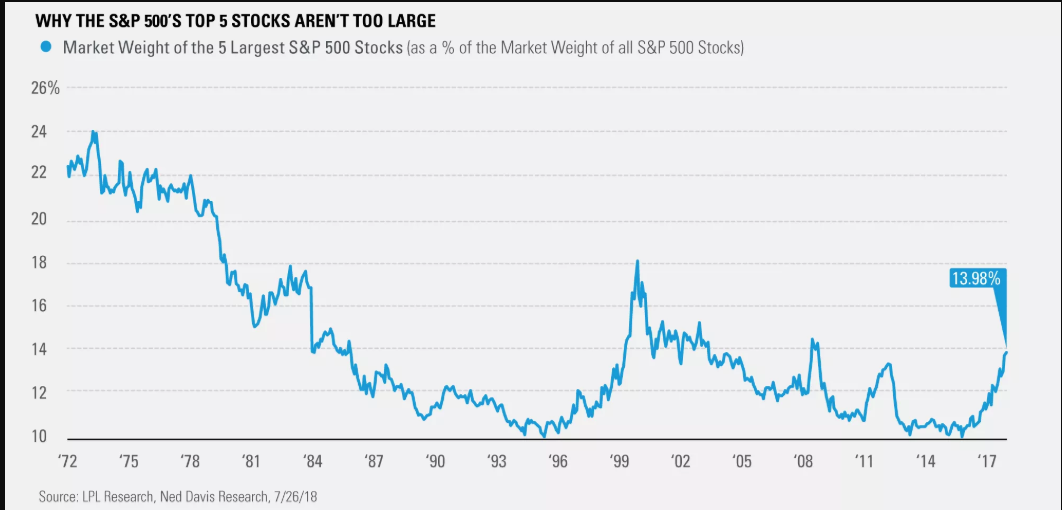

There has been a lot of news coverage around the five largest companies now being worth more than the bottom 250 in the S&P 500. Thanks to data from our friends at Ned Davis Research (NDR), the top five stocks in the S&P 500 account now for 13.98% of the total index. As our LPL Chart of the Day shows, the current weight of the top five stocks is actually beneath the average of 14.33% using NDR’s data going back to 1972.

This is another sign that investors should ignore the narrative that only a few stocks are leading us higher and that the market is doomed.

2.Big 4 Banks Making Most Money on Rising Rates…$5 Trillion in Deposits.

Here’s my math: The nation’s four biggest banks — Bank of America Corp., Citigroup Inc., JPMorgan Chase & Co. and Wells Fargo & Co. — have just more than $5 trillion in deposits among them. Those deposits, based on the Fed’s overnight lending rate, are generating about $94.5 billion a year for the banks, up from $6.3 billion three years ago, before the Fed started raising rates. And that’s before the money they make lending out those deposits. Interest rate disclosures and recent calculations from analysts at KBW, an investment bank that specializes in the financial sector, indicate that those four banks are capturing as much as $73 billion of that $88 billion increase. Depositors’ income has risen just $1.25 billion a month, or $15 billion annually at current rates.

Minimum Deposit

Earnings from deposits for the big banks are growing faster than what they are paying customers

Source: KBW, Bloomberg

Big banks is quarterly income earned by Bank of America, Citigroup, JPMorgan Chase and Wells Fargo on deposits before lending. Customers is quarterly income paid out to deposit account holders.

https://www.bloomberg.com/view/articles/2018-08-02/big-banks-not-savers-get-payday-from-higher-rates

https://www.bloomberg.com/view/articles/2018-08-02/big-banks-not-savers-get-payday-from-higher-rates

3.More on Buybacks.

Hot Chart: Buyback Season Approaches

Posted July 24, 2018 by Joshua M Brown

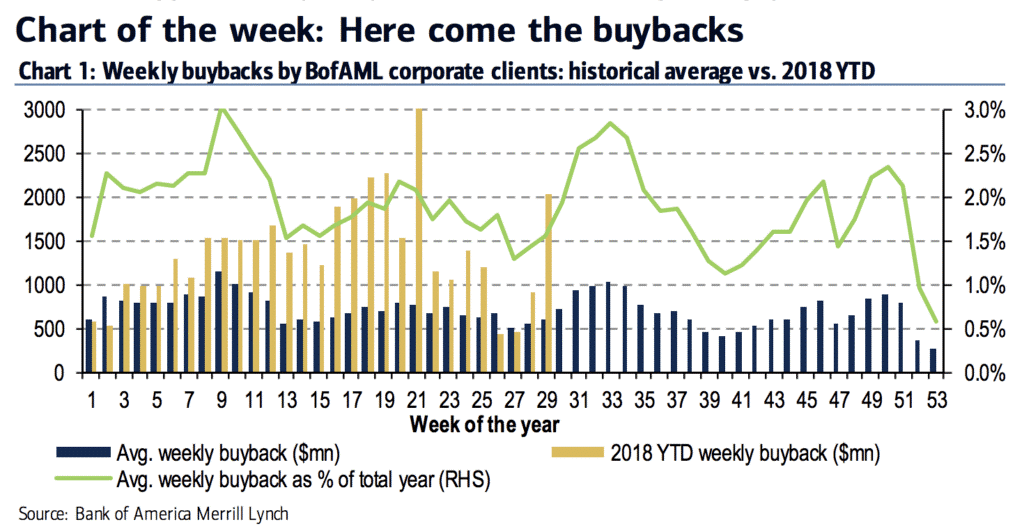

I haven’t really seen anything like the chart below, which comes to us via Savita Subramanian’s group at Bank of America Merrill Lynch. They’re showing the seasonality of stock buybacks broken down by weeks of the year. Apparently, we’re headed into the thick of buyback season, and this past week was way above trend…

Buybacks by our corporate clients last week were the sixth largest in our data history since 2008. In particular, Tech companies’ buybacks were the fourth-largest in our data history.

In a reversal to recent trends, buybacks in Financials and Health Care stocks picked up last week. Financials saw the second-biggest buybacks (after Tech) by our corporate clients.

Josh here – what’s interesting to me is that the pace of buybacks historically spikes twice in the average year, in what looks like the 8th week (end of Feb) and then around the 34th week. If last week’s kickoff to the season was indicative of what the rest of the summer will look like, it’s not hard to understand why we’d be making new record highs soon.

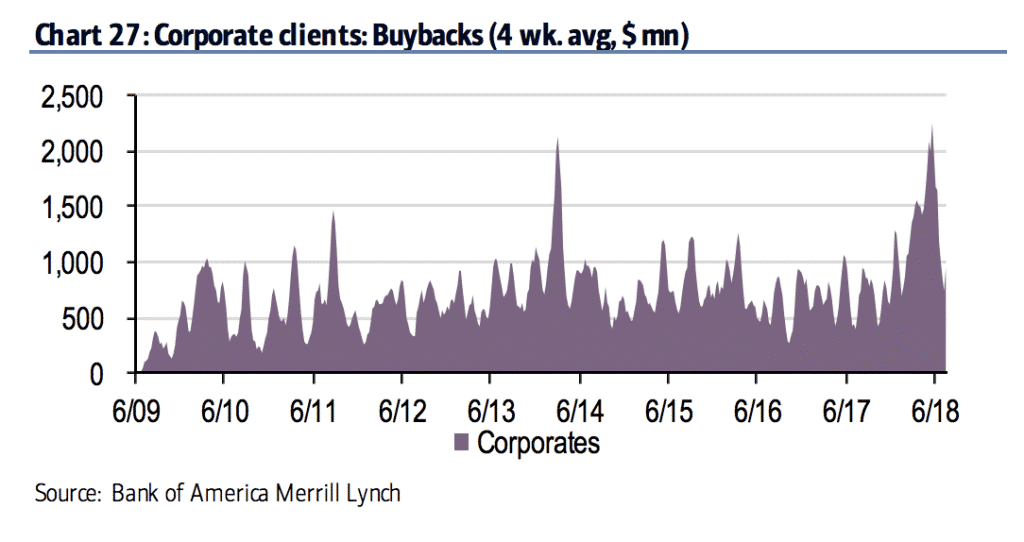

By the way, regardless of what happens with buybacks this summer, I think it’s clear that, thanks to the tax cut, 2018 is going to be a year to remember. Here’s the post-crisis history of buybacks on a 4-week rolling average from the same report:

Source:

Here come the buybacks

Bank of America Merrill Lynch – July 24th, 2018

From Josh Brown Reformed Broker

4.More on Value vs. Growth.

Value still waiting for a catalyst

Written by Russ Koesterich, CFAPortfolio Manager for BlackRock’s Global Allocation Team

Value continues to look cheap, however predicting when it will begin to outperform is challenging. Russ suggests one potential catalyst: an unexpected acceleration in nominal economic growth.

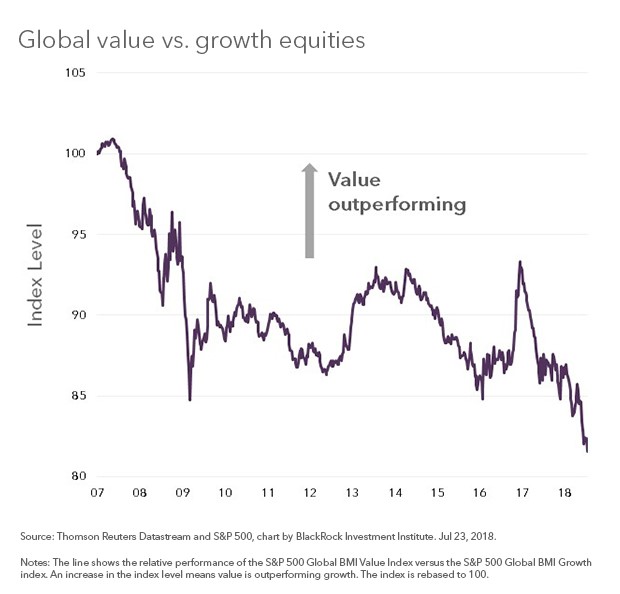

The view that value looks cheap has become axiomatic; when value will actually start outperforming has been much harder to predict. Despite offering historically low valuations, at least relative to growth, value continues to lag. Year-to-date the Russell 1000 Growth Index has outperformed the Russell 1000 Value by over 11%.

Valuation gap

I last discussed this valuation gap in November. Since then it has only widened. Based on price-to-book (P/B), the Russell 1000 Value index has typically traded at around a 57% discount to the Growth Index. In November the discount was approaching 70%; today it is at 72%.

Does this suggest that value is even more of a “screaming buy”? Perhaps, but the timing is not obvious. The valuation gap looks less extreme depending on the exact valuation metric and time-frame. For example, although the current P/B discount looks out-sized relative to the long-term history, it looks less severe compared to the post-global financial crisis norm. Since 2010, value has traded at an average discount of 64%. In this light, current valuations appear less extreme.

You reach a similar conclusion by changing the valuation metric. Historically, based on trailing price-to-earnings (P/E), value has traded at a 25% discount to growth. Recently, stellar earnings growth has kept the P/E ratios for growth companies well below the nose-bleed levels of the late 1990’s. Today, value, based on trailing P/E trades at only a 32% discount to growth; larger than the historical average but not unprecedented.

Read more from Russ K.

Still waiting for economic growth to breakout

Beyond the question of relative value looms a second challenge: the lack of a catalyst. As I highlighted last November, you would have reached the same conclusion on value looking cheap at any point during the past three years. Yet, with the exception of late 2016 value has consistently under-performed over this period (see Chart 1)

The catalyst most likely to revive value is the same one that drove out-performance during the back-half of 2016: an unexpected acceleration in economic growth, particularly nominal growth. Unfortunately, as everyone now knows, nominal growth has failed to accelerate on schedule.

Despite a late-cycle tax-cut, first quarter growth of 2% was another disappointment. And while inflation has risen, so far it has been a gentle climb. The good news is growth, both real and nominal, should accelerate from here. The challenge is whether or not the acceleration will impress investors. What made the latter part of 2016 so ideal for value was the abrupt change in sentiment: investors went from panic over China to a U.S. tax-cut led euphoria in less than six months. In other words, economic expectations went from dismal to optimistic very quickly.

Bottom line

This time around expectations may be harder to beat. Unlike in early 2016, when China fears led many to expect another recession, expectations for growth have risen of late. According to Bloomberg, since last October consensus growth expectations have risen from 2.3% to 2.9%. For value to really start to outperform, economic growth may need to surge in a way we have not seen for some time.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.

5.20 Most Shorted ETFs

20 Most Shorted ETFs

Source: Bloomberg; data as of July 24, 2018

Email Sumit Roy at sroy@etf.com or follow him on Twitter sumitroy2

Unsurprising Targets

Given the nature of short selling, which requires a margin account and consistent monitoring of the position, it’s typically only done by active traders with a high risk tolerance. Still, it’s a popular method of betting against ETFs.

In addition to SMH, there are a few other ETFs that have more shares being shorted than there are shares outstanding. They are the SPDR S&P Retail ETF (XRT), the VelocityShares 3X Inverse Silver ETN (DSLV) and the iPath S&P 500 VIX Short-Term Futures ETN (VXX).

It’s not surprising to see XRT be a popular target for short-sellers. As consumers increasingly turn to online merchants to make their purchases, brick-and-mortar retailers have been losing business and shuttering their stores en masse.

Meanwhile, VXX is another unsurprising entry on the most-shorted list. The Cboe Volatility Index—better known as the VIX—is used regularly by hedgers and speculators to bet on and against volatility. VXX tracks VIX futures, meaning anyone who shorts it is effectively shorting the VIX.

http://www.etf.com/sections/features-and-news/most-shorted-etfs

6.Fear and Greed Index Update.

https://money.cnn.com/data/fear-and-greed/

7.Health..4 Health Benefits of Cold Showers

June 27, 2018/Adam Rhew/1 Comment

Sure, it sounds miserable, but standing under chilly water in the morning could improve your physical health—and your outlook on the world. Cold showers have been the secret weapon for everyone from the ancient Spartans, who thought it made them tougher, to James Bond, who claimed they made him more alert.

There are hosts of physical and psychological benefits to an invigorating shower. And that’s not to mention the added plus of a shorter morning routine, because who wants to stand under an icy tap for longer than necessary?

- Immunity boost

Researchers have found a correlation between exposure to cold water and an increase in glutathione, an amino acid that boosts your immune system, rids the body of toxins and fights stress.

- Better skin

Hot water strips essential oils from your skin, dermatologists say, leaving it dry and itchy. Showering in cold water a few times a week will reduce skin inflammation and keep your hair from becoming brittle.

- Faster muscle recovery

Athletes, from high school track sprinters to NFL linebackers, soak in ice baths for short periods of time to ease muscle soreness after a race or game. The same principle applies to weekend warriors who want to shorten recovery time from a long run or an afternoon of gardening.

- Improved mood

Researchers at Virginia Commonwealth University found cold showers could ward off depression. They studied “adapted cold showers,” which consist of a five-minute gradual transition period of dropping water temperature (to make the shock of the chilly water a little less unpleasant), followed by two to three minutes of showering in 52-degree water. “A cold shower is expected to send an overwhelming amount of electrical impulses from peripheral nerve endings to the brain,” they wrote, “which could result in an anti-depressive effect.”

Related: 8 Small, Everyday Actions to Improve Your Health

https://www.success.com/4-health-benefits-of-cold-showers/

8.The 3 Biggest Success Habits That Are Working for Me This Year

by Ryan Warner | Aug 2, 2018 | Articles, Productivity, Self-Improvement, Skill Development, Time Management

As the great Og Mandino wrote, “Bad habits are the unlocked door to failure.”

On the other hand, good habits can bring us closer to our goal or mission. The definition of a habit, after all, is “a regular (repeated) tendency or practice.”

I encourage you to ask yourself the same thing I did a few months ago: Do your current habits bring you closer to or push you away from your goals? If your answer leans a little too heavily on the latter, then you might want to try “installing” some new habits into your daily routine. And maybe I can help…

I’d like to share 3 new habits that have been working for me in 2018. I’ll preface my unveiling by admitting that these habits aren’t earth-shattering. In fact, they are quite simple in application. Yet, if practiced consistently, you’ll enjoy some incredible benefits, i.e., enabling more peace of mind, better focus, and improved productivity. What’s more, you’ll have better practice building the good habits that set you up for success.

Habit #1: Set your phone on airplane mode while eating

This one was tough. I travel a ton for work, and spend a lot of time eating by myself. You can imagine, then, that it’s incredibly tempting to whip out my phone and scroll through the endless loops of Instagram, email, ESPN, Facebook, and LinkedIn. The next meal it’s the same thing all over again. The worst part is, it’s unbelievable the number of times I’ll do this without even noticing.

But I finally did notice. And I recognized this incessant phone use as a bad habit. So, inspired by entrepreneur and CEO Aubrey Marcus, my phone now goes into airplane mode anytime I sit down to eat. This not only gives my screen-weary eyes a break, but it also gives me the space to enjoy my meal and be present in the moment. It’s truly amazing the reflection and gratitude I can engage in while enjoying a quiet meal without digital distractions.

Plus, taking a break from the phone charges my mental batteries so that when the meal is over, I’m ready to hit the next task of the day with full focus and energy.

Habit #2: Institute a pass/fail grading policy for your days

Craig often talks about the importance of doing a brain dump each night during the week. I’d like to tack on to that with a unique “grading” tool that puts the pressure on to achieve daily.

Each night, write down your three most important tasks for the next day. Write “pass/fail” above them, so that your list looks something like this:

Pass/Fail

1.) Lead weekly ad revenue meeting

2.) Spend time with kids before dinner

3.) Spend 20 minutes working on writing projects

When you start the next day, you know exactly what needs to be done. If these three tasks are completed, no matter what else happens, you get a “pass” and can quote the beloved Ice Cube: “Today was a good day.” The goal, of course, is to have as many “pass” days as possible.

The real benefit to this one is the momentum you start to build after a handful of “pass” days. I’ve found myself staying up late to complete a task I otherwise would have pushed to the next day, just to keep the “pass day” streak alive.

Don’t get me wrong. I have plenty of “fail” days, but there’s benefit to these, too; they give me a jolt of motivation to make the next day better.

Habit #3: Visualize meetings in advance

“Visualization” is about as overused as “mindfulness” and “mediation.” Yet, I never thought to apply the practice to sales meetings, which are the lifeblood of my craft.

Now, I spend 10 to 15 minutes visualizing every detail of a meeting on the day it’s scheduled. I picture everything—from the moment I walk into the lobby, to the sound of my shoes on the floor, to the introduction of our team, to kicking off the agenda, to walking out of the building. I’ll do this three or four times for a big meeting.

The benefits are incredible. I’ve never felt more calm and prepared for a meeting—and all it took was 3 simple 10-minutes visualization exercises. It makes sense, of course; I’m so calm because I’ve literally practiced the meeting in my head for a good half-hour before it even starts.

The best part: This habit can be applied to any activity that you deem important. Spend time with your thoughts, and vividly imagine every step of the activity of importance. I guarantee it will not only put you at ease, but it will actually help you “rehearse” without needing to go through the motions.

What new habits are you employing in 2018 to take your life to the next level? Share them in the comments below!

https://www.earlytorise.com/the-3-biggest-success-habits-that-are-working-for-me-this-year/