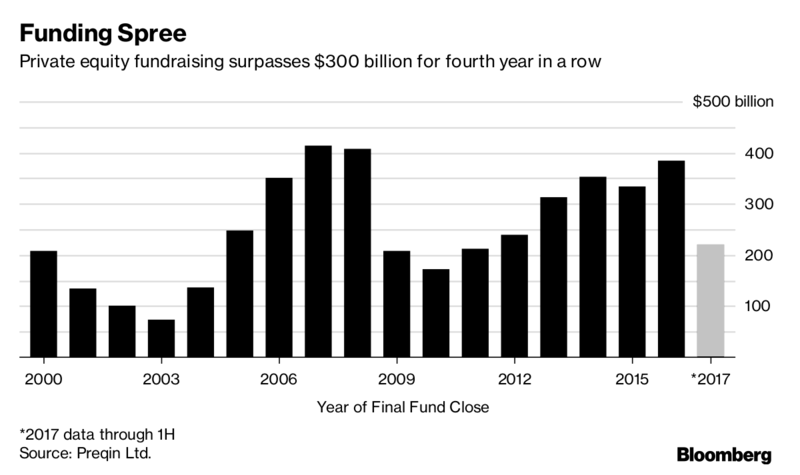

1.Global Private Equity Sitting on $1.5 Trillion in Cash…Up 50% Since 2012

Preqin noted in its 2017 annual report that 48% of institutional investors plan to increase allocations to private equity.

http://www.barrons.com/articles/big-ipo-gain-dont-bet-on-it-1505529036

https://www.bloomberg.com/news/articles/2017-08-08/why-private-equity-is-betting-on-your-online-shopping-addiction

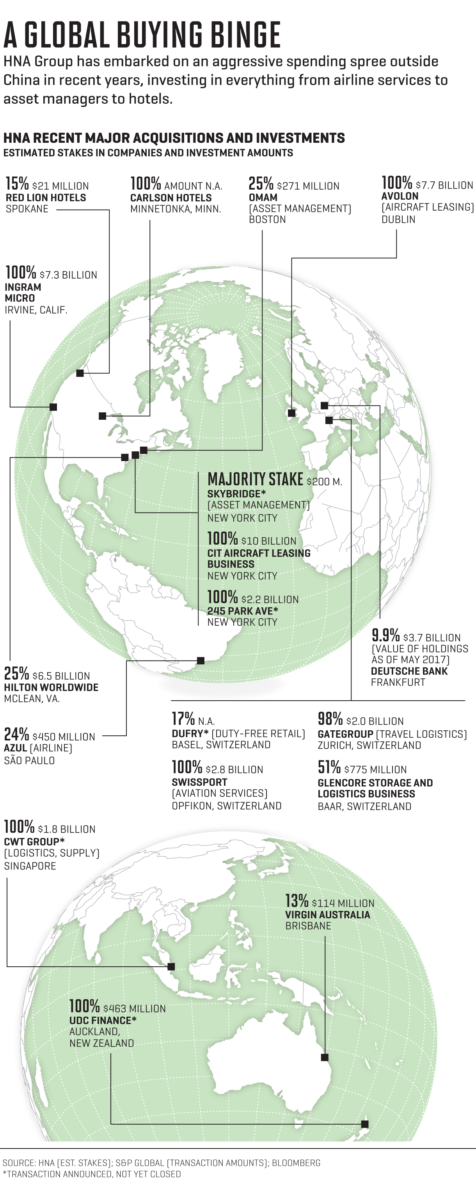

2.Add in Conglomerates Like HNA….They Own $35Billion in U.S. Assets.

You’ve Never Heard of HNA Group. Here’s Why You Will.

Jul 24, 2017

The $53 billion Chinese conglomerate already owns a company near you.

On a warm summer night in Paris, hundreds of executives, bankers, diplomats, and French officials walk the red carpet snaking up the steps of the Petit Palais museum—a sumptuous Beaux Arts building in the heart of the French capital, with sculptures and paintings set around a manicured garden. Under 200-year-old frescoes, the guests dine on lobster, duck, and white-chocolate mousse, prepared by a top French chef, washed down with grand cru Bordeaux, and topped off with entertainment from the Peking Opera. Three large red letters affixed to the ornate gates offer a clue about who’s throwing the invitation-only affair: HNA.

To the hundreds of people passing by, the name HNA probably means nothing. But to the business world at large, the presence of those three letters is another sign—if any is needed—that a little-known Chinese conglomerate with provincial roots has, in just a few years, transformed into a powerful global player with tentacles stretching across the planet.

HNA Group, headquartered in Hainan in southern China, still lacks the brand-name status it eagerly seeks. That’s despite the fact that it has plowed tens of billions of dollars into buying up foreign assets since 2015, on every continent—including $5.66 billion in just the past six months, according to the tracking firm Dealogic. By the company’s estimation, its investments in the U.S. alone have reached $35 billion.

Over the past two years, about $1 trillion has flowed out of China, as Chinese individuals and companies, having made fortunes at home and with state-owned banks willing to lend, invested elsewhere. Among those companies, one of the most aggressive has been HNA. Its dealmaking in some ways highlights how a mere handful of Chinese groups have snapped up dozens of Western assets, especially since the 2008 economic crisis, while at the same time leaving unanswered questions over ownership and transparency.

Source: Fortune

Found on Barry Ritholtz Blog

http://ritholtz.com/2017/09/global-buying-binge/

3.S&P 1500 Most Heavily Shorted Stocks

Sep 14, 2017

With the latest short interest figures for the end of August being released on Tuesday, we wanted to provide an update to our list of most heavily shorted stocks. Within the S&P 1500 as a whole, there are currently 17 stocks that have more than 40% of the free-floating shares sold short. Topping the list in the most recent update is Applied Optoelectronics (AAOI). You may recall a couple of months ago that we highlighted how well AAOI had performed even though it had more than half of its float sold short. Ironically, just after many shorts covered their bets, the stock cratered. Now, after the fact, the shorts are piling back in the name, pushing short interest to over 70% of its float. That’s higher than it ever got before the fall!

So far this month, shares of AAOI are just barely up, but most of the other most heavily shorted stocks are up a lot more. In fact, the average performance of the 17 stocks listed so far this month was a gain of 10.31% through Wednesday’s close. That average is a bit skewed by the 50%+ gain (yes, 50%!) in RH, but even on a median basis, the stock listed are up over 5% MTD compared to a gain of 1.1% for the S&P 1500 as a whole. Furthermore, only two of the stocks listed are down this month, and neither is down more than 1%.

https://www.bespokepremium.com/think-big-blog/

4.Huge Flows into Safety Trade Cash and Treasury ETFs

Barrons

Global fund managers are trading out of U.S. stocks, reducing their holdings to the lowest level since 2007, according to a survey released last week by Bank of America Merrill Lynch. So where are they putting their money? They’re more overweight emerging market stocks than they have been in seven years. They have a higher-than-average allocation to cash, at 4.8%, and more have taken out protection against a market drop than during any month in the past 14.

http://www.barrons.com/articles/dow-hits-record-highs-four-days-in-a-row-1505532324

From Dave Lutz at Jones

FLOW SHOW– U.S. fund investors sought shelter during the latest week, pouring more than double the amount from the previous week into money markets, and stockpiling the most in “safe haven” Treasuries in more than a year. Lipper and EPFR

Cash-like money market funds pulled in $17.7 billion, accelerating from $6.8 billion the previous week – Treasury mutual funds and ETFs attracted $3 billion, the most since January 2016 – TLT snapped up $1.7 billion in its largest week of inflows on record (Shares Outstanding TLT Above

5.Lumber Up Double the S&P this Year now Hurricane Season.

5.Lumber Up Double the S&P this Year now Hurricane Season.

Barrons

“In the second half of the three major hurricane years this century—2005, 2010, and 2013—lumber futures increased about a third in price on average” from the first half of those years, he says. The Atlantic hurricane season runs from June 1 to Nov. 30. The sharpest advance was in 2010, when futures gained 55% in the second half of the year, Rhind says. There were a dozen Atlantic hurricanes that year, including Hurricanes Earl and Igor.

http://www.barrons.com/articles/hurricanes-could-spur-big-rise-in-lumber-prices-1505530385

WOOD Lumber ETF +23% vs. S&P 11.5%

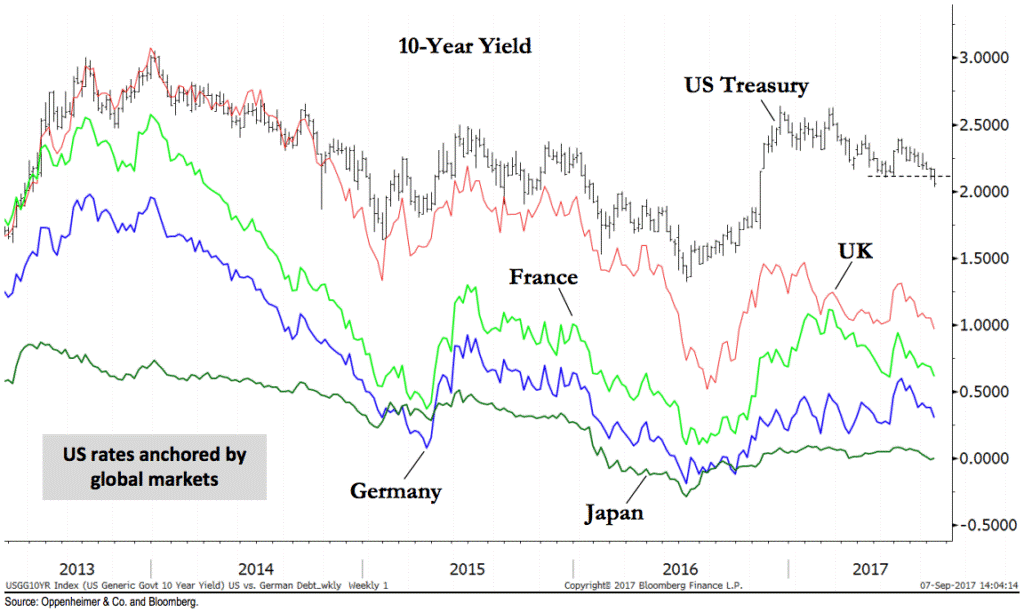

6.One Chart Tells Story of Why U.S. Rates Not Moving Higher.

From Josh Brown Blog The Reformed Broker

Ari Wald did this chart for Oppenheimer over the weekend and I think it’s a really good illustration of this phenomenon for those who don’t follow this sort of thing all day long.

US Rates Anchored Overseas

One risk to our bullish outlook is if US yields play “catch-down” to considerably lower rates in Europe and Asia, and a replay to the 2014 to 2016 market environment develops characterized by narrow internal breadth and wide credit spreads. Conversely, we think rising interest rates would be a tailwind towards a synchronized equity market recovery, and we think rates outside of the US need to move higher if rates in the US are going to move higher.

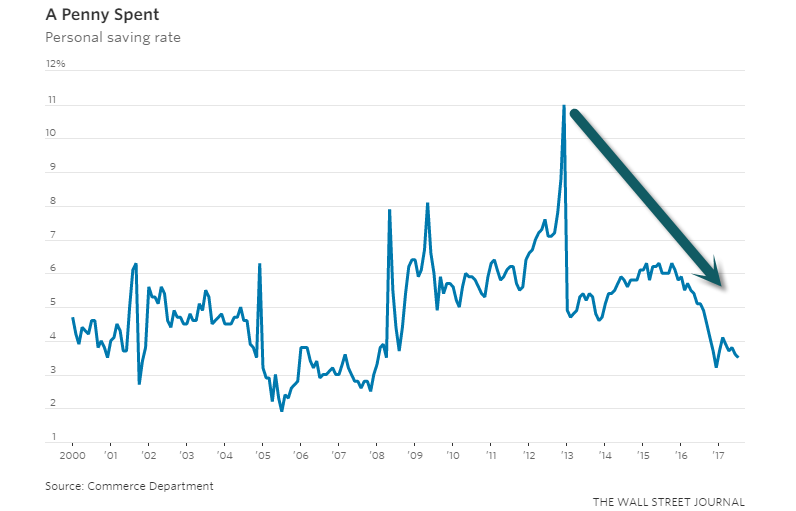

7.Americans Personal Savings Rate Erasing the Post 2008 Spike.

https://www.wsj.com/articles/why-u-s-consumers-are-feeling-spent-1505489481?tesla=y

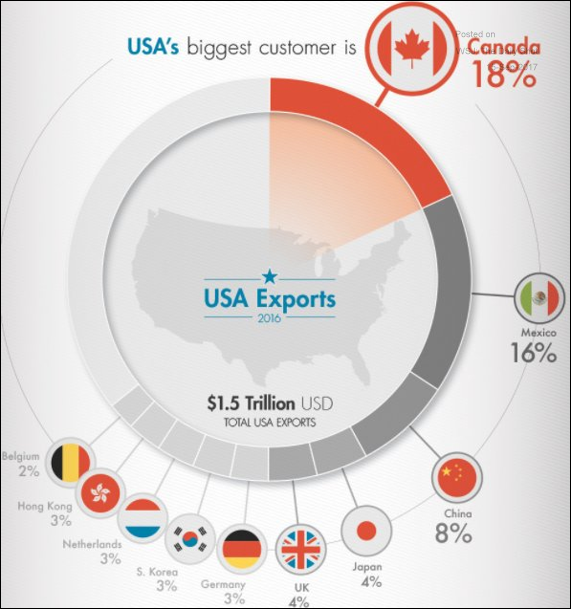

8.The United States: This chart shows the breakdown of US exports by country.

Source: @wef; Read full article

9.Read of Day…Vanguard Enters Active ETF Space.

Will Vanguard Trigger an Influx of Active ETFs?

Sept. 15, 2017 3:17 p.m. ET

The SEC’s decision to let Vanguard list active ETFs could prompt other active managers to create ETF versions of their mutual funds, according to Wealth Management.

The SEC earlier this month said it planned to approve Vanguard’s request to offer ETF versions of its actively managed mutual funds; analysts said that could increase competition and push down costs.

Active managers are uncomfortable with ETFs’ transparency, but they can’t deny the market demand, Todd Rosenbluth, director of ETF and mutual fund research at CFRA, tells Wealth Management. “It’s easier for them to not participate now because the pool of assets in active ETFs is small and you can say, ‘Well there’s isn’t yet client demand,’” Rosenbluth says. “If Vanguard proves there’s client demand—and we think they will—it’s an easier decision to make.”

Right now, 190 actively managed ETFs have a combined $40 billion of the ETF industry’s $3 trillion of assets. Rosenbluth believes Vanguard’s active ETFs will take off, prompting investors and advisors to look anew at the existing products.

The idea that daily transparency may be scaring many active managers away from ETFs is probably overstated, according to Ben Johnson, Morningstar director of global ETF and passive strategies research. “I think many are probably flattering themselves and thinking that people are anxious to get their hands on that recipe,” he tells Wealth Management, “but in this case just given the nature of the strategy, (daily portfolio disclosure) is not a very big concern.”

http://www.barrons.com/articles/will-vanguard-trigger-an-influx-of-active-etfs-1505503034

10.Why Successful People Spend 10 Hours A Week On “Compound Time”

Warren Buffett, Albert Einstein, Oprah Winfrey all do this one thing outside their to-do-lists everyday.

One question has fascinated me my entire adult life: what causes some people to become world-class leaders, performers, and changemakers, while most others plateau?

I’ve explored the answer to this question by reading thousands of biographies, academic studies, and books across dozens of disciplines. Over time, I’ve noticed a deeper practice of top performers, one so counter intuitive that it’s often overlooked.

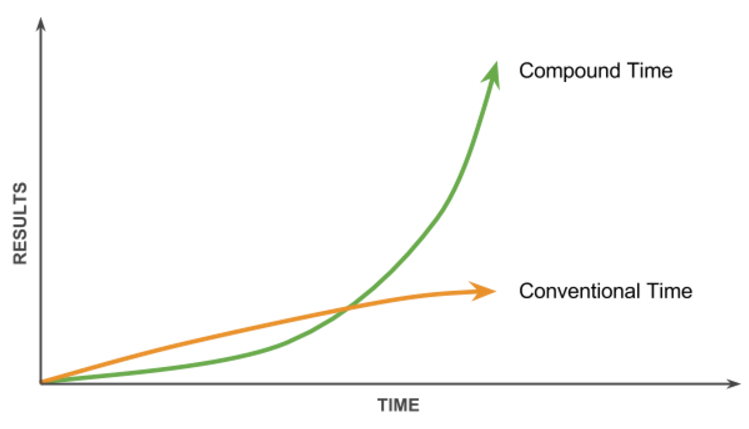

Despite having way more responsibility than anyone else, top performers in the business world often find time to step away from their urgent work, slow down, and invest in activities that have a long-term payoff in greater knowledge, creativity, and energy. As a result, they may achieve less in a day at first, but drastically more over the course of their lives.

I call this compound time because, like compound interest, a small investment now yields surprisingly large returns over time.

Warren Buffett, for example, despite owning companies with hundreds of thousands of employees, isn’t as busy as you are. By his own estimate, he has spent 80 percent of his career reading and thinking.

At the 2016 Daily Journal annual meeting, Charlie Munger, Buffett’s 40-year business partner, shared that the only scheduled item on his calendar one week was getting his haircut and that most of his weeks were similar. This is the opposite of most people who are overwhelmed with short-term deadlines, meetings, and minutiae.

Ben Franklin once wisely said: “An investment in knowledge pays the best interest.” Perhaps the source of Buffett’s true wealth is not just the compounding of his money, but the compounding of his knowledge, which has allowed him to make better decisions. Or as billionaire entrepreneur, investor, and philanthropist Paul Tudor Jones has eloquently said, “Intellectual capital will always trump financial capital.”

To build your own intellectual capital, here are six compound time activities that you can start incorporating into your life immediately:

Hack #1: Keep a journal. It could change your life.

Many top performers go beyond open-ended reflection: they often combine specific prompts with a physical journal.

Each morning, Benjamin Franklin asked himself, “What good shall I do this day?” and each evening, “What good have I done today?” Steve Jobs stood at the mirror each day and asked, “If today were the last day of my life, would I want to do what I am about to do?” Both billionaire Jean Paul DeJoria and media maven Arianna Huffington takes a few minutes each morning to count their blessings. Oprah Winfrey does the same: she starts each day with her gratitude journal, noting five things for which she’s thankful.

Billionaire entrepreneur and investor Reid Hoffman asks himself questions about his thinking before bed: What are the kind of key things that might be constraints on a solution, or might be the attributes of a solution? What are the tools or assets I might have? What are the key things that I want to think about? What do I want to solve creatively? Grandmaster chess player and world champion martial artist Josh Waitzkin has a similar process, “My journaling system is based around studying complexity. Reducing the complexity down to what is the most important question. Sleeping on it, and then waking up in the morning first thing and pre-input brainstorming on it. So I’m feeding my unconscious material to work on, releasing it completely,and then opening my mind and riffing on it.”

Whenever legendary management consultant Peter Drucker made a decision, he wrote down what he expected to happen; several months later, he’d compare the results with his expectations. Leonardo da Vinci filled tens of thousands of pages with sketches and musings on his art, inventions, observations, and ideas. Albert Einstein amassed more than 80,000 pages of notes in his lifetime. Former President John Adams kept over 51 journals throughout his life.

Ever notice that after writing about your thoughts, plans, and experiences, you feel clearer and more focused? Researchers call this “writing to learn.” It helps us bring order and meaning to our experiences and becomes a potent tool for knowledge and discovery. It also augments our ability to think about complex topics that have dozens of interrelated parts, while our brain, by itself, can only manage three in any given moment. A review of hundreds of studies on writing to learn showed that it also helps with what’s calledmetacognitive thinking, which is our awareness of our own thoughts.Metacognition is a key element in performance.

Hack #2: Naps can dramatically increase learning, memory, awareness, creativity, and productivity.

Pulling from the results of more than a decade of experiments, nap researcher Sara Mednick of the University of California, San Diego, boldly states: “With naps of an hour to an hour and a half… you get close to the same benefits in learning consolidation that you would from a full eight hour night’s sleep.” People who study in the morning do about 30% better on an evening test if they’ve had an hour-long nap than if they haven’t.

Albert Einstein broke up his day by returning home from his Princeton office at 1:30 p.m., having lunch, taking a nap, and then waking with a cup of tea to start the afternoon. Thomas Edison napped for up to three hours per day. Winston Churchill considered his late afternoon nap non-negotiable. John F. Kennedy ate his lunch in bed before drawing the curtains for a one- to two-hour nap. Others who swore by daily naps include Leonardo Da Vinci (up to a dozen 10-minute naps a day), Napoleon Bonaparte (before battles), Ronald Reagan (every afternoon), Lyndon B. Johnson (30 minutes a day), John D. Rockefeller (every day after lunch), Margaret Thatcher (one hour a day), Arnold Schwarzenegger (every afternoon), and Bill Clinton (15–60 minutes a day).

Modern science confirms that napping makes us not only more productive, but also more creative. Maybe that’s why greats such as Salvador Dali, chess grandmaster Josh Waitzkin, and Edgar Allen Poe used naps to induce hypnagogia, a state of awareness between sleep and wakefulness that helped them access a deeper level of creativity.

Hack #3: Only 15 minutes of walking per day can work wonders.

Top performers also build exercise into their daily routine. The most common form is walking.

Charles Darwin went on two walks daily: one at noon and one at 4 p.m. After a midday meal, Beethoven embarked on a long, vigorous walk,carrying a pencil and sheets of music paper to record chance musical thoughts. Charles Dickens walked a dozen miles a day and found writing so mentally agitating that he once wrote, “If I couldn’t walk fast and far, I should just explode and perish.” Philosopher Friedrich Nietzsche concluded, “It is only ideas gained from walking that have any worth.”

Others who made a habit of walking include Gandhi (took a long walk every day), Jack Dorsey (takes a five-mile walk each morning), Steve Jobs (took a long walk when he had a serious talk), Tory Burch (45 minutes a day), Howard Schultz (walks every morning), Aristotle (gave lectures while walking), neurologist and author Oliver Sacks (walked after lunch), and Winston Churchill (walked every morning upon waking).

Now we have scientific data proving what these geniuses intuited: taking a walk refreshes the mind and body, and increases creativity. It can even extend your life. In one 12-year study of adults over 65, walking for 15 minutes a day reduced mortality by 22%.

Hack #4: Reading is one of the most beneficial activities we can invest in

Here’s an amazing truth: no matter our circumstances, we all have equal access to the favorite learning medium of Bill Gates, the richest person in the world: books.

Top performers in all areas take advantage of this high-powered, low-cost way to learn.

Winston Churchill spent several hours a day reading biographies, history, philosophy, and economics. Likewise, the list of U.S. presidents who loved books is long: George Washington, Thomas Jefferson, Abraham Lincoln, and JFK were all voracious readers. Theodore Roosevelt read one book a daywhen busy, and two to three a day when he had a free evening.

Other lumineer readers include billionaire entrepreneur Mark Cuban (three-plus hours a day), billionaire entrepreneur Arthur Blank (two-plus hours a day), billionaire investor David Rubenstein (six books a week), billionaire entrepreneur Dan Gilbert (one to two hours a day), Oprah Winfrey (credits reading for much of her success), Elon Musk (read two books a day when he was younger), Mark Zuckerberg (a book every two weeks), Jeff Bezos (read hundreds of science fiction novels by the time he was 13), and CEO of Disney Bob Iger (gets up every morning at 4:30 a.m. to read).

Reading books improves memory, increases empathy, and de-stresses us, all of which can help us achieve our goals. Books compress a lifetime’s worth of someone’s most impactful knowledge into a format that demands just a few hours of our time. They provide the ultimate ROI.

Interested in reading more? I recorded a webinar to help you to find the time to read and double your return on learning.

Hack #5: Conversation partners lead to surprising breakthroughs

In Powers Of Two: Finding the Essence of Innovation in Creative Pairs, author and essayist, Joshua Shenk, makes the case that the foundation of creativity is social, not individual. The book reviews the academic research on innovation, highlighting creative duos from John Lennon and Paul McCartney to Marie and Pierre Curie to Steve Jobs and Steve Wozniak.

During long daily walks, psychologists Daniel Kahneman and Amos Tverskydeveloped a new theory of behavioral economics that won Kahneman the Nobel Prize. J.R.R. Tolkien and C.S. Lewis shared their work with each otherand set aside Mondays to meet at a pub. Francis Crick and James Watson, the co-discoverers of the structure of DNA, batted ideas back and forthrelentlessly, both in their shared office and during daily lunches in Cambridge. Crick recalled that if he presented a flawed idea, “Watson would tell me in no uncertain terms this was nonsense, and vice-versa.” Artists Andy Warhol and Pat Hackett took two hours each morning to “do the diary” together: recounting the previous day’s activities in detail.

Many greats made a habit of conversing in large, ritualized groups.Theodore Roosevelt’s “Tennis Cabinet” included friends and diplomats who exercised together daily and debated the issues facing the country. Benjamin Franklin created a “mutual improvement society” called the Junto that gathered each Friday evening to learn from each other. The Vagabonds were a group of four famous friends — Henry Ford, Thomas Edison, Harvey Firestone, and John Burroughs — who took road trips each summer: camping, climbing, and “sitting around the campfire discussing their various scientific and business ventures and debating the pressing issues of the day.”

Hack #6: Success is a direct result of the number of experiments you perform

There’s a reason that Jeff Bezos says, “Our success at Amazon is a function of how many experiments we do per year, per month, per week, per day….”

One big winner pays for all of the losing experiments. In a recent SEC filing, he explains why:

“Given a ten percent chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten. We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs. The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in awhile, when you step up to the plate, you can score 1,000 runs.”

No matter how much you read and discuss, you’re still going to have to spend some time making your own mistakes. If that discourages you, just remember Thomas Edison. It took him more than 50,000 botched experiments to invent the alkaline storage cell battery, and 9,000 to perfect the light bulb. But at his death, he held nearly 1,100 U.S. patents.

Experiments don’t just happen in the “real” world. Our brain has an incredible ability to simulate reality and explore possibilities at a much faster rate and lower cost. Einstein used thought experiments (imagining himself chasing a light beam through space, for instance) to help construct breakthrough scientific theories; you can use them to set your imagination free on slightly smaller conundrums. The journals of Thomas Edison, Leonardo da Vinci, and other luminaries aren’t just filled with writing, they’re also filled with sketches and mind maps.

Standup comedy is a far cry from inventing, but experimentation is just as key in the arts as it is in science. Take a star comedian like Chris Rock, for instance. Rock prepares for huge shows in venues such as Madison Square Garden by piecing his routine together in small clubs for months on end, trying out new material and getting instant feedback from audiences (they either laugh or they don’t).

Others use experiments to force them to take on new habits or break unhealthy ones. Iconic producer and writer Shonda Rhimes decided to take on her workaholism and extreme introversion and say yes to everything that scared her in an experiment she called the Year of Yes. Jia Jang confronted the universal fear of rejection with his 100 Days of Rejection project, which he then catalogued on YouTube. College grad Megan Gebhart spent the first year of her career taking one person a week out for coffee; she compiled the lessons she learned in a book called 52 Cups of Coffee. Filmmaker Sheena Matheiken wore the same black dress every day for a year as an exercise in sustainability.

As Ralph Waldo Emerson said, “All life is an experiment. The more experiments you make, the better.”

Go Ahead, Take That Hour Now

In a world where everyone is speeding up and cramming their schedule to get ahead, the modern knowledge worker should do the opposite: slow down, work less, learn more, and think long-term.

In a world where frantic work is the focus, top performers should focus deliberately on learning and rest. In a world where artificial intelligence is automating more and more of our work, we should unleash our creativity.Creativity is not unleashed by working more, but by working less.

It’s easy to say to yourself, “Sure! Warren Buffett can do it because… well…. he’s Warren Buffett.” But don’t forget that Warren Buffett has had his learning ritual for his entire career, way before he was the Warren Buffett we know today. He could have easily fallen into the trap of the constant “busy-ness,” but instead, he made three crucial decisions:

- Ruthlessly remove the busy work in order to rise above incessant urgent deadlines, meetings, and minutiae.

- Spend almost all of his time on compound time, things that create the most long-term value.

- Tap dance the work because he leverages his unique strengths and passions.

This lifestyle may not happen for you overnight, but in order to leverage compound time, you first need to believe that a lifestyle where you work less but accomplish more is possible and beneficial; that a lifestyle where you ruthlessly focus on your strengths and passions is not only feasible, but necessary.

To get started, follow the 5-hour rule: for an hour a day, invest in compound time: take that nap, enjoy that walk, read that book, have that conversation.You may doubt yourself, feel guilty or even worry you’re “wasting” time… You’re not! Step away from your to-do list, just for an hour, and invest in your future. This approach has worked for some of the world’s greatest minds. It can work for you, too.

This article was originally published on Medium.com.

About the Author: Michael Simmons is an award-winning entrepreneur; best-selling author; Forbes, Fortune, and HBR Contributor; blogger; and Co-Founder of @iEmpact.

https://www.earlytorise.com/why-successful-people-invest-in-compound-time/