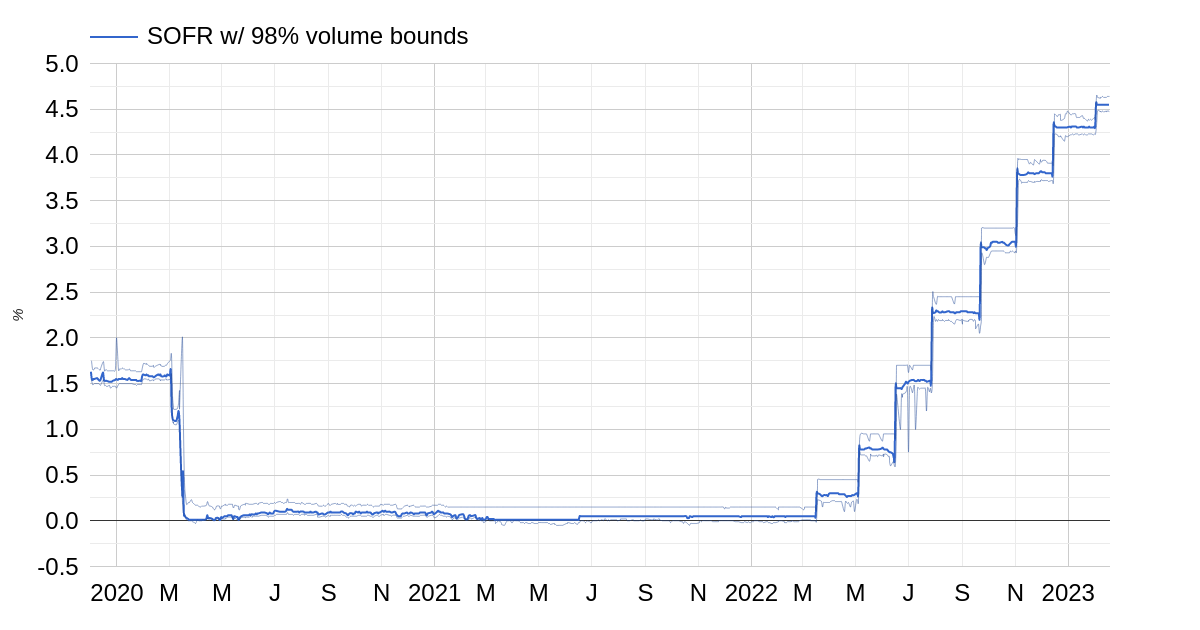

1. SOFR Rate 0% to 5% in 12 Months

What is SOFR? The Secured Overnight Financing Rate (SOFR) is intended to replace the US dollar London Interbank Rate (US LIBOR) in future financial contracts. SOFR was selected by the Alternative Reference Rates Committee (ARRC) chaired by the New York Federal Reserve in 2017.SOFR is the average rate at which institutions can borrow US dollars overnight while posting US Treasury bonds as collateral. Similar to a mortgage rate, SOFR is a secured borrowing rate in the sense that collateral is provided in order to borrow cash. SOFR differs from US LIBOR in that the latter is a rate for unsecured borrowing (where no collateral is posted).Major central banks globally have taken on similar reforms to replace their US LIBOR equivalents with more reliable rates.

SOFR rate history

https://www.sofrrate.com/

2. 10-Year Treasury Yield Update

Jim Reid Deutsche Bank “The “average” Fed hiking cycle sees yields peak at around 13 months after the first hike. Although the peak so far in this cycle was back in October, we are currently only c.30bps below this peak 11 and a bit months after the Fed started hiking, and 10yr yields are the highest in 3.5 months.”

10-Year Yield breaks above November highs….30bps. below new highs

3. EUFN-European Financials Runs Back to 2022 Highs

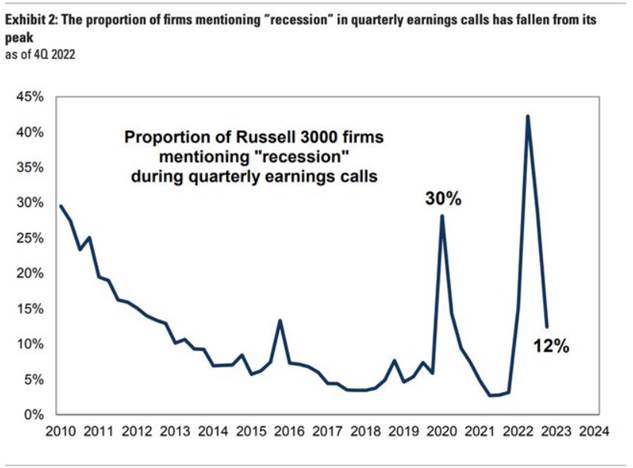

4. Number of Firms Mentioning Recession in Earnings Call.

From Dave Lutz at Jones Trading “The proportion of firms mentioning ‘recession’ in quarterly earnings calls has fallen from its peak” – Goldman

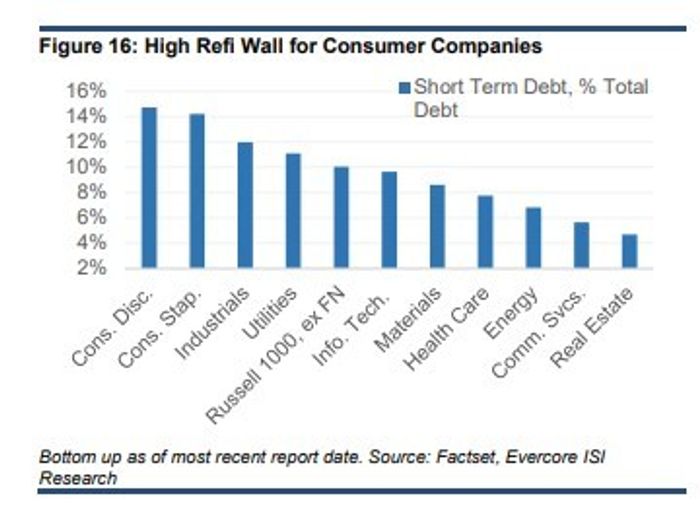

5. Consumer Discretionary and Staples Facing Short-Term Debt that Needs Re-Financing

Marketwatch By Jamie Chisholm

Evercore also notes that consumer discretionary and consumer staple companies face problems from higher interest rates because they have a large proportion of short-term debt that will soon need refinancing. However, those sectors will be supported by the spending of households sporting relatively healthy balance sheets.

“[H]ouseholds have remained relatively sheltered from rising interest rates. Deleveraging since the GFC [global financial crisis] is expected to have lowered households’ interest rate sensitivities. Balance sheets have improved across nearly all income quintiles,” said Evercore.

The end of easy money is bad news for these stock sectors, says Evercore ISI – MarketWatch

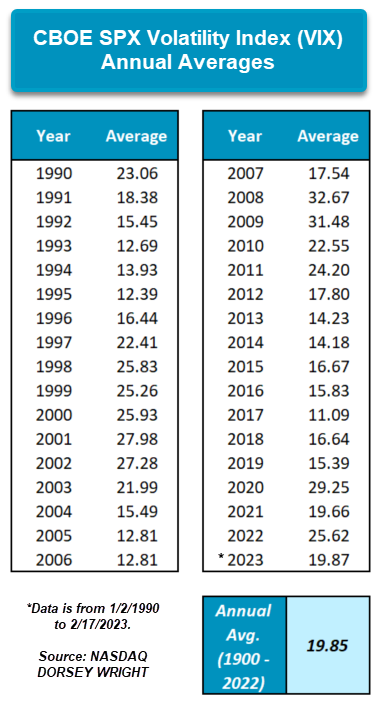

6. History of VIX

Nasdaq Dorsey Wright

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

7. Tesla May Start Mining Lithium

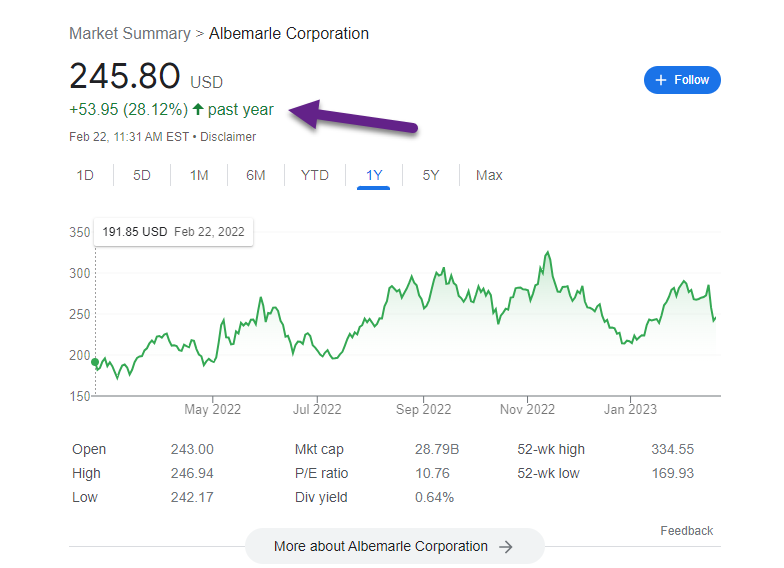

ALB Lithium company sideways at high level for 18 months

Relative performance one-year +28%

https://www.google.com/search?q=alb+chart&rlz=1C1CHBF_enUS898US898&oq=alb+chart&aqs=chrome..69i57j0i10i433i512j0i10i512l5j69i60.3457j1j9&sourceid=chrome&ie=UTF-8

8. Nukes, Nazis and lies: 5 takeaways from Putin’s annual address to Russia

ALEXANDER NAZARYAN-YAHOO NEWS

Speaking the day after President Biden paid a dramatic surprise visit to the Ukrainian capital of Kyiv, Russian President Vladimir Putin delivered a state of the nation address from Moscow on Tuesday that revisited familiar themes of geopolitical and cultural grievance while also seeming to raise, though not for the first time, the prospects of a nuclear confrontation.

Putin spoke as Biden was preparing to make another set of remarks, this time in Warsaw. With the war in Ukraine on the cusp of its first anniversary — Russian rockets began to fall on Kyiv in the early morning hours of Feb. 24, 2022 — Western resolve to supply Ukraine with the heavy weaponry it needs to defend itself remains unshaken.

Just how long that resolve will last remains one of the war’s key questions. But for now, Russia’s gains have been modest — and the price of those gains in terms of human life, economic pain and international isolation has been immense.

That difficult reality left Putin with few options but to reiterate the warped complaints and historical revisions that led him to launch the invasion in the first place.

1. The nuclear threat, updated and elevated-Putin’s most newsworthy — and arguably most troubling — announcement was that Russia is “suspending its cooperation” in the New START treaty negotiated in 2010.While the announcement does not mean that nuclear war is imminent, it does signal the end of the effort to reduce the threat of such a conflict, most famously symbolized by the 1986 meeting between President Ronald Reagan and Soviet leader Mikhail Gorbachev in the Icelandic capital of Reykjavik.

Putin’s announcement appeared to be predicated on the false assertion that the United States was conducting nuclear tests of its own — which it has, in fact, not done since 1992.“Of course, we will not do this first. But if the United States conducts tests, then we will. No one should have dangerous illusions that global strategic parity can be destroyed,” Putin said.

New START limits both Russia and the United States to 1,550 nuclear warheads mounted on ballistic missiles, or carried by heavy bombers and submarines. If Putin were to use nuclear weapons against Ukraine — a remote possibility, though a real one — he would almost certainly deploy smaller “tactical” devices not covered by the convention.U.S. Secretary of State Antony Blinken criticized the news of Russia’s backing away from its nuclear arms control commitment as “deeply unfortunate and irresponsible.”

2. It’s still about the NazisThe Kremlin initially justified its invasion of Ukraine by arguing that it was necessary to “de-Nazify” the ruling regime in Kyiv. The argument was nonsensical to begin with, as Ukrainian President Volodymyr Zelensky is the first Jewish person to lead that country.

And while there are far-right elements within Ukrainian society and armed forces, the same is true of Russia, most European countries and the United States.Still, in a country where the defeat of Hitler in World War II remains a source of deep collective and personal pride, tying the Ukrainian invasion to victory over the Nazis may be politically prudent, if egregiously ahistorical and ultimately damaging to the legacy of the enormous Soviet sacrifice in the fight against fascism.

Putin began Tuesday’s address by invoking the supposed need “to eliminate the threat coming from the neo-Nazi regime that had taken hold in Ukraine,” a reference to Kyiv’s increasing orientation away from Russia and toward the West since the popular antigovernment uprisings of 2014. He later referenced Ukrainian units that seemed to be wearing regalia that originated with the Wehrmacht — the German army during the Third Reich — or the murderous deaths squads of the SS.

“Their hands are also stained with blood,” Putin said.He also suggested that the West was abetting the rise of fascism in Ukraine just as it had done in Germany in the 1930s, when concerted action could have almost certainly stopped Hitler’s ascent.“I would like to recall that, in the 1930s, the West had virtually paved the way to power for the Nazis in Germany. In our time, they started turning Ukraine into an ‘anti-Russia.’ Actually, this project is not new,” Putin warned.As usual, he elided the inconvenient fact that Soviet dictator Josef Stalin, whom Putin reveres, signed a nonaggression pact with Hitler and, in fact, supplied the German war machine with critical supplies.

3. It’s a war for culture Putin has long been a favorite of nationalists in both Europe and the United States, who have regarded his authoritarian, militaristic and superficially Christian regime as a model to emulate.As the war effort in Ukraine has faltered, Putin and other top Kremlin officials have sometimes resorted to a cultural framing of the conflict, depicting themselves as noble defenders of Western tradition against the corrupting forces of progressivism and globalization.

Putin has even used the language of “cancel culture” to make his case, in an apparent — and not entirely unsuccessful — appeal to Western conservatives.He made that appeal again on Tuesday. With the chief cleric of the Russian Orthodox Church — the virulently pro-Putin Patriarch Kirill, who has been condemned by leaders of other Christian denominations — Putin criticized a new Church of England proposal to refer to God by gender-neutral pronouns.

“They distort historical facts, constantly attack our culture, the Russian Orthodox Church, and other traditional religions of our country. Look at what they do with their own peoples: the destruction of the family, cultural and national identity, perversion, and the abuse of children are declared the norm,” he warned.Reprising the ominous tone of last fall’s speech celebrating the illegal annexation of four Ukrainian regions, Putin darkly warned that “millions of people in the West understand they are being led to a real spiritual catastrophe.”

4. Russia is the victim-Putin is shown on large screens as he delivers his address. (Dmitry Astakhov/Sputnik/Kremlin/Pool via AP)

Since the fall of the Soviet Union, Russia has invaded Chechnya (twice), Georgia and Ukraine, first in 2014 and then again last year. Still, the Kremlin continues to proffer the argument that Russia is the victim of Western expansionism. Inaccurate as it is, that argument plays on an inferiority complex that dates back to czarist times, when European architects were enticed to turn St. Petersburg — a swampy outpost — into a city to rival Paris.Charging the West with “Russophobia and extremely aggressive nationalism,” Putin cast the Ukraine invasion not as a war of aggression he started but as a proxy conflict the West is using to destroy Russia. He charged that the recent security conference in Munich, attended by Vice President Kamala Harris, was “an endless stream of accusations against Russia.”

During the conference, Harris said that Russia had committed crimes against humanity.

Russians, however, are fed a relentless stream of propaganda supposedly showing Ukranians as the perpetrators of abuses, with their own soldiers depicted as noble liberators. And it was the Ukrainians, according to the official Russian narrative, that started the war on their own soil, by repressing the pro-Russian sentiments in the nation’s eastern regions.“We were doing everything in our power to solve this problem by peaceful means, and patiently conducted talks on a peaceful solution to this devastating conflict,” Putin said.In reality, it was Russia alone that sought conflict.

5. Russia will winParticipants applaud Putin’s annual address. (Maxim Blinov/Sputnik/Kremlin via Reuters)Putin once imagined himself as one of Russia’s great leaders, on par with Peter the Great or Stalin. Now he is regarded as a criminal by much of the world, and even loyalists are said to be plotting to succeed him.

It is not clear that victory is even possible at this point, given Western commitment to bolstering Ukraine’s defenses. And what would that victory even look like, with the dream of the Russian tricolor flying over Kyiv having been relegated to one of history’s more notorious military miscalculations? Still, if Putin is to save his own legacy, victory in Ukraine is the only option. Defeat will likely place his fantasy of a Pan-Slavic, autocratic Russia — however fantastical to begin with — in danger.“Russia will answer any challenges, because we are one people,” Putin said near the end of Tuesday’s speech.The crowd, which seemed somnolent at times, stood and clapped.

Nukes, Nazis and lies: 5 takeaways from Putin’s annual address to Russia (aol.com)

9. 3 common retirement dreams that can become big disappointments

By Christine D. Moriarty

When deciding on the ideal place to retire, a little homework can spare you a lot of headaches

Before you move to be near your kids, ask yourself if you like the area enough that you would move there if your child was not there.

When it comes to where to retire, people often get caught up in the illusion, rather than the reality. Before making a commitment to move, understand this change is a fine mix of dreams, practicalities and your vision.

You can find your perfect mix when you consider all the factors, beyond the weather, amenities and proximity to friends.

With an ocean of options, how do you decide? Consider your vision and your wants and needs, because none of the “Best Places to Retire” lists can consider your personal likes and dislikes. Also, there are practical and financial considerations to recognize.

Here are three dreams that disappointed many newly minted retirees:

1. Live near your children

You finally have time for family time. You want to be available to your children and more engaged in their lives. Best of all, if you are lucky enough to have grandchildren, you desire to get to know them better, even teaching them things your grandparents taught you.

There are some valuable conversations you need to have with your children before you put up that “For Sale” sign and look for a place nearby. As your children are working with full schedules, plan time for a serious chat. This important conversation is so you can understand their life a bit more and learn what works for them.

Some conversation starters are: How does your child and their family fit you into their life? Do they want you around more often? Are they worried about the time and energy of being with you? Or caring for you eventually? You may be healthy now, but such an issue may be on their mind.

Then, ask yourself if you like the area enough that you would move there if your child was not there. Is the community a good fit? The weather? The available activities?

If you do make the move, remember that your adult children had a routine and schedule before you got there. When you arrive, create a life without them as much as with them. Retirees who settle in and focus only on family often feel lost 10 years down the road when the toddler grandchildren who they saw everyday grow into teenagers who prefer to be with friends. If they end up moving away for college, you will see them even less.

Prepare for change, just in case. A job transfer, career change, corporate merger or any number of other life-disrupting events may lead your child’s family to relocate in coming years. Would you feel you had no option but to follow them again? Or could you stay put because you had built a community that would let you confidently live on your own?

A couple bought a condominium in Arizona in anticipation of their retirement one year out and enjoyed the vacation time they spent with their children and grandchildren before they retired. Three months after they retired and moved, their son-in-law’s company transferred him to California. The couple was left alone and reflecting on the possible need for another move.

2. Move to a favorite vacation area

That summer vacation retreat might be a lot different at other times of the year.

Vacations are freedom from everyday life. It’s easy to dream of retiring in your favorite vacation spot. Before committing to a location, stay longer than usual. Rent a home for a month, a season or a year. Explore the area as a local.

Do not forget seasons. Spend a winter at the lake or a summer at the ski resort before committing to buy.

Just because you like to vacation somewhere does not mean it is the ideal retirement home location. Many people move twice because they thought they knew what they wanted. And moving is expensive. The average moving company bill for a 1,200-mile move is $4,000.

One couple made a quick decision to sell their home without thinking it through. As soon as the sale went through, they went to Florida and bought a condominium in an area where they spent their annual vacation.

They discovered they bought in a rental area, not a residential area, so making friends was difficult and some services limited. A year later, they moved to another area, incurring moving costs and Realtor fees again.

Emotional and personal reasons for moving are important, but so are costs such as taxes. If you change residency to a new state, consider the cost of new car registrations and legal fees for an updated estate plan. Explore the true costs of the area you want to move to, so you avoid surprises.

3. Head for the border and skip the country

The grass always looks greener … and that applies whether you are considering Canada, Mexico, Europe or beyond. In the excitement to retire, many people only consider the big picture of what looks good rather than practicalities of an international move.

If you are moving for cultural immersion, understand many of the places that attract you also draw other Americans. The good news: you can associate with people who share your experience. But by sticking together, you are less likely to be treated as a local than foreigners who assimilate.

There is the legal side of residency. Understanding how you can live in a country long-term is essential, so check out the visa process. A country may or may not make it easy for U.S. citizens to immigrate. For example, Canada recently banned foreign nationals from buying property for two years.

The cost of living is one reasonable draw to live outside the U.S., yet there are other financial considerations. “Retirement income will be 100% taxable by the U.S. and perhaps additionally in the country you move to,” says Malissa Marshall, a Certified Financial Planner in Bristol, Vermont.

“The tax situation may be higher than anticipated, offsetting the lower cost of living,” she emphasizes.

You may want to hire a tax professional in the country you are considering and one in the U.S. before finalizing any plans. An international expert can explain the reality in a short time.

Consider healthcare abroad

Then, there is the issue of healthcare and insurance, especially if you do not pay for the Medicare premiums while you live abroad. If you ever return to the U.S., your Medicare insurance premiums will be permanently higher. Medicare charges a premium penalty for the months you did not pay but were qualified, even if you were covered overseas.

Finally, due to the reality of having lived through a pandemic, we have all come to understand living out of the country in a new way. Would it be OK with you if you could not cross the border to go home to be with loved ones or vice versa?

If you keep the above in mind, the facts and fiction of retirement location will be clearer. As you consider each possibility, be prepared to adjust dreams and make trade-offs. Knowing the actual cost of your choices will make your retirement more like the fairy tale you want.

Christine D. Moriarty, CFP, has over 25 years of experience coaching individuals, couples and business owners on their finances. Her focus has been the intersection of emotions, behavior and money. She is living her dream in Vermont and delights in sitting down with a cup of Irish tea and a good book. Find more at Moneypeace.

This article is reprinted by permission from NextAvenue.org, ©2023 Twin Cities Public Television, Inc. All rights reserved.

10. The Next 30 Longevity Tips -Novos Longevity

SLEEP

32. Take care of your sleep. Make sure you sleep enough and go to bed around the same time every night. You can find more than 50 tips to improve your sleep here.

33. Buy sleep aids, like an Oura ring or the Dreem headband.

34. Download sleep and relaxation apps, like Calm, Buddhify, Headspace

35. If you are older than 50 years, use 500 ug (0.5 mg) to max 1000 ug (1 mg) of extended-release melatonin before going to sleep. Melatonin can also extend lifespan and slow down aging (R).

TRACKING

36. Reduce your blood sugar levels. Buy a continuous glucose sensor to track how your body processes sugars based on foods, sleep, etc. If that’s out of your budget, consider a regular blood glucose monitor, available at your local drugstore.

37. Measure your heart rate variability (HRV), which can be predictive of health and mortality. Improve your HRV via HRV biofeedback devices, like HeartMath and Sweetwater HRV.

38. Get regular health checkups. Prevention is key!

39. Track your facial age.

40. Track your overall health.

LIFESTYLE

41. Protect your skin very well against the sun: always wear strong sunscreen and a hat when going outside in the sun.

42. Use high-concentration retinol creams (over-the-counter) or Retin-A (aka “tretinoin,” a prescription) for your face.

43. Take supplements that slow skin aging and reduce wrinkles.

44. Brush and floss your teeth at least twice per day.

45. Always wear your seatbelt.

46. Don’t smoke.

47. Do yoga.

48. Don’t be overweight, and make sure you don’t have too much abdominal fat (a beer belly). Measure your waist circumference here and calculate your BMI (body mass index) here.

49. Schedule everything.

MINDSET

50. Try to be positive and always see the silver lining in things. Most centenarians have a very optimistic disposition.

51. Learn how to be happy.

52. Reduce stress.

53. Practice meditation. Download meditation apps such as Calm or Headspace.

54. Have a purpose and goals in life (that is, feeling useful).

55. Be social.

56. Challenge your mind every day.

57. Use medication sparingly: most drugs have significant side effects.

58. Use blue-light blocking glasses 30 minutes before going to sleep.

59. Keep a gratitude journal.

60. Be an empowered health advocate for your own body: don’t just rely on the health care system to keep you healthy.

We go more into detail on how to slow down aging and live longer here.

https://novoslabs.com/60-top-

Share this page with friends and family!