1. Inflation–5 Year TIPS/Treasury Breakeven Rate About to Break-Out to 10 Year Highs

Lead Lag Report

2. Inflation Signs Increasing but Gold Charts Going Bearish.

GLD Gold ETF…50day blue crosses below 200 day red line…bearish

©1999-2021 StockCharts.com All Rights Reserved

Bigger Pattern…Gold Approaching Blue Uptrend Line Going Back to 201

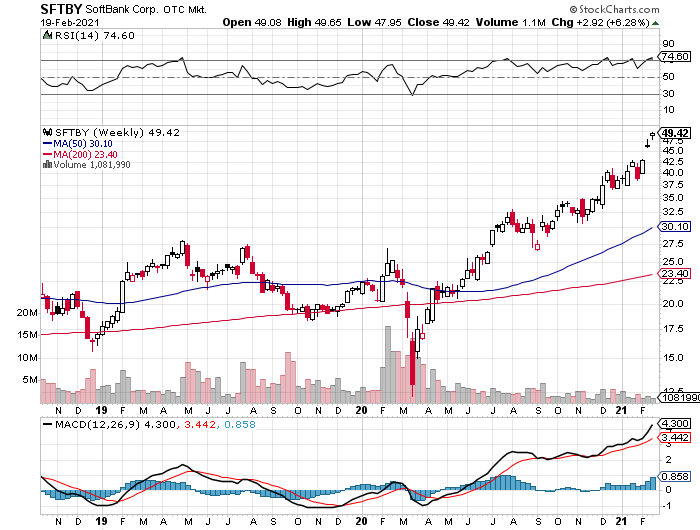

3. SoftBank +400% From Lows

Softbank Chart …Hit Low $13.5…$49.50 last

©1999-2021 StockCharts.com All Rights Reserved

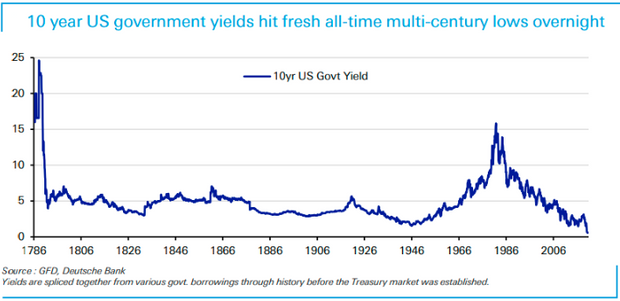

4. Did We See The Generational Low in Interest Rates? 2020 Hit 235 Year Low

According to Deutsche Bank, this record low stretches farther back than most might expect. They calculated the current nadir in the 10-year yield went back 234 years, based on data spliced together from the various times the U.S. government has borrowed money in the past.

“The U.S. has been through depressions, deflations, wars, restrictive gold standard regimes, market crashes and many other major events and never before have we seen yields so low back to when the Founding Fathers formed the country,” said Jim Reid, Deutsche Bank’s chief credit strategist, in a Friday note.

10-year Treasury yield plunged to its lowest in 234 years, says Deutsche Bank

By Sunny Oh

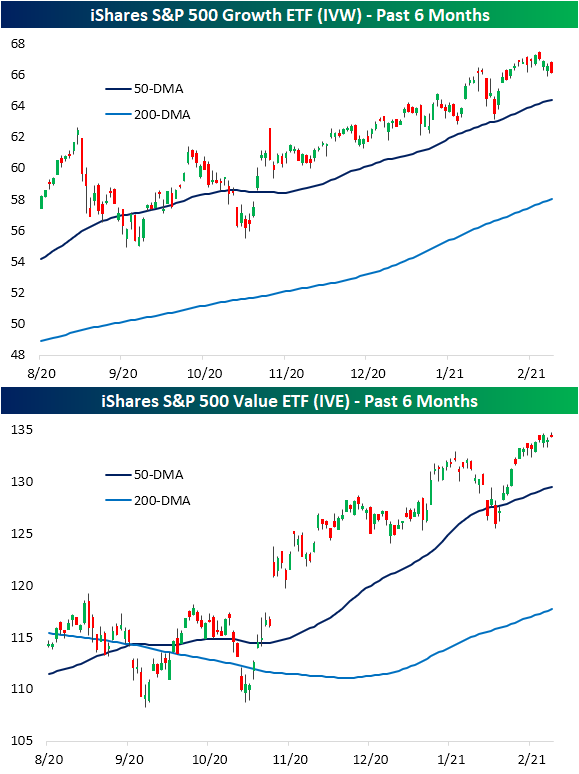

5. Value Outperforming Growth But Only for Large Caps

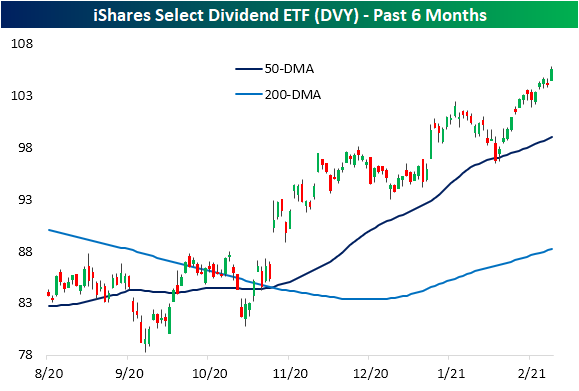

While the S&P 500 traded lower today, value stocks had a strong finish to the week. Starting with a look at dividend stocks, the iShares Select Dividend ETF (DVY) rose 1.35% today for its best day since January 6th when DVY rose nearly 4%. As shown below, DVY has recently been on a tear

Along with the dividend ETF (DVY), the iShares S&P 500 Value ETF (IVE) rose 0.31%, reaching a new 52-week high intraday. That compares to the growth counterpart, the iShares S&P 500 Growth ETF (IVW), which saw a bearish engulfing on its 0.65% decline. Today was the widest outperformance for value (IVE) over growth (IVW) since mid-January. As shown below, while both are still trending nicely higher long-term, the value ETF is at new highs while growth is closer to its 50-day moving average.

6. Amazon Top Sellers-Almost Half are China Based.

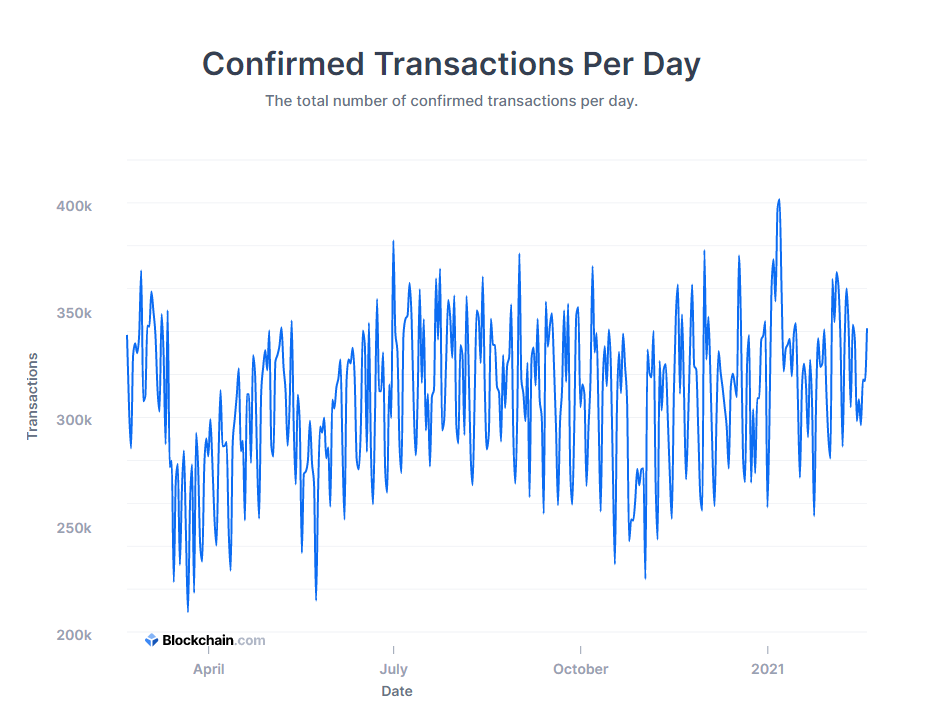

7. Bitcoin Transactions Per Day and Transaction Fees.

https://www.blockchain.com/charts/n-transactions

https://www.coindesk.com/bitcoin-payments-vs-value

8. China is 65% of Bitcoin Mining….Cheap Electricity.

China’s cheap electricity keeps Chinese miners at peak efficiency and allows them to outlast their foreign competitors.

Bitcoin Mining in China, Jordan Tuwiner

https://www.buybitcoinworldwide.com/mining/china/

9. Bitcoin hits $1 trillion market cap, surges to fresh all-time peak

By Gertrude Chavez-Dreyfuss, Tom Wilson

NEW YORK/LONDON (Reuters) – Bitcoin hit a market capitalization of $1 trillion as it rose to yet another record high on Friday, countering analyst warnings that it is an “economic side show” and a poor hedge against a fall in stock prices.

The world’s most popular cryptocurrency jumped to an all-time high of $56,399.99, posting a weekly gain of 14%. It has surged nearly 70% so far this month and was last up 8% at $55,664.

Bitcoin’s gains have been fueled by signs it is gaining acceptance among mainstream investors and companies, from Tesla Inc and Mastercard Inc to BNY Mellon.

All digital coins combined have a market cap of around $1.7 trillion.

“If you really believe there’s a store of value in bitcoin, then there’s still a lot of upside,” said John Wu, president of AVA Labs, an open-source platform for creating financial applications using blockchain technology.

“If you look at gold, it has a market cap of $9 or $10 trillion. Even if bitcoin gets to half of gold’s market cap, that’s still growth of 4X, or $200,000. So I don’t know when it stops rising,” he added.

The next milestone will be overtaking Alphabet Inc, currently valued at $1.431 trillion, said Jacob Skaaning, portfolio manager at crypto hedge fund ARK36.

“There will likely be some big fluctuations along the way, but I’m still very bullish and I believe the uptrend will continue for the time being,” he added.

Still, many analysts and investors remain skeptical of the patchily regulated, highly volatile digital asset, which is little used for commerce.

FILE PHOTO: A representation of virtual currency Bitcoin is seen in front of a stock graph in this illustration taken January 8, 2021. REUTERS/Dado Ruvic/File Photo

Analysts at JP Morgan said bitcoin’s current prices were well above estimates of fair value. Mainstream adoption increases bitcoin’s correlation with cyclical assets, which rise and fall with economic changes, in turn reducing benefits of diversifying into crypto, the investment bank said in a memo.

“Crypto assets continue to rank as the poorest hedge for major drawdowns in equities, with questionable diversification benefits at prices so far above production costs, while correlations with cyclical assets are rising as crypto ownership is mainstreamed,” JP Morgan said.

Bitcoin is an “economic side show,” it added, calling innovation in financial technology and the growth of digital platforms into credit and payments “the real financial transformational story of the COVID-19 era.”

Other investors this week said bitcoin’s volatility presents a hurdle for it to become a widespread means of payment.

On Thursday, Tesla boss Elon Musk – whose tweets have fueled bitcoin’s rally – said owning the digital coin was only a little better than holding cash. He also defended Tesla’s recent purchase of $1.5 billion of bitcoin, which ignited mainstream interest in the digital currency.

Bitcoin proponents argue the cryptocurrency is “digital gold” that can hedge against the risk of inflation sparked by massive central bank and government stimulus packages designed to counter COVID-19.

Yet bitcoin would need to rise to $146,000 in the long-term for its market cap to equal the total private-sector investment in gold via exchange-traded funds or bars and coins, according to JP Morgan.

Rival cryptocurrency ether also hit an all-time peak of $1,974.99 on Friday, and was last up 1.2% at $1,961.32, after its futures were launched on the Chicago Mercantile Exchange.

Bitcoin’s surge extended to crypto-related stocks as well, such as Silvergate Capital Corp, which was up 8.2%, cryptocurrency miner Riot Blockchain, 13.5% higher, and Marathon Patent Group, up 7.3%.

Shares of Overstock.com, an online retailer and blockchain tech investor, gained 4.1%; while MicroStrategy Inc, a bitcoin buyer and business intelligence software firm, advanced 4.1%.

Reporting by Gertrude Chavez-Dreyfuss in New York and Tom Wilson in London; Editing by Dan Grebler, Jonathan Oatis and Diane Craft

Our Standards: The Thomson Reuters Trust Principles.

MORE FROBitcoin hits $1 trillion market cap, surges to fresh all-time peak | Reuters

Catalysts Insights Blog Simon Lack, Portfolio Manager

10. The Skill You’ve Always Wanted: How to Instantly Read People

By Tony Alessandra | October 4, 2017 | 0

The ability to “read” people is by far one of your most valuable skills in business. The people you interact with each day send you signals, and if you learn what to look and listen for, each person will tell you exactly how to effectively work with him.

Everyone experiences the same basic human needs—results, recognition, regimentation and relationships—with some holding more dominance than others. Depending on the weight placed on each need, people differ in personality.

So what is there to read?

Dozens of signals—verbal, vocal and visuals—tell you when to speed up or slow down, when to focus on the details or when to work on building the relationship. But, because people are different, the same technique won’t always work.

Human Behavior Has Two Dimensions

When people act and react—with verbal, vocal and visual actions—in social situations, they exhibit clues to their behavioral style. Identifying that is possible by classifying a person’s behavior on two dimensions: openness and directness.

Open vs. Guarded: Openness is the readiness and willingness with which a person outwardly shows emotions or feelings and develops interpersonal relationships.

Others commonly describe open people as being relaxed, warm, responsive, informal and personable. They tend to be relationship-oriented, and in conversations with others, they share personal feelings and tell stories and anecdotes. They tend to be flexible about time and base their decisions more on intuition and opinion than on hard facts and data. They also are likely to behave dramatically and to give you immediate nonverbal feedback in conversation.

Guarded individuals, on the other hand, commonly are seen as formal and proper. They tend to be more aloof in their interpersonal relationships. They are more likely to follow the letter of the law and try to base their decisions on cold, hard facts. Guarded people are usually very task-oriented and disciplined about time. As opposed to open people, they hide their personal feelings in the presence of others.

Direct vs. Indirect: Now consider the second dimension—directness. This refers to the amount of control and forcefulness that a person attempts to exercise over situations or other people.

Direct people tend to “come on strong,” take the social initiative and create a powerful first impression. They are fast-paced people, making swift decisions and taking risks. They easily become impatient with others who cannot keep up with their fast pace. They are active people who do a lot of talking and appear confident and dominant. Direct people express their opinions readily and make emphatic statements.

On the opposite end of that spectrum, indirect people give the impression of being quiet and reserved. They seem to be supportive and easy-going, and they tend to be security-conscious—moving slowly, meditating on their decisions and avoiding risks. They ask questions and listen more than they talk. They reserve their opinions and make tentative statements when they must take a stand.

When directness is combined with openness, it forms four different, recognizable and habitual behavioral styles: the socializer, the director, the thinker and the relater.

Related: This Is the Ideal Workplace for Your Personality

Socializer: Open and Direct

The socializer exhibits such characteristics as animation, intuitiveness and liveliness. He is an idea person—a dreamer—but can be viewed as manipulative, impetuous and excitable when displaying behavior inappropriate to a particular situation.

The socializer is a fast-paced person with spontaneous actions and decisions. He is not concerned about facts and details, and tries to avoid them as much as possible. This may prompt him at times to exaggerate and generalize facts and figures. He thrives on involvement with people and usually works quickly and enthusiastically with others.

The socializer always seems to be chasing dreams, but he has the uncanny ability to catch others up in his dreams because of his good persuasive skills. He always seems to be seeking approval and pats on the back for his accomplishments and achievements. The socializer is a very creative person who has that dynamic ability to think quickly on his feet.

Director: Direct and Guarded

The director exhibits firmness in his relationships with others, is oriented toward productivity and goals and is concerned with bottom-line results. Closely allied to these positive traits, however, are the negative ones of stubbornness, impatience, toughness and even domineeringness.

A director tends to take control of other people and situations and is decisive in both his actions and decisions. He likes to move at an extremely fast pace and is very impatient with delays. When other people can’t keep up with his speed, he views them as incompetent. The director’s motto: “I want it done right, and l want it done now.”

The director is typically a high achiever who exhibits very good administrative skills. He likes to do many things at the same time. He keeps adding on until the pressure builds to such a point that he turns his back and lets everything drop. Then he turns right around and starts the whole process over again.

Related: What Kind of Leader Are You? A Fixer, Fighter or Friend?

Thinker: Indirect and Guarded

The thinker is a persistent, systematic problem-solver. But he also can be seen as aloof, picky and critical. A thinker is very security-conscious and has a strong need to be right. This leads him to an over-reliance on data collection. In his quest for data he tends to ask many questions about specific details.

The thinker works slowly and precisely by himself and prefers an intellectual work environment that is organized and structured. He tends to be skeptical and likes to see things in writing.

Although he is a great problem-solver, the thinker is a poor decision-maker; he may keep collecting data even beyond the time when a decision is due.

Relater: Open and Indirect

The relater is unassertive, warm, supportive and reliable. However, the relater sometimes is seen by others as compliant, soft-hearted and acquiescent. The relater seeks security and belongingness and, like the thinker, is slow at taking action and making decisions. This procrastination stems from his desire to avoid risky and unknown situations. Before he takes action or makes a decision, he has to know how other people feel about it.

The relater is the most people-oriented of all four styles. Having close, friendly, personal and first-name relationships with others is one of the most important objectives of the relater’s style.

The relater dislikes interpersonal conflicts so much that he sometimes says what he thinks other people want to hear rather than what is really on his mind. The relater has tremendous counseling skills and is extremely supportive of other people. He also is an incredibly active listener. Because a relater listens so well to other people, when it comes his turn to talk, people usually listen. This gives him an excellent ability to gain support from others.

Learning to identify these four distinct personality types by their behavior takes time, but evaluating people’s behavior within this framework can help you better understand others and yourself.

Related: The 3 Types of People You Need in Your Life

Editor’s note: This post was originally published in August 2014 and has been updated for freshness, accuracy and comprehensiveness.

HTTPS://WWW.SUCCESS.COM/THE-SKILL-YOUVE-ALWAYS-WANTED-HOW-TO-INSTANTLY-READ-PEOPLE/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.