Sep 11, 2017

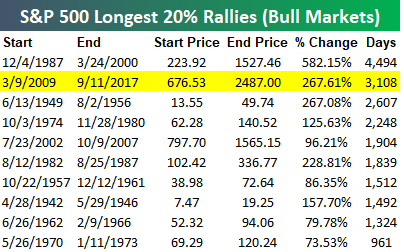

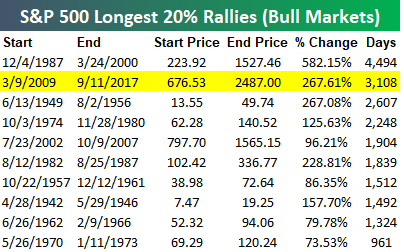

Back in late July we published a Chart of the Day looking at the current rally and how it ranks in terms of length without a significant pullback of any kind. With the S&P 500 closing at a new all-time high today, it has now been 3,108 calendar days since the last 20% decline (the standard bull/bear market distinction). As shown in the table below of the longest bull markets on record, the current bull is the second longest behind the 4,494 days that passed between December 1987 and March 2000 without a 20%+ pullback.

Today’s close was also a big deal in terms of gains for the current bull market. As shown, the S&P’s gain of 267.61% makes this the second strongest bull market on record as well.

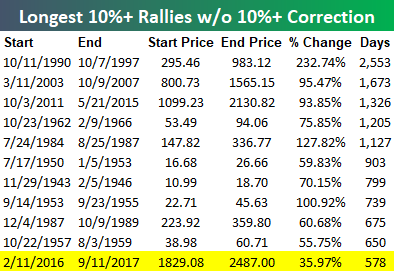

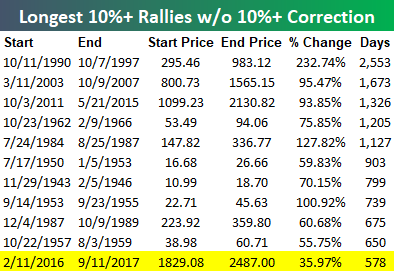

It has also been a long time since the S&P 500 had a 10% correction. As shown, the current streak of 578 days since the last 10%+ correction is the 11th longest on record going back to 1928.

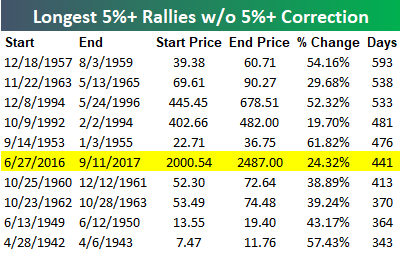

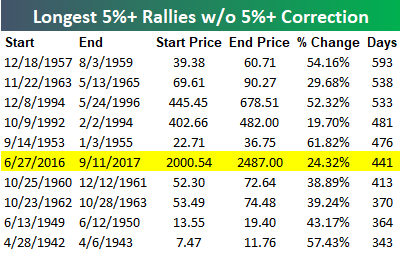

Not only have we not had a 10% correction in more than 18 months, but we also haven’t even had a 5%+ correction since last June. The 441-day streak without a 5%+ correction is the sixth longest on record for the S&P 500.

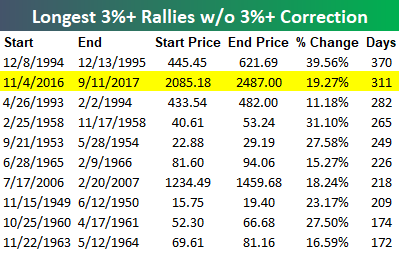

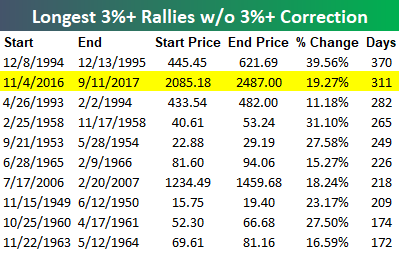

And finally, it has now been 311 days since the S&P 500 last experienced just a 3% pullback. As shown below, this is the 2nd longest streak of all-time without a 3%+ pullback.

To break this record, we’ll need to go another 59 days without declining 3% from today’s close.

Pay just $1 to access any of Bespoke’s premium membership levels for the next month!

https://www.bespokepremium.com/think-big-blog/

Continue reading →

IAT-breaks 200day back to June lows.

IAT-breaks 200day back to June lows.