1.XES Oil and Gas Equipment ETF -20% Correction….EXXON Hits 10 Year Low.

XES ETF

XOM breaks 2018 levels…hits 10 year lows.

2.Oil Demand Facing 15% Drop in Next 2-3 Months.

According to S&P Global Platts Analytics, oil demand could drop by 200,000 bpd over the next two to three months. This demand erosion would represent around 15 percent of the expected oil demand growth this year. But if the coronavirus turns out to be as deadly as the Sudden Acute Respiratory Syndrome (SARS) was in 2003, then crude oil demand loss could be in the region of 700,000-800,000 bpd

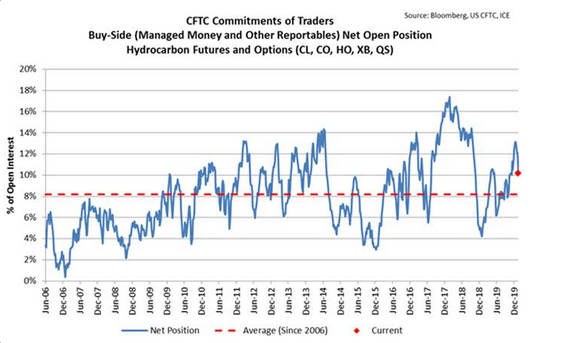

CFTC’s “Commitment of Traders” – CFTC data showed the buy-side (Managed Money + other reportables) sold $8.5Bn notional across WTI, Brent, Heating Oil, RBOB Gasoline, and Gas Oil futures over the week ending 1/28 showed, driven primarily by longs being liquidated. As a % of total open interest, this was the largest weekly selling from the buy-side since the week ending 2/13/18 (and 11/8/16 before that).

The S&P 500 energy sector entered a bear market Friday, registering its worst January on record as oil prices dropped on concerns about global growth – The group has fallen 11% this month, by far the weakest performance of the 11 sectors in the S&P 500, which is down 0.2% for the year after a selloff Friday – Energy shares have declined 20% since a recent high on April 23, 2019, when the price of Brent crude, the global oil benchmark, was above $74 a barrel, WSJ notes. XOP down a amazing 20% in January

From Dave Lutz at Jones Trading

3.High Yield Energy Bonds Saw Rally Right Before Coronavirus Hit.

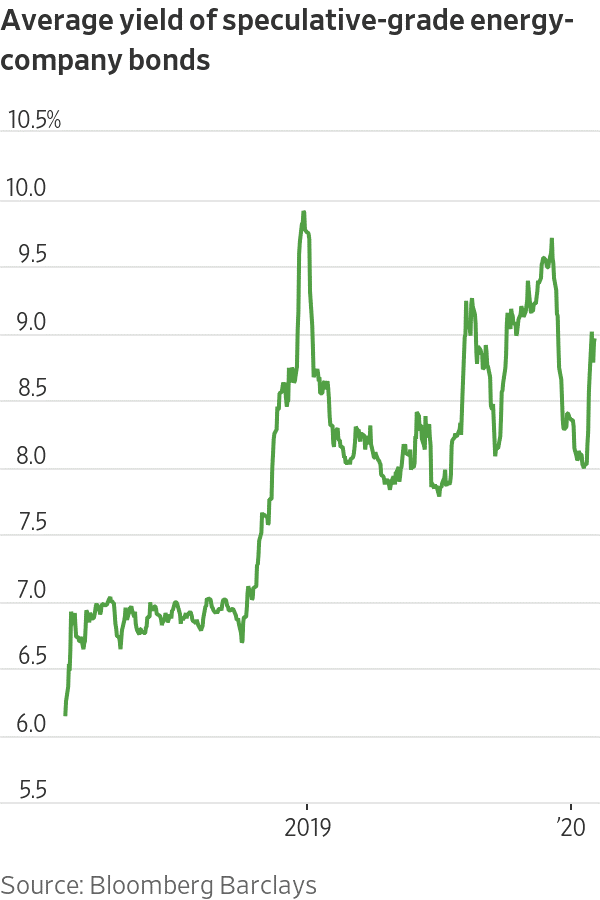

The economic threat posed by the coronavirus is helping erode demand for energy-company debt just weeks after bond issuance in the sector surged, highlighting the virus’s far-reaching effects on companies and financial markets.

Early last month, a surprise rally in the debt of energy companies allowed oil and gas businesses to issue the largest amount of speculative-grade bonds in one week since just before oil prices crashed in the fall of 2014.

No sooner had companies issued the bonds, however, than fears that the coronavirus will slow global growth sapped appetite for riskier debt—underscoring the good timing of the businesses that were able to push out looming debt payments but heightening the challenges for those that still need financing.

On Jan. 10, shale company Laredo Petroleum Inc. sold $400 million of 2028 unsecured bonds at par with a 10.125% interest rate, at the high end of what typically makes economic sense for companies. On Monday, those bonds were trading at around 89 cents on the dollar, implying Laredo would have had to pay an interest rate of more than 12% if it had waited to issue the debt, according to MarketAxess.

Overall, the average price of speculative-grade energy-company bonds has fallen to 89.67 cents on the dollar as of Friday, from a recent high of 92.54 cents on Jan. 16, pushing yields on the bonds to 8.96% from 7.99%, according to Bloomberg Barclays data. That comes after the yield had dropped from 9.71% in early December. Bond prices and yields move in opposite directions.

The New Threat to Energy-Company Bonds: Virus Fears

Several newly issued energy bonds have sunk in the wake of a short-lived oil rally BySam Goldfarb and Alexander Gladstone

4.Global Investors Have Never Had This Much Gold Stashed in ETFs

Global Investors Have Never Had This Much Gold Stashed in ETFs

More

(Bloomberg) — Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

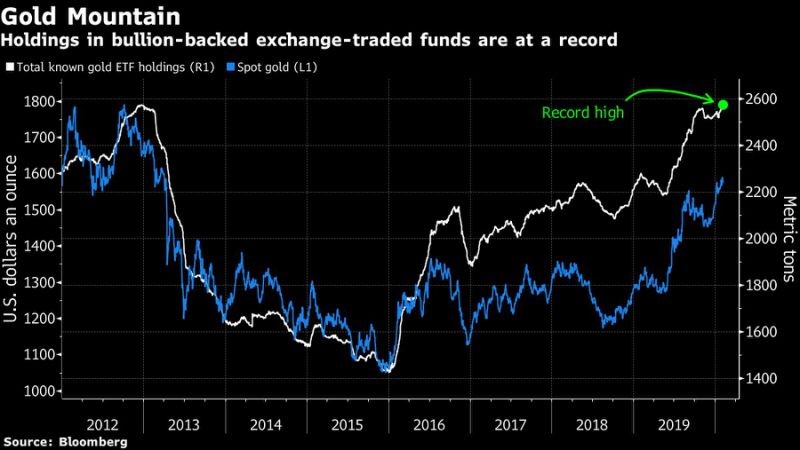

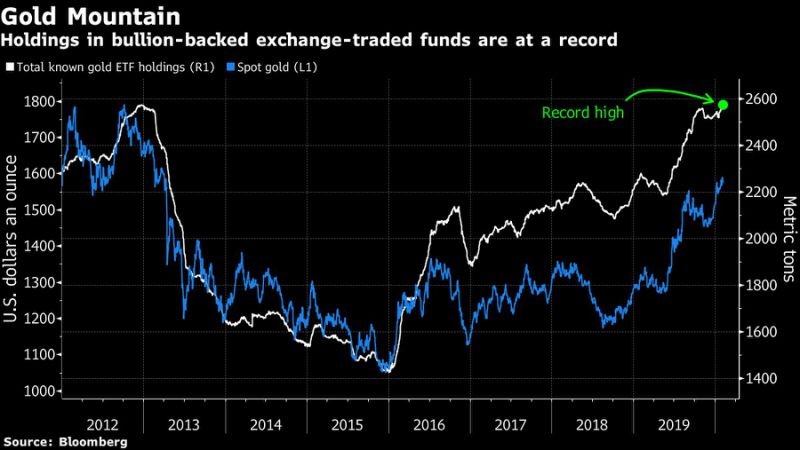

The global stash of gold in exchange-traded funds has risen to a record after a long run of accumulation that’s been given added impetus in recent weeks by the fall-out from the widening coronavirus crisis.

Worldwide holdings in bullion-backed ETFs climbed to 2,573.9 tons on Monday, topping the previous peak set in 2012, according to an initial Bloomberg tally. The latest additions follow four straight years of inflows, and come as prices of the traditional haven trade near the highest level since 2013.

https://finance.yahoo.com/news/global-investors-never-had-much-063749282.html

5.Money Flows…Equities Trailing Bonds and Money Markets.

Tracy Alloway Twitter

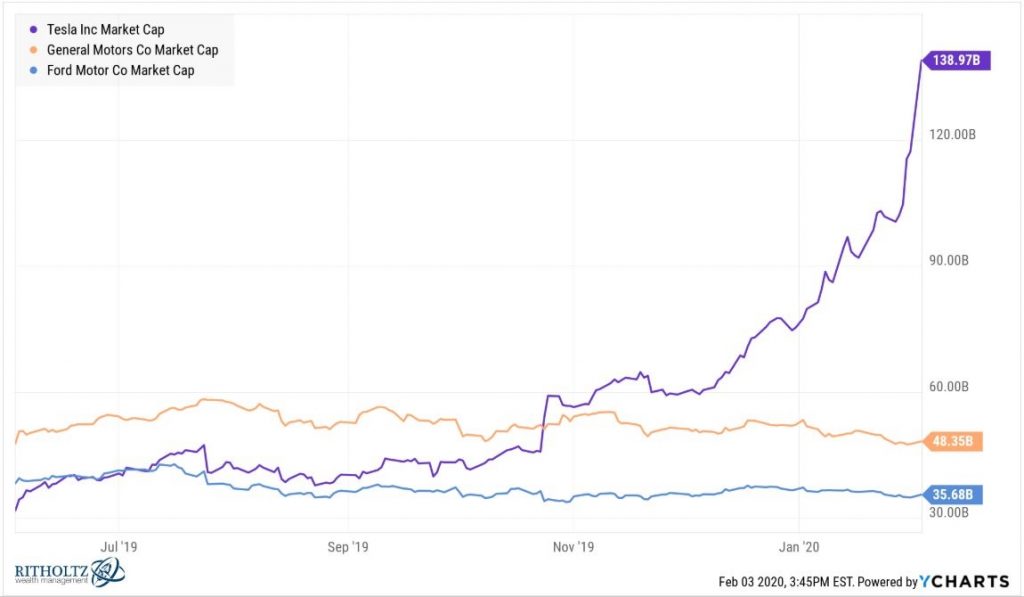

6.Tesla Market Cap Now Bigger Than Ford and GM Combined.

Ben Carlson https://twitter.com/awealthofcs

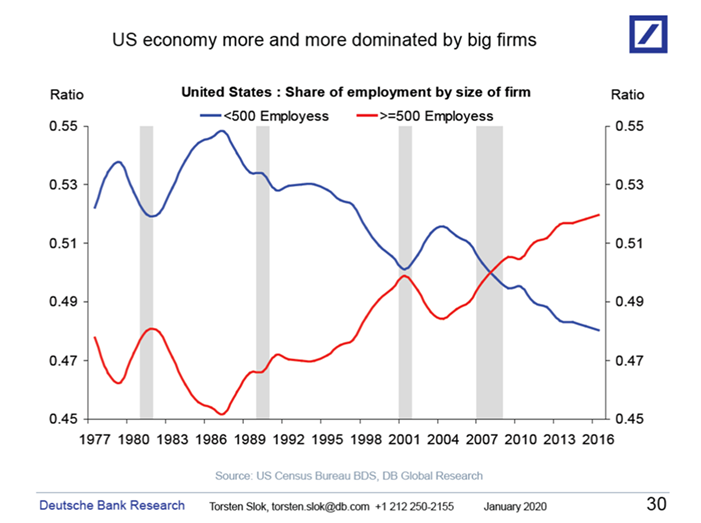

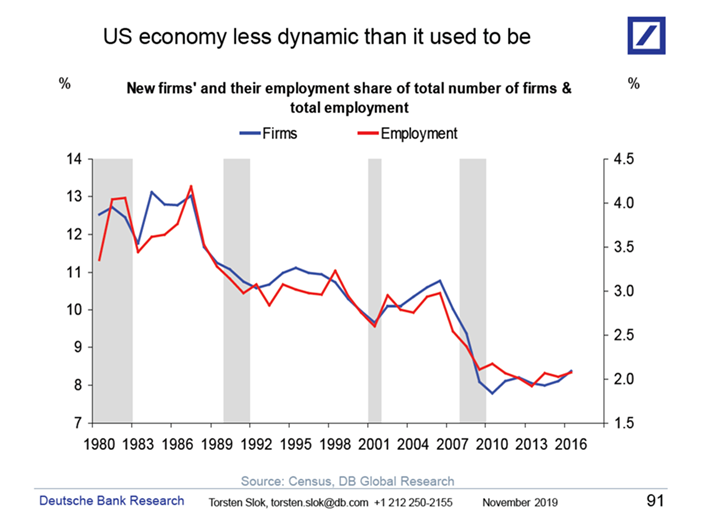

7..U.S. Economy More and More Dominated by Big Firms.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

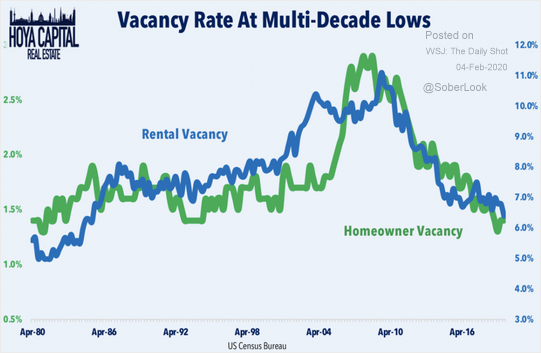

8.Housing Market Update

The Daily Shot WSJ

Next, we have some updates on the housing market.

• Housing vacancies remain near multi-decade lows.

Source: Hoya Capital Real Estate

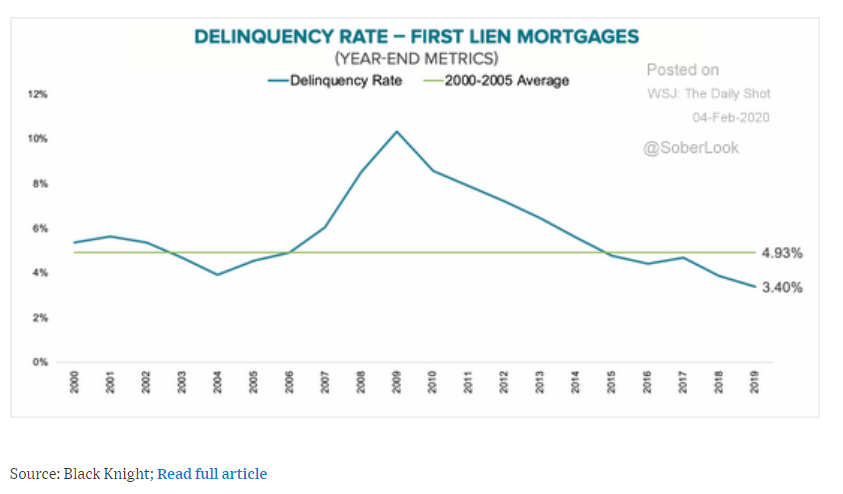

• According to Black Knight, the 90+ day delinquency rate on first-lien mortgages declined in December and is now near lows last seen in the mid-2000s.

Source: Black Knight; Read full article

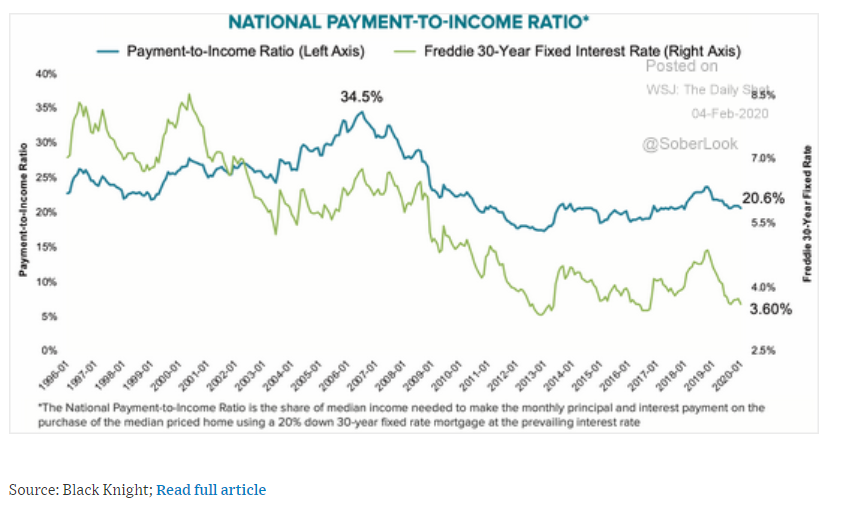

The payment-to-income ratio has been declining along with mortgage rates. This is a key factor for housing affordability amid rising prices.

The Daily Shot

9.HSAs are the best deal going if you’re careful and organized

These triple tax-favored health savings accounts can also bolster your retirement plan

You need a well-organized, easy-to-use system to maximize a HSA.

ByRICHARDCONNOR

I’m a big fan of health savings accounts, or HSAs. They’re becoming more popular as a way to pay for medical costs—and, in the right circumstances, they can also be a valuable addition to your retirement plan.

What’s so great about HSAs? If used properly, they’re triple tax-favored. You get a tax deduction when you deposit funds. The growth thereafter is tax-deferred. And if you use distributions to pay for qualified medical expenses, withdrawals are tax-free. Result? There’s a saying that HSA funds “go in like a traditional 401(k) and come out like a Roth.”

An important feature of HSAs: The money is yours forever. You can accumulate it year after year, unlike a flexible spending account for health care expenses, which has to be largely or entirely emptied each year. There’s also no time limit for using the funds to pay for qualified medical expenses. As long as you have proper documentation, you can get distributions at any time in the future—and those distributions will be tax-free, even if the medical expenses were incurred years earlier.

The upshot: You can use an HSA as another retirement savings vehicle. Think of the strategy as having two phases: an accumulation phase and a decumulation phase. In the accumulation phase, you’re not only amassing funds in the account, but also accumulating medical expenses for later reimbursement. In the decumulation phase, you submit prior expenses and get reimbursed tax-free from your HSA.

Let’s say you have 10 years to retirement, and you have enough income to both fund an HSA and pay medical expenses out of pocket. Each year, you fund the account up to the IRS maximum and invest for long-run growth. You also save your medical receipts each year. You do this for the 10 years leading up to retirement, building up both a nice sum and a pile of medical receipts.

At retirement, you start the decumulation phase. You take the saved medical receipts and “cash them in” against your HSA account balance. As long as the expenses were for qualified medical expenses, the distribution is tax-free. Note there are no required minimum distributions for an HSA, unlike most retirement accounts. A key caveat: Although you can wait years to be reimbursed for a medical expense, the expense must have been incurred after the account was established.

Sounds easy? Don’t underestimate the record-keeping that’s involved. IRS Publication 969 says you must keep records sufficient to show that:

• The distributions were exclusively to cover qualified medical expenses

• The qualified medical expenses hadn’t been previously covered by the HSA or another source, such as your health insurance company; and

• The medical expenses hadn’t been claimed as an itemized deduction in any year on your federal tax return.

What if you’re ever audited? Each account holder is responsible for maintaining all records associated with their HSA for tax purposes. Experts recommend keeping receipts for three-to-seven years after you’re reimbursed by the account.

I’ve found that to maintain multiple years of receipts, you need a well-organized, easy-to-use system. You can do this yourself with folders for each year. Alternatively, you might scan receipts and save them on digital media for future uploading to your HSA account. This is how I started. Luckily, the technology and sophistication of HSA accounts are making this easier. Some HSA providers have the capability to maintain a digital paper trail of your HSA spending by capturing and uploading images, even allowing users to add notes and organize receipts into folders.

Once you have your receipts saved, you can cash them in as desired. I’m aiming to hold off until my wife retires and we need the income. I am, however, worried that the amount of data will get too great and become hard to manage. I also worry that, if I’m not around, it would be a burden for my wife. Given these concerns, I’m considering some “harvesting” strategies, such as withdrawing a past year’s medical expenses each year in retirement or perhaps two years of expenses every other year.

What if you don’t have enough medical expenses to use up your HSA balance? You might use the funds to pay for a long-term-care policy. After age 65, HSA funds can be used to pay Medicare Part B, Part D and Medicare Advantage premiums (but not, alas, for a Medigap policy). You can also use the funds to pay for COBRA benefits.

After age 65, HSA distributions can be made from an HSA for nonmedical expenses. These distributions will be taxed as ordinary income, just like withdrawals from a traditional IRA. What if you make withdrawals for nonmedical expenses before age 65? You’ll get hit not only with income taxes, but also a 20% tax penalty.

Richard Connor is a semiretired aerospace engineer with a keen interest in finance. His previous articles include Read the Fine Print, Return on Investment and Decision Time. Follow Rick on Twitter @RConnor609.

This article first appeared on Humble Dollar. It was republished with permission.

10.Why We All Need to Recharge and Recover Like Pro Athletes

The secret to optimizing our health and vitality lies in recharging our batteries — in bed.By Shelly Ibach, President and CEO of Sleep Number; Sleep Editor-at-Large, Thrive Global

Brocreative / Shutterstock

At this time of year, many of us are full of good intentions related to everything from exercise and nutrition to what it takes to lead a good, productive life. Along those lines, in my view, there is no better time than the start of a new year for a conversation about one of my favorite subjects: the value of recharging and recovering.

This month, millions of people around America and across the globe — myself included — are intently focused on football, with the NFL Super Bowl in full swing. I believe everyone can learn about the value of consistent, quality sleep from the way athletes are now paying attention to it. At Sleep Number, we are proud partners of the NFL, and it’s no secret that on the road to the Super Bowl, harnessing the benefits of quality shut-eye ensures that players are performing at their peak.

For one thing, sacrificing sleep leads to loss of aerobic endurance, according to recent science. And that, in turn, can result in higher levels of cortisol,(a stress hormone), which can lead to worry and anxiety, affecting mood and, subsequently, performance. Sleep deprivation also results in a decrease of human growth hormone, which is important for tissue repair and crucial for muscles to recover after physical activity. In addition, you need good sleep to stimulate your immune system and reduce inflammation.

The importance of quality sleep for professional athletes is compounded by the specific challenges they face, for example jet lag-induced fatigue, as teams fly across the country for games. Caused by the disruption of our circadian system, otherwise known as our internal body clock, jet lag can lead to grogginess and a loss of productivity. All in all, it’s easy to understand why resting and recharging is vital for athletes who need stamina and often sustain injuries — and that it’s equally important for the rest of us.

For more on the science, I spoke to Dr. Chris Winter, M.D., director of the Charlottesville Neurology and Sleep Medicine Center and author of The Sleep Solution. “Athletic recovery depends upon getting consistent, quality sleep, (eight to 10 hours of shut-eye is recommended for football players). “Particularly critical is deep sleep, which generally happens in the first two to three hours of your night, because for adults, it’s about the only time we make growth hormone,” says Dr. Winter. He explains that to get deep sleep, it is important to go to bed around the same time each night. “If you typically fall asleep around 11p.m. and get up around 6 a.m., that deep sleep’s going to happen from about 11 p.m. to 1 a.m. Therefore, if you suddenly go to bed at 4 o’clock in the morning, you don’t get your deep sleep that night.” After just one night of poor sleep or no sleep, your body feels different and your motivation wanes.

Dr. Winter has often given this sage advice to professional athletes who insist that they can get away with a few hours a night, without any adverse impact on their game or their health. He says: “I’ve told football players I work with, ‘You’ve got to make some better choices, because that kind of lifestyle is not conducive to being a pro athlete for a long period of time.’” Dr Winter adds that getting restricted sleep for just three to five nights will have a serious negative impact on performance — whether that’s in the office or on the field. “Athletes and investment bankers come to see me and say: ‘Hey, Doc, as long as I get my four hours I’m fine,’” says Dr. Winter. “I tell them: ‘No, you’re not. Your ability to perform is completely impaired, even if you don’t feel it. You may be doing triathlons, but make no mistake, if you are only getting four hours of sleep, your health will suffer seriously as you get older. Just be aware of that.’”

I asked Dr. Nathaniel F. Watson, M.D. M.Sc., professor of neurology at the University of Washington and director of the Harborview Medical Center Sleep Clinic, to add his expertise. He pointed out that “sleep is the time when what’s called the lymphatic system in the brain takes out the trash, so to speak. When you go to sleep,” he says, “the brain contracts a little and opens up channels for cerebrospinal fluid to flow around, collecting and taking out all the byproducts of a day’s worth of cognitive use.” In other words, the brain is completing and clearing the cellular “gunk” that accumulates during wakefulness, so we can be refreshed and revitalized when we wake up.

When we get a good night’s sleep, we wake up mentally alert, prepared to perform at our best. Our cognitive performance will improve, and we can think more quickly and make the correct decisions at a faster rate, says Dr. Watson, who treats college athletes and professional teams for sleep issues and disorders. Sleep is absolutely crucial to both the mind and the body. “There’s no substitute for sleep, so don’t fight it,” says Dr. Watson, who recommends listening to and respecting your body’s natural signs and signals. “When it’s dark out in the evening and you are ready for bed, go to sleep as soon as you feel drowsy, if possible,” he says, “and wake up spontaneously without setting an alarm clock.”

Quality shut-eye is a key to high performance and longevity. Basketball players shoot better free throws. Swimmers swim faster. Tennis players hit their balls 50% more accurately and have fewer mental lapses. As a general rule, you’ll find that athletes who have had long careers take sleeping and recharging seriously, because they’ve discovered the value for themselves. I encourage everyone to take the same approach. And on that note, with 20/20 vision, I intuitively feel it’s going to be a great year.

Sleep well, Dream Big, Shelly

— Published on January 31, 2020https://thriveglobal.com/stories/recharge-recover-quality-sleep-athletes-exercise-science-performance/