1.Growth Stocks Still Leading….Tech and Consumer Discretionary Momentum Sectors Still Leading.

LPL Research

https://twitter.com/JohnLynchLPL

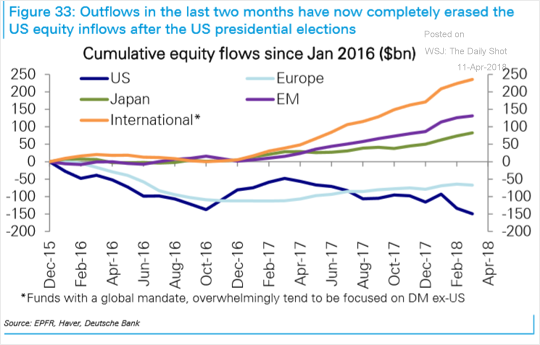

2.Global Developments: This chart shows equity fund flows across major markets.

U.S. Equity Flows Completely Erase Inflows Post-Election in 2 Months.

Source: Deutsche Bank Research

www.thedailyshot.com

3.30 Year Treasury Yield Has Gone Sideways for 18 Months.

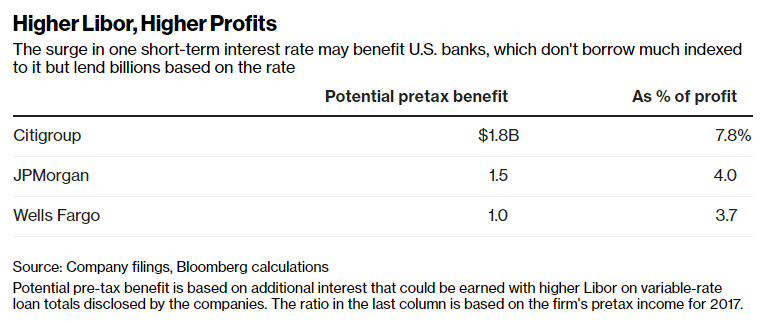

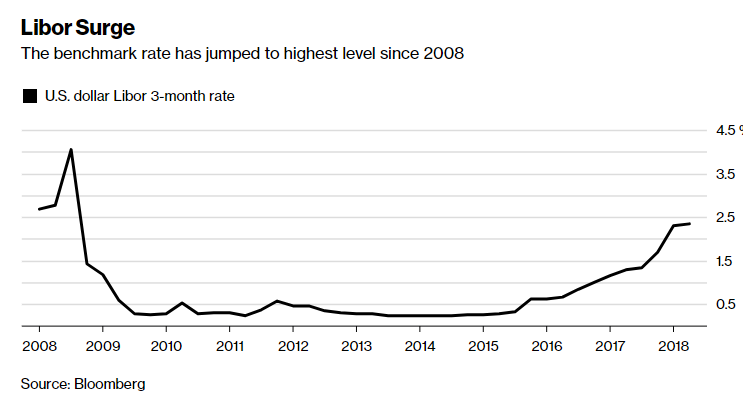

4.We Discussed Rising Libor Multiple Times on Top 10….It’s Adding Billions to Bank Bottom Lines.

Surging Libor, Once a Red Flag, Is Now a Cash Machine for Banks

By

Yalman Onaran

April 12, 2018, 5:00 AM EDT

- JPMorgan, Citi poised for billion-dollar bump to revenue

- Deposit rates barely budge while loans get more profitable

A surge in one key short-term interest rate 10 years ago was a harbinger of a crisis that nearly broke the U.S. banking system. A similar jump this year will probably add billions to the industry’s bottom line.

The largest U.S. lenders could each make at least $1 billion in additional pretax profit in 2018 from a jump in the London interbank offered rate for dollars, based on data disclosed by the companies. That’s because customers who take out loans are forced to pay more as Libor rises while the banks’ own cost of credit has mostly held steady.

Higher Libor, Higher Profits

The surge in one short-term interest rate may benefit U.S. banks, which don’t borrow much indexed to it but lend billions based on the rate

Source: Company filings, Bloomberg calculations

Potential pre-tax benefit is based on additional interest that could be earned with higher Libor on variable-rate loan totals disclosed by the companies. The ratio in the last column is based on the firm’s pretax income for 2017.

“During the 2008 crisis, it was the sign capital markets were frozen,” said Fred Cannon, head of research at Keefe, Bruyette & Woods. “Now there’s all this liquidity, so they don’t need to borrow in the Eurodollar market,” where rates are based on Libor, he said.

Since banks aren’t dependent on the short-term overseas markets the way they were 10 years ago, they’re funding much of their operations through deposits. The companies pay those customers interest rates that stayed low even after the Federal Reserve raised its benchmark rate three times in 2017, for a total of 0.75 percentage point. The average rate paid by the largest U.S. banks on their deposits climbed only about 0.1 percentage point last year, according to company filings.

Still, some of the benefit could be eroded by higher rates the banks will end up paying on long-term debt that’s hedged using Libor-based swaps. The firms don’t disclose how much of their debt is hedged.

Most banks don’t reveal how much of their lending is at variable rates, or if they do, how much of it is indexed to Libor. JPMorgan Chase & Co., the biggest U.S. bank, said in its 2017 annual report that $122 billion of wholesale loans were at variable rates. Assuming those were all indexed to Libor, the 1.19 percentage-point increase in the rate in the past year would mean $1.45 billion in additional income.

Citigroup Inc.’s $149 billion of floating-rate consumer-mortgage and corporate loans as of the end of last year could be counted on for as much as $1.77 billion in additional pretax profit, based on the same assumption.

And Wells Fargo & Co. said in its annual report that it had stopped hedging the interest rate on $86 billion of Libor-based commercial loans to benefit from rising rates. A pile that large would generate $1.02 billion this year, not counting any other loans indexed to the benchmark that were never hedged.

Spokesmen for the three banks declined to give more details on their loan portfolios beyond what’s already in public filings.

Libor Surge

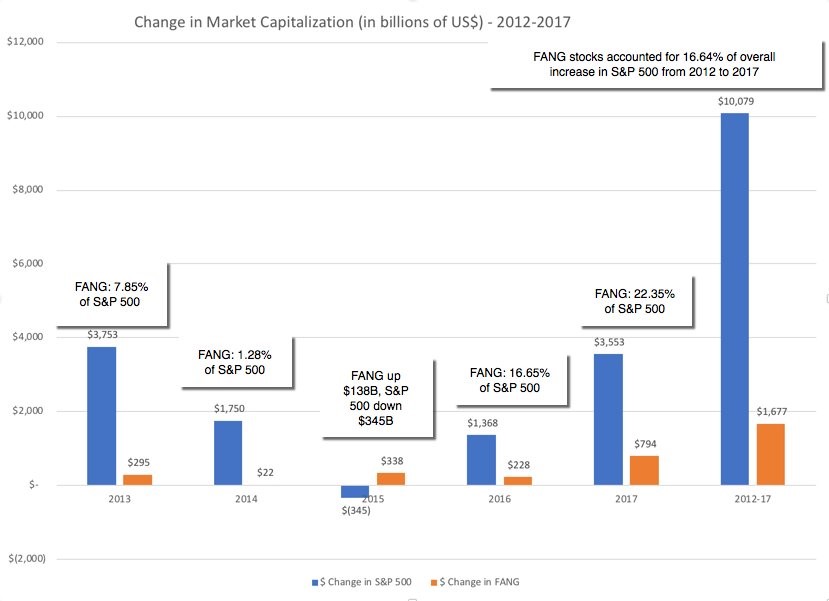

5.FANG 2012-2017 Change in Marketcap.

The FANG stocks, unstoppable between 2012 and 2017, accounted for a sixth of all of the gain in the S&P 500. They have lost $282 billion in market value between March 15 and April 2. My assessment of where things stand, as a prelude to valuing all four: http://bit.ly/2GH9Kt9

https://twitter.com/AswathDamodaran

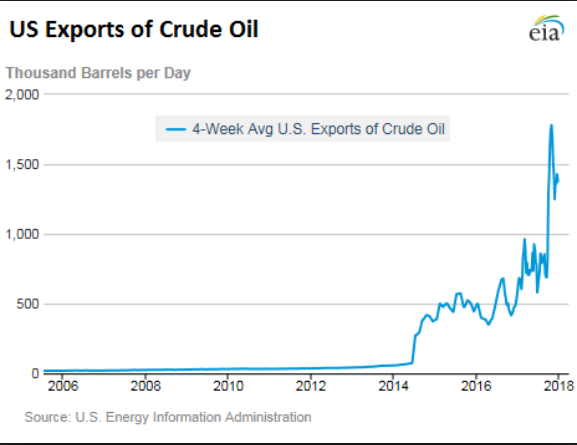

6.U.S. Crude Exports 4 Year Spike…

https://wolfstreet.com/2017/12/29/us-oil-exports-boom-2017-as-opec-cuts-production/

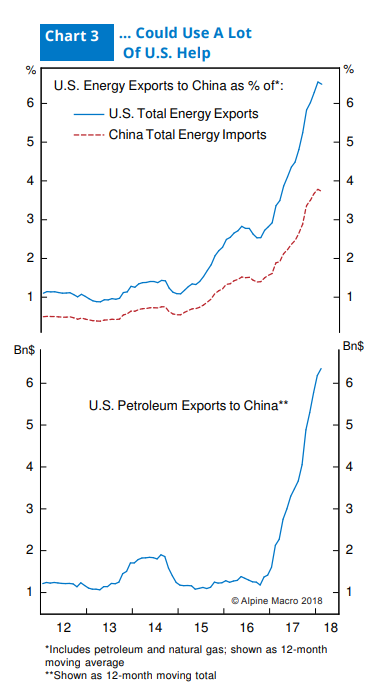

Exports to China

Yan Wang 王 岩Partner, Chief EM & China Strategist at Alpine Macro2d

This week’s Alpine Macro Emerging Markets & China Strategy report titled “Deal Or No Deal: Prospects Of A U.S. – China Trade War” discusses how the situation may develop going forward and how to invest with this risk. In this report, we address three main issues: • In the near term, we make the case that the current round of trade tensions between the U.S. and China should not lead to an immediate turning point for the global economy or financial markets. There is enough common ground for both countries to reach a compromise. • There are structural challenges that will likely further strain the relationship between the two countries in the medium to long term. • As far as investment strategy is concerned, we have identified countries that are more vulnerable in the current environment, regardless of how the trade tensions evolve. If you are interested in reading this report, please contact us at info@alpinemacro.com

https://www.linkedin.com/feed/

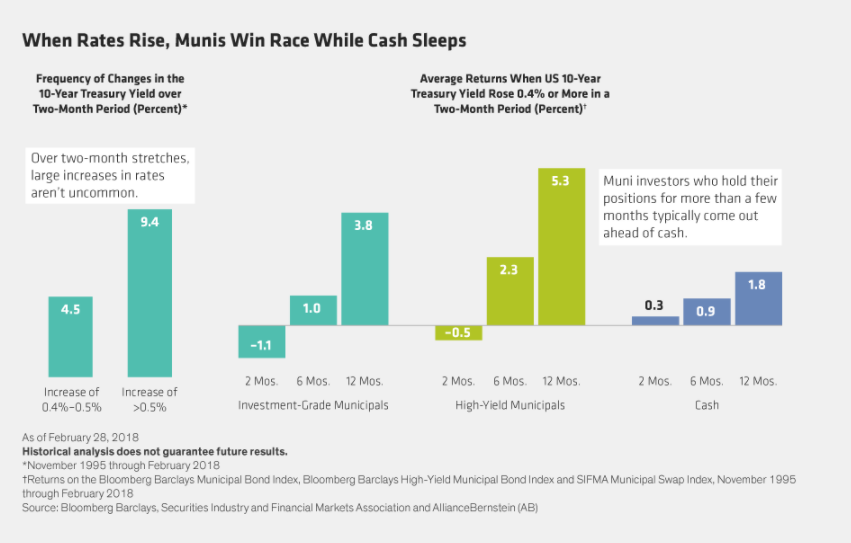

7.What Do Munis Do When Rates Rise?

AB Blog

Nonetheless, we compared how an investor who timed a move to cash just right would have done during those periods when the 10-year Treasury yield rose more than 0.4% in two months. At first, the cash investor would have outperformed the investor who had stayed put in either investment-grade or high-yield munis. But within four months of the start of the rate increase, muni investors would have broken even. By six months, on average, munis were beating the cash investor. And by 12 months, they were dominating, at 3.8% and 5.3%, for high-grade and high-yield municipals, respectively, versus 1.8% for cash. The winning tortoise in this race? Municipal bonds.

Simply put, when money sleeps, it stops working for you. As a muni investor, you need your money to work hard. So as rates rise, stay invested and let the power of yield plus time fuel your race.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

https://blog.alliancebernstein.com/library/what-to-do-about-rising-rates

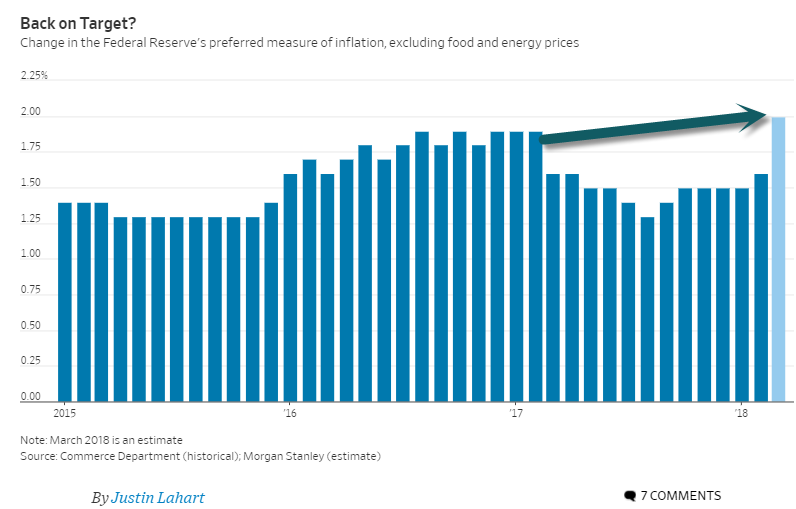

8.Federal Reserve About to Hit It’s Inflation Target.

The Fed’s Inflation Target Is Getting Close—Now What?

Higher inflation is a relief to the Federal Reserve, the risk is it runs too hot

Don’t look now, but the Federal Reserve is about to hit its inflation target.

The Labor Department on Wednesday reported that consumer prices fell 0.1% last month from February, which put them 2.4% above their year-earlier level. Core prices, which exclude food and energy to better capture inflation’s trend, rose 0.2% on the month and were up 2.1% on the year.

While the Fed prefers a different set of data, it does have a 2% inflation target. Based on Wednesday’s inflation report, Morgan Stanley economists estimate the Commerce Department measure, which the Fed uses, will register a March gain on the year of 2.1%, with the core up 2%. Core inflation was last above 2% in 2012.

9.Read of the Day.

Three Takeaways from Mark Zuckerberg’s Senate Testimony: DealBook Briefing

That wasn’t a waste of time.

Congressional hearings focusing on corporate missteps often reveal little, in part because lawmakers lack the expertise and the executives taking questions are good at stone-walling.

Still, Tuesday’s hearing turned out to be a serious attempt to grapple with the growing influence of a powerful company that is entwined in the lives of millions of Americans.

Lawmakers, it became clear, no longer see Facebook and other large tech companies as mostly benign forces for innovation. In his responses, Mr. Zuckerberg was competent but notably did not reveal much that was new about how Facebook will respond to its enormous challenges.

On balance, the hearing probably leaves Facebook and its peers on the back foot in three important ways.

Legislation to rein in social media companies is now a possibility.Lawmakers now seem much more aware of how much power large technology companies have. This was encapsulated in questions posed by Senator Lindsey Graham, Republican of South Carolina. He framed Facebook as a monopoly and brought up the possibility of regulating Facebook, asking Mr. Zuckerberg: “But you as a company welcome regulation?” Mr. Zuckerberg gave a response often heard from C.E.O.s: “I think if it’s the right regulation, then yes.” Senator Graham then secured something of a commitment from Mr. Zuckerberg to work with the Senate on what regulations are necessary.

A Senate with a Republican majority may be less likely to pass legislation, but if the Democrats gain control, top senators from that party might push for new laws ahead of a potential run in 2020. Some of the most penetrating questions on Tuesday came from Kamala Harris, Democrat of California, and Cory Booker, Democrat of New Jersey.

Recidivism may now be taken more seriously. One of the reasons that Facebook is under scrutiny is that it has been the source of several scandals. Patience has apparently worn thin in the Senate. Facebook has not convincingly explained why it took so long to reveal Cambridge Analytica’s misuse of the data of 87 million users. Senator Bill Nelson, Democrat of Florida, sounded bewildered by that misstep: “You apologized for it. But you didn’t notify them. And do you think that you have an ethical obligation to notify 87 million Facebook users?” Facebook may now only be one big scandal away from a stringent government response.

Large technology companies sense an economic threat. Mr. Zuckerberg made an intriguing comment that suggested Facebook could, in theory, offer a paid version, presumably to users who do not want ads or to share certain data with Facebook. He said: “There will always be a version of Facebook that will be free.” This suggests that Facebook has begun to think about how it can adapt to a situation in which it gets access to less data from users. In other words, it may be taking a threat to its business model seriously.

The fact that Facebook’s stock rose through the hearing should not be taken as a sign that the company is in the clear.

— Peter Eavis

10.5 Ways You Should Treat Yourself Like a Business

by Ryan Warner | Apr 5, 2018 | Articles, Motivation, ProductivitySelf-ImprovementSkill Developmen

I wrestled with the question for a few days, and ultimately decided to play out the possibility. I’m now three months into managing myself as a business, and have experienced a number of positive benefits:

- I have shifted my focus, time, and energy to things that really “move the needle” in my life.

- I have discovered (and constantly reiterate) a life mission—something that guides every action I take.

- I’ve learned that I’m the only one who will succeed (or fail) in my own life. My butt is on the line, so I make every minute of every day count. I’m driven to make an impact on the world.

How did I actually get here? Surely, you argue, it takes more than a simple paradigm shift or a thought exercise to take such huge strides forward.

It does indeed. But as you can see from the benefits above, the work it takes to create positive change is absolutely worth it. If you’re on board with what a business lens can do to your own life, then start implementing the steps below.

- Define Your Business Philosophy

If someone were to navigate to Yourname.com and click on the About page, what would they find?

Tim Ferris shone a light on this self-definition recently. On his podcast, Ferriss hosted psychologist Michael Gervais, during which Gervais told a story about how he came to develop his personal philosophy, “Make everyday a living masterpiece.”

Twenty years back, Gervais was asked by his mentor who he was. A simple question, right? But Gervais fumbled. He jumped into hokums about what he liked to do, what he did in the past, and what his goals were. The elderly mentor smiled and said, “Come back to me when you’re ready.”

Young Gervais—the now world-renowned performance psychologist—could not answer this seemingly simple question. But he endeavored to find an answer. What resulted was his personal philosophy.

You should do the same for yourself as a business. Why? Your business philosophy is what continually reminds you what you stand for. A well-crafted philosophy will not leave room for ambiguity or loopholes; it will hold your feet to the fire every day.

Before you move onto the steps below, then, take a few hours and sketch out your own philosophy. What do you stand for? What is your “business”? What are your end goals? These will need tweaking, of course, but it’s important to start now.

To get you started, here’s my “business” philosophy in a nutshell: Ryan Warner will always be grateful for obstacles. He will maintain the discipline needed to attack every task with absolute focus. He will spread love and laughter every day.

As you can see, philosophies are not all about stuff. In fact, the best ones tackle the most important questions of morality and purpose, leaving money to fall where it may. That said…

- Capitalize on Investments

Investments are focused on how we spend our time and money. The former is the scarcest resource in the world; we should be mindful of this when we commit ourselves to daily tasks. We want to invest only in those things that move the needle in our “business” every day

What would a business do with a hefty helping of time? They would invest labor and research in things that create value for shareholders. Likewise, we should put our time into activities that build us up as individuals and enable us to offer value to our family, friends, coworkers, and the world at large.

Here’s a good example: Spend a Sunday morning analyzing your strengths and weaknesses. Be ruthless about your weaknesses, and really drill into what you want to improve in your life. Do you want to learn how to be a better leader or public speaker? Do you want to be more present for your family? Do you wanted to be more invested in your job? What are your friends, family, and colleagues doing well in these areas that you could learn from?

The second piece of our daily investment is financial. How does a business look at finances? In simple terms, it’s about increasing top-line growth while maintaining a tight bottom line. Incoming dollars are viewed not as income, but as revenue, and revenues are re-invested in the company to increase growth.

Now think of yourself as a money-making business. What sort of revenues are you bringing in? And how will you get the best return on investment for the money you spend?

For example, if you—as a business—have $20 left over in the budget after a light month, would you reinvest in yourself or squander that money on meaningless stuff and empty activities? Would you buy a book or head to the bar and buy a round of beers?

By thinking of yourself as a business, always looking to increase value, your investments will start to align with your philosophy.

- Nurture Relationships

How important are personal connections and relationships to a business? Very. They make or break a business’ success; without relationships, there are no customers, partners, board members, or staff.

You need relationships in your business. A lone wolf will not make it.

Former UFC champion Frank Shamrock has a strategy for building relationships that he calls “Plus, Minus, and Equal.”

For the Plus, he looks for someone who is more successful than he is (however one might define success). This person is at the level where Frank wants to be at some point. He or she would make a great mentor.

On the flipside, a Minus is someone whom Frank can teach. Teaching not only helps a Minus, but also helps you increase your understanding of the topic(s) you teach. After all, you can’t teach a subject effectively unless you know it inside and out.

An Equal is a peer—someone with whom you can share feedback as you move your “business” closer to success. These shared struggles and success stories build on mutual experiences and inform future decisions for even better outcomes—increasingly value exponentially.

It’s important that every business have a balance of Plus, Minus, and Equal relationships to keep them afloat. Each one enourages development, maturity, and social engagement.

Oh, one last point on relationships. Make an effort to remove negative relationships from your life. (Just b careful you’re not removing Minuses, though!)

- Maintain Health

Maintaining a healthy lifestyle may seem like a given, but many people ignore it. I love focusing on health for my “business” because it often has the most immediate ROI. Don’t believe me? Hop on an elliptical for 30 minutes, then spend 15 minutes meditating. How do you feel? It’s amazing the amount of energy and focus we gain from working out.

But what’s the business angle here? Well, think of your mind like the CEO of the company and the rest of your body as employees. You want to spend time making sure each part of your body—or “employee”—is healthy so it can work properly, both on its own and in conjunction with other parts of the body.

To make that work, feed your body what it needs—lots of fresh vegetables, lean meats, and limited carbohydrates. Avoid refined sugars and processed foods. Then, keep a regular exercise regimen going; five days a week of 20-30 minutes of cardio and weight-bearing exercise should be plenty. More on that here.

The result: A healthy body—”collaborative workforce”— that is an unbeatable productivity machine.

But don’t neglect the mind. Dedicate time to meditation, reading, and journaling throughout your week. Challenge your mind with new types of learning, like language study, crossword puzzles, or trivia games. These activities keep your mind sharp, ready for whatever life throws at you.

- Take Action Every Single Day

A CEO doesn’t take weeks off without working on his/her business, and neither should you. Every day is an opportunity to improve the state of your business and a chance to increase the value you deliver to your shareholders.

Entrepreneur Jesse Itzler takes this concept to a whole new level. He calculates the average life expectancy of a Caucasian male and subtracts his age from it. That leaves him with the number of years he likely has left in this world. Seeing that number in black and white makes only one thing matter: The mission to do the most with your life TODAY.

Jason Feifer, editor-in-chief of Entrepreneur Magazine, takes a different approach. He focuses on the hours that comprise a day, and at the end of each hour asks, “What did I just accomplish in the past hour? Would my family be proud of how I lived in the last 60 minutes?”

In both cases, however, the idea is the same; as the old saying goes, “Live your life like there’s no tomorrow.”

There are two parts to this imperative action. The first is your “why”—which is derived from your mission statement. Don’t just act to act; act knowing what you’re doing is a real-life manifestation of your mission statement.

The second is your “how”—derived from your investment strategy. How do you act in relationships, at home, and at work to reflect your commitment of time and money? How are these an accurate reflection of what your mission statement demands?

Don’t let these questions derail you, however. Examine your actions—carefully, but not too long—and act with integrity, confidence, and purpose.

Treating yourself as a business has the potential to reframe your personal development and rebrand your identity with a crystal clear “why.” Be thoughtful about crafting your philosophy and mission statement to make this possible; bear these out in your investment decisions; nurture your relationships with these principles at your core; and act like there’s no tomorrow.

Be energized, be focused, be true to yourself and humbly inspired by the possibilities of your life. If you can manage this—as any good business would—you will find success, however you define it.

I sure have.

I’d love to learn what steps you think I’m missing here, so please leave a comment below with your thoughts/additions.

https://www.earlytorise.com/why-and-how-you-should-treat-yourself-like-a-business/