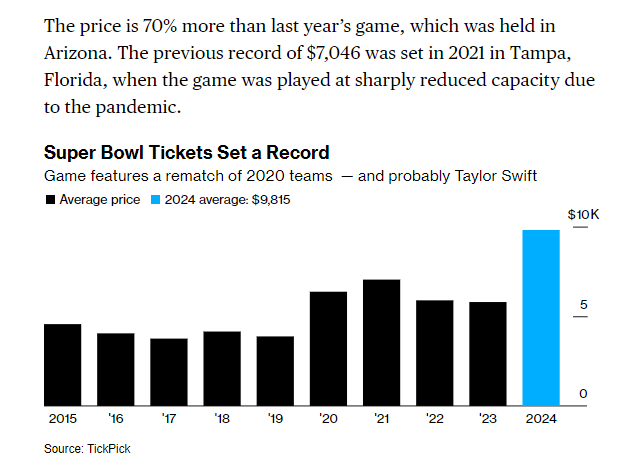

1. History of a Positive January

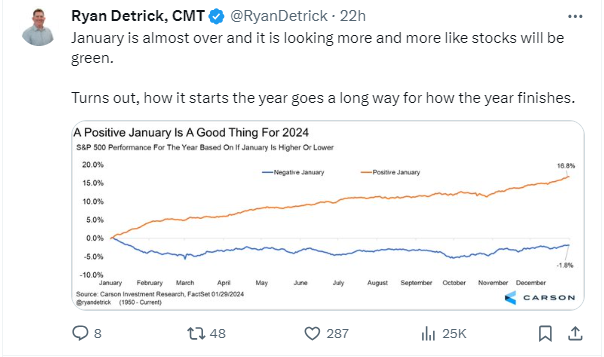

2. Big 7 Reporting this Week …Big Growth Premium

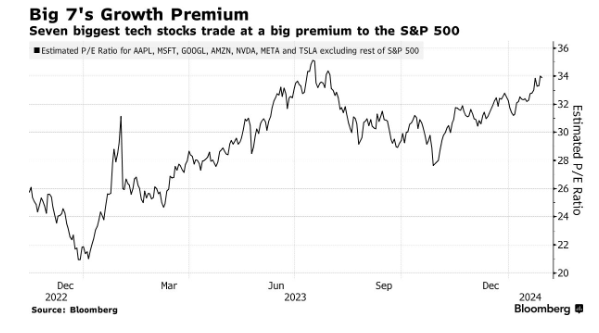

Jonathan Krinsky at BTIG noted that a basket of 50 companies that “matter most” to hedge funds is about as extended on a daily basis as it’s been over the last two decades. Many of these holdings are semiconductors, megacap tech and communication services, he noted.

3. Tesla 30x Sales to 6.6x Sales

@charliebilello

4. GM vs. Tesla

GM earnings yesterday stock finished +8%….GM vs. Tesla chart 50day about to go thru 200day to upside.

5. GM vs. Rivian and Lucid Chart

GM vs. RIVN about to break to new highs.

GM vs. LCID

6. Disney Chart Update

DIS showing some life…holding 200-day a couple times…breaking above sideways 3 months.

7. UPS Staircase Down for 3+ Years

See if UPS holds Nov. 2023 lows.

8. Banks Selling Some Commercial Loans at Discount

Business Insider Daniel Geiger Lenders are bailing out of commercial real estate as a wave of debt builds Aon Center, an 83-story tower in Chicago, entered special servicing at the beginning of 2023.

- Some $2.1 trillion of commercial estate debt is estimated to come due by the end of 2025.

- Banks and other lenders could face big losses on those debts.

- Recent loan sales show that banks are trying to limit their exposure.

Amerant Bank, a large community bank based in Coral Gables, Florida, recently announced that it had reached a deal to sell a $401 million portfolio of loans tied to a collection of apartment buildings in Houston for $370 million – a roughly 7% discount on the debt’s remaining balance. Amerant’s chief executive, Jerry Plush, described the planned sale on a January 25 earnings call as part of an effort to refocus its business on clients with whom the bank has an ongoing relationship.

Banking and loan experts, however, see deeper motivations behind the decision by the bank and a growing number of other financial institutions that are beginning to unload commercial real estate loans.”I don’t ever like banks having to take a loss,” said Stephen Scouten, a senior research analyst at Piper Sandler who covers Amerant. “Longer term, it’s probably of some benefit.”

Roughly $2.1 trillion of debt connected to commercial real estate assets, including office properties, apartment buildings, hotels, and retail spaces, will come due between now and the end of 2025 in the US, according to the real estate services firm JLL. With higher interest rates sapping commercial property values, JLL estimates that property owners will have to pour about $265 billion into paying down those loan balances in order to refinance. The wave of maturities and the enormous equity shortfalls have raised concerns that a growing number of commercial real estate debts will fall into distress, forcing banks and other lenders to suffer losses.

The recent loan sales suggest that lenders are beginning to take a defensive posture, diminishing their exposure to the commercial property sector and raising cash. “Staring at a problem is not going to make it go away,” said Kevin Aussef, the president of US investment sales at CBRE, who noted that the firm had just been hired by the Canadian bank CIBC to sell a $316 million bundle of US office loans. “At some point in time, you are better off responding to it than waiting.”

Aussef said that, for the time being, banks were seeking to sell off healthier loans at prices close to the face value of the debt and avoid heavily discounted sales that might force them to mark down loans more broadly across their portfolios. “We’re not seeing an avalanche of these lenders coming to the market,” Aussef said. The pace, however, is picking up.

https://www.businessinsider.com/banks-commercial-real-estate-loan-sales-debt-interest-rates-2024

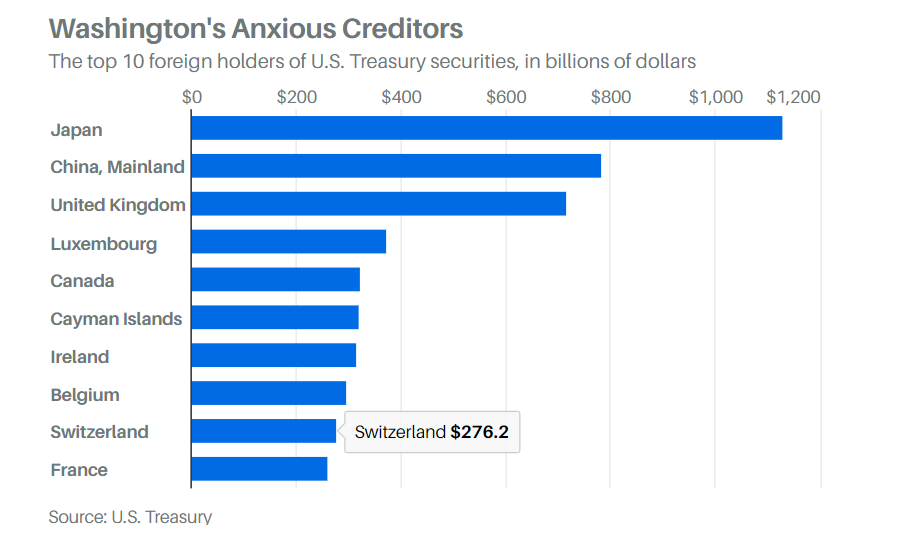

9. Update on Holders of U.S. Treasuries

Barrons By William Pesek

https://www.barrons.com/articles/treasury-debt-china-japan-politics-4bb5d665?mod=past_editions

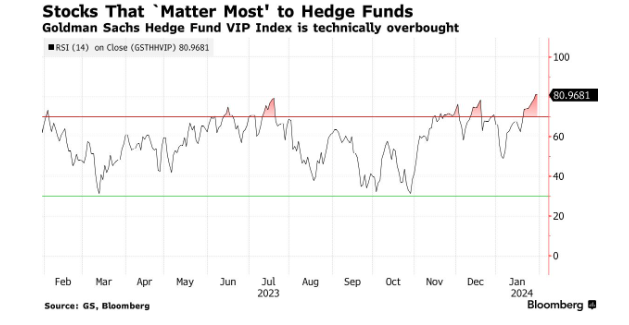

10. Superbowl Tickets 70% More than Last Year’s Game

Bloomberg