1. 30 Year Mortgage Rates Hit Another Record Low….Average 30 Year Rate 3%

· The average contract interest rate for 30-year fixed-rate mortgages decreased to 3% from 3.01%.

· Applications for a mortgage to purchase a home fell 2% for the week but were 24% higher annually, the Mortgage Banker’s Association said.

· Applications to refinance a home, which are most sensitive to weekly interest rate movements, fell 0.3% for the week.

https://www.cnbc.com/2020/10/14/mortgage-rates-set-yet-another-record-low-but-applications-fall.html

30 Year Mortgage Rate 1971-2020

https://fred.stlouisfed.org/series/MORTGAGE30US

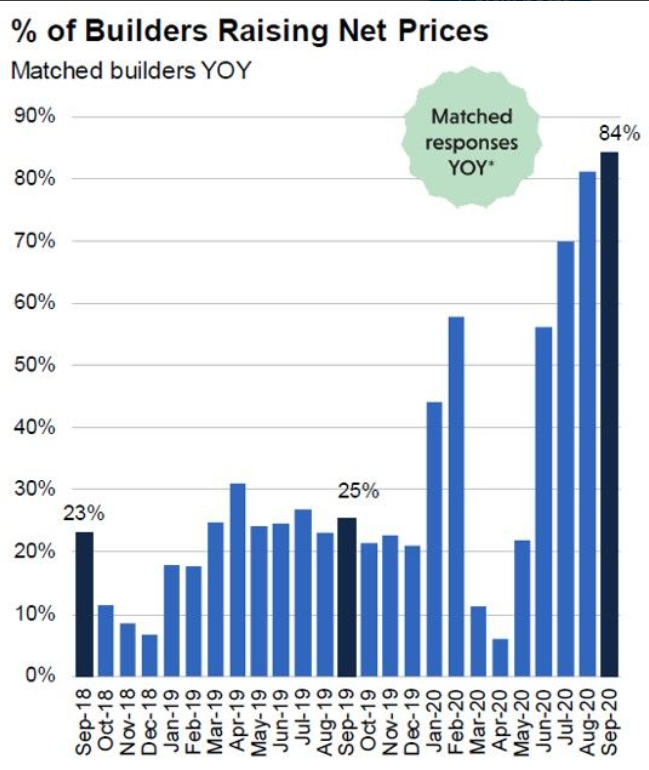

2. 84% of Home Builders Raised Prices in September.

https://www.linkedin.com/in/johnburns7/

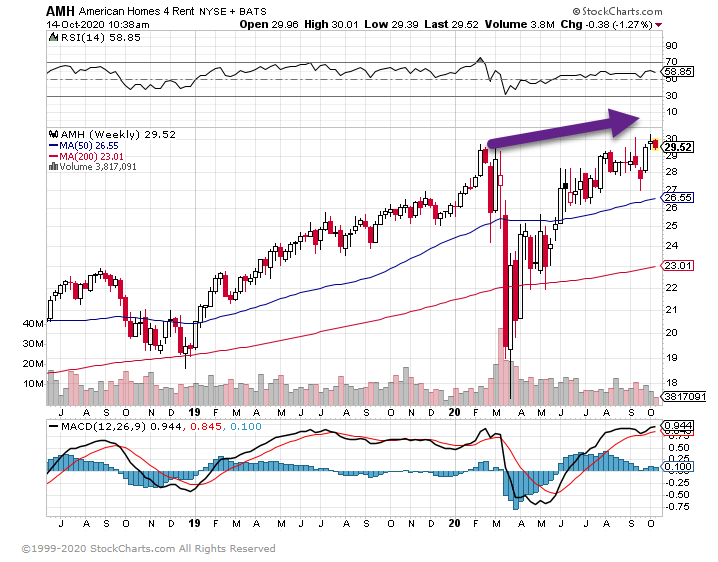

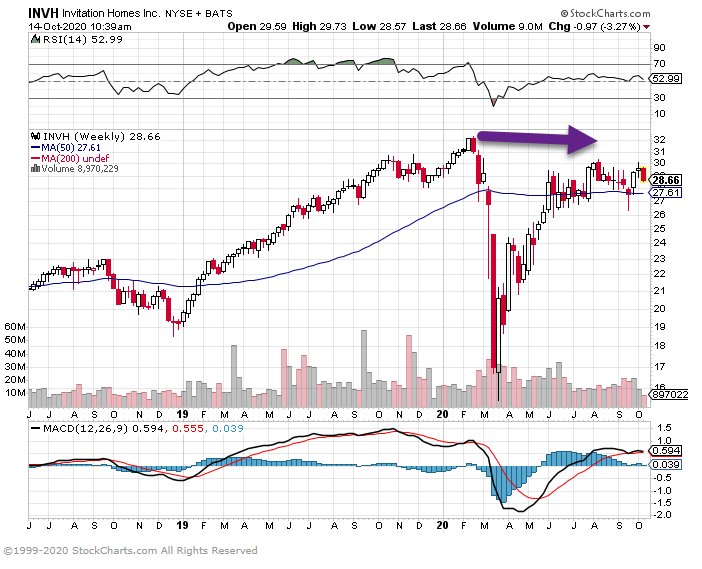

3. Wall Street Started Syndicating and Institutionalizing Suburban Homes Post 2008 Crisis.

AMH-American Homes for Rent Makes New Highs.

INVH-Invitation Home Still Below Highs

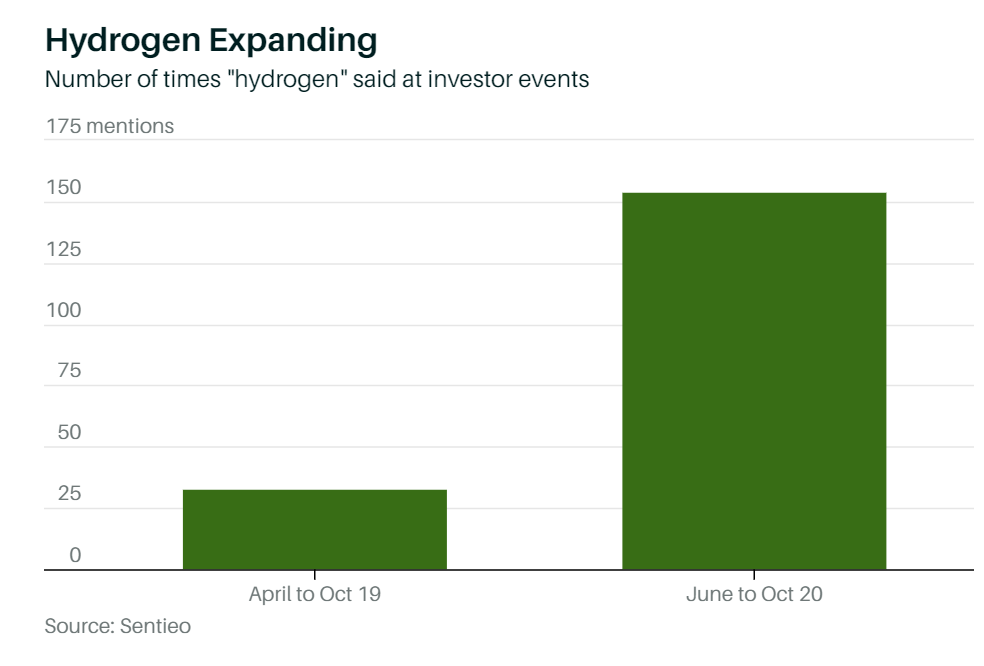

4. Hydrogen Stocks Take Off….PLUG +455% YTD….BLDP +169%

BARRONS

The idea that hydrogen can be a viable alternative fuel to oil and gas has enjoyed something of a renaissance in 2020.

Wall Street is taking notice. So are investors, who have bid up hydrogen stocks over the past few months. What remains to be seen, however, is whether company earnings can match the hype.

Even if the cost goals look aggressive, stock performance always draws a crowd. And other hydrogen-linked stocks have caught fire, including Plug Power (PLUG), which makes fuel-cell powered forklifts and has plans to branch out into heavy-duty trucks, and Ballard Power (BLDP), which makes fuel-cell components. Plug stock is up about 445% year to date. Ballard stock is up about 169% year to date.

Hydrogen Stocks Are Hyped. Earnings Will Have to Keep Up.–By Al Root

5. RGR Sturm Ruger -25% Off Highs…The Stock Went Up 1000% During Obama Administration.

Sturm, Ruger – 30 Year Stock Price History | RGR….

https://www.macrotrends.net/stocks/charts/RGR/sturm,-ruger/stock-price-history

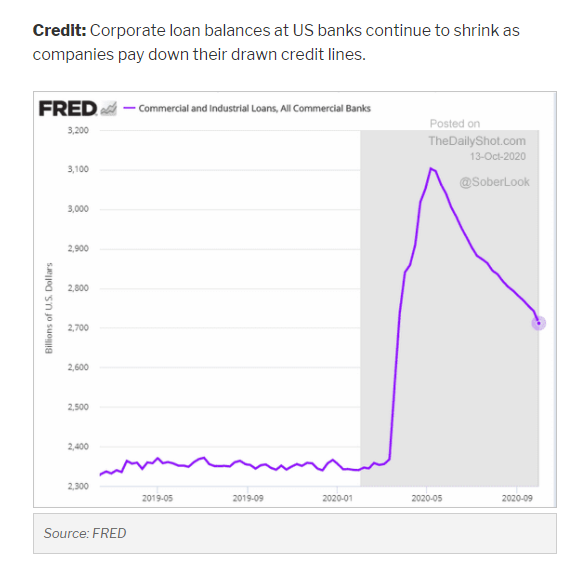

6. Corporate Loan Balances Being Paid Down.

From the Daily Shothttps://dailyshotbrief.com/the-daily-shot-brief-october-13th-2020/

7. Where Defaults Are Surging

Institutional Investor–Christine Idzelis

About 70 percent of corporate defaults in the U.S. this year are in four sectors, S&P says.

The U.S. is leading the world in defaults, with most of them occurring in four sectors that have been pummeled by the coronavirus pandemic, according to S&P Global.

About 70 percent of corporate defaults in the U.S. are in the consumer products, oil and gas, retail and restaurants, and media and entertainment sectors, S&P Global Ratings said in a report Friday. The credit rater tallied 122 U.S. defaults this year, the highest globally, followed by Europe with 30.

The pace of defaults in the pandemic is faster than during the global financial crisis of 2008 to 2009, S&P analyst Sudeep Kesh said Friday in a phone interview. S&P estimated the trailing 12-month default rate is now at 6.3 percent in the U.S., which compares with a historic average of around 4 percent, he said.

“The credit environment was very, very vulnerable to some kind of economic shock” before Covid-19 led to lockdowns globally, Kesh said. That’s because companies were aggressively increasing their debt levels for years as interest rates remained low for so long, he explained.

The consumer products sector is the hardest hit by the pandemic. This year 81 percent of defaults by consumer products companies globally are in the U.S., compared to about half at the end of 2019, according to the report. Covid-19 has had an uneven impact on such businesses, S&P said, with food and household products and personal care benefiting from stay-at-home orders during the pandemic while food service, durables, luxury, and apparel have been hurt by social distancing policies.

The U.S. has the largest population of rated companies globally, Kesh said. S&P expects the country’s speculative-grade corporate default rate to rise to 12.5 percent by June 2021, according to a report from the credit ratings firm in late August.

Recent U.S. defaults include specialty apparel retailer Jill Acquisition and TMK Hawk Parent Corp., a provider of food service equipment and supplies, S&P said in its report Friday.

Kesh said defaults during the Covid-19 recession were driven by missed interest and principal payments as companies’ revenues dried up. Distressed debt exchanges have been a less significant driver of defaults as the Federal Reserve’s emergency intervention in credit markets earlier this year led to an increase in debt prices, according to Kesh.

While the total number of defaults is “very, very high,” Kesh said that the rate of defaults has been suppressed by the larger pool of speculative-grade borrowers since the financial crisis.

https://www.institutionalinvestor.com/article/b1nqzhy696j9zc/Where-Defaults-Are-Surging

Found at Abnormal Returns www.abnormalreturns.com

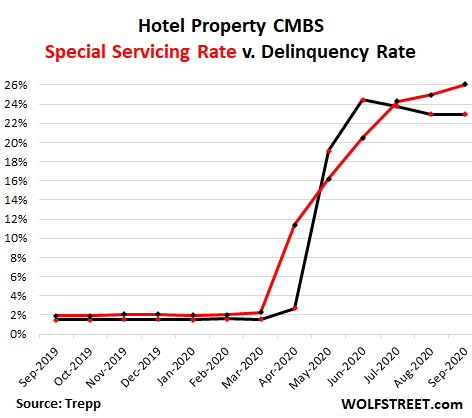

8. Special Servicing Rate for Hotel CMBS Spikes to 26%

Two San Francisco Hiltons Add to Woes of Commercial Mortgage-Backed Securities. Special Servicing Rate of Hotel CMBS Spiked to 26%

by Wolf Richter • Oct 12, 2020 • 83 Comments

By Wolf Richter for WOLF STREET.

If the borrower and the servicer cannot work out a deal, the loan is sent to a third party, the Special Servicer, and thereby added to the Special Servicing List. If the mortgage becomes delinquent, it is then added to the Delinquency list.

This Special Servicing rate for hotel properties spiked to a record of 26.0% at the end of September, according to Trepp, in its October report on CMBS.

But the delinquency rate of hotel properties ticked down, to a still astronomical 22.9%, as some delinquencies were “cured” because the delinquent loans were granted forbearance, and were therefore no longer considered delinquent, though no payments needed to be made. But the loans that have been granted forbearance continue to stay on the Special Servicing list, and the Special Servicing rate shows a more accurate picture of the state of the hotel property loans:

9. Big Tech Is Just the Beginning: House Dems Seek Major Changes to Antitrust Law

Enforcement is supposed to be about protecting “consumer welfare.” Overturning that goal would be bad for all of us.

ANDREA O’SULLIVAN | 10.13.2020 8:30 AM

(Boon Leng Teo / Dreamstime.com)

Last week, Democrats on the House Subcommittee on Antitrust released their much-ballyhooed report on competition in tech to great fanfare. It’s a beast of a crie de couer, clocking in at 449 meandering pages of disputations on the power (but not so much the efficacy) of big tech companies. To absolutely no one’s surprise, antitrust hawks love it while antitrust doves (and the targeted companies) are picking it apart.

There was a minor subplot involving Republican subcommittee members splitting into two slightly differing dissenting reports, with ranking member Rep. Jim Jordan focusing on censorship against the outer party and Rep. Ken Buck offering a “third way” of marginal reforms (data portability, more merger scrutiny, more funding for regulators) that fall far short of the Democrats’ proposed radical antitrust overhaul. But for the most part, the reports didn’t break new ground (or really, much new news) beyond underscoring battle lines with a thick permanent marker.

Here’s what the Democrats want: to remove “the narrow construction of ‘consumer welfare’ [e.g. effects on prices and quality] as the sole goal of antitrust laws” with legislation that would be designed to protect “workers, entrepreneurs, independent businesses, open markets, a fair economy, and democratic ideals” through a grab bag of new prohibitions on specific practices like mergers.

That might sound nice to many. The problem is that protecting workers can mean not protecting entrepreneurs (or vice versa) depending on the case and the judge. And what is a “fair economy”? What are “our democratic ideals”? “Open markets”—a term favored by both George Soros and Charles Koch (do they agree)? Would any two Supreme Court justices—let alone our army of lower court judges—come up with the same definitions?

A great strength of the consumer welfare standard is that it’s, well, a standard. Some of us are workers, some of us are entrepreneurs, some of us own businesses, but we are all consumers. Setting the most inclusive group as the focus of attention removes the potential for inconsistently biasing exclusive groups.

You can measure economic changes. How do you measure democratic ideals? This is why critics say the Democrat plan would “politicize antitrust”—the proposed system introduces judicial subjectivity that could empower enforcers to effectuate social agendas through antitrust. Indeed, some antitrust hawks proudly admit this is the point.

Where the Democrats have been in lockstep, the Republicans have been a bit schizophrenic. It’s easy to see why. On the one hand, Silicon Valley has no love for the GOP. Executives from the firms now under antitrust scrutiny had a bit of an open-door policy with the Obama administration (and vice versa). Needless to say, those chummy visits have stopped under the Trump administration.

On the other hand, the consumer welfare standard that is in the Democrats’ crosshairs is arguably the greatest legal victory of movement conservatism. Republicans don’t say it very forcefully, but departing from the consumer welfare standard would empower the courts with a broad grant of arbitrary power over the economy—much of which could be used to promote Democrat party priorities like climate change regulation, quotas, and income redistribution. It makes sense that Republicans would oppose this, even if they don’t well articulate exactly why.

It’s not as straightforward to see why the Democrats of all people are going after big tech in particular. Silicon Valley is a major Democrat support center. Their employees vote Democrat, they support other planks of the Democrat agenda, and many are personal friends of Democrat leaders. Why not go after another big business bogey—the healthcare industry (only slightly more Democrat leaning) or energy companies (mostly in the hole for Republicans)? What political sense does it make to “split up” or weaken the companies that reliably support your party?

Actually, the antitrust investigations against big technology companies are already snaking their way through the system. The Department of Justice could announce its big suit against Google any day now. Other cases against Amazon, Apple, and Facebook are in early stages among DOJ and the Federal Trade Commission (FTC). State attorneys general have their own legal efforts as well.

It is unlikely that the Supreme Court would overturn even one of the dozen or so precedents the Democrats singled out for axing before all of these cases have concluded, let alone that Congress could get its act together to pass major partisan legislation rendering those decisions moot in this climate. Will the election give Democrats more of an edge in the Senate (and perhaps the Supreme Court)? Maybe. But overturning the consumer welfare standard will have to be a longer-term play.

Looking at the bigger picture, this antitrust push is probably not only about “big tech.” These tech companies just happen to provide a good excuse to make changes to antitrust that the left has wanted for a long time.

Some of the companies under scrutiny don’t actually charge prices to users. They do charge prices to advertisers, and there is a good deal of competition there, but this kind of two-sided market does require new considerations about how to consistently apply the consumer welfare standard. If you don’t like the antitrust jurisprudence in general, this is a great pretext to say “it doesn’t work, away with it all!” and push through a more precautionary antitrust regime.

It’s unfortunate that tech companies are the camel’s nose being used to promote an unraveling of U.S. antitrust law. It may ultimately end up disappointing even those who think big tech should be reined in but otherwise desire a strong U.S. economy. For instance, these particular tech companies could end up far short of being “broken up” (and still quite left-leaning) while everyone else still becomes subject to the expanded prohibitions and punishments of the Democrats’ proposed antitrust regime.

Take a look at the FTC’s list of competition enforcement actions. You probably don’t recognize many of the companies involved. Big companies’ cases get a lot of media airtime, but competition law applies to everyone—under an expanded antitrust regime, a lot more company names will be on that list. Empowering government agents to preemptively determine what a “fair economy” (or whatever) looks like and punish random companies who violate those subjective norms does not bode well for economic vitality.

This is the whole reason that the consumer welfare standard emerged in the first place: before it, you had judges going after Utahn frozen pie makers for selling cheaper lemon meringue than the former market leader. Consider our hyperpolitically charged atmosphere. Returning to the unfocused antitrust environment that produced such bizarre old pie-jinks would today come with the bonus of contemporary hot-button social issues. Does this sound like a great environment in which to live and do business?

The House Democrats pose as FDR-style populists, holding power to account on behalf of the forgotten man. They often quote Justice Louis Brandeis: “We may have democracy, or we may have wealth concentrated in the hands of a few, but we cannot have both.” Because we all know that the Democrats are famously hostile to moneyed interests. This is why you see decidedly non-moneyed interests like the senior chairman of Goldman Sachs enthusiastically endorsing the House report on CNBC. Republican populists would do well to point these things out.

10. Why Your Brain Dwells on Unfinished Tasks

October 12, 2020

A few months ago, a friend recommended I watch Crash Landing on You (CLOY) — a South Korean drama that has been praised around the world. I’m not a huge fan of soaps. They drag too long, force you to invest a ton of time (and emotion), and I, for one, can’t wait to find out what the end is going to be. I much prefer curling up with your traditional two-hour movie or an evening of truth with an observational documentary.

But now that I have more time on the weekends — no parks to visit, no grocery stores to frequent, no friends to meet because of lockdown restrictions — I took the plunge. I watched the first two episodes of CLOY on Saturday, and another two on Sunday. Then I was sucked into a black hole. I found myself constantly thinking about the soap: What’s going to happen next? How will the story unfold? Will she or won’t she confess her love for him? Will they ever be able to meet again?

*biting nails and sobbing*

“Can I get to end of this already?”

I finished the 16-episode show (each episode ran for a little over an hour) in four days and began to question my entire being. Why am I this way? Why can’t I just sit with the unknown?

The more I thought about it, the more behavioral patterns I began to see — especially when it comes to my work. If I have an unread email, I find myself constantly wondering what it says. If I have an article that still needs editing, I can’t relax until I have a plan of execution. At the same time, if you ask me about that same article once it’s published a week later, I won’t remember much about it — at least not compared to how well I can recall the ins and outs of something on my still-to-do list.

Curiosity is good they say. So I started looking for possible reasons to justify my behavior (to myself, of course).

It turns out there is a name for this phenomena and it’s called the Zeigarnik effect. It was first observed by a Russian psychologist named Bluma Zeigarnik. Once, while sitting at a busy restaurant, she noted that the waiters had better memories of unpaid orders (or unfinished tasks), but once the bill had been settled, the waiters had difficulty remembering the exact details of the order. Zeigarnik suggested that failing to complete a task creates underlying cognitive tension, which is what makes you keep coming back to it.

“That’s interesting,” I thought, but I needed some more explanation. I reached out to Dr. Roma Kumar, a psychologist with more than 30 years of experience and the founding partner of Emotionally.in, to understand what actually happens inside our brains when we have unfinished tasks.

“Once our brain receives information, it stores it in the sensory memory for a very brief time,” she explained. “Sensory memory is where information received through our five senses — sight, hearing, smell, taste, and touch — is stored temporarily before it moves to the short-term memory. It moves to our short-term memories only if we pay attention to the information. Many of these short-term memories are forgotten fairly quickly, but when a task isn’t complete, our brains constantly rehearse it to keep the information active. That is what creates the underlying cognitive tension. Once we complete the task, the information is easily forgotten.”

Basically, when we have an unfinished task, we can’t help but torture ourselves by recalling it, over and over again, to keep it in our short-term memories. Our brains can’t let it go until it’s done. This is why TV dramas use cliffhangers to end episodes and also why I still think about what could’ve possibly happened to Malaysia Airlines Flight 370 that disappeared en route to Beijing in March 2014.

I listened keenly, and as I digested, I wondered: If I can’t overcome this task-specific cognitive tension, how can I put it to good use, especially when it comes my to-do list, which is, in fact, much too long. Dr. Kumar helped me narrow it down to four ways we can use the Zeigarnik effect for good (instead of evil):

1) Reduce your tendency to procrastinate: If there is a task you’ve been avoiding for a long time, just begin with the smallest thing to be done — even if that means opening a Word document and typing out the title of your report. Once you do that, the task will remain unfinished until you complete it. Since your mind needs to close the loop on that task, the constant reminder will help you take small steps to get it done and bring you closer to the final outcome.

2) Get people to pay more attention to what you’re saying: Do you really want the recipient of your email to open and read the message? Try using ellipses instead of a full stop in your headline. The ellipses will leave the reader feeling like “there’s more to this,” and they’ll be sure to open your email.

3) Memorize more information: Whether you are studying for a big exam or trying to memorize a speech or presentation, break your preparation down into parts. Or even better, spread your learning over several days. If you cram all the information into your head the night before your big day, you will reduce the likelihood of retaining all of it because it is not an incomplete task anymore, and hence, it is easily forgotten. While memorizing large chunks of information, brief interruptions can actually work to your advantage — it will signal to your brain that something’s not complete. Before a big exam, try and take deliberate breaks when you’re revising your course content. It could be as simple as reading two paragraphs, getting up to go grab a coffee or taking a lunch break, and coming back to the rest.

4) Remember tough names: Since the pandemic, all networking and events are taking place online, which means you could be meeting with and getting introduced to people from different parts of the world. You might find some names hard to remember (they’re long, the pronunciation is tough, or you’re not familiar with the accent). A good way to remember difficult names is to learn them in parts (that is, introduce interruptions). Learn one part of the name, memorize it, and then come back to the second part when you’re done memorizing the first. You’ll find it much easier to remember them this way.

So while those unfinished tasks will continue to haunt me, I now know that I can put that energy to good use and actually get things done that I would otherwise struggle with.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.