1.Value Massive Underperformance vs. Growth Shuts Down AJO One of the First Quant Value Shops…..1999 Value Shops were Closing Across U.S. Before Value had Reversion to Mean.

Ted Aronson AJO Hangs It Up……”drought in value is the heart of the challenge”

5 Year small cap value vs. small cap momentum…..DWAS Small Cap Momentum ETF+69%vs. VBR small cap value ETF+18%

2. Goldman Recommending Shift to Value Sectors

Sector recommendations that emerge from this thesis can be found in the table below.

| OVERWEIGHT | NEUTRAL | UNDERWEIGHT |

| Autos & parts | Chemicals | Food, beverage & tobacco |

| Banks | Financial services | Personal care, drug & grocery stores |

| Basic resources | Industrial goods & services | Retailers |

| Construction & materials | Insurance | Telecoms |

| Consumer products & services | Media | Regulated utilities |

| Energy | Real estate | |

| Healthcare | Technology | |

| Civil aerospace | Travel & leisure | |

| Luxury goods | Utilities | |

| Renewables | ||

| Source: Goldman Sachs Global Investment Research |

Read: These are the ETFs to help you prepare for a Biden presidency

Move over, tech. It’s finally value’s turn, Goldman says

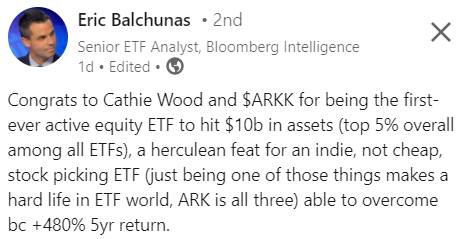

3. Meanwhile Growth Sub-Sector ARKK First Active ETF to $10B…+450%5 year

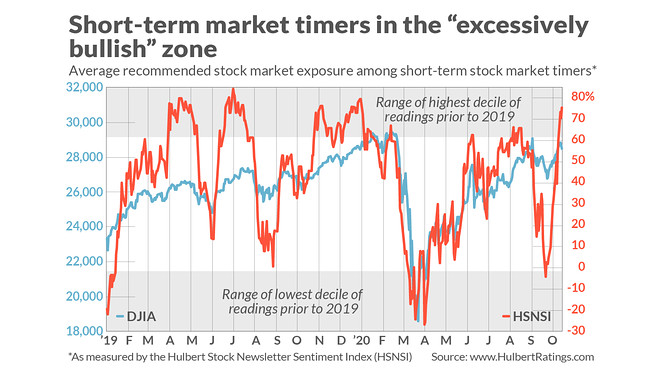

4. Short-Term Market Timers Overly Bullish

Marketwatch–Stock market weakness is likely to persist as extreme bullishness is reaching a crescendo

Contrarians weren’t surprised the stock market fell this week. They think more weakness is in store.

That’s because short-term stock market timers recently became more bullish than at almost any other time since data began being collected in 2000. In the past, the stock market has reliably struggled in the wake of bullishness this extreme.

Bear this in mind as you read the myriad reasons that commentators are giving for why the stock market is falling. Among the most-cited are the spike in coronavirus cases in Europe and the absence of a new stimulus program out of Washington. Notice, however, that none of those factors is new; they therefore can’t explain why the stock market is struggling now.

To put the timers’ current exuberance in perspective, consider the Hulbert Stock Newsletter Sentiment Index (HSNSI), which reflects their average recommended equity exposure. Since 2000, 99% of the HSNSI’s daily readings have been lower than where it stands today.

As you can see from the accompanying chart, above, this puts the latest HSNSI reading well inside the zone that some contrarians consider to represent extreme bullishness.

Today’s sentiment is at the opposite extreme of what prevailed just one month ago. Then, as you might recall, I reported that the HSNSI had fallen into the “extreme pessimism” zone and that, as a result, contrarians were expecting the market to rally. At its high earlier this week, the Dow Jones Industrial Average DJIA, -0.06% was more than 1,500 points higher than where it stood when that month-ago column was published.

To illustrate this contrarian perspective on stock market timer sentiment, consider the performance of the Russell 2000 Index RUT, +1.06% in the wake of past periods of excessive bullishness or bearishness. The table below reflects data since 2000, which is when my firm started calculating the HSNSI on a daily basis.

I chose the Russell 2000 to illustrate the impact of market sentiment based on research conducted by Malcolm Baker of Harvard Business School and Jeffrey Wurgler of New York University. They found that “stocks of low-capitalization, younger, unprofitable, high-volatility, non-dividend paying growth companies … are likely to be disproportionately sensitive to broad waves of investor sentiment.”

That, of course, is a good description of the companies in the Russell 2000.

| SUBSEQUENT TO EXTREME BULLISH SENTIMENT (HSNSI READINGS IN TOP 10% OF HISTORICAL DISTRIBUTION) | SUBSEQUENT TO EXTREME BEARISH SENTIMENT (HSNSI READINGS IN BOTTOM 10% OF HISTORICAL DISTRIBUTION) | |

| Russell 2000 over subsequent one month | -0.8% | +1.4% |

| Russell 2000 over subsequent two months | -1.3% | +3.7% |

| Russell 2000 over subsequent three months | -2.8% | +5.1% |

The extent and duration of market weakness in coming days depends, according to contrarian analysis, on how quickly the market timers retreat to the bearish camp. If they stubbornly hold on to their current excessive bullishness, then a longer and deeper decline will be necessary to rebuild the so-called “wall of worry” that contrarians tell us that bull markets like to climb.

In contrast, if the market timers quickly jump on the bearish bandwagon, then the market’s impressive rally may resume in relatively short order. I note in this regard how quickly sentiment about Fastly turned negative over the past 24 hours, causing the stock FSLY, -27.18% to lose a quarter of its value.

Contrarians believe there is no reason to try guessing which is which, and argue instead that we can let the sentiment data tell the story. We will know soon enough.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

5. Stocks in the Final Months of Election Years.

Blackrock

https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/weekly-commentary

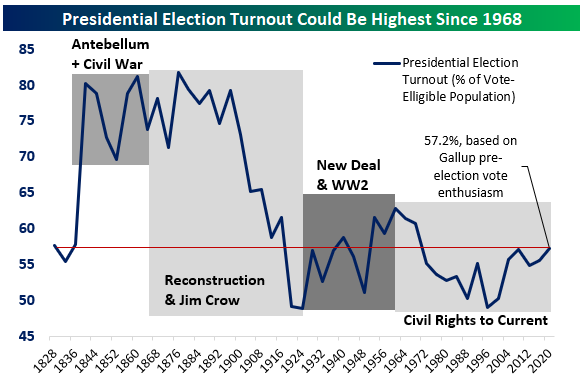

6. Early Voting Data Predicting Biggest Turnout Since 1968 for Presidential Election

Bespoke Investment Group

If the Gallup numbers are correct, and the early vote numbers are certainly consistent with them, then this would be the highest turnout year since 60.7% of Americans voted in the 1968 election of Richard Nixon (Republican), higher even than the 2008 election of Barack Obama (Democrat). Stay on top of major election trends and their impact on the financial markets with a Bespoke. Click here to view Bespoke’s premium membership options for our best research available.

2020 Elections: Strong Turnout Ahead

https://www.bespokepremium.com/interactive/posts/think-big-blog/2020-elections-strong-turnout-ahead

7. America Has the Fewest Cops in 25 Years

The number of sworn police officers rose steadily throughout the 1990s, in part due to expanded federal funding under the 1994 crime bill. That increase has been associated with significant reductions in crime and is considered to be a major driver of the “great crime decline” of the late ’90s and early 2000s.

But, after remaining elevated throughout the middle of that decade, police employment rates began to crater amid the Great Recession, as state and local austerity kicked in. They took another nosedive beginning in 2016, the year after the first round of police protests drove public confidence in cops to its lowest level to date.

These two events have contributed to deeper demographic and labor market shifts, with many departments seeing a wave of retirements, according to a 2018 report from the Police Executive Research Forum, a nonpartisan organization of police chiefs. At the same time, the relatively meager wages of policing and increasing legal and social threats to the job are pushing away young people who might otherwise take up the badge.

America Has Fewest Cops in a Quarter Century, Data Find

https://freebeacon.com/national-security/america-has-fewest-cops-in-a-quarter-century-data-find/

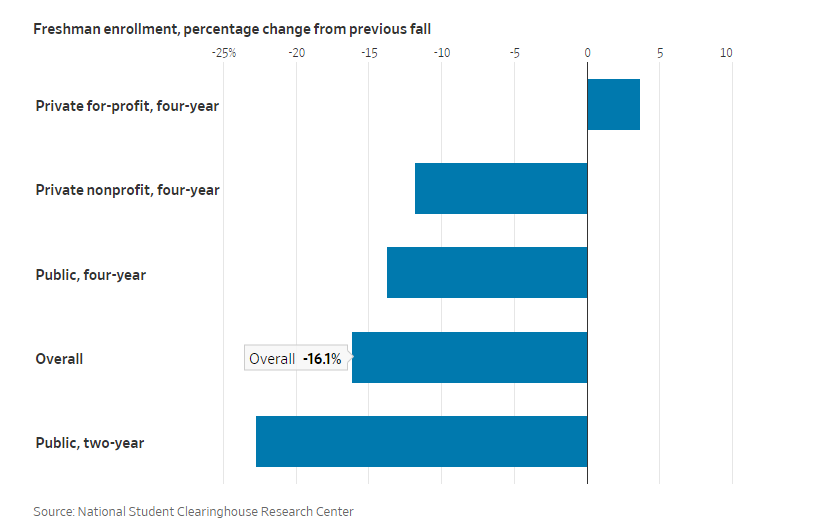

8. College Enrollment -16% Year Over Year.

College Enrollment Slid This Fall, With First-Year Populations Down 16%–Early tally shows sharp enrollment declines at community colleges and among men

9. 12 ways to keep your brain young

Published: June, 2006

Every brain changes with age, and mental function changes along with it. Mental decline is common, and it’s one of the most feared consequences of aging. But cognitive impairment is not inevitable. Here are 12 ways you can help maintain brain function.

1. Get mental stimulation

Through research with mice and humans, scientists have found that brainy activities stimulate new connections between nerve cells and may even help the brain generate new cells, developing neurological “plasticity” and building up a functional reserve that provides a hedge against future cell loss.

Any mentally stimulating activity should help to build up your brain. Read, take courses, try “mental gymnastics,” such as word puzzles or math problems Experiment with things that require manual dexterity as well as mental effort, such as drawing, painting, and other crafts.

2. Get physical exercise

Research shows that using your muscles also helps your mind. Animals who exercise regularly increase the number of tiny blood vessels that bring oxygen-rich blood to the region of the brain that is responsible for thought. Exercise also spurs the development of new nerve cells and increases the connections between brain cells (synapses). This results in brains that are more efficient, plastic, and adaptive, which translates into better performance in aging animals. Exercise also lowers blood pressure, improves cholesterol levels, helps blood sugar balance and reduces mental stress, all of which can help your brain as well as your heart.

3. Improve your diet

Good nutrition can help your mind as well as your body. For example, people that eat a Mediterranean style diet that emphasizes fruits, vegetables, fish, nuts, unsaturated oils (olive oil) and plant sources of proteins are less likely to develop cognitive impairment and dementia.

4. Improve your blood pressure

High blood pressure in midlife increases the risk of cognitive decline in old age. Use lifestyle modification to keep your pressure as low as possible. Stay lean, exercise regularly, limit your alcohol to two drinks a day, reduce stress, and eat right.

5. Improve your blood sugar

Diabetes is an important risk factor for dementia. You can help prevent diabetes by eating right, exercising regularly, and staying lean. But if your blood sugar stays high, you’ll need medication to achieve good control.

6. Improve your cholesterol

High levels of LDL (“bad”) cholesterol are associated with an increased the risk of dementia. Diet, exercise, weight control, and avoiding tobacco will go a long way toward improving your cholesterol levels. But if you need more help, ask your doctor about medication.

7. Consider low-dose aspirin

Some observational studies suggest that low-dose aspirin may reduce the risk of dementia, especially vascular dementia. Ask your doctor if you are a candidate.

8. Avoid tobacco

Avoid tobacco in all its forms.

9. Don’t abuse alcohol

Excessive drinking is a major risk factor for dementia. If you choose to drink, limit yourself to two drinks a day.

10. Care for your emotions

People who are anxious, depressed, sleep-deprived, or exhausted tend to score poorly on cognitive function tests. Poor scores don’t necessarily predict an increased risk of cognitive decline in old age, but good mental health and restful sleep are certainly important goals.

11. Protect your head

Moderate to severe head injuries, even without diagnosed concussions, increase the risk of cognitive impairment.

12. Build social networks

Strong social ties have been associated with a lower risk of dementia, as well as lower blood pressure and longer life expectancy.

Get the information you need to strengthen your intellectual prowess, promote your powers of recall, and protect the brain-based skills when you buy A Guide to Cognitive Fitness, a special health report by the experts at Harvard.

https://www.health.harvard.edu/mind-and-mood/12-ways-to-keep-your-brain-young

10. Warren Buffett: 3 Things in Life Separate the Doers and Achievers From the Daydreamers

Now at 90 years of age, the Oracle of Omaha shares some of his most important life lessons.

· BY MARCEL SCHWANTES, FOUNDER AND CHIEF HUMAN OFFICER, LEADERSHIP FROM THE CORE@MARCELSCHWANTES

Warren Buffett. Getty Images

Warren Buffett is arguably the best investor who ever lived. The Oracle of Omaha, as he is known, started investing in 1942 with just $114.75 and is now among the top 10 richest persons globally.

While Buffett is occasionally wrong about economics (his biggest mistake being the $358 million investment in US Airways), he is spot-on about his most famous life lessons, like the three examples below.

1. Love the work that you do

Plain and simple, when you do what you love, success will follow. Buffett has lived by this rule, stating that when you’re passionate about your work, “you’ll never work a day in your life.” He concludes, “There comes the time when you ought to start doing what you want. Take a job that you love. You will jump out of bed in the morning.” So, what is it that you really want to do?

2. Stop your “thumb-sucking”

Ever sat on a decision too long and did nothing when you should’ve acted on it? That, according to Buffett, is thumb-sucking. It’s stalling, procrastinating, and avoiding something that may have been your best bet to begin with to reach your goals. We’re all guilty of it, and Warren Buffett is no exception.

In his 1989 letter to Berkshire Hathaway shareholders, Buffett said, “I have passed on a couple of really big purchases that were served up to me on a platter and that I

was fully capable of understanding. For Berkshire’s shareholders, myself included, the cost of this thumb-sucking has been huge.”

The lesson? As with most important decisions in life, including investing, do your research thoroughly, get all the information, and then act swiftly on your decision. And if the answer is no, act with the same clarity of mind and walk away knowing you made the right choice.

3. Don’t judge yourself by other people’s standards

When setting the bar for your own goals, don’t fall for the trap of measuring it by other people’s measure of success. Instead of trying to keep up with the Joneses, measure yourself by one of Buffett’s most famous rules — your “inner scorecard”– which defines your own standards and not what the world imposes on you.

The inner scorecard, a principle he learned from his father, comes from deep within and speaks your truth. It gives meaning to who you are, and how you naturally behave and see the world on the basis of your values and beliefs, not someone else’s. In short, it’s taking the higher road to achieve success because it comes from the heart.

Join Mark Cuban, Daymond John, Michael Strahan, Rebecca Minkoff and more of the biggest names in business at the Inc. 5000 Vision Conference on October 19-23. Claim your free pass now.

OCT 13, 2020

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.FacebookTwitter