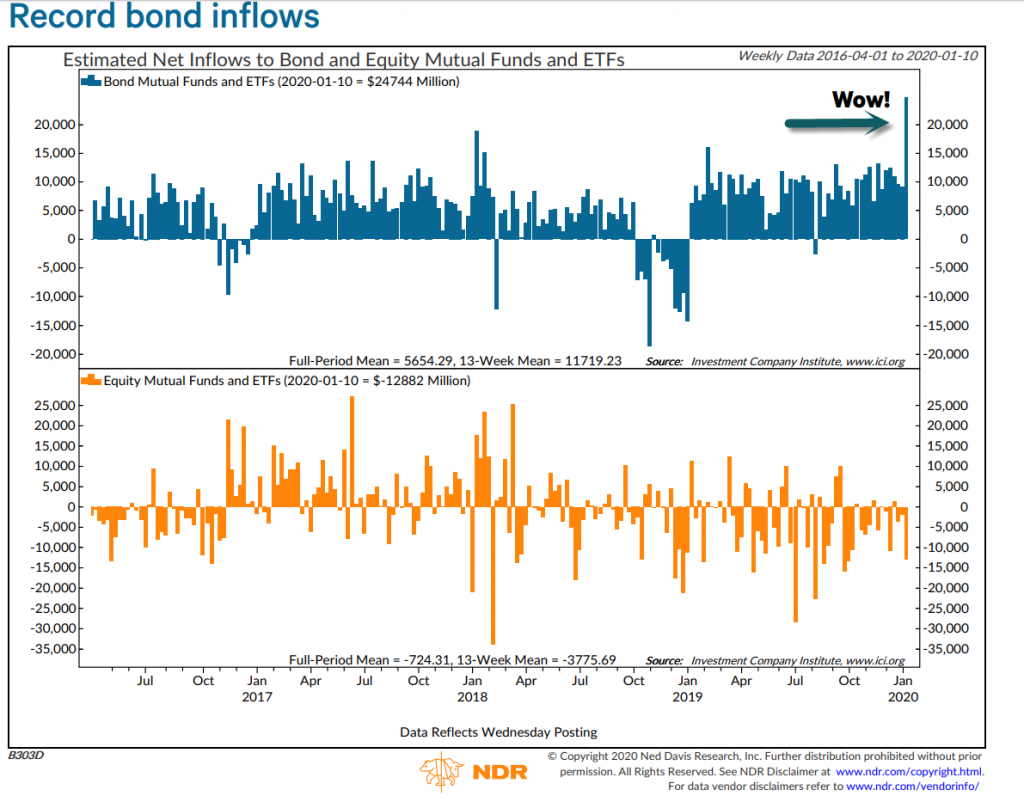

1.Record Bond Inflows in First Week of January 2020.

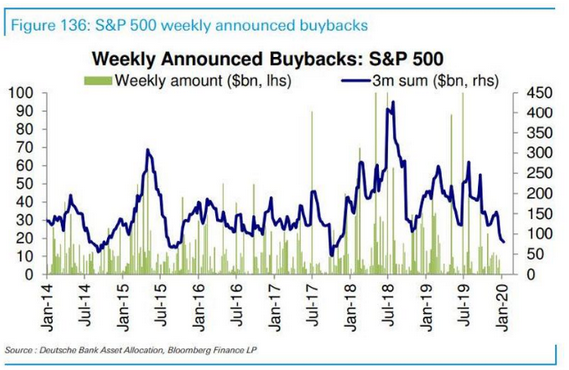

DB shows the collapse of buybacks into earnings, despite the equity rally

From Dave Lutz at Jones Trading.

Continue reading

REIT SPDR Holds Key Moving Average as its Biggest Components Spring to Life

Arthur Hill | January 10, 2020 at 06:09 PM

https://stockcharts.com/articles/chartwatchers/2020/01/reit-spdr-holds-key-moving-ave-262.html

Found at Abnormal Returns www.abnormalreturns.com

Continue readingBespoke Investment Group

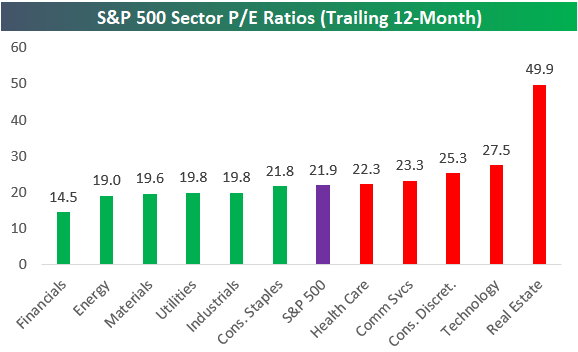

We continue to see elevated P/E ratios. The S&P’s trailing 12-month P/E is currently 21.9, while Real Estate is at 49.9, Technology is up to 27.5, and Consumer Discretionary is at 25.3. The only sector with a P/E ratio below 19 is Financials at 14.5.

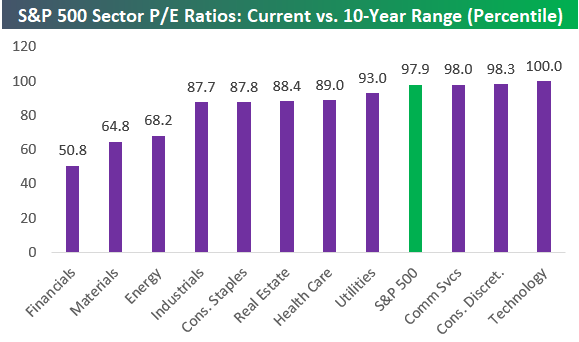

Absolute levels of valuations like the chart above don’t tell you much. The chart below shows where valuations stand for sectors relative to levels seen over the last ten years. As shown, the S&P 500’s current P/E ratio is higher than 97.9% of all other P/E readings seen for the index over the last ten years. That’s high! And three sectors have valuations in the 98th percentile or higher, with Technology at the top at 100%. Over the last ten years, Tech’s P/E ratio has never been higher.

The only sector where valuations are currently “average” compared to the last ten years is Financials. Sign up for Bespoke Premium and get half off your first three months. Click here for this special offer.

https://www.bespokepremium.com/interactive/posts/think-big-blog/sector-valuations-stretched

Continue reading

Source: Financial Times

From Barry Ritholtz The Big Picture https://ritholtz.com/