1.PIMCO Chart Breaking Down Leadership into 3 Year Periods.

Large Cap Growth Leading for 6 ½ Years.

Cigna’s quarterly sales per share are expected nearly to double, even with significant dilution from issuing shares to help pay for its acquisition of Express Scripts.

Despite all the good economic news, earnings growth is expected to slow to a crawl this year for large U.S. companies. It may also surprise you that the health-care sector is seen as one of the exceptions.

During the first quarter of 2019, earnings per share declined from a year earlier for six of the S&P 500’s SPX, +0.45% 11 sectors. These are the five that countered the trend, according to S&P Global Market Intelligence:

| S&P 500 sector | Increase in Q1 EPS |

| Health Care | 9.8% |

| Real Estate | 7.4% |

| Financials | 6.2% |

| Industrials | 5.9% |

| Information Technology | 4.0% |

| Source: S&P Global Market Intelligence |

For the second quarter, consensus estimates among analysts polled by S&P Global Market Intelligence are for the S&P 500’s weighted aggregate EPS to increase 2.2% from a year earlier. Even so, all but these three sectors are expected to show declines:

| S&P 500 sector | Expected increase in Q2 EPS |

| Financials | 4.3% |

| Health Care | 2.0% |

| Industrials | 0.2% |

| Source: S&P Global Market Intelligence |

Health care is one of the stock market’s healthiest sectors right now

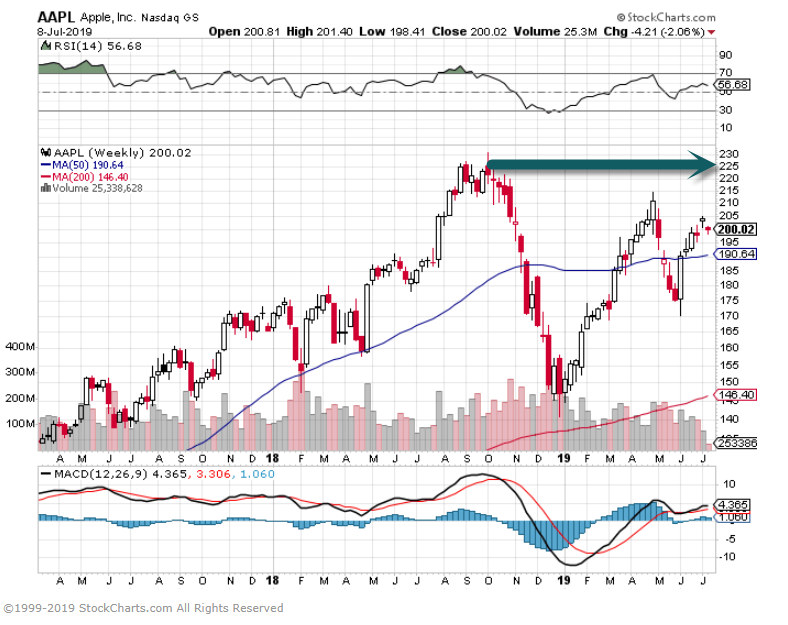

Apple Downgraded to Sell at Rosenblatt Securities

(Bloomberg) — Wall Street hasn’t been this down on Apple Inc. in a long time.

Rosenblatt Securities downgraded the company to sell on Monday, bringing the total number of bearish analysts up to five, among the 57 ratings tracked by Bloomberg. Five is the highest number of sell ratings the iPhone maker has had since at least 1997, according to historical data compiled by Bloomberg. To put that into context, Apple wouldn’t release its iMac computer until August 1998, and the iconic iPod wouldn’t debut until October 2001.

In another sign of the growing caution around the company, Apple’s consensus rating — a proxy for the company’s ratio of buy, hold, and sell ratings — is currently 3.76, according to Bloomberg data. That’s the lowest since 2004.

Skepticism surrounding the company has accelerated in 2019, with all five of the sell ratings coming in this year. Both New Street Research and HSBC lowered their ratings on the stock to sell in April, and in January, the number of firms with buy ratings dropped below 50% for the first time since 2004.

The caution has been largely driven by uncertainty surrounding demand for the company’s critical iPhone line, with the U.S.-China trade war seen as a particular headwind. In January, Apple cut its revenue outlook for the first time in almost two decades, in large part because of iPhone weakness. Apple’s third-quarter results are currently expected to come out on July 30.

According to data compiled by Bloomberg, more than 60% of Apple’s 2018 revenue was related to the iPhone, while roughly 20% came from China, which is also a critical part of its supply chain. Last week, Citi wrote that Apple’s China sales “could be cut in half” due to “a less favorable brand image desire.”

Rosenblatt’s downgrade came as analyst Jun Zhang expects the company “will face fundamental deterioration over the next 6-12 months,” based on disappointing sales trends. The downgrade pushed Apple stock lower by as much as 2.9% in Monday trading.

Still, the sell-equivalent ratings hardly represent a consensus view. A plurality of 23 firms recommend buying the stock, while another 21 have hold ratings, according to data compiled by Bloomberg.

The 2019 caution hasn’t really been reflected in Apple’s stock performance. Shares are up more than 40% from its January low, though they remain about 14% below record levels.

The news was not entirely negative for Apple on Monday, however, as Wedbush wrote it was “incrementally more positive on global iPhone demand” following checks in Asia. “We saw a ‘slight uptick’ out of Apple suppliers during our checks although overall handset demand remains challenging,” analyst Daniel Ives wrote. He affirmed his outperform rating and $235 price target.

(Adds context in second paragraph, consensus rating in third, and stock performance in ninth.)

To contact the reporter on this story: Ryan Vlastelica in New York at rvlastelica1@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Steven Fromm

For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Continue reading

Jim Grant in Barrons.

Jim Grant: The Trouble With Austria’s 100-Year Bonds By James Grant