1. History of Bond Cycle

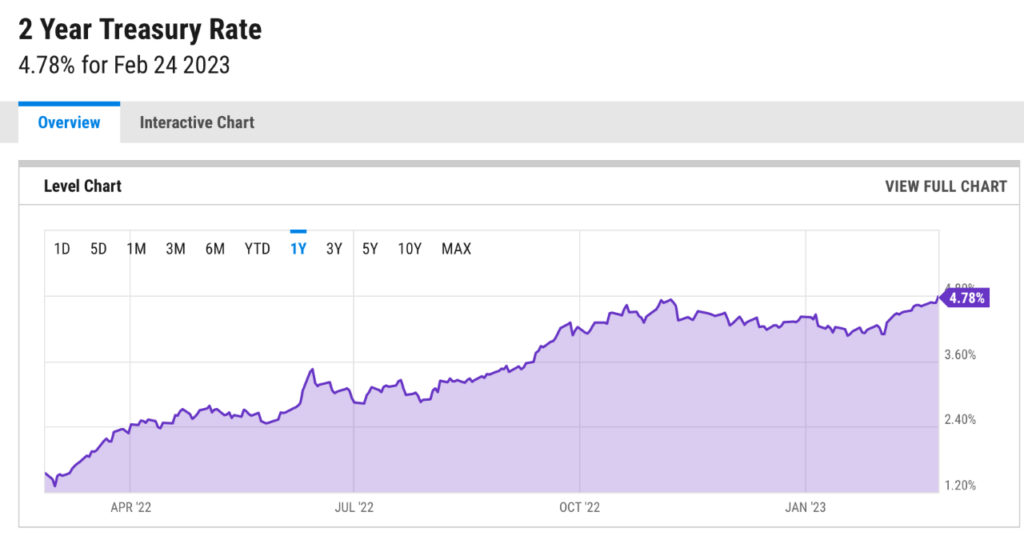

Barrons Over the near term, Treasury yields have significantly further to rise, even after their recent jump, according to Bianco’s analysis. In every cycle, he finds, the two-year note’s yield tops out above the eventual peak in the Fed’s funds rate target. Treasury yields probably will rise further, if the Fed meets the market’s expectations of three more 25-basis-point hikes, in March, May, and June, to a 5.25%-5.50% target range. (A basis point is 1/100th of a percentage point.) In that case, the two-year note should hit about 5.40% from 4.81% Friday, according to the precedent cited by Bianco. Friday’s yield topped the previous recent high of 4.70%, reached in November, and was the highest since 2007. Randall W. Forsyth

https://ycharts.com/indicators/2_year_treasury_rate

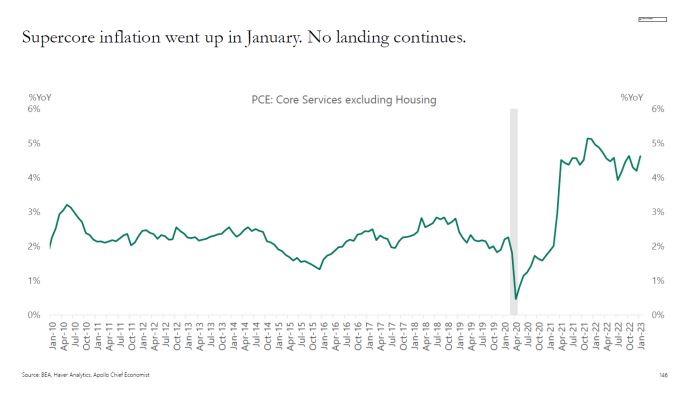

2. Supercore Inflation Well Above Fed Target

The PCE inflation data that came out on Friday shows that the Fed’s preferred measure of inflation, namely core inflation excluding housing, also known as supercore inflation, increased in January to 4.6%, dramatically above the Fed’s 2% inflation target. The economy outside the interest rate-sensitive components – which only make up 20% of GDP – is simply not slowing down.

Even the housing market is starting to show signs of a rebound, driven by strong job growth, high wage growth, and high levels of savings across the income distribution, which is particularly problematic given the consensus expectation that OER should be declining over the coming quarters. As a result, the Fed has to raise interest rates more, and this continues to be a downside risk to equity and credit markets.

A Fed-driven tightening in financial conditions with higher rates, lower equities, and wider credit spreads increases the probability that no landing will be followed by a hard landing.

Torsten Slok, Ph.D.Chief Economist, PartnerApollo Global Management

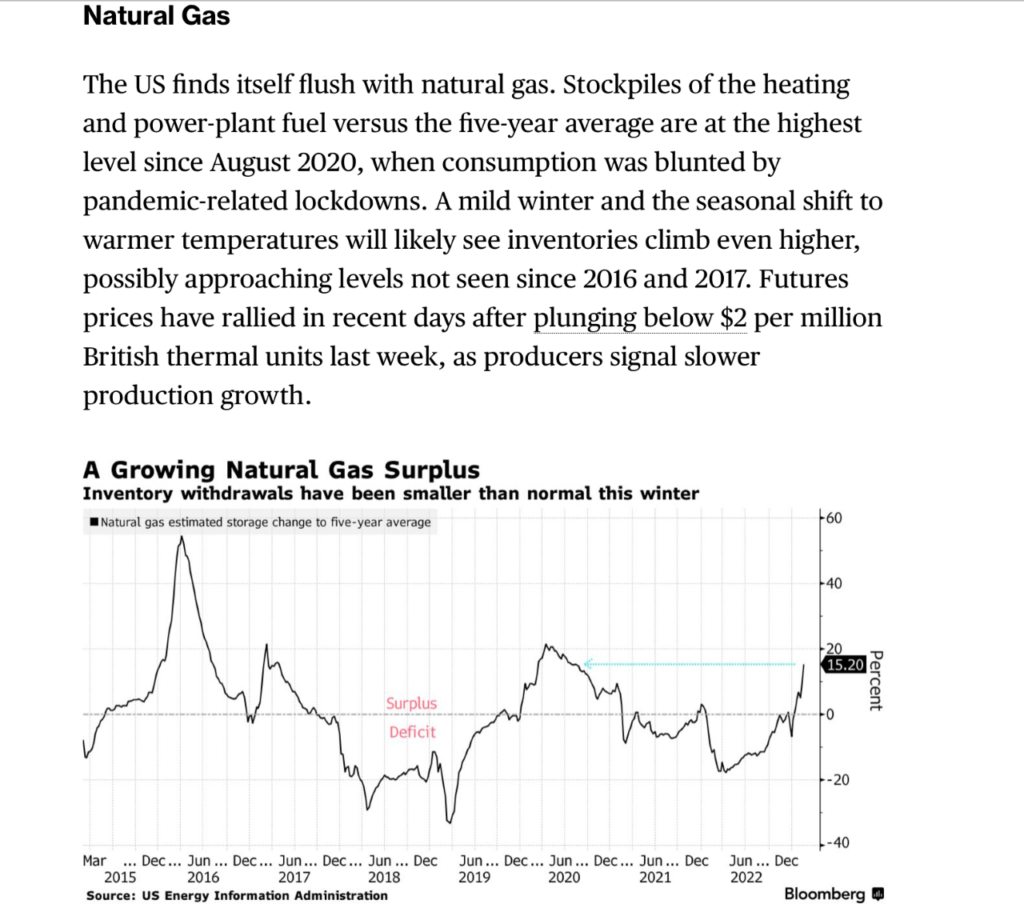

3. Natural Gas Surplus

Bloomberg –Sophie Caronello

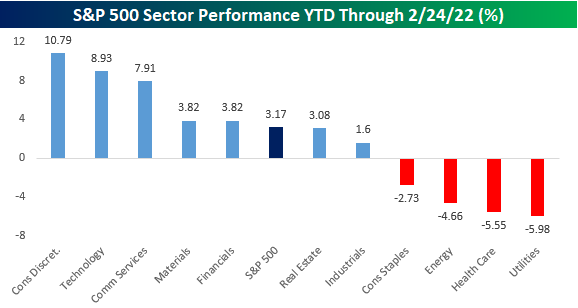

4. Sector Performance YTD ….Tech and Discretionary Lead…Defensives Negative

Bespoke Looking more recently at sector performance YTD, it’s a similar trend. Consumer Discretionary, Technology, and Communication Services have all outperformed the S&P 500 by a factor of at least 2x while defensive-oriented sectors are not only underperforming the market, but they’re also down YTD. The market may not exactly be following the bull market playbook, but sector leadership isn’t following a recessionary playbook either.

https://www.bespokepremium.com/interactive/posts/think-big-blog/mixed-signals

5. PKW Stock Buyback ETF Did Not Make New Highs.

6. Dominos Pizza Breaks Thru Lows Going Back to 2021

DPZ Chart 50week thru 200week to downside.

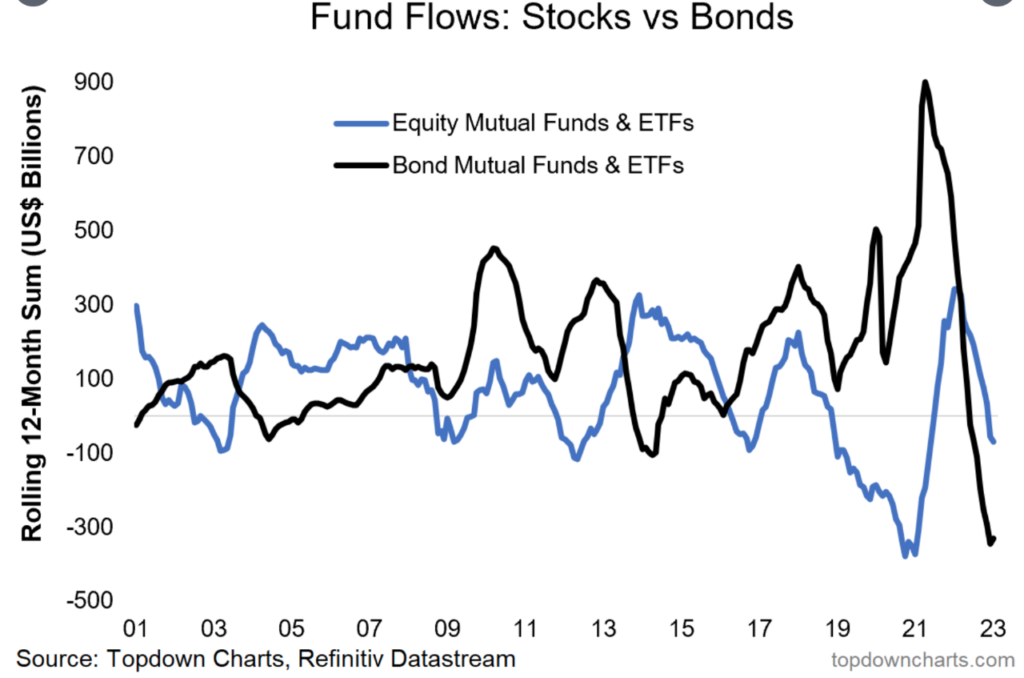

7. Retail Investors are Selling Stock and Bond Funds

Last week we showed a chart of retail investors still trading individual stocks at high level….But fund flows are negative

Top Down Charts-Callum Thomas

https://twitter.com/Callum_Thomas/status/1629763416327081986/photo/1

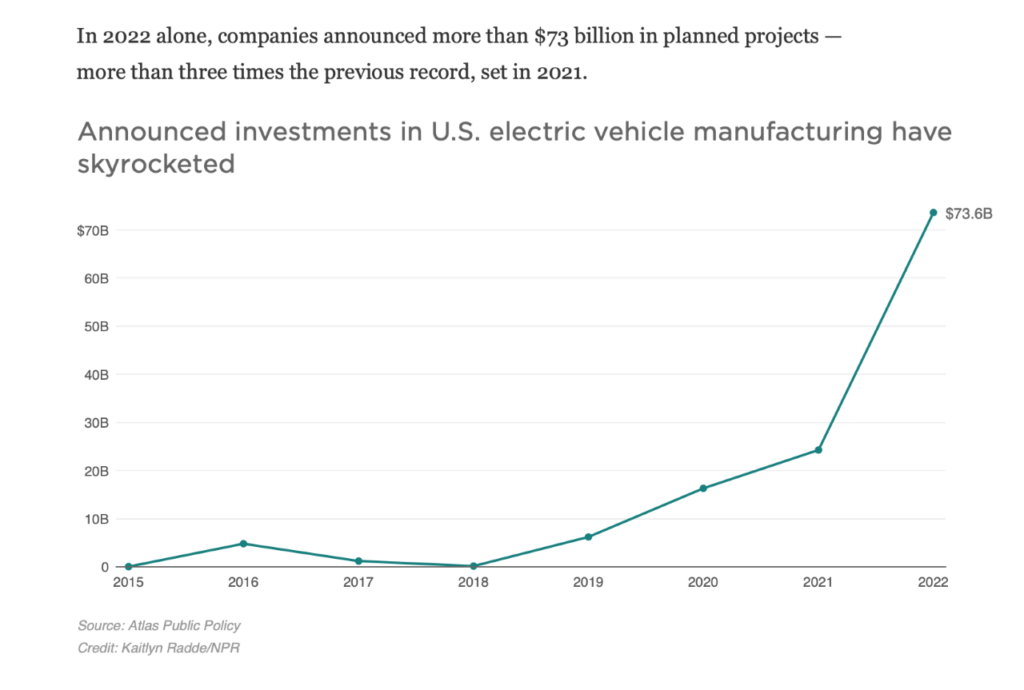

8. 17 New Electric Vehicle Battery Plants are Under Construction

Barrons Most new investment since the law passed has gone into battery factories, primarily to supply electric vehicles. There are subsidies for those plants, and auto makers need North American batteries to qualify for the largest tax benefits. At least 17 new battery plants are being built, including factories for Panasonic in Kansas and Toyota in North Carolina, according to Bank of America. But the factory expansion also threatens industry profitability. Credit Suisse predicts the U.S. market could actually be oversupplied by middecade as capacity ramps up, “which could put pricing pressure on battery manufacturers down the road.”

https://www.npr.org/2022/12/30/1145844885/2022-ev-battery-plants

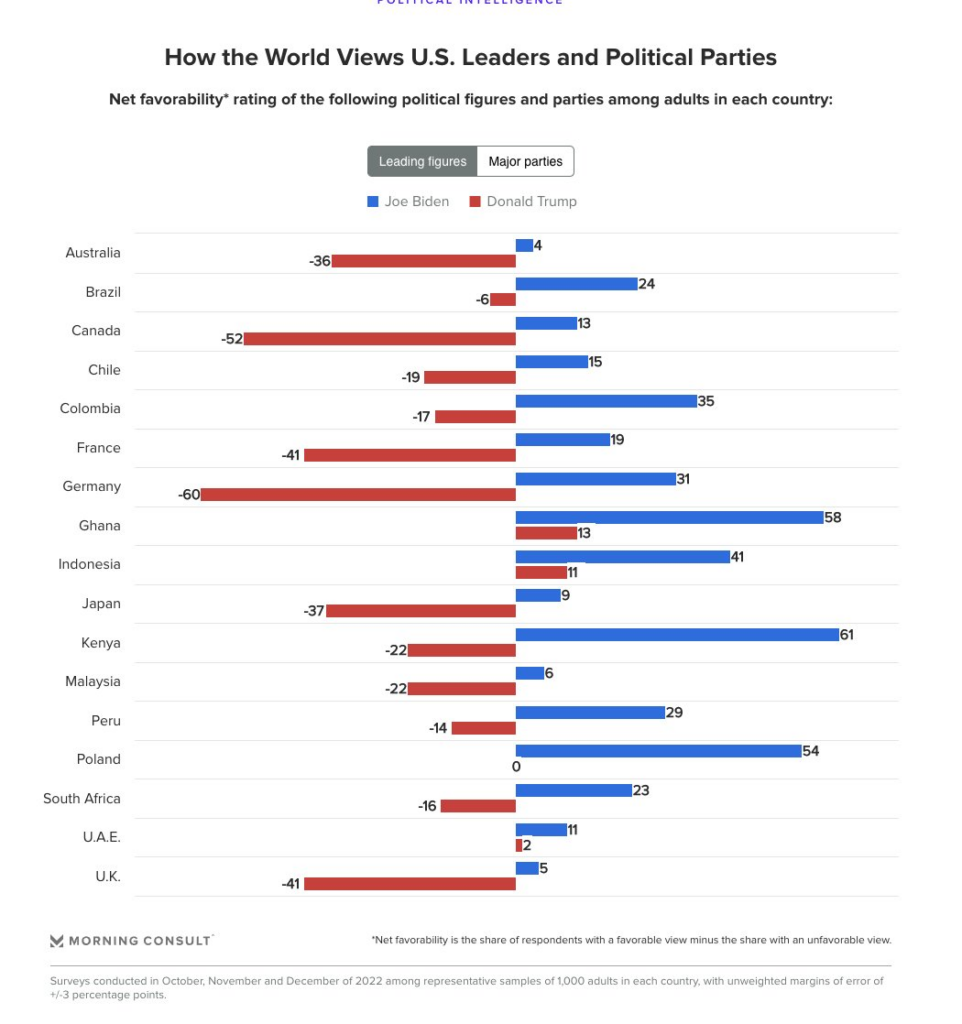

9. How people in other countries view Biden vs Trump

From Barry Ritholtz The Big Picture Blog

Source: @crampellhttps://ritholtz.com/2023/02/sunday-reads-313/

10. Stress is a Deviation from Homeostasis

Farnam Street “Stress is any deviation from homeostasis or our neutral baseline position. So every time we tilt that pleasure, pain, balance to the side of pleasure or pain, we’re also setting off our own endogenous adrenaline or stress hormone. That is the definition of stress, a deviation from homeostasis. So I think that in many ways the source of our stress in modern life is the constant stimulation, the constant hits of pleasure from reaching for our phone in the morning to our morning cup of Joe to the donuts, to the Netflix binges at night, to the hookup, you name it. We’re actually experiencing stress as a result of overabundance.”

— From my conversation with Dr. Anna Lembke on pleasure, pain, and addiction. We discuss dopamine, addictive behaviors, warning signs, and treatment. She offers plenty of actionable insights and takeaways. Listen here or read the transcript.