1. Longest Rally Since…

Sep 11, 2017

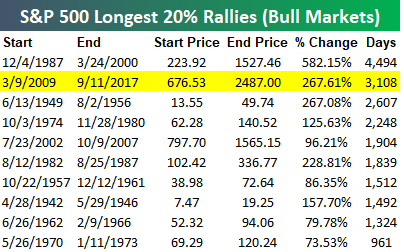

Back in late July we published a Chart of the Day looking at the current rally and how it ranks in terms of length without a significant pullback of any kind. With the S&P 500 closing at a new all-time high today, it has now been 3,108 calendar days since the last 20% decline (the standard bull/bear market distinction). As shown in the table below of the longest bull markets on record, the current bull is the second longest behind the 4,494 days that passed between December 1987 and March 2000 without a 20%+ pullback.

Today’s close was also a big deal in terms of gains for the current bull market. As shown, the S&P’s gain of 267.61% makes this the second strongest bull market on record as well.

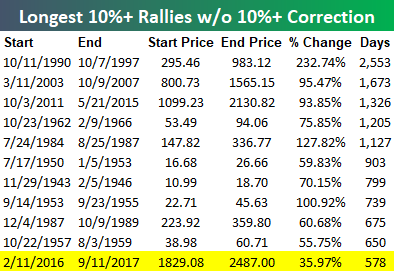

It has also been a long time since the S&P 500 had a 10% correction. As shown, the current streak of 578 days since the last 10%+ correction is the 11th longest on record going back to 1928.

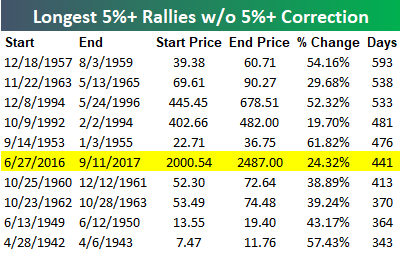

Not only have we not had a 10% correction in more than 18 months, but we also haven’t even had a 5%+ correction since last June. The 441-day streak without a 5%+ correction is the sixth longest on record for the S&P 500.

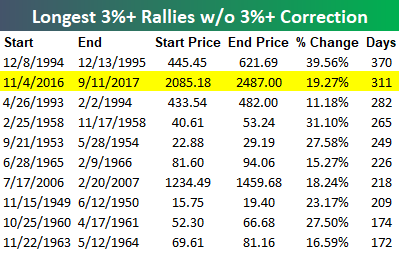

And finally, it has now been 311 days since the S&P 500 last experienced just a 3% pullback. As shown below, this is the 2nd longest streak of all-time without a 3%+ pullback.

To break this record, we’ll need to go another 59 days without declining 3% from today’s close.

Pay just $1 to access any of Bespoke’s premium membership levels for the next month!

https://www.bespokepremium.com/think-big-blog/

2.Tech Continues to Lead

Gap Widens between Tech and Value

QQQ +22% YTD vs. RUJ small cap value -2%

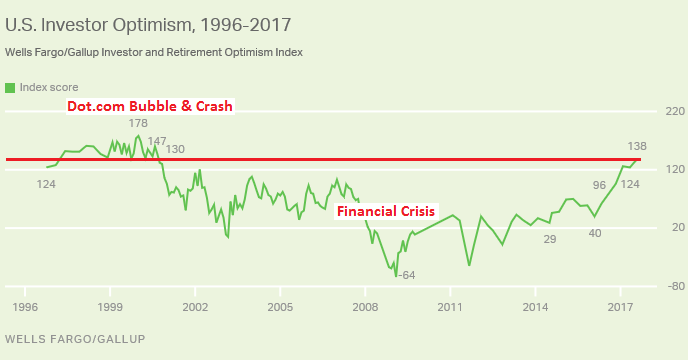

3.According to Wells Fargo Sentiment Poll Retail is at Bullish Records

Since February 2016, the overall index has soared 98 points, “the largest increase in the 20-year history of the index that is not a rebound immediately after a major drop in optimism.” This is the kind of move contrarians eat up.

4.Biggest Shorts in Retail Space.

Stock pickers are betting big against these 10 retail stocks

People waiting for a horse race at the San Siro center in Milan.

The retail apocalypse could pay off in a huge way for stock pickers.

Bets against retail stocks continue to increase as traders eye an even bigger drop in their stock prices. Analysts at RBC Capital Markets have identified 10 stocks with the most short interest.

Topping the list are some usual suspects like J.C. Penney, which announced earlier this year that it would close 138 stores. But there are some newcomers as well. RBC notes that Urban Outfitters, Boot Barn, and Signet Jewelers have seen the biggest spikes in short interest.

On the other hand, Buckle, Abercrombie & Fitch, and The Children’s Place have seen the biggest drops in short interest.

Scroll to see the 10 retail stocks with the highest short interest, according to RBC:

- The Children’s Place

Ticker: PLCE

Short interest as a percent of float: 26%

- Abercrombie & Fitch

Ticker: ANF

Short interest as a percent of float: 26%

- Under Armour

Ticker: UAA

Short interest as a percent of float: 28%

- The Finish Line

Ticker: FINL

Short interest as a percent of float: 28%

- Ascena Retail Group

Ticker: ASNA

Short interest as a percent of float: 29%

- Tailored Brands

Ticker: TLRD

Short interest as a percent of float: 30%

- Fossil

Ticker: FOSL

Short interest as a percent of float: 35%

- Dillard’s

Ticker: DDS

Short interest as a percent of float: 40%

- J.C. Penney

Ticker: JCP

Short interest as a percent of float: 42%

- Boot Barn Holdings

Ticker: BOOT

Short interest as a percent of float: 55%

5.SPY No Longer King of ETF World….S&P ETF Sees Outflows for the Year as Price Wars Kick in…

Least Popular ETFs Of The Year

September 12, 2017

It may be surprising to hear that in a year in which ETFs are shattering records with regard to the amount of money they are taking in, the world’s largest exchange-traded fund isn’t participating in the bonanza. That’s right; the SPDR S&P 500 ETF Trust (SPY), the $242 billion behemoth, has actually had net outflows this year to the tune of $4.2 billion.

SPY isn’t the only ETF giant bleeding assets. There are a number of other funds from which investors have pulled billions of dollars. In some cases, there’s seemingly no rhyme or reason why these funds are losing interest. In others, it’s possible to come up with a plausible explanation.

In the case of SPY, for example, we can assume investors are gravitating toward cheaper rivals that track the same index.

- A $100 discount on registration to Inside ETFs 2018, the world’s largest ETF conference, and a chance to win a FREE pass to the event.

- A copy of Cerulli Associates’ “Advisor Edge: The Practice Management Issue.”TAKE THE SURVEY

For example, the iShares Core S&P 500 ETF (IVV) took in $24 billion this year, making it the world’s second-largest exchange-traded, fund with $125 billion in assets under management.

Investors likely appreciate IVV’s 0.04% expense ratio, which is less than half of SPY’s 0.09% expense ratio.

| Ticker | Fund | Expense Ratio | YTD Flows | AUM ($B) |

| SPY | SPDR S&P 500 ETF Trust | 0.09% | -3.5B | 242.33 |

| IVV | iShares Core S&P 500 ETF | 0.04% | 24B | 124.60 |

A Few Basis Points Matter

The same reasoning may be behind why the $37 billion iShares Russell 2000 ETF (IWM), which comes with an expense ratio of 0.20%, had outflows of $1.9 billion in the year-to-date period.

Competing funds like the ultra-cheap Vanguard Small Cap-Value ETF (VBR), the Schwab U.S. Small-Cap ETF (SCHA) and the iShares S&P Small Cap ETF (IJR)―with expense ratios of 0.05% to 0.07%―picked up a more than $6 billion in combined assets this year.

| Ticker | Fund | Expense Ratio | YTD Flows | AUM ($B) |

| IWM | iShares Russell 2000 ETF | 0.20% | -1.7B | 37.1 |

| VBR | Vanguard Small Cap Value Index Fund | 0.07% | 1.2B | 11.3 |

| SCHA | Schwab U.S. Small-Cap ETF | 0.05% | 0.7B | 5.5 |

| IJR | iShares Core S&P Small Cap ETF | 0.07% | 4.2B | 30.5 |

http://www.etf.com/sections/features-and-news/least-popular-etfs-year-0

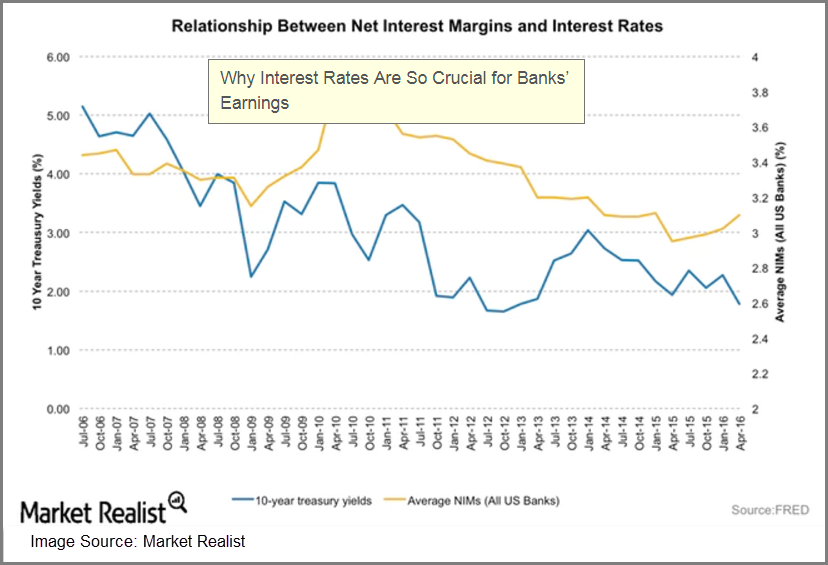

6.Banks Giving Back Most of Post Election Rally as Rates Move Lower.

Bank Bet was on Rates Moving Higher thereby increasing net interest margins

7-8.History Lessons of Storms.

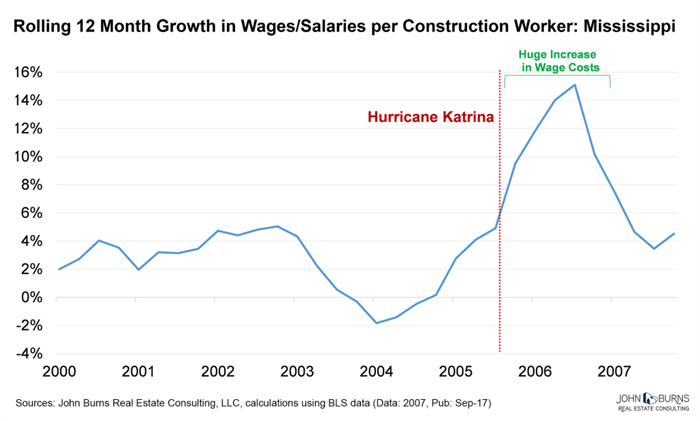

History Lesson #1: Labor Costs Will Rise

Following Hurricane Katrina, wages and salaries per construction worker jumped by over 14% in the state of Mississippi, as a shortage of workers drove up costs.

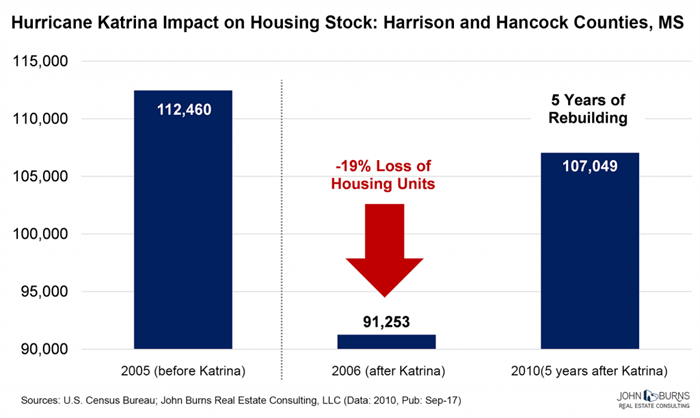

History Lesson #2: Five-Plus Years of Rebuilding for Hardest-Hit Areas

It took five years of rebuilding for Harrison and Hancock counties after Hurricane Katrina. Initially, this was catastrophic for the housing stock, as nearly 20% of housing was destroyed.

We expect 2017 US disaster repair and recovery spending to reach $23 billion, which is at least double that of 2016. Overall, this will increase national R&R spending 4% in 2017 and 1% in 2018. We are raising our 2017 and 2018 forecasts to 10% and 6% increases, respectively, in repair and remodeling expenses.

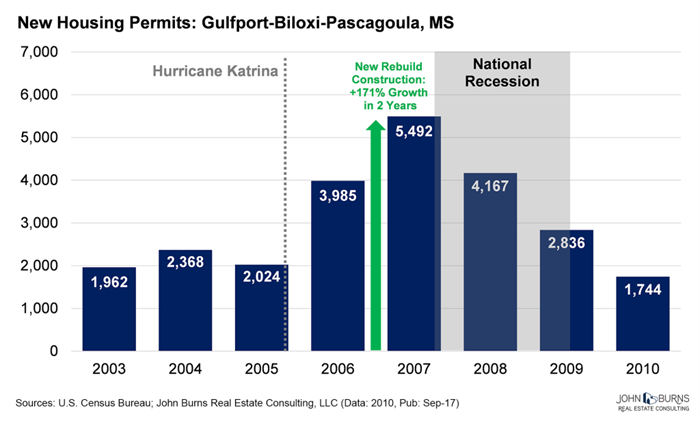

History Lesson #3: Short-Term Pain Immediately after Hurricane, Followed by ‘Catch-Up’ in Construction Volume

Construction grew by 171% in the two years following Hurricane Katrina, as homes lost to hurricane damage had to be rebuilt—despite approximately 200,000 New Orleans residents permanently relocating.

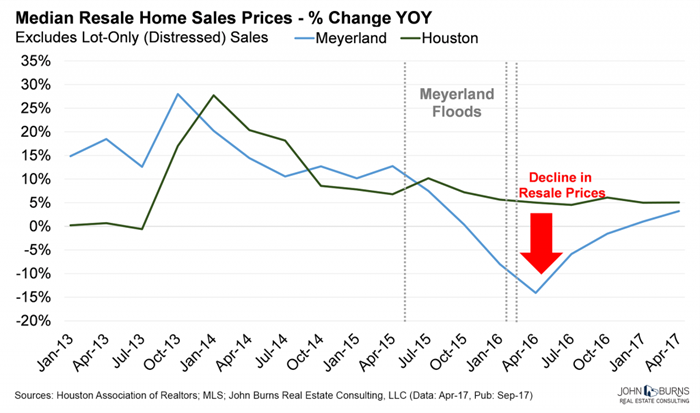

History Lesson #4: Resale Home Prices Take a 1-Year Hit after a Flood

Floods are hard on home prices. We looked at the impact of flooding on resale home prices in Meyerland, a community within Houston. Meyerland has flooded four times since 2015, with a huge effect on median home prices compared to the rest of the city. Resale prices declined by high single digits for about a year after the flood, while prices in the rest of Houston increased.

Median resale prices fell for two reasons:

- Meyerland became a less desirable neighborhood after repeated flooding.

- Many resale transactions (up to 20% in periods immediately following a flood) were homes in need of repair. The chart below shows home sales excluding lot-only (distressed from storm) sales.

In summary, it will be a long time before Houston returns to normal. We believe new home construction will fall in the short term but rise in the long term. New home prices will have to go up because costs will go up. We believe Houstonians will work hard to rebuild the region we love.

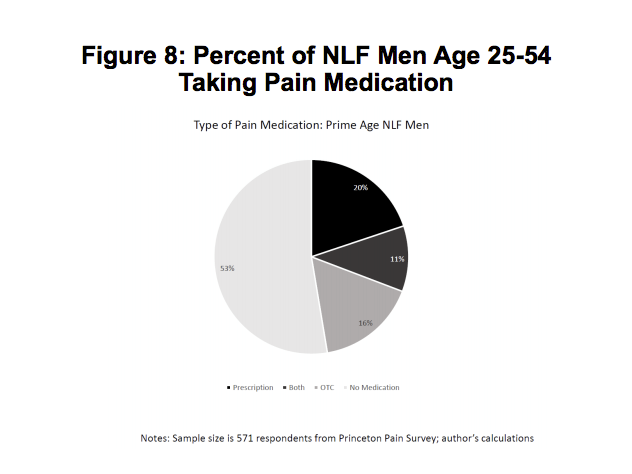

9. According to the author’s calculations….47% of men age 25-54 take pain medication.

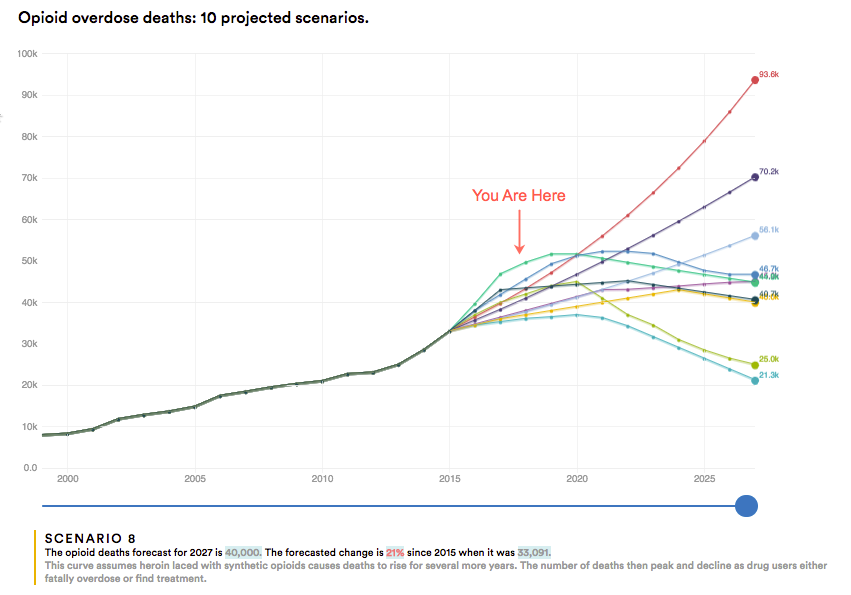

Princeton professor and former Obama White House economist Alan Krueger is out with a Bookings paper titled: Where Have All the Workers Gone? An Inquiry Into The Decline Of The U.S. Labor Force Participation Rate. In the report, Krueger gives it his best to correlate the “mushrooming opioid crisis in the U.S. since the early 2000’s” in connection between the use of “pain medication and opioid prescription rates” with the declining labor force of prime age males.

10.Let the Ball Come to You

I sucked at baseball when I was younger. It wasn’t because I was physically incapable of playing baseball.¹ It was mainly because I was undisciplined and tried to do too much. For instance, I was a decent right handed hitter, but I spent half my time practicing left handed. I had this infatuation with being a switch hitter because I grew up watching Bernie Williams and was obsessed with Mickey Mantle. And after having played hockey left handed for much of my youth I was comfortable swinging a bat left handed. This was super dumb. Baseball is hard enough as it is. Most great batters get out 70% of the time and here I was trying to get good at both sides of the plate wasting half my time on a skill I didn’t need. Quite simply, I lacked the discipline to focus on one thing and do it well.

I later retired from baseball and joined one of those old guy beer drinking softball leagues. This was even harder than baseball.² I joined a team loaded with young guys playing in an older guy’s league. We were superstars on paper. I learned to stay on one side of the plate, but the underhand pitch moved so slowly that I couldn’t get disciplined hitting it. It took weeks just to let the ball come to me so I could slap it at the right time it crossed the plate. Long story short, the old guys kicked the crap out of us and to add insult to injury we probably lost the beer drinking competition along the way. Our problems weren’t athleticism. It was all discipline. Let the ball come to you….

My fielding was even worse. I generally played infield and my discipline here was equally disastrous. My impatience resulted in lifting my head/glove or converging on the ball too quickly. I couldn’t ever get used to the ball just coming to me and staying patient and down on it. Again, a lack of discipline was the cause of so many problems. Let the ball come to you….

You can probably see all the asset allocation metaphors in there:

- Most people try to do more than they need to.They want the optimal portfolio rather than the appropriate portfolio. They think sophisticated beats simple when the exact opposite is usually true.

- Most people aren’t disciplined.They chase the markets rather than letting the markets come to them. Short-termism leads to undisciplined behavioral biases.

Before you can become good at something you have to first recognize why you’re not good at it now. Luckily for me I made most of my investment mistakes on the baseball field long before I ever had a dime at risk in the financial markets. Understanding those mistakes and creating a process for minimizing those mistakes has been a crucial element of better investment performance.

https://www.pragcap.com/let-the-ball-come-to-you/

¹ – What I mean by this is that I can run and throw. Not fast or well necessarily. But I am physically capable of both.

² – Funny story, my high school baseball team once played a women’s softball team for charity. I had never seen an underhand fastball and boy was that something to behold. I walked three times that game and thanked my lucky stars that she couldn’t throw that 80 mph pitch across the plate 3 times because I would have been toast.