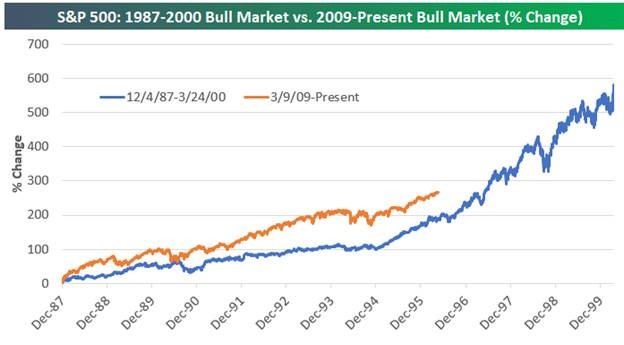

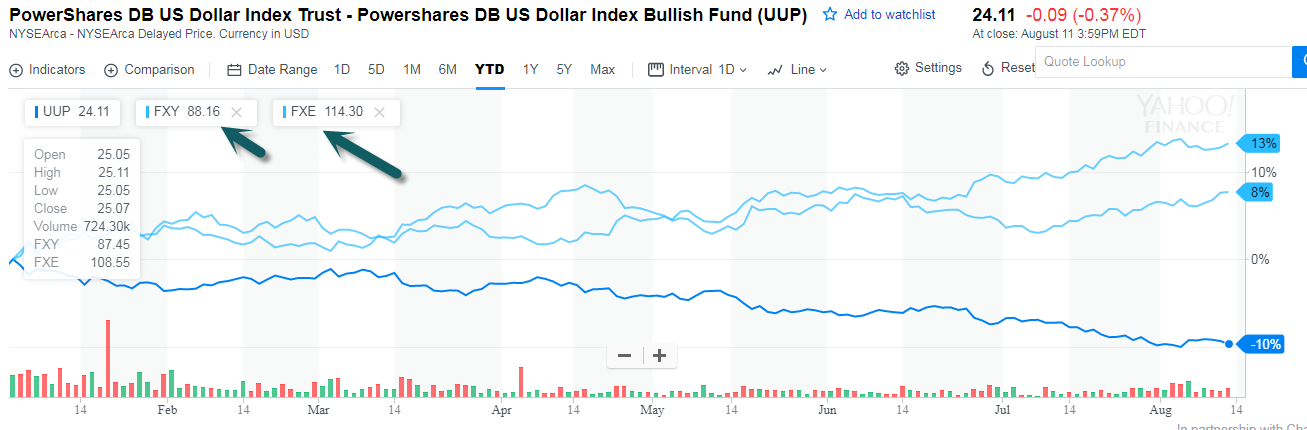

1.Dollar Bull Chart UUP -10% in 2017.

Dollar Bull Chart UUP Vs. FXY (YEN) FXE (Euro)

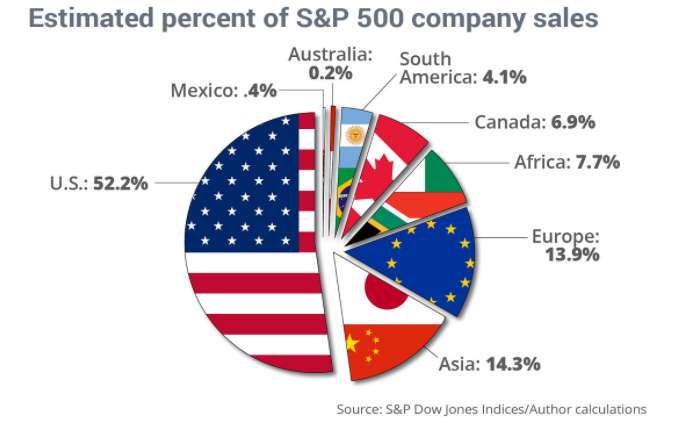

As Large Cap Growth has Dominated Market…Will they get another boost from weak dollar??? Tech sales 64% international

Barrons Story

The Bad News Buck

The dollar has declined against every major currency in 2017, and is down 11% against the euro, 6% against the yen and 5% against the pound sterling.

The buck has declined against every major currency in 2017; it’s down 11% against the euro, 7% against the yen, and 5% against the pound sterling. This boosts U.S. exports, pads the buying power of visitors, and has widespread impact in the stock market: Technology companies’ strong sales, nearly 60% of which are earned abroad, look even stronger when translated back into dollars. The 50 stocks in the Standard & Poor’s 500 index with the most overseas revenues surged 13.8% in the first half, versus 1.3% for the 50 with the most domestic sales, notes Bespoke Investment Group.

http://www.barrons.com/articles/the-bad-news-buck-1502505659