1. Big Level to Hold for BYD

TSLA international competitor and Warren Buffett Holding BYD…about to break 2022 and 2023 lows.

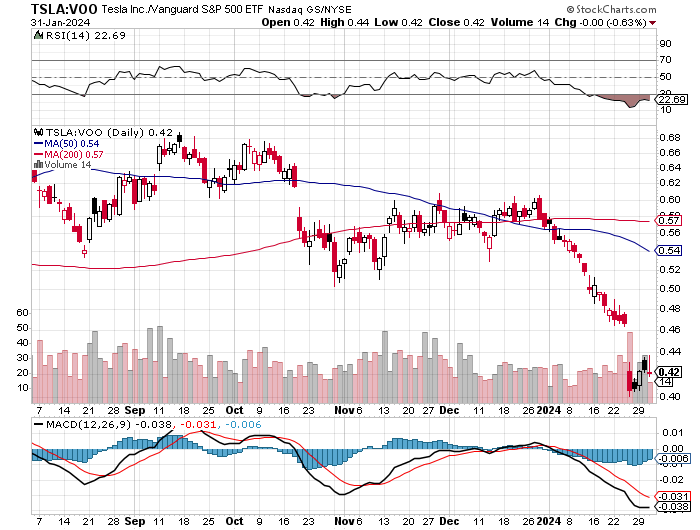

2. Tesla -24% YTD…TSLA Vs. S&P Chart.

This chart is TSLA vs. S&P…new lows with gap down 2024

3. AAPL held 200day Twice in 2024

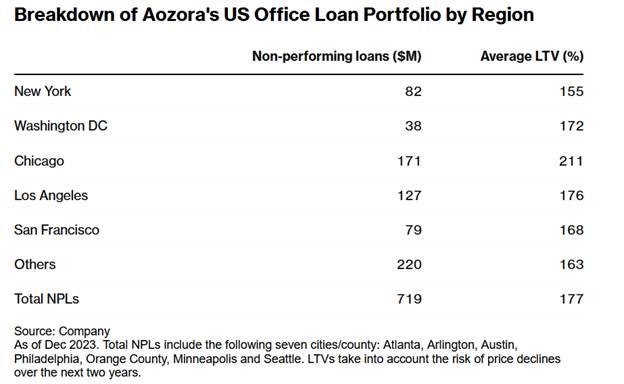

4. Tokyo Bank Aozora Loan to Value Book in U.S. …Loan to Value Book (LTVs) Not Good.

Dave Lutz Tokyo-based Aozora Bank plunged more than 20% after warning of a loss tied to investments in US commercial property. In Europe, Deutsche Bank AG more than quadrupled its US real estate loss provisions to €123 million ($133 million) in the fourth quarter from a year earlier

89% of US household debt is fixed rate (mortgage, student, and auto loans) and 11% is floating rate (credit cards, HELOC, and other types of debt).

As a result, the transmission mechanism of monetary policy has been weak. Combined with significant excess savings during the pandemic, Fed hikes have had a limited impact on the consumer.

5. Spin-Off ETF Did Not Make New All-Time Highs Yet

Spin-Offs favorite of hedge funds

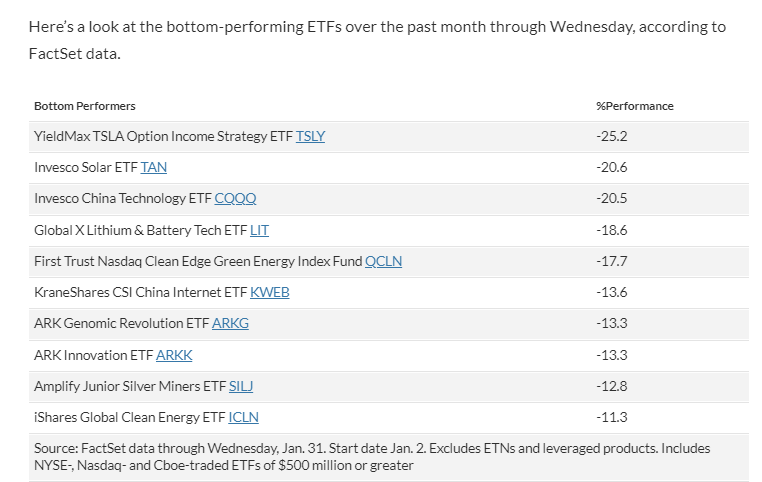

6. Worst Performing ETFs 2024

From Marketwatch By Isabel Wang

7. 89% of U.S. Consumer Debt is Fixed Rate

Torsten Slok, Ph.D. Chief Economist,PartnerApollo Global Management

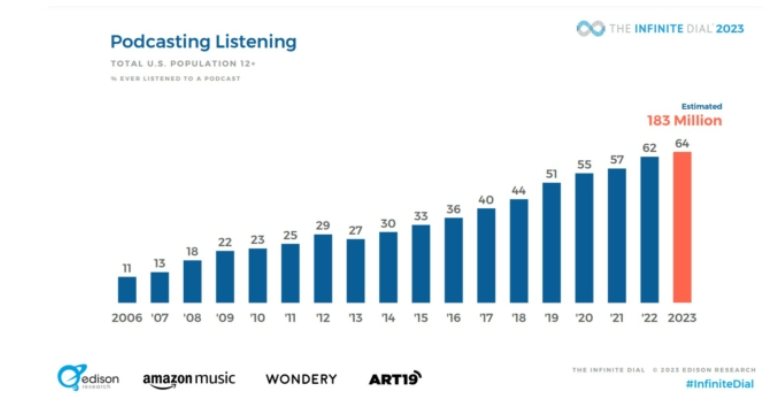

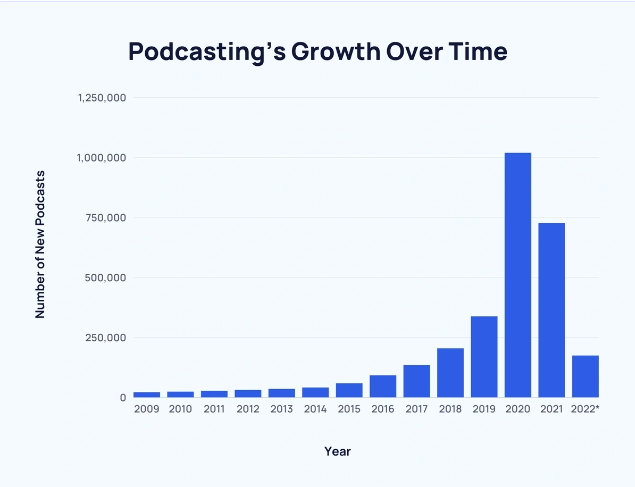

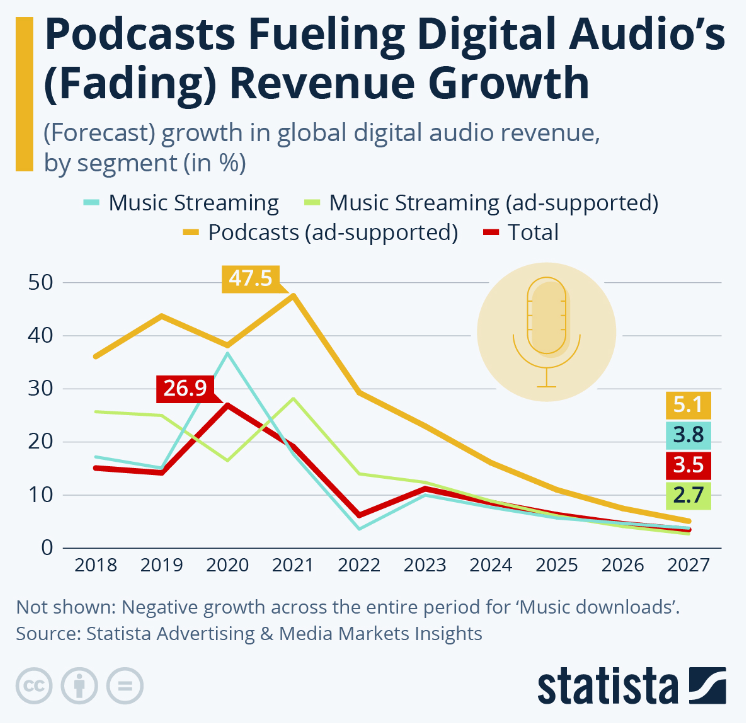

8-9. Podcast Growth and Lack of Profitability

https://explodingtopics.com/blog/number-of-podcasts

https://www.statista.com/chart/29217/digital-audio-revenue-growth-forecast-by-segment/

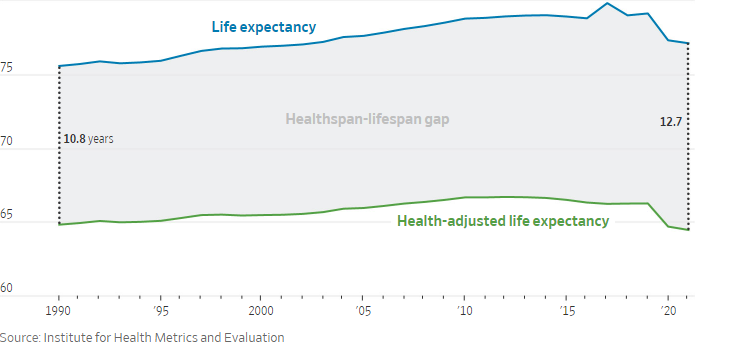

10. What’s The Most Overlooked Component Of Your Financial Plan?

by Anthony Isola found at Abnormal Returns Blog

“I guess it comes down to a simple choice – get busy living or get busy dying.” The Shawshank Redemption (1994)

Retirement is more than just years.

The two most integral terms regarding your retirement have zero to do with stocks and bonds.

Understanding the difference between Healthspan and Lifespan drives the quality of your retirement, regardless of how much money you’ve accumulated.

A simple definition of Healthspan is the number of years we feel good. How long can we continue doing the activities that produce the most pleasure? To increase Healthspan, we need freedom from disability and disease.

Lifespan is the length of time we live, disregarding health. The gap between these has noticeably increased over the last 30 years, surging from 10.8 to 12.7 years over this timeframe.

A dominant reason for the increased gap is Americans are living longer. Old age presents more opportunities for developing chronic health conditions.

The dilemma is not all of the disparity is explained by age-related causes. Substance Abuse, Obesity, and Diabetes are becoming more prevalent in younger people. The same applies to mental health disorders.

According to a Centers for Disease Control and Prevention study in 2018, roughly 27% of U.S. adults had multiple chronic conditions, up from 25% in 2012 and 22% in 2001.

Health conditions can wreck the retirement of any individual. Seven-figure portfolios aren’t immune from chronic diseases’ devastating toll.

The data on the importance of Healthspan vs. Lifespan should serve as a wake-up call to anyone who believes a bull market is the prime ingredient for a successful retirement plan.

According to the Wall Street Journal:

Developing health conditions takes more than a physical toll. A substantial health problem reduces life satisfaction more than losing a job or becoming widowed, divorced, or separated, according to a 2022 study published in the Journal of Economic Behavior and Organization.

Do you want to live to be a centenarian if the price includes 20-25 years of existing with chronic painful conditions slowly decaying your cognitive and physical abilities?

That’s the distinction between Healthspan and Lifespan.

https://tonyisola.com/2024/01/whats-the-most-overlooked-component-of-your-financial-plan/ Found at Abnormal Returns Blog www.abnormalreturns.com