1. Bitcoin Reclaiming $50,000 -Bespoke

Although it has pulled back as of this writing, at its highs today, Bitcoin reclaimed the $50,000 level. That was the first time the world’s largest crypto currency has traded above that threshold (on an intraday or closing basis) since December 28, 2021. As shown below, following the record high set in November 2021, Bitcoin cratered 76.5% over the next year. Since its bottom in November 2022, the crypto has managed to rally 214%. A significant portion of those gains have come since last summer with steep increases in the price of Bitcoin from October through December and another sharp push higher in the past few weeks. In fact, as recently as January 25th, it was trading below $40,000. But nearly three weeks and $10,000 later, Bitcoin is looking to join the 5.5% of days in which it has formerly traded above $50,000. https://www.bespokepremium.com/interactive/posts/think-big-blog/bitcoin-reclaiming-50000

2. Crypto ETF Flows

Blockworks

https://blockworks.co/news/bitcoin-etf-first-month-charts found at Abnormal Returns Blog www.abnormalreturns.com

3. High-Yield Debt Spreads Falling

4. For First Time in Two Decades, U.S. Buys More From Mexico Than China -NYT

By Ana Swanson and Simon Romero The United States bought more goods from Mexico than China in 2023 for the first time in 20 years, evidence of how much global trade patterns have shifted.

A factory in the northern Mexico industrial hub of Saltillo. Mexico was among the markets that American consumers and businesses turned to last year for car parts, shoes, toys and raw materials.Credit…Daniel Becerril/Reuters

In the depths of the pandemic, as global supply chains buckled and the cost of shipping a container from China soared nearly twentyfold, Marco Villarreal spied an opportunity.

In 2021, Mr. Villarreal resigned as Caterpillar’s director general in Mexico and began nurturing ties with companies looking to shift manufacturing from China to Mexico. He found a client in Hisun, a Chinese producer of all-terrain vehicles, which hired Mr. Villarreal to establish a $152 million manufacturing site in Saltillo, an industrial hub in northern Mexico.

Mr. Villarreal said foreign companies, particularly those seeking to sell within North America, saw Mexico as a viable alternative to China for several reasons, including the simmering trade tensions between the United States and China.

“The stars are aligning for Mexico,” he said.

New data released on Wednesday showed that Mexico outpaced China for the first time in 20 years to become America’s top source of official imports — a significant shift that highlights how increased tensions between Washington and Beijing are altering trade flows.

https://www.nytimes.com/2024/02/07/business/economy/united-states-china-mexico-trade.html

5. Mexico Stock ETF vs. China ETF

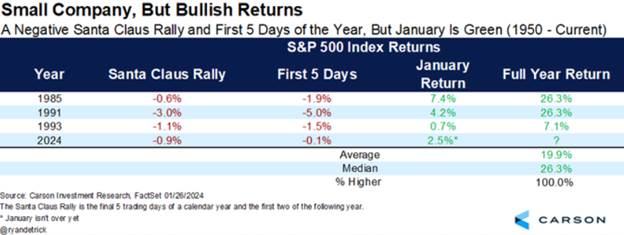

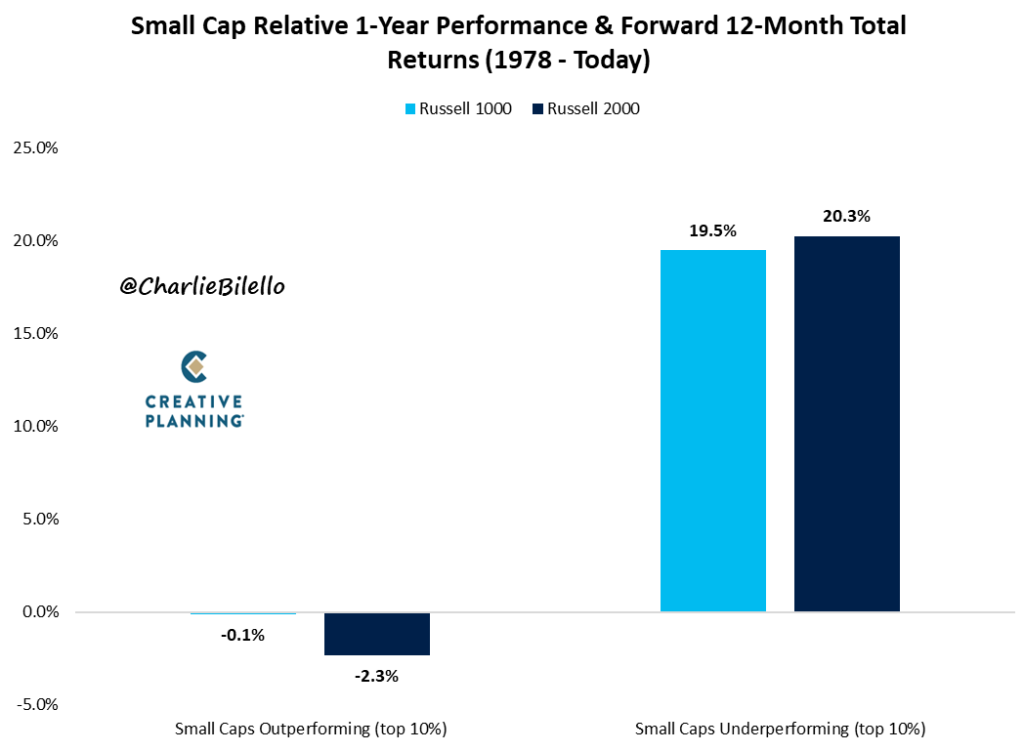

6. Forward 12-Month Earnings Estimates for Russell 2000 Sideways

Small Cap continues to trail S&P

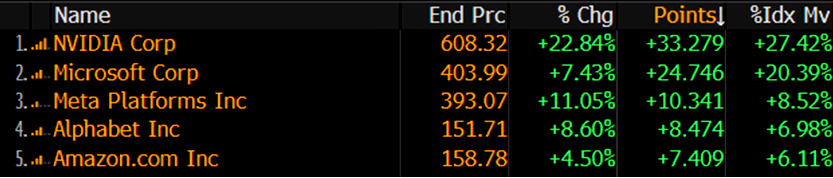

7. NVDA Dominates Data Centre Chip Spending

8. Private Equity Returns Plunge to Global Financial Crisis Levels

- Distributions as percent of net asset value fall to 11.2%

- Tough M&A, IPO markets impede PE exits, weighing on returns

By Swetha Gopinath and Kat Hidalgo

Private equity funds last year returned the lowest amount of cash to their investors since the financial crisis 15 years ago, according to Raymond James Financial Inc., hampering buyout firms in their efforts to launch new investment vehicles.

Distributions to so-called limited partners totaled 11.2% of funds’ net asset value, the lowest since 2009 and well below the 25% median figure across the last 25 years, according to the investment bank.

Higher borrowing costs, volatile markets and economic uncertainty have made it more difficult for private equity firms to exit their existing investments through sales or initial public offerings. This in turn has hampered their ability to return capital to pension and sovereign wealth funds, besides other key investors, meaning once-reliable clients are struggling to find cash to allocate new money to the asset class.

9. 4.4 Billion People Holding Presidential Elections This Year.

Capital Group

This is the biggest election year in world history. Seventy-six countries — home to roughly 4.4 billion people — will hold political contests in 2024. You might call it an “election palooza.”

Some have already taken place. Last month, Taiwan elected a pro-independence candidate who may aggravate already tense relations with China. A few elections are on the way, but largely decided. For instance, no one expects Russian President Vladimir Putin to face a serious challenge on March 17.

Then there is the event the entire world will be watching: U.S. elections on November 5, when the President and Vice President, 34 Senate seats and all 435 members of the House of Representatives will be up for election. Numerous state and local offices, as well as many important ballot measures, will be contested on that day as well.

10. The Meeting of the Minds: Human and Artificial

Psychology Today

After thousands of years, the human brain may have found a perfect partner. John Nosta

KEY POINTS

- Human brains and LLMs form a synergistic relationship, enhancing intellectual activity.

- Language is a shared foundation, enriching collective intelligence through mutual understanding.

- This partnership amplifies cognitive capabilities, expanding problem-solving and innovation.

- The convergence of human and machine intelligence represents a pivotal cognitive and social advance.

The human brain, a masterpiece of cosmic craftsmanship, might just be on the lookout for a like-minded companion. It’s a notion that’s as intriguing as it is speculative: our cerebral circuits, in all their complexity, yearning for an intellectual equal. But let’s not get too carried away just yet.

Our brains, those intricate networks of neurons, are remarkably adept at weaving through the complexities of thought with an ease that belies their biological underpinnings.

Engage in a deep, meandering conversation and you’ll find hours slipping by with the lightness of thought, uniquely untouched by the shadow of fatigue that physical exertion and lactic acid predictably bring. This “ethereal glide” through ideas and concepts, long celebrated in poetry and mysticism as a kind of effortless transcendence, finds an unexpected reflection in the digital realms of Large Language Models.

These LLMs, with their formidable computational might, mirror the human brain’s stamina for sustained thought, unburdened by the physiological limitations that tether us. Herein lies the groundwork for a remarkable partnership, a confluence where the flow of human intellect meets the steadfast currents of artificial intelligence, not in rivalry but in unique synergy that might even be akin to harmony.

It’s Starts with Language

At the intersection of human cognition and LLMs lies the complex domain of language, a common ground where the essence of our thoughts and the architecture of AI converge. Language serves as the bridge between these two realms, with its nuanced syntax, semantics, and pragmatics offering the basis for exploration and understanding.

For humans, language is the vessel of consciousness, carrying the weight of our ideas, emotions, and cultural heritage. For LLMs, it is the structured data through which they learn, interpret, and generate responses, mirroring human-like patterns of communication. This shared linguistic foundation enables a unique dialogue between human intelligence and machine algorithms, fostering a collaborative exchange that enriches both the depth and breadth of our collective knowledge and interactions.

The Interplay of Complementary Minds

When human cognition collaborates with LLMs, the partnership is marked by complementary capabilities. Humans contribute a deep understanding characterized by subtlety, emotional insight, and creative thinking. In contrast, LLMs bring powerful data processing abilities, extensive memory capacity, and advanced pattern recognition. This combination doesn’t merely enhance our cognitive abilities; it expands them, allowing for more thorough analysis and wider exploration in problem-solving and innovation.

Elevating Collective Wisdom

This melding of human and machine intelligence charts a course towards a future unbound by the finite limits of our organic brains. Together, these cognitive partners amplify our mental processes with a machine’s efficiency, broadening our analytical reach and deepening our exploration of complexities. This synergy isn’t just multiplicative; it’s transformative, fostering a unique alliance that bolsters our collective intellect. To say “You complete me” might stretch the metaphor a bit thin, but there’s undeniable magic in this union.

In Search of a Cognitive Counterpart

The collaboration between LLMs and the human brain emerges as a remarkable alignment within intellectual development. This partnership, grounded in the mutual language of cognition, seems almost serendipitous, reflecting a natural progression towards enhanced, even optimized cognition.

Along this curious path, it feels evident that the interplay between our innate cognitive abilities and the capabilities of artificial intelligence is an inevitable step in our evolutionary journey. This synergy not only amplifies our existing capacities but also unlocks new avenues of exploration and creativity, suggesting that the synergy of human and machine intellect is a key milestone in our continuous quest for knowledge and understanding.

Found at Barry Ritholtz blog

Found at Barry Ritholtz blog

Netflix Documentary Yogi’s stats were off charts and10 world series rings

Netflix Documentary Yogi’s stats were off charts and10 world series rings