1. 2021 Big Sector Dispersion Already…

2. Russell 2000 50 day 200% Above 200 day for the First Time in History.

From Dave Lutz at Jones Trading–Bloggers note in the Russell, the 50ma is more than 25% above the 200ma – the 1st time in history that the 50ma has been this extended vs the 200ma.

3. Blue Collar Jobs Boom—Wait Until the $5 Trillion in Money Markets Starts Getting Spent.

WSJ–Strength in housing and e-commerce during the pandemic has helped propel hiring in blue-collar occupations, which were hard hit by previous recessions. Many economists and companies expect blue-collar jobs to continue growing, though at a slower pace, after the coronavirus is contained. They predict the key factors driving employer demand for blue-collar workers—a swift pickup in online orders and a buoyant housing market—will largely stay even after vaccines are widely distributed and consumers shift some of their spending from goods to services.

“The demand for the workers is not going to go down,” said David Berson, chief economist at Nationwide Mutual Insurance Co. “We’re still going to need good warehousing. We will continue to see great strength in the demand in the construction area, particularly housing.”

Blue-

CoBlue-Collar Jobs Boom as Covid-19 Boosts Housing, E-Commerce Demand – WSJ

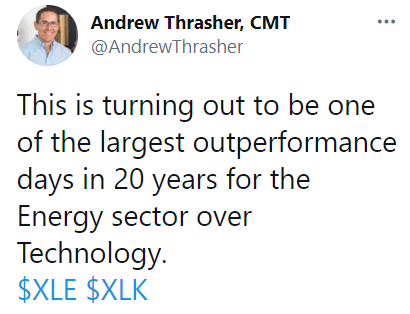

4. Monday-One of the Largest Outperformance Days in 20 Years Tech vs. Energy

https://twitter.com/AndrewThrasher/status/1363950063664451587/photo/1

5. ARK Innovation ETF -5.8% Yesterday

Cathie Wood’s Ark ETF Tumbles as Rates Spike Rips High-Flyers By Katherine Greifeld and Vildana Hajric

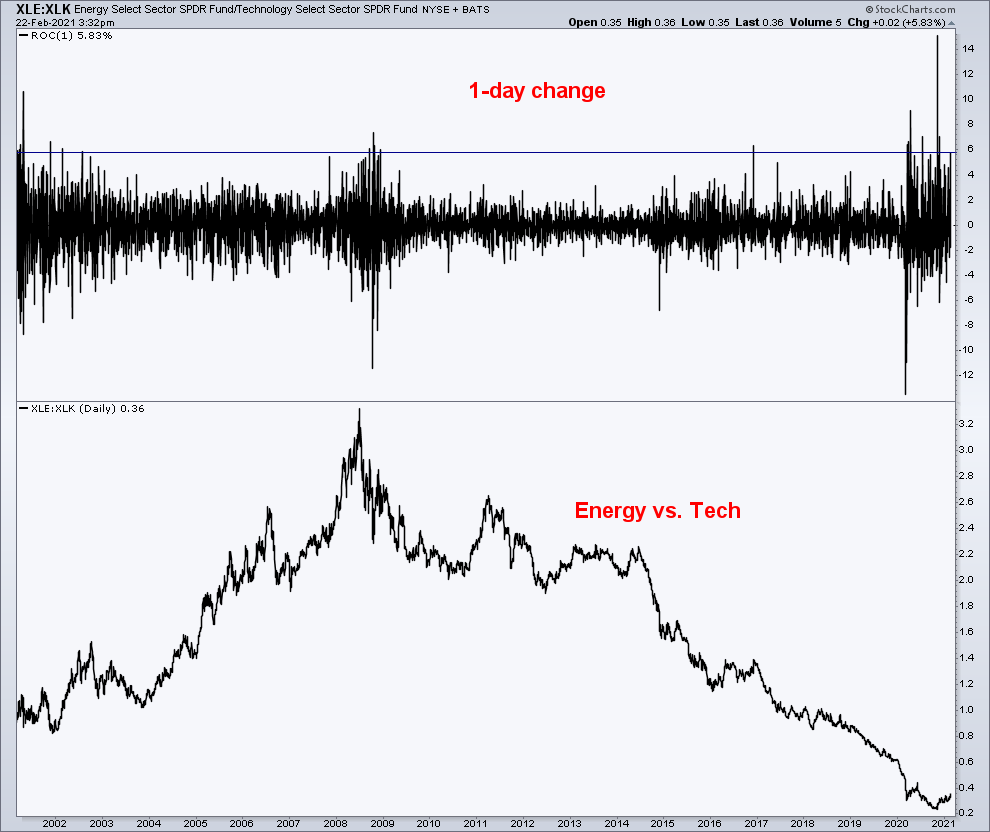

6. 20 Year Treasury Short Interest Highest Level Since 2018

Katie Greifeld–Bond ETFs of Every Flavor Hammered by Building Inflation Bets

https://finance.yahoo.com/news/bond-etfs-every-flavor-hammered-172640757.html

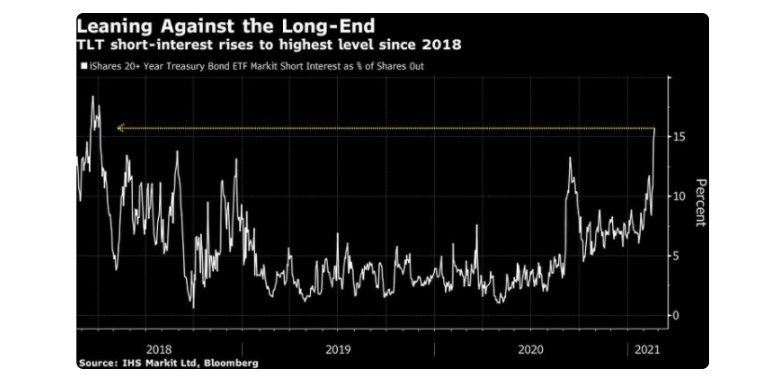

7. More on the Underperformance of Minimum Volatility ETFs…10 Year Relative Performance Lows

Irrelevant Investor

They Want Max Vol-Posted February 21, 2021 by Michael Batnick https://theirrelevantinvestor.com/2021/02/21/they-want-max-vol/

8. Energy Consumption Per Capita…Canada Energy Hog.

BP’s Statistical Review of World Energy offers many interesting and sometimes surprising insights about global energy. Start with our neighbors to the north. In a poll last year, two thirds of Canadians believed climate change is as serious an issue as Covid. Canada has a carbon tax, and lowering emissions has long been official government policy. However, adjusted for population Canada is an energy hog, consuming 380 Gigajoules (GJ) per person, compared with the U.S. at 288 GJ. Canada has the highest use of any OECD (i.e. rich) country, and two times the OCED average.

Some Surprising Facts About Energy | Catalyst Insights (catalyst-insights.com)

9. More Than 90 Percent of NYC Restaurants Could Not Pay Full Rent in December, Survey Says

A new survey shows the city’s restaurants can’t pay rent while subsisting on takeout, delivery, and outdoor dining — especially during the winter

by Luke Fortney@lucasfortney Feb 16, 2021, 11:39am EST

Photo by Alexi Rosenfeld/Getty Images

As New York City approaches the one-year anniversary of its first reported case of coronavirus, the citywide rent crisis continues to deepen. A new survey of more than 400 businesses from the New York City Hospitality Alliance shows that a staggering 92 percent of restaurants could not pay full rent in December.

The portion of businesses unable to pay their rent has steadily increased since last June, when the citywide organization first started collecting survey data, and an estimated 80 percent of restaurants could not pay rent. Those numbers have only worsened as temperatures dipped, funds from the Paycheck Protection Program dried up, and uncertainty around the status of indoor dining in NYC continues to loom.

The latest survey data accounts for rent payments during the month of December, when restaurants and bars were restricted to takeout, delivery, and outdoor dining service following a citywide ban on indoor dining. At that time, many businesses decided it would be cheaper to temporarily close for the winter season and pay for multiple months of rent than to remain open for service.

According to the December survey, 60 percent of landlords had not waived any rent payments during the coronavirus pandemic. Among the 40 percent that did, less than a fifth waived more than half of a business’ rent. An alarming — though perhaps unsurprising — 86 percent of respondents say they have not been able to renegotiate the terms of their leases during the pandemic.

Indoor dining is now allowed at 25 percent capacity across the five boroughs, a move that the NYC Hospitality Alliance applauded — and then criticized, calling on elected officials to expand indoor dining to 50 percent capacity, as is the case elsewhere in the state. “While the reopening of highly regulated indoor dining is welcome news, we need to safely increase occupancy to 50 percent as soon as possible, and we urgently need robust and comprehensive financial relief from the federal government,” saysAndrew Rigie, executive director of the NYC Hospitality Alliance.

Some restaurant and bar owners have declined to partake in indoor dining, citing safety concerns for restaurant workers and staff, while others say that 25 percent is not enough to stay afloat. The return of indoor dining, an extended 11 p.m. curfew, warmer weather on the horizon, and a possible infusion of federal aid may all be cause for optimism in the months ahead, but experts say a full economic recovery in NYC will likely take years.

https://ny.eater.com/2021/2/16/22285434/nyc-rent-crisis-december-2020

10. Your Environment Shapes Your Decisions

When it comes to making decisions, your environment matters. Just as it’s hard to eat healthily if your kitchen is full of junk food, it’s hard to make good decisions when you’re too busy to think. Just as the kitchen influences what you eat, your office influences how you make decisions.

The Modern Office is Terrible for Thinking

No one understands how your environment shapes your ability to make decisions more than Warren Buffett and Charlie Munger. While they’re gifted with intellect, they make sure they get the most out of it by structuring their environment to help them make good decisions.

Most of us make decisions in an environment where it is very hard for us to behave rationally.

You can’t design a worse environment for good decisions than the modern office. When you first arrive at work, you immediately start to answer the critical emails from your swelling inbox. The inner voice in your head tells you don’t worry; you’ll get to the rest later. Suddenly, the phone rings, it’s your boss wanting to know if you have time to chat on the 15-page proposal she was supposed to read for the meeting in 30 minutes. But you haven’t read the proposal either. So you glance at the executive summary and, like anyone that has learned to survive in an office, you confidently act like you know what’s going on. You haven’t done the work to have an opinion. But that’s the game. Everyone else did the same thing. When you finally lift your head up, your email box is swelling again, you have missed calls, and it’s almost time to pick up the kids from school. Where did the day go?

This isn’t an abnormal day. This is every day. From the moment you arrive until the moment you leave, you make an inch of progress on twenty things rather than ten feet of progress on one thing.

The unwritten rule is that you have to do these things to justify your job. If you’re not pushing paper, firing up hundreds of emails, calling and attending meetings, and chasing something down … just what the heck are you doing?

The cultural environment is typically about politics and signalling, not about putting people in a position to succeed. The physical environment is about busyness and distraction, not focus and thinking. Neither of these environments line up with the good decision making.

Contrast this to Warren Buffett. He has no computer in his office. He’s not distracted every few minutes by that annoying little ding that signals a new email has arrived. His day isn’t full of meetings. He doesn’t have an annoying boss that comes around and asks him for something tangible that’s he’s working on. He just reads and thinks. No wonder he’s so good at it.

If you want to think for yourself, you can’t have someone always whispering in your ear. If you want space to think, you need quiet and calm not a bunch of smart people throwing out new ideas. That’s why Buffett moved from New York to Omaha. “In some places, it’s easy to lose perspective. But I think it’s very easy to keep perspective in a place like Omaha,” Buffett says. He continues:

It’s very easy to think clearly here. You’re undisturbed by irrelevant factors and the noise generally of business investments. If you can’t think clearly in Omaha, you’re not going to think clearly anyplace.

Putting Buffett in a modern office is like giving Superman kryptonite. His superpowers would disappear. He wouldn’t be able to think and concentrate. Luckily, he intentionally set up his environment in a way that makes it easier to behave rationally.

The (Super) Power of Environment

We influence our environments, but we forget they influence us too.

We like to believe that we are in charge that our brains are only influenced by our conscious thoughts. That sounds amazing, but it’s wrong. Our conscious brain is much smaller than our subconscious brain. And yet when it comes to getting better at thinking and making decisions, we place all the emphasis on the conscious brain, learning mental models and methods of thinking that improve outcomes. In so doing, we improve the raw horsepower of our brain. Yet, there is no point having a 400 horsepower engine if you can only get 25 horsepower out of it.

Designing an Effective Environment

There is no environment that works for everyone. We all respond differently to different stimuli. A corner office on the 100th floor in New York might provide inspiration to some and distraction to others. What works for me might not work for you.

Here are three things we’ve found work for a lot of different people in a lot of different situations.

First, structure your day to maximize your energy. Most people do the tasks requiring the least amount of thought (answering emails, checking voicemails, catching up with people) in the morning when they are most productive. Meetings and decisions get pushed to the afternoon when our brains are not working as well. Switch your day around. Do the most important thing first.

Second, use chunks of time and be conscious when interrupting other people. Block chunks of time in your calendar for your own projects. I don’t mean like 20 minutes, I mean like hours. I have every morning blocked off from 9-12. It’s not easy to get into a state of flow, but once you’re there, you’re focused on one thing. It could be thinking about a problem in a three dimensional way or refining a report that you’re writing for work. If you interrupt this time, it’s expensive to get back to where you were, often taking 25 minutes or more to recover. Keep that in mind when you interrupt others.

Third, make effective behaviors easy. If there is chocolate in our office, you can be sure I’ll eat it. That’s why I lock the good stuff in a safe. Literally. This makes it harder to get to, and I eat less of it. OK, you probably want a better example than chocolate. Here’s one I used to use at work. On the first page of my notebook at the intelligence agency, I listed some general thinking tools that I could fall back on for tough decisions. This prompted me to think through problems in a structured way and saved me from more than one mess. (Update: These are now a book).

Your Environment Matters More Than You Think

We intuitively know that the physical and cultural environment matters.

You don’t control everything in your environment, but you control enough to make a huge difference. Think about what you control and how you can change it to get more horsepower out of your brain.

Your Environment Shapes Your Decisions (fs.blog)

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.