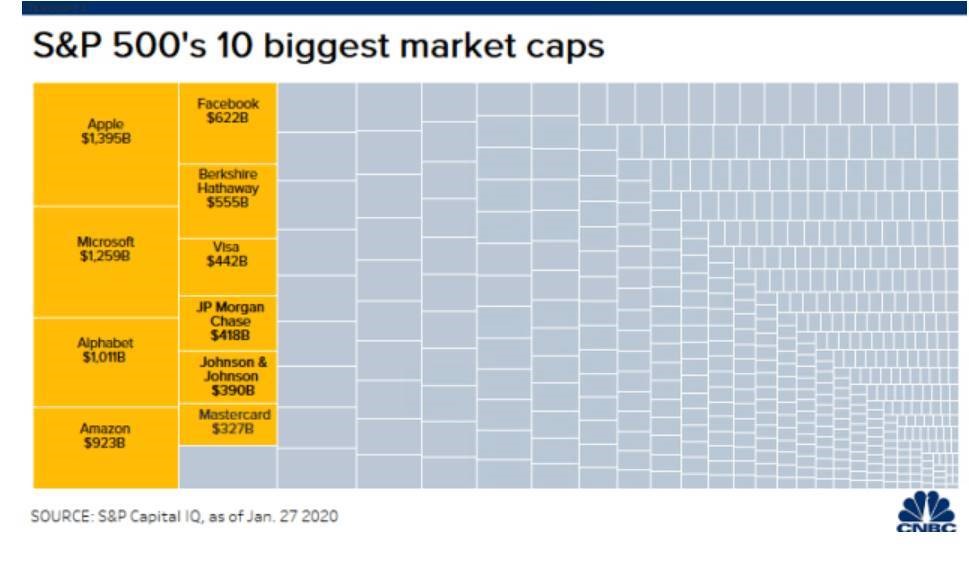

1. 5 Companies 17.5% of S&P

The five biggest tech companies now make up 17.5% of the S&P 500 — here’s how to protect yourself

Ari Levy@LEVYNEWSLorie Konish@LORIEKONISH

https://www.cnbc.com/2020/01/28/sp-500-dominated-by-apple-microsoft-alphabet-amazon-facebook.html

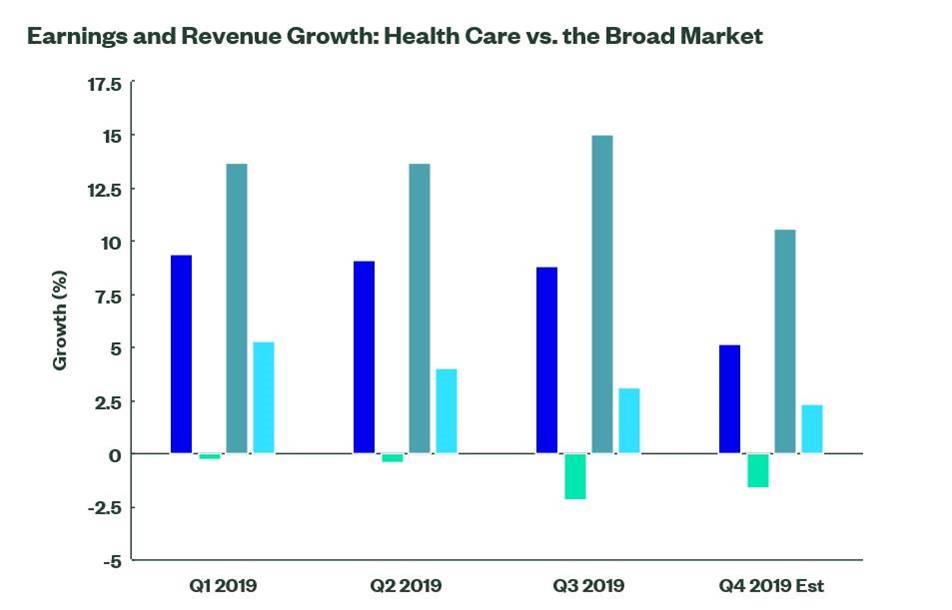

2.Healthcare Sector Earnings Compared to S&P 2020.

SPDR FUNDS

Health Care: Capture stable growth with an

attractive valuation

Health Care led earnings sentiment with strong and broad

earnings beats and faster growth than the broad market in 2019, as shown in the

chart below. As we progress into the new year, analysts have upgraded their

earnings estimates for the sector, while projections for the broad market

continue their downward trend.1

https://www.ssga.com/us/en/individual/etfs/insights/spotting-trends-3-sectors-we-re-looking-at-in-q1

3.The IPO-pocalypse didn’t last long-….IPO Market No Hiccup in Failed Unicorns.

The IPO-pocalypse sure didn’t last long.What’s happening: Three months after WeWork pulled its offering, we’re expecting an offering above $1 billion this week and another next week. It also appears that mattress maker Casper will push forward with its listing, albeit as an “undercorn.”

- First up will be Reynolds Consumer Products, which is best known for its aluminum foils, plastic wraps and Hefty trash bags. At the top of its range, it would raise around $1.3 billion at a $5.7 billion market cap.

- Next week we should get PPD, a private equity-owned pharma contract research group that could raise $1.6 billion at a $9.2 billion market cap.

Yes, both of these are profitable, well-established companies. And few pundits seem to care about the unprofitable biotechs that also expect to price this week (sorry biotechs — maybe you should do something more interesting than curing our diseases and saving our lives… have you considered scooters?).

So that brings us to Casper Sleep, the unprofitable, upstart mattress maker that was inexplicably valued like a tech company by venture capitalists.

- Casper this morning set IPO terms that seemed to acknowledge how the private markets erred.

- If it prices at the top of its range, the company would be valued at around $744 million, which is well shy of the unicorn valuation it previously received (no, the fully-diluted value doesn’t get you there either).

- But, but, but: The very fact it’s launching its road-show, in the face of ongoing skepticism, suggests that the macro IPO chill has thawed. Or at least that bankers are willing to take the reputational risk.

The bottom line: No one company’s failings, no matter how massive, can single-handedly derail the broader equity or capital markets. That’s true whether it’s WeWork, Boeing, or whatever misery comes next.

IPO ETF NEW HIGHS

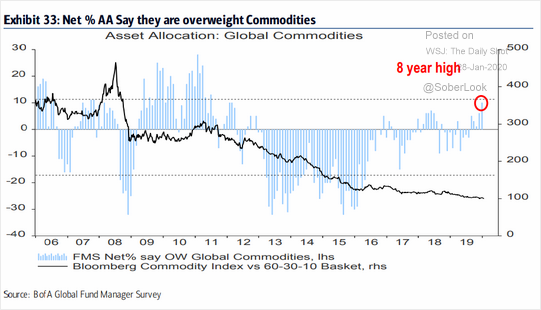

4.Commodities Trade Down 8% to October Levels

Novel Coronavirus in China Hits Commodities.—CRB Commodity Index

5.Global Fund Managers Started Year Overweight Commodities at Highest Level in 8 Years.

According to the BofAML FMS monthly survey, global fund managers started the year overweight commodities (highest in eight years). Based on the charts above, these positions didn’t work out well. Nonetheless, once the coronavirus scare eases, we may see a rebound in some commodity markets.

Source: BofA Merrill Lynch Global Research

The Daily Shot https://blogs.wsj.com/dailyshot/2020/01/28/the-daily-shot-fund-managers-stung-by-commodities/

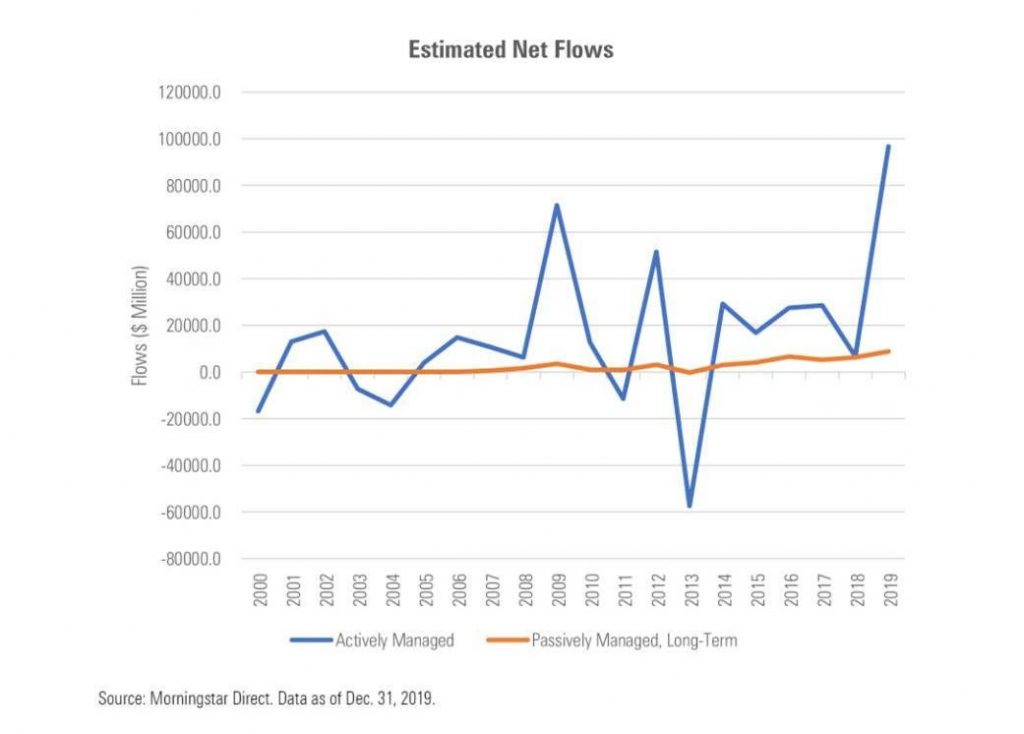

6. Muni Funds See Record Inflows in 2019

Municipal-bond funds saw record inflows in 2019, as investors poured a massive net $105.5 billion into muni open-end mutual funds and exchange-traded funds during the year. That amount dwarfed the annual gains of each of the past 25 years, including the group’s previous boom year of 2009, which brought in roughly $75 billion.

Demand remained high throughout the year, as muni funds saw 12 straight months of net inflows over $5 billion, and by midyear had gathered 10 times the assets that flowed into those strategies in all of 2018.

Roughly 90% of 2019’s flows went into actively managed mutual funds, yet a substantial $8.7 billion went to passive strategies, mainly muni ETFs, which have continued to gain prominence since they first arrived on the scene in 2000.

Muni Funds See Record Inflows in 2019

Investors’ appetite for municipal bonds soared last year, helping push already low muni yields even lower.Elizabeth Fooshttps://www.morningstar.com/articles/963165/muni-funds-see-record-inflows-in-2019

Found at Abnormal Returns Blog www.abnormalreturns.com

7.Top Health Industry Issued 2020-PWC

Top health industry issues of 2020: Will digital start to show an ROI?

In 2020, US healthcare, and especially how it is delivered and how much we pay for it, will be top of mind. Politicians will float many bold plans for transforming the industry. Health system leaders will tout their investments in technology and transformation, as the US health industry works to catch up to the rest of the digital economy. The question for 2020 will be whether this digital transformation will benefit consumers — marking a new dawn for the US health industry and for the people whose lives depend on it.

A looming tsunami of high prices

Facing a tsunami of high-priced gene and cell therapies and ever-rising provider prices in 2020, employers, public and commercial payers, and American consumers will seek — and sometimes find — creative ways to finance care, spread risk and ensure that their money is paying for value.

True or false?

Medical cost trend is expected to decrease in 2020. Find the answer and learn more.

Regulation trumps policy

Despite strong rhetoric on healthcare from campaigning politicians, the outcome of the 2020 election is unlikely to bring about profound, industry-shaking change. Instead, the heated political contest likely will determine the fate of Trump administration policies on Medicaid, the Affordable Care Act, pricing transparency and trade.

True or false?

Industry should expect the HHS to publish less regulation than usual next year. Find the answer and learn more.

Consumers inch closer to DIY healthcare

In 2020, DIY healthcare takes on new meaning as American consumers will begin to finally reap benefits from the enormous investments in data collection, storage and analysis that have been made by the US health industry. Beyond offering them tools to monitor their vitals, at-home devices to test for strep throat or flu or personal health records that consumers themselves must populate, companies are building business models around giving consumers access to their own data, with insights attached.

True or false?

Across all industries, the biggest obstacle to monetizing data is lack of

analytical talent. Find the answer and learn more.

US health organizations are seeking opportunities overseas and through innovation. Beware of the tax risks.

US-based healthcare organizations increasingly are hunting for new ways to grow their healthcare mission overseas and through investments in novel technologies and business models. Their objectives can range from extending healthcare services to new communities to unearthing rich new sources of funds.

True or false?

The OECD wants to profoundly change the way member nations tax digital business

activity. Find the answer and learn more.

A whole new you: Deals as makeovers

In 2020, organizations will make strategic deals not to just grow larger but instead to expand into new identities with platforms anchored in value, innovation, customer experience and population health. As they weigh their options, health companies will need to ensure that the deals they pursue pass the sniff test of employers and consumers seeking more affordable care.

True or false?

Healthcare consumers by and large believe healthcare deals activity benefits them. Find the answer and learn more.

8. James Simons: My Guiding Principles

The chair of the Simons Foundation describes his five principles for building a successful organization.

Guiding Principles

IN LATE 2010, just after I stepped down from Renaissance and started full-time at the foundation, I gave a talk at MIT. Marilyn accompanied me to the talk, and on the way there, she suggested that at the end I discuss my values. I felt ‘values’ was not quite the right word, so I used ‘guiding principles’ instead. They are listed below, and I believe they have been useful in my life and careers. After setting them forth, I will give a number of examples of their effect in building the foundation.

- 1 DO SOMETHING NEW; DON’T RUN WITH THE PACK. I am not such a fast runner. If I am one of N people all working on the same problem, there is very little chance I will win. If I can think of a new problem in a new area, that will give me a chance.

- 2 SURROND YOURSELF WITH THE SMARTEST PEOPLE YOU CAN FIND. When you see such a person, do all you can to get them on board. That extends your reach, and terrific people are usually fun to work with.

- 3 BE GUIDED BY BEAUTY. This is obviously true in doing mathematics or writing poetry, but it is also true in fashioning an organization that is running extremely well and accomplishing its mission with excellence.

- 4 DON’T GIVE UP EASILY. Some things take much longer than one initially expects. If the goal is worth achieving, just stick with it.

- 5 HOPE FOR GOOD LUCK!

After a few years, Yuri Tschinkel succeeded David as head

https://www.simonsfoundation.org/2020/01/22/my-guiding-principles/