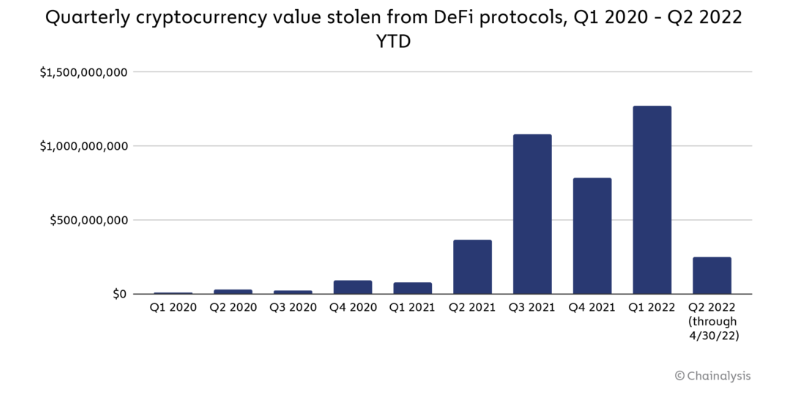

1. Inflation Adjusted S&P Returns Worst in Modern Times

Food for Thought: Lastly, here are US inflation-adjusted stock market returns during past episodes of turmoil:

The Daily Shot Blog https://dailyshotbrief.com/the-daily-shot-brief-july-8th-2022/

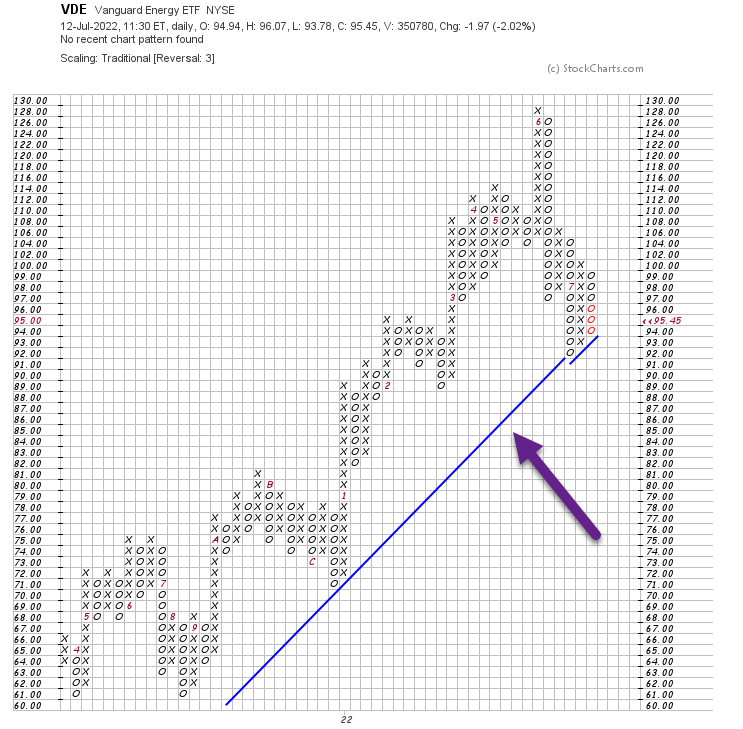

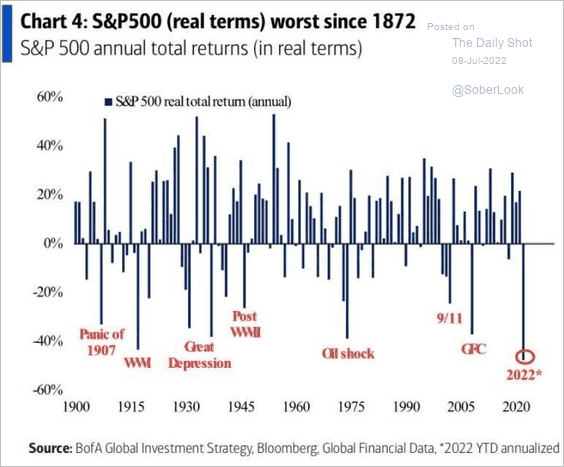

2. Are Commodities Third Peaking Asset Class?

Callum Thomas-It’s the old textbook market cycle in progress: first bonds peak, then stocks peak, then commodities peak… At it’s simplest, price just reflects the progression of the business cycle (and inflation/monetary policy)

https://twitter.com/Callum_Thomas

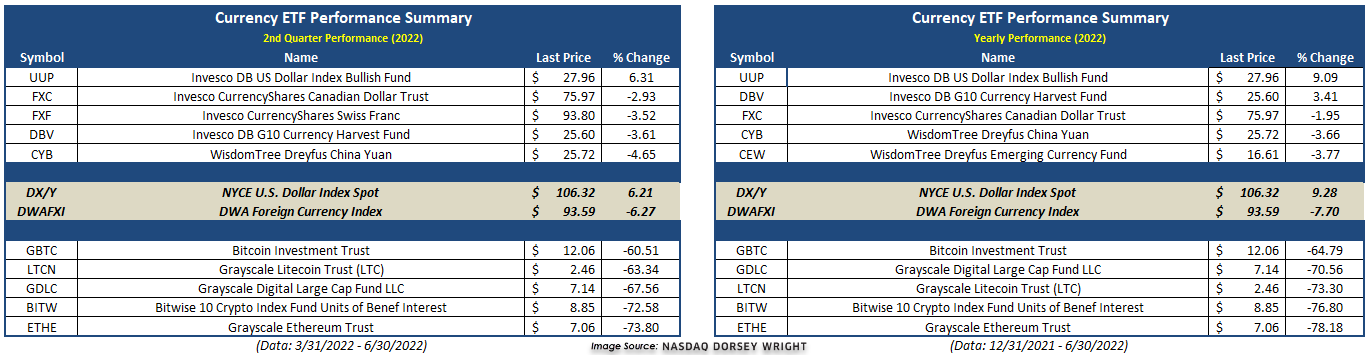

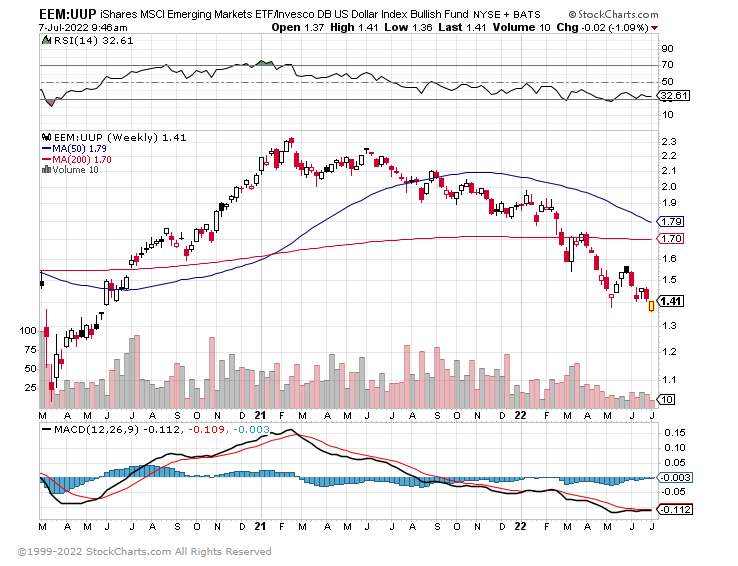

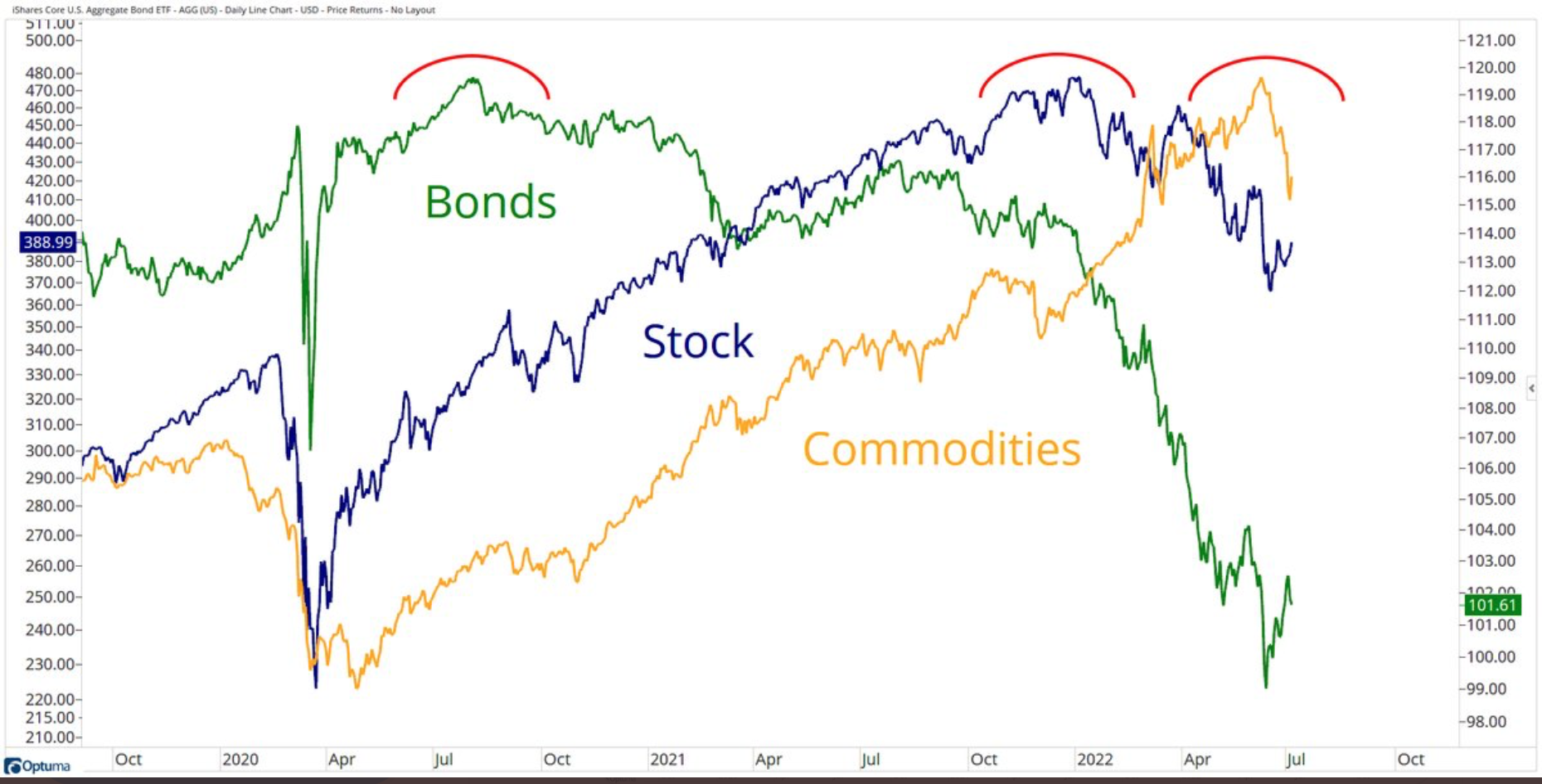

3. U.S. Dollar Record Strength

ZeroHedge Blog-Earnings Season The simple math on S&P 500 earnings from currency is that for every percentage point increase on a year-on-year basis it’s approximately a 0.5x hit to EPS growth. At today’s 16% year-on-year level, that translates into an 8% headwind for S&P 500 EPS growth, all else equal.

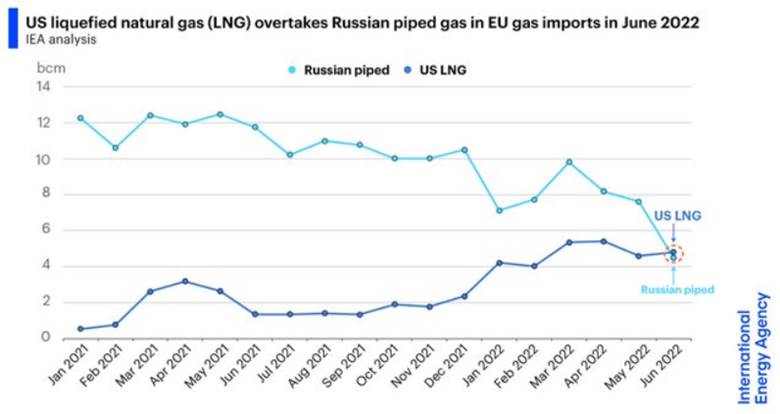

4. Driving Electric Car in Germany Getting Very Expensive

Electricity Pricing in Germany

Michael A. Arouet

https://twitter.com/MichaelAArouet/status/1546107176116260865/photo/1

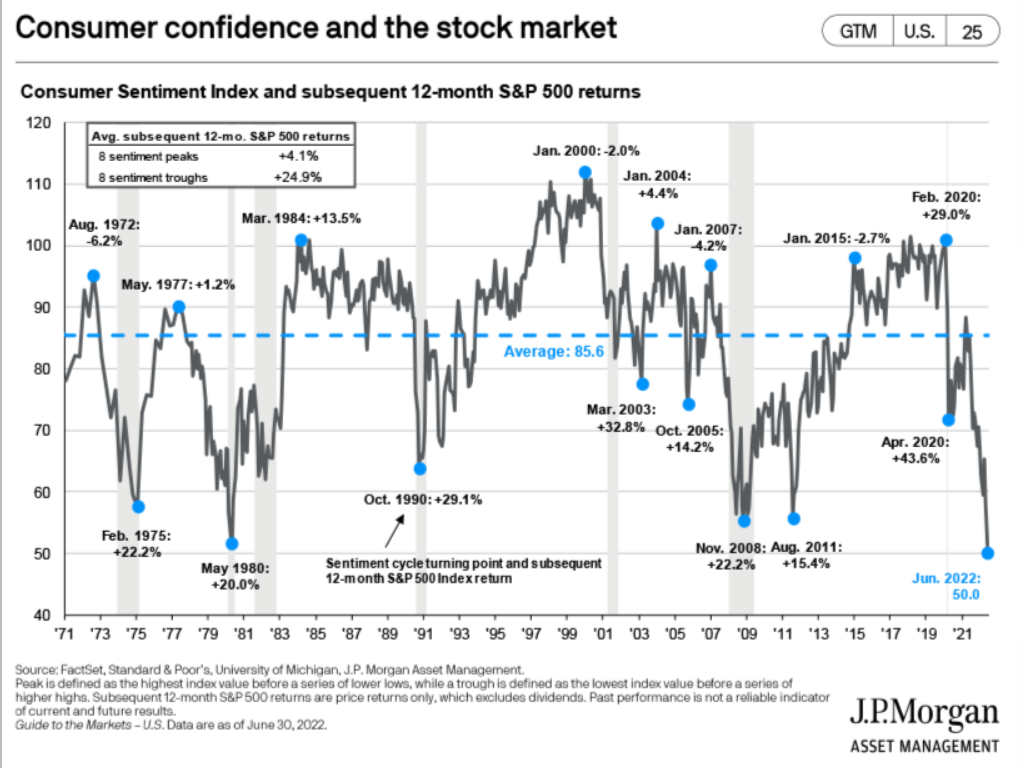

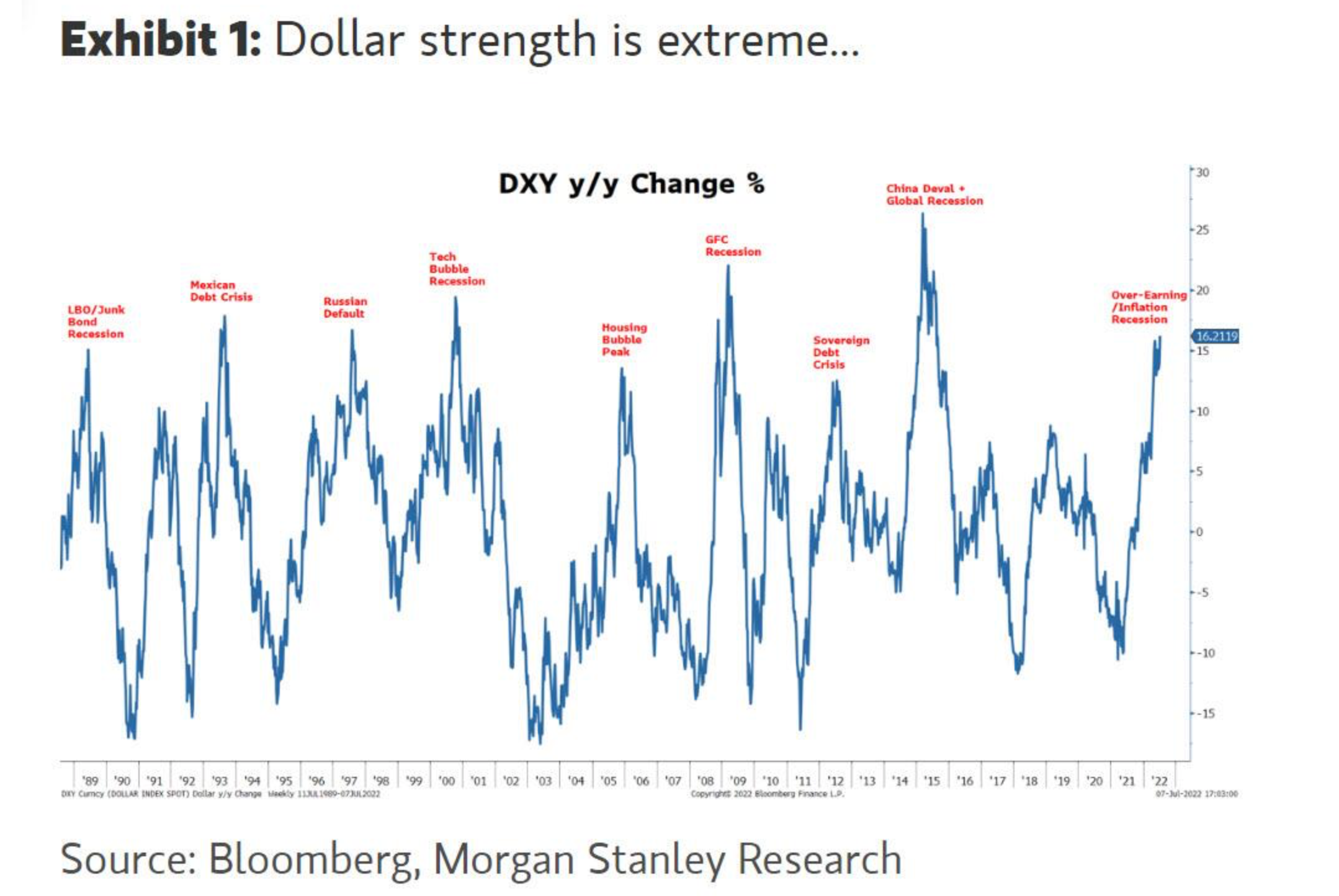

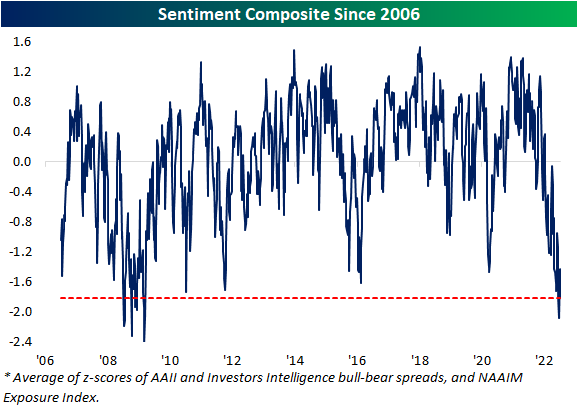

5. Three Popular Sentiment Measures Combined…Hit GFC Lows

Investors Sentiment as Contra Indicator….All Hitting Lows

Bespoke Blog -The more bearish turn at the expense of bulls witnessed in this week’s AAII survey was echoed by other readings on sentiment like the Investors Intelligence survey and NAAIM Exposure index. Combining all three of these sentiment readings into one composite, overall outlooks for the market took a further bearish turn this week with the average survey currently 1.8 standard deviations below its historical norm. That is slightly better than earlier this spring, but still, the only period since the mid-2000s with similarly pessimistic readings was in late 2008 and into 2009.

https://www.bespokepremium.com/interactive/posts/think-big-blog/bulls-back-below-20-2

6. Short Duration 1-3 year Bonds -3.5% vs. 20 Year Bond -23%

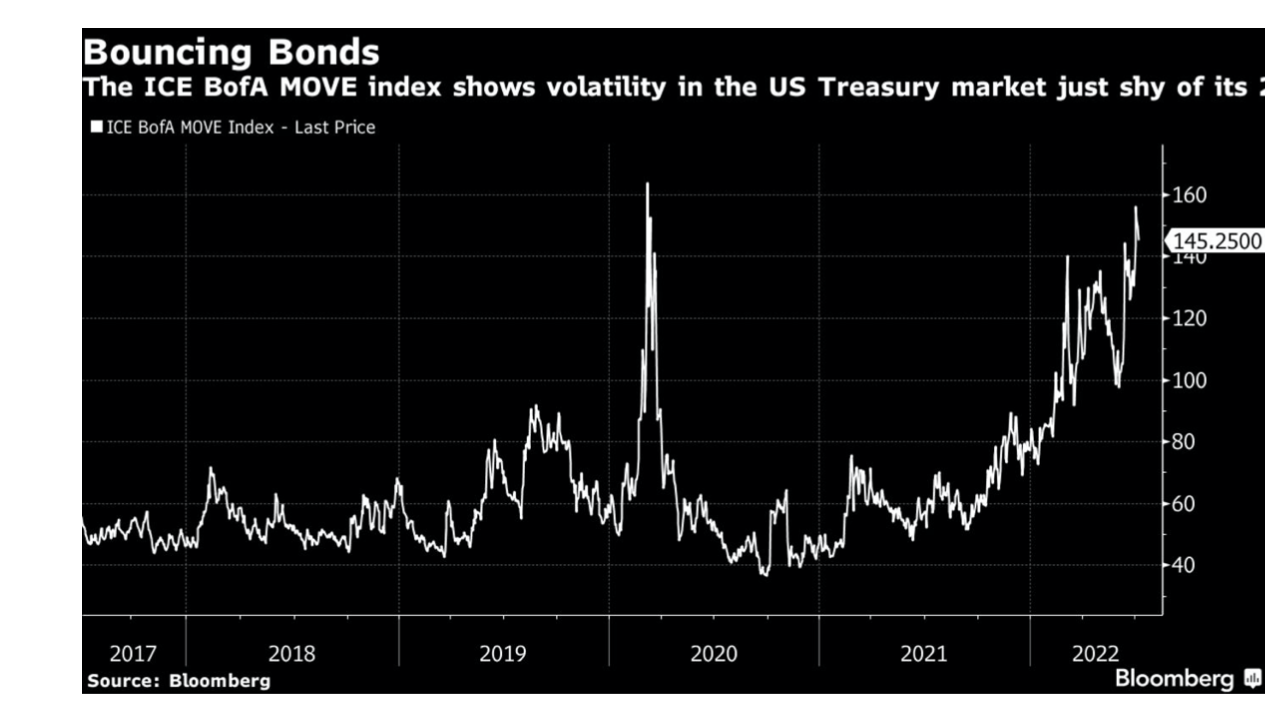

7. Treasury Market Volatility Traded Back to Covid Crisis Levels in 2022

8. Amazon Spent $700m Policing Counterfeiting Last Year

This was 2019

Amazon puts out counterfeit warning

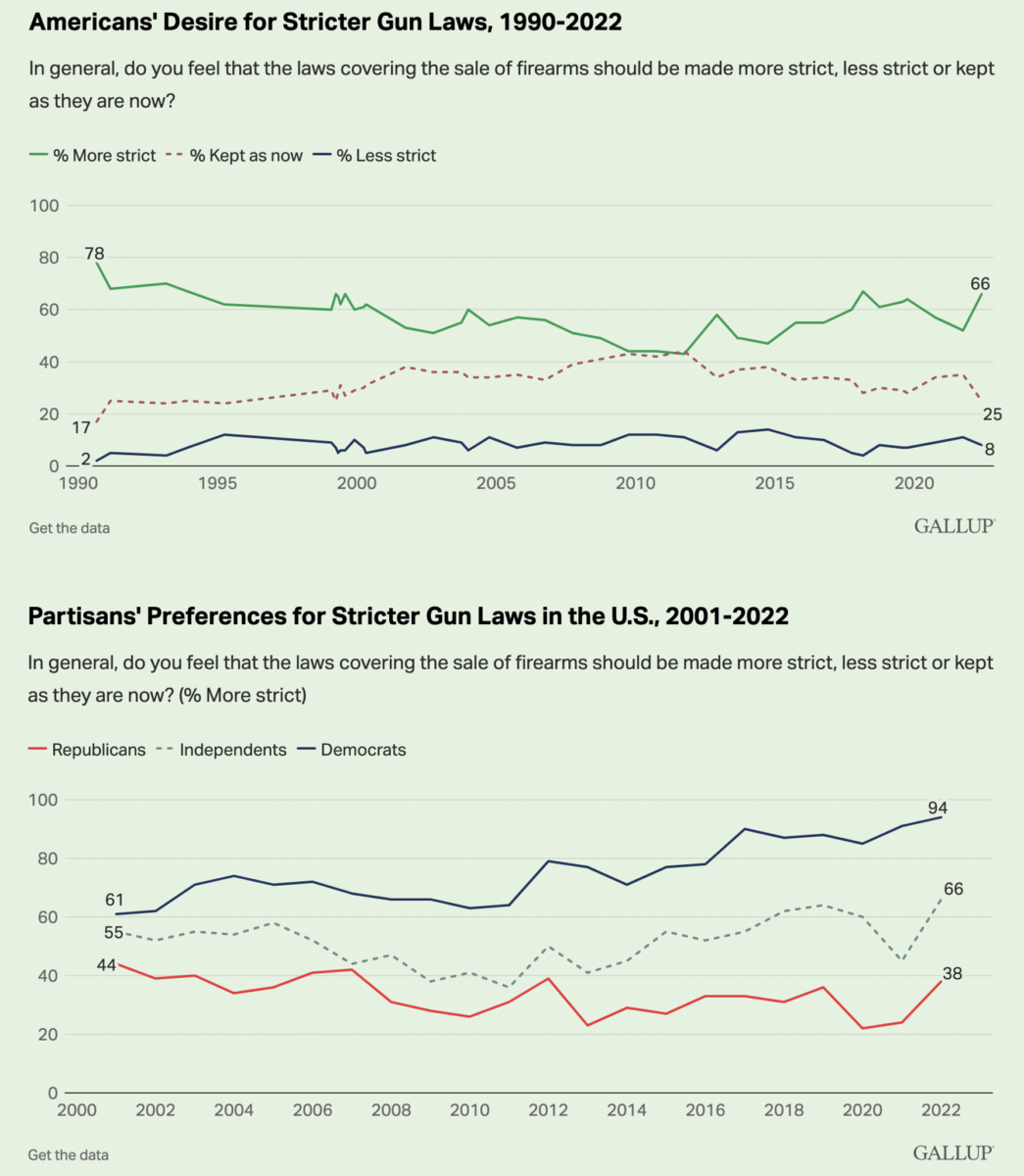

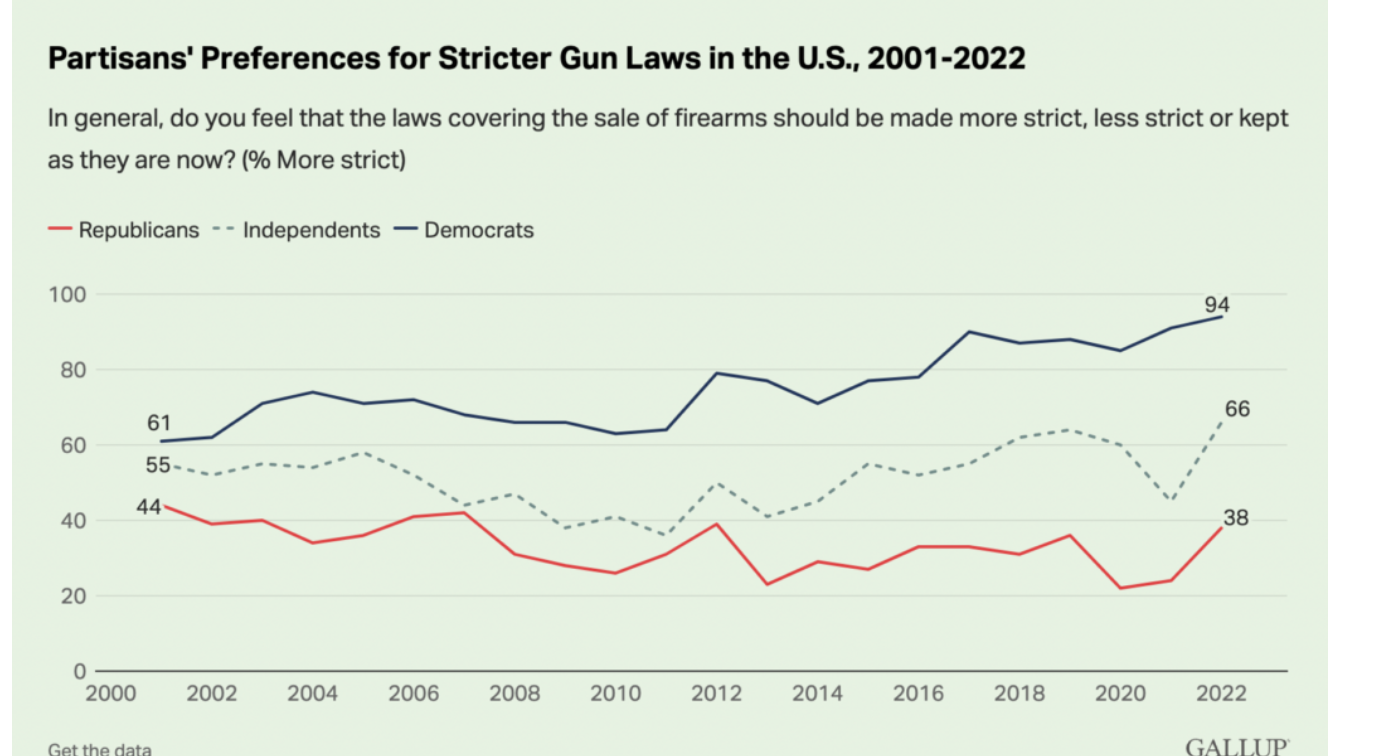

9.Americans on Gun Laws

From the Big Picture Blog-by Barry Ritholtz

https://ritholtz.com/2022/07/sunday-reads-281/

10. 3 Ways to Not Feel Overwhelmed Anymore

Psychology Today-Research explains how to withstand the toughest of emotions-Mark Travers Ph.D.

We all feel like we’re being held hostage by our emotions every now and then. While emotions can be overwhelming at times, most psychologists will tell you that they can also be powerful carriers of information about your mind and personality.

However, it can be difficult to understand your emotions from a detached distance if they begin to overpower you. To combat this vulnerability, here are three research-backed ways you can gain more control over problematic or painful emotions and build mental fortitude.

#1. Undo rejection through objectivity

According to psychologist Mark Leary of Duke University, rejection can come in six forms:

- Criticism

- Betrayal

- Active dissociation (for example, a romantic breakup)

- Passive dissociation (like not being included)

- Being unappreciated

- Being teased

Hurt feelings resulting from any of the mentioned events can result in the experience of the “rejection emotion,” which can then turn into sadness, anger, or even anxiety.

“People don’t need to be actually rejected to have the subjective experience of rejection,” says Leary. “For instance, even though we know that our romantic partners accept and love us, they can (unintentionally) make us feel rejected and hurt our feelings in certain situations.”

In order to tackle our rejection emotion, Leary explains that we must first understand why it is so important for us to feel accepted. Simply put, people feel accepted when they think that they have high “relational value,” or worth, to another person or group of people. A great deal of our behavior, thought, and emotion, according to Leary, is driven by our need to belong to groups.

Therefore, Leary advises, if you are experiencing the rejection emotion, make sure that you do not underestimate your relational value because of ambiguous social cues or misinterpreting neutral feedback from others as negative feedback. This is necessary because most people go through life feeling more rejected than they actually are.

“Viewed in this way, the first step to address one’s concerns with rejection is to examine the evidence as objectively as possible, trying not to read too much negativity into them,” warns Leary.

Having said that, if you are going through an obvious and painful rejection, here’s how you can boost your feeling of acceptance:

- Learn to ignore the negative reactions of people whose opinions of us are unimportant

- Seek connections with people with whom we have a higher relational value

- If necessary, make changes in ourselves that would increase the degree to which other people value having connections with us

#2. Watch closely for emotion dysregulation

Emotion dysregulation is best understood as the repeated encroachment of unhelpful emotional patterns. According to researchers, it lies at the core of a range of psychological disorders.

Emotional dysregulation can be elusive, as it can result from multiple causes. According to psychologist Arela Agako, instances of this phenomenon coalesce around five themes:

- Brain activation

- Physiology

- Cognition

- Behavior

- Individual experience

“We can draw some conclusions from the overlap between all the different theories out there that try to define emotions and emotion dysregulation,” says Agako. “For example, in the case of fear, our amygdala gets activated (brain activation), we notice a lot of changes in our body, such as our heart rate increasing (physiology), we might notice thoughts related to danger (cognition), we might have an urge to run away (behavior), and we also might have different ways of describing this experience (experiential).”

An emotion can be activated when it is not helpful or needed. Or, an emotion can fail to activate when it is needed. It is not uncommon for the intensity of an emotion to be too high or too low than what is helpful in the moment. Moreover, emotions can last longer or shorter than we need them to. These things happen to everyone because our brains and bodies aren’t perfect.

If you are someone who struggles with emotional dysregulation, Agako has the following advice:

- Make time for the emotion, preferably in a comfortable setting and when you can dedicate a few minutes to it without being interrupted

- Notice precisely what the emotion feels like in your body

- Try to name the emotion

- Reflect on whether the emotion was justified by the situation or whether it came from somewhere else

- If the emotion is justified, ask yourself what the emotion is telling you you need at that moment. Is it finding social support? Is it figuring out a way to get out of a dangerous situation? Is it apologizing to someone? Or, is it something else?

- If the emotion isn’t justified, ask yourself if there is another way to think of the situation or what you might say to a friend who is in the same situation

#3. Use the “thinking threshold” to ride your emotional wave

Emotions are like waves: they have a beginning, middle, and end. Something (a situation in life, a thought about the past) triggers an emotion inside us. Like waves, emotions rise up, peak, and eventually come back down.

A study by psychologist Jennifer Villieux identified the “thinking threshold” as a level of emotional intensity above which thinking is impaired—where thinking is driven more by emotion than by logic. When one reaches this point, it is inadvisable to use strategies like cognitive reappraisal that require you to think logically as a means to regulate your emotions. Beyond the thinking threshold, complex cognition is impaired.

Therefore, using behavioral or sensory strategies is a better idea when above the thinking threshold, like splashing your face with ice water, taking a walk, or getting a hug.

Villieux also has the following words of wisdom for anyone who relates to this experience:

- Sometimes emotions need to be felt. It’s okay to just ride it out, because the emotion will not last forever. It will come down because that’s what emotions do; waves crest and then recede.

- In some cases, cognitive appraisal as a coping strategy may not be the best choice. For instance, cognitive reappraisal may lead to rationalizing of an abuser’s actions in a predatory or abusive relationship.

- When you have made it past the emotional peak, make a concerted effort to use cognitive strategies to avoid such surges in the future. So, when you can think clearly, try to engage in some perspective-taking, problem-solving, or reflection on the experience.

Conclusion: Emotions are a big part of our lives, whether we like them or not. With a little bit of perspective, planning, and objectivity, they can transform from being our kryptonite to being our North Star.

https://www.psychologytoday.com/us/blog/social-instincts/202207/3-ways-not-feel-overwhelmed-anymore