1. S&P Post-Election Rally Only Gains Back 2 Week Sell-Off.

S&P Still Below Sept Highs

S&P Still Below Sept Highs

I heard this stat from Joel Greenblatt interview on Masters in Businesshttps://www.bloomberg.com/podcasts/masters_in_business?sref=GGda9y2L

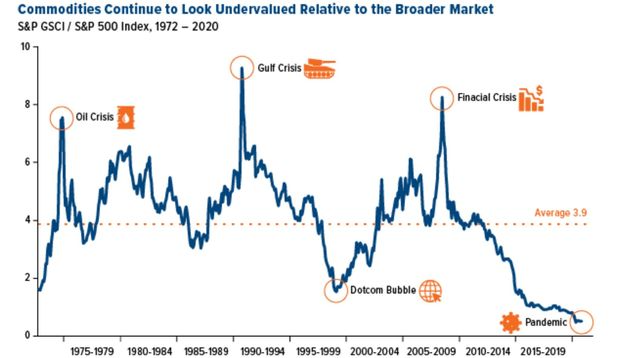

Commodity Index vs. S&P Historical

Goldmannotesearnings beats are not being rewardedand misses are getting sold

Continue reading