1.IWM Russell 2000 Small Cap Had Worst Quarter Ever.

Small Cap Russell 2000 ETF

https://money.cnn.com/quote/etf/etf.html?symb=IWM

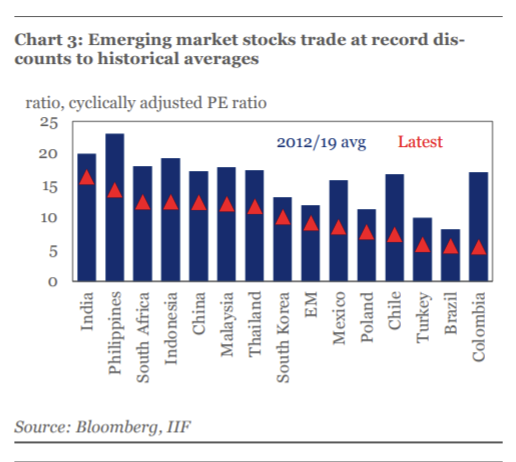

2.Emerging market stocks trade at record 65% discount to U.S. after $18 trillion global equity wipeout

Concerns about growth outlook, commodities, debt servicing will weigh on near-term risk appetite: IIF

The global financial rout triggered by the COVID-19 pandemic wiped $18 trillion off global equity markets in the year to date — and emerging markets, in particular, have been beaten down relative to the rest of the world.

Data from the Institute for International Finance shows that the discount emerging markets hold relative to U.S. equities now stands at 65%, the largest ever. Indeed, emerging markets are trading at record discounts to a range of historical averages, the IIF noted (see chart below).

Institute for International Finance

That might make emerging markets sound appealing to bargain hunters, but there’s still reason for caution.

“While valuations at these levels are compelling from a long-term perspective, concern about the outlook for growth and commodity prices — coupled with the immediate threat of the virus for underdeveloped health care systems — will weigh on risk appetite,” IIF economists said in a weekend note.

The MSCI Emerging Markets Index 891800, +2.65% is down 25.4% year to date versus a 23% fall for the S&P 500 SPX, 2.994%. The emerging markets index is down 23.4% over the last 12 months versus a 14% decline for the S&P 500.

The emerging-markets rout has had much to do with the stresses on the global financial system sparked by the pandemic. A rising tide of dollar-backed loans around the world, but particularly in emerging market economies, contributed to a global scramble for the U.S. currency that was blamed for amplifying the stock-market selloff and volatility across financial markets. Efforts by the Federal Reserve and other central banks have been credited with helping to ease those funding pressures at least in the short term.

Meanwhile, a rebound in oil prices, if sustained, may offer some respite. The IIF economists noted that the positive correlation between emerging-market stocks and commodity prices remains near all-time highs. Oil futures bounced sharply at the end of last week on hopes for a deal between Saudi Arabia and Russia that would end a price war that’s threatened to flood the world with unneeded crude at the same time that demand fell off a cliff due to the pandemic.

Oil plunged in March, with Brent crude BRN00, 1.936%, the global benchmark, hitting a 17-year low.

Emerging markets are also dealing with rising fears of sovereign debt distress.

With a rising number of countries looking to the International Monetary Fund for emergency financial assistance, the cost of insuring sovereign bonds against default is up sharply for many emerging-market and low-income countries, the IIF noted, with energy exporters suffering the biggest hit.

Outstanding public and publicly guaranteed long-term external debt stands at over 25% of GDP, leaving many low- and lower-middle-income countries now face much higher debt-servicing costs than a decade ago.

Institute for International Finance

“Facing the prospect of a sharp contraction in global trade and remittance flows, the strength of the U.S. dollar represents a major challenge for many sovereigns,” the IIF wrote. “Nearly 65% of public and publicly guaranteed external debt in low income countries is in U.S. dollars.”

High-frequency data on sovereign borrowing shows that around $180 billion of bonds and loans are due to mature across 89 low- and middle-income countries through the end of the year, the IIF said, with African countries responsible for nearly half the total.

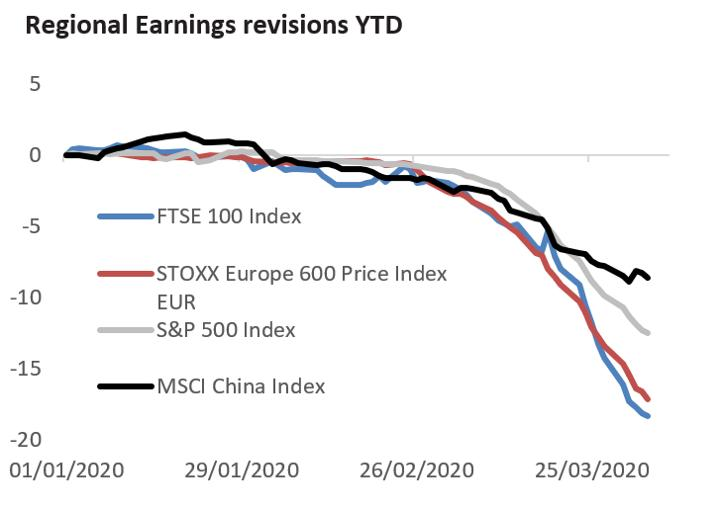

3.S&P Earnings Estimates Have Only Been Revised Down 13.1%

S&P 500 earnings estimates have only been revised lower by 13.1% this year. They started the year with 12% expected growth, so we have gotten to the point where analysts are now forecasting no earnings growth for 2020.

Patrick Armstrong -Plurimi Wealth

https://www.linkedin.com/in/patrickarmstrongcfa/

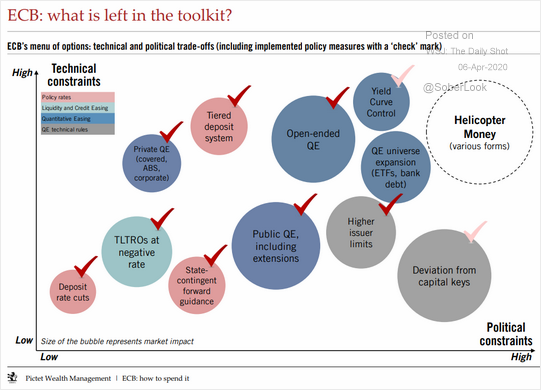

4.Euro Central Bank—Any Bullets Left?

Source: Pictet Wealth Management

The Daily Shot https://blogs.wsj.com/dailyshot/2020/04/06/the-daily-shot-some-americans-by-filing-for-unemployment/

5.10 Worst Days U.S. Stocks 1980-2019

Hartford Funds

6.Mad Dash for Cash and Liquidity.

YARDENI RESEARCH. The virus pandemic triggered a pandemic of fear during March. As a result, there was a mad dash for cash during the month. Liquid assets soared $685 billion during the four weeks through March 23. Estimates by the Investment Company Institute show investors pulled $265 billion out of bond mutual funds and ETFs, and $56 billion out of similar equity funds during the four weeks through March 25.

Ed Yardeni https://www.linkedin.com/in/edward-yardeni/

7.However…Dash for Cash is Not Near 2008 Crisis Levels.

The Flight to Safety “March 2020 saw a huge move to cash among investors relative to recent years. However, the aggregate cash holdings are nowhere near the levels seen during the GFC or the end of the DotCom bubble.” https://buff.ly/3e88wZh

Ritholtz Wealth

8.The S&P 500 is mostly concerned with duration (chart)

Posted April 7, 2020 by Joshua M Brown

Building on my post from the other day, ‘Not Depth…Duration’, I want to show you something from this morning’s Bank of America Merrill Lynch Chart Blast – it shows a very correlation between how bad the drawdowns for the S&P 500 are versus the amount of months a recession goes on for. The longer the recession, the worse the stock market’s trough. In other words, the eye-popping “30 PERCENT DECLINE IN GDP” stuff is missing the point. It’s not how bad things get at their worst, it’s for how long it goes on for that the stock market usually reacts to. BofA looked at recessions going back to 1928 to create this chart:

Recession duration vs S&P 500 selloffs Recession duration provided the strongest indication of how sharp S&P 500 selloffs would be with a 0.69 R squared. In discussing the eventual recovery, The BofA economics team notes that ultimately, what level activity returns to depends critically on the response of confidence and demand, and the effectiveness of macro stimulus. Indeed, the longer the shutdown, the deeper the wounds that need to heal before confidence fully returns. Our work shows this view on the impact of duration of contraction is generally true, beyond the scope of the pandemic.

Source:

Sizing up recessions: The extent of contraction and market corrections

Bank of America Merrill Lynch – April 7th, 2020

9.Walgreens to open 15 drive-thru testing sites for the coronavirus across 7 states

KEY POINTS

· Walgreens plans to open 15 drive-thru testing locations across seven states, starting later this week.

· The sites will be in Arizona, Florida, Illinois, Kentucky, Louisiana, Tennessee and Texas.

· The pharmacy chain said it worked with Department of Health and Human Services to select the locations based on where COVID-19 cases are rising.

· The drive-thrus will use Abbott Laboratories’ rapid COVID-19 test.

Walgreens said Tuesday that it plans to open 15 drive-thru testing locations for the coronavirus across seven states, starting later this week.

The sites will be in Arizona, Florida, Illinois, Kentucky, Louisiana, Tennessee and Texas, the drugstore chain said in a news release. They will use Abbott Laboratories’ rapid COVID-19 test.

Walgreen’s expansion of drive-thru testing marks the acceleration of an effort that the White House announced more than three weeks ago. President Donald Trump met with leaders of major U.S. retailers and health-care companies March 13 and announced in the Rose Garden that four companies — Walmart, Target, CVS Health and Walgreens — would host drive-thru testing in their parking lots. The U.S. has lagged behind other countries in the availability of coronavirus testing.

Since then, only about a handful of sites have opened in the retailers’ parking lots. Most are staffed by government health-care workers. Walmart has two drive-thrus and Walgreens has one drive-thru in the Chicago area, but they restrict tests to first responders. CVS has a drive-thru in Massachusetts and said Monday that it would open two new drive-thru locations: one in Atlanta and one near Providence, Rhode Island. These latest sites are not in CVS parking lots, but at larger locations that can support multiple lanes of cars.

In interviews, Walmart and CVS executives have acknowledged challenges with the rollout, saying it’s been difficult to get protective gear for workers and has taken time to coordinate with state and federal officials.

Walgreens said in a news release that it chose the new sites with the Department of Health and Human Services based on anticipated hot spots for cases of COVID-19. It said it expects to test up to 3,000 people per day across the sites.

Tests will be by appointment only. Walgreens pharmacists will oversee the testing, which will be outside of the stores. Members of the public who show COVID-19 symptoms will fill out an assessment on Walgreens’ website or its app. If they qualify for the test, they will make an appointment for a drive-thru site.

Testing is free for people who meet the Centers for Disease Control and Prevention’s criteria. The rapid COVID-19 test, which the sites will use, delivers positive results in as little as five minutes and negative results within 13 minutes.

Walgreens president Richard Ashworth said the pharmacy chain learned how to scale test sites after opening its first location in Massachusetts.

“We’re continuing to do everything we can, both with our own resources and also by partnering with others, to serve as an access point within the community for COVID-19 testing,” he said.

10. 10 Ways to Cut Down on Screen Time

By Scott Bedgood | March 31, 2020 | 0

Recently, I’ve been getting the dreaded Screen Time notifications, telling me that my time looking at my phone has increased by a significant margin. I know I’m not alone these last few weeks, and it makes sense—so many of us are sitting at home a lot these days.

Although our phones are beneficial in these disconnected times—right now, it’s often the only way we can see our friends or our families—I have to be honest, when I look at what I’m using my phone for the most, it isn’t for that.

It’s for things like this NASCAR game I got suckered into downloading thanks to an Instagram ad. I don’t even like NASCAR! But such is the level of my boredom, and I was instantly hooked.

The point is, with all the benefits of our phones, there’s also drawbacks to staring at it all day.

So, while we’re all on our couches, scrolling away, it seems fitting to share some ideas for cutting down on screen time. Pulling yourself away from the notifications and social media apps—and yes, racing games—will make you feel better about your day. Choose at least one to start!

1. Set screen-time limits.

This is the easiest way to cut down on your screen time. Apple has a way to set time limits on individual apps, groups of apps or your whole phone. You can even set dark hours for when you don’t want to use your phone, like when you go to bed and when you first wake up. If you really want to get serious about it, have someone you live with put in the password so you can’t easily get around your own regulations.

2. Delete time-sucking apps.

If you feel like even 30 minutes on a certain app is draining you, just delete it! Deleting time-sucking apps removes temptation, and the clean home screen feels good, too. If you don’t trust your self-control and want an added obstacle, you can set your content restrictions so that you can’t download new apps. You can find your password keeper if you must download something.

3. Read a “real” book.

Digital reading is an amazing thing. E-readers are convenient and great for traveling or poolside. But there’s nothing quite like cracking open a physical book, is there? They have a certain smell and feel to them that’s more soothing than a device. And being at home, especially in this uncertain time, why not choose the thing that brings you a sense of comfort? Plus, a book doesn’t come with the ability to pull up an internet browser the second you get distracted by something.

If your bookshelf needs some TLC, order a book from a local bookstore to support your community! Try a personal development classic you’ve been meaning to read, or one you’ve never heard of to mix things up—either way, you’ll find it beneficial.

4. Listen to a podcast.

Now, this idea does require you to use your phone, but just to start; you can press play and set your phone aside while you stream your favorite show. My wife runs a bakery out of our house and loves listening to entrepreneurship podcasts while she makes cookies. Time goes by faster, and she’s learning business skills while she bakes. You can squeeze in a listen during some of your daily activities, too, like walking the dog, cooking dinner, cleaning the house—and this kind of multitasking is approved.

Need some recommendations? Start with some of the SUCCESS New Thought Leaders:

5. Write down your workout plan.

Maybe this one seems odd, but the point here is to think of all of the ways that we rely on our screens and try to work around them. Streaming a workout video on your phone or computer is really helpful when you can’t go to the gym or the studio, but if you’re trying to go on a screen-time fast, there are other options. Like using a notebook to write out your workout plan, or a sheet of paper to print it off. Exercising is a great way to clear your mind, so don’t let a device interrupt that Zen.

6. Play a board game or a card game.

Board games are a great way to get the whole family together and away from all of your screens. Classic strategy games like Catan and Risk (that you normally might not have time to play) can stretch over multiple nights, now that you don’t have plans. Just you and your roommate or significant other? Try a strategic party game that’s playable with as little as two players, like Unstable Unicorns or Codenames. Or quicker games like Bananagrams. And if you live alone, there’s always a good old-fashioned deck of cards or that puzzle you started last week… And, of course, go outside in your yard if you have one! You can play lawn games like Spikeball, or put your woodworking skills to the test and make your own cornhole set.

7. Use a recipe book.

Quarantined at home is the perfect opportunity to learn to cook if you don’t usually have the energy after a long commute, or to try a new recipe if the kitchen is already your happy place. Home chef or not, your impulse is probably to hop on Pinterest or pull up your favorite food blogger’s Instagram to find inspiration, but if you’re looking for a true escape from the screen, how about dusting off the cookbooks that live on top of your refrigerator instead? There’s almost certainly some hidden gems in their pages. Or what about that family recipe you’ve never made yourself but loved to eat growing up? Combine two good things by calling your parents or grandparents to check in and ask for the recipe. Write it down on a notecard so you can keep it in your kitchen and consult it—no screen required!

8. Leave your phone outside the bathroom and the bedroom.

It’s OK to admit that you take your phone in the bathroom with you; most people do. But it’s actually a good time to unplug. If you’ve been quarantined with little kids or a clingy roommate for weeks, sometimes those quiet moments are few and far between. Sit quietly with your thoughts, or leave a magazine in the bathroom if you want to be occupied.

Also, a tip I got from Robin Sharma’s book The 5 AM Club: Buy an old-school alarm clock and leave your phone in another room at night. The light emitted by your phone makes it harder to sleep, and if you’re working on being more self-disciplined, the faster you fall asleep, the easier it is to get up early and win the day.

9. Set specific times to check email and notifications.

OK, so you’ve set those screen-time limits as your very first step, but you also need to be checking your emails to make sure you don’t miss anything important. Try setting specific times to check everything. Whether that’s every three hours, or one five-minute period per hour, or once a day, depends on your work and personal situation. Find what works for you, and you won’t be needlessly refreshing your email or reacting to notifications every five seconds anymore.

10. Mail handwritten letters.

Handwritten letters are just more thoughtful and personal than text or email. Video calls, of course, are a wonderful way to stay connected in a disconnected world, but snail mail is always a special surprise. Send your grandparents a card (wash your hands first!), or have your kids write letters to family members or friends. Bring back the joy of pen pals!

I am far from the model citizen when it comes to limiting screen time, but that also means I’ve tried lots of different things over the years, and these are some of my quick wins and efforts that have made me better. Try them out for yourself, and come up with solutions of your own.

You’re probably reading this on a screen, so now’s the time to put the phone down and step away. I’ll be doing the same, but first I’ve got to check on my NASCAR driver… Wait, nope. I deleted that app!

Photo by GaudiLab/Shutterstock.com