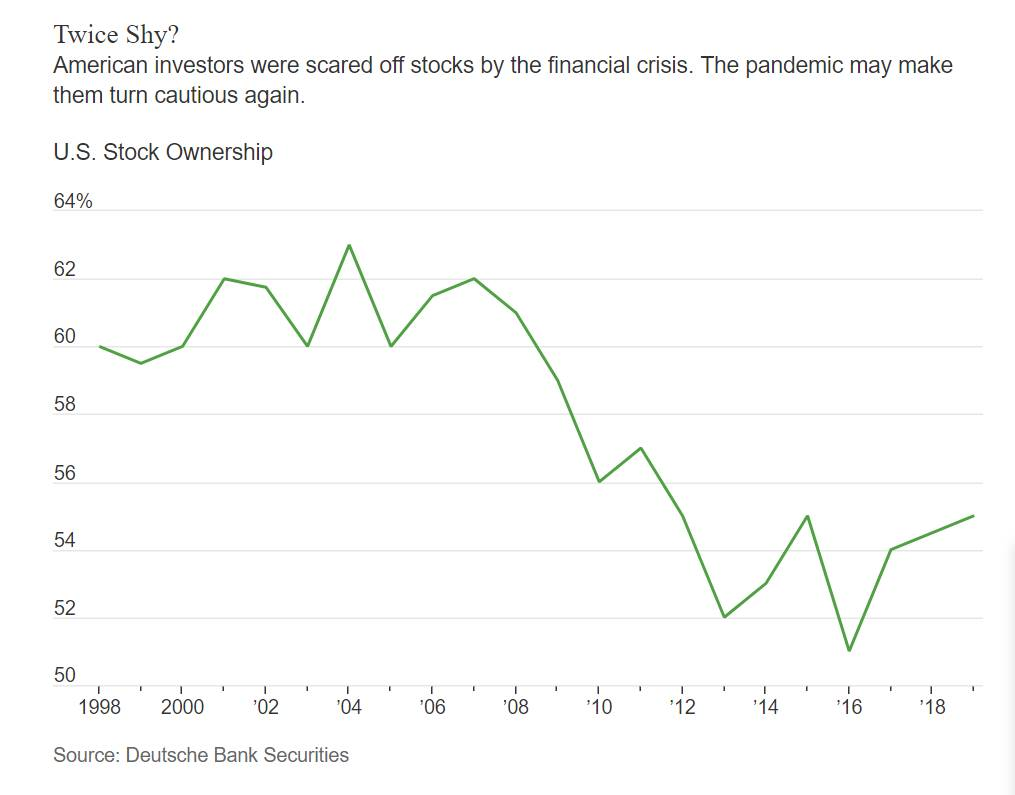

1.Stock Ownership by American Investors Never Came Close to Recovering to 2000 and 2008 Levels

Barrons

Get Ready for a PostCoronavirus World. The Economy Will Never Be the Same.–By Reshma Kapadia

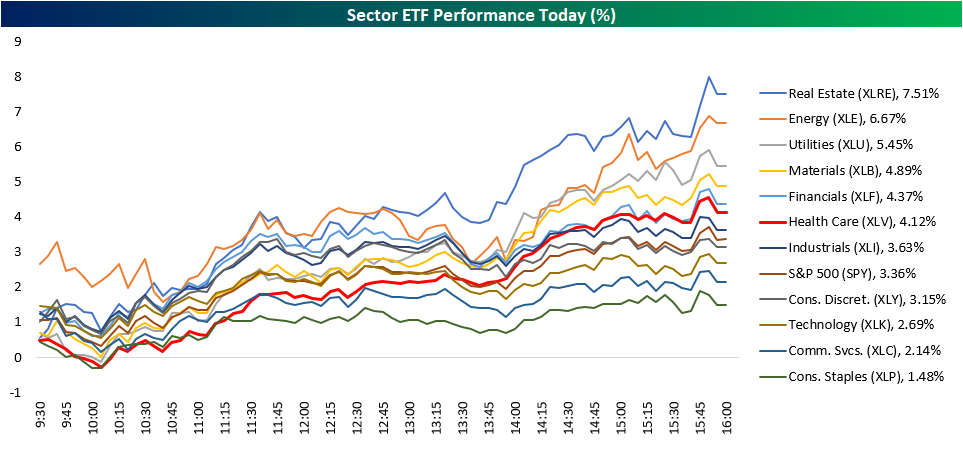

2.Small Cap Stocks Outperform During Rally Week.

Last week IWM Russell 2000 Small Cap +15% vs. S&P +12%

3.Big Annual Stock Market Declines Are Rare.

LPL BLOG

4.Bitcoin -46% in March.

Bitcoin was not defensive during downturn.

https://www.coindesk.com/price/bitcoin

5.MOVE Index (bond vol) vs. VIX (stock vol)

I am not familiar with this comparison but Jim Paulsen in Barrons below ….

Volatility Anomaly Bodes Well

Paulsen’s Perspective

by The Leuthold Group

April 7: A rare situation currently [is] evident within the financial markets. The stock market’s VIX volatility index remains near its 99th percentile since 1990, but the bond market’s MOVE volatility index has recently collapsed and is now lower than 84% of the time. This combo—a very high VIX with a low MOVE—has historically happened less than 10% of the time.

Moreover, when stock and bond volatility has been this diverse—stock vol very high, with bond vol below average—stock market returns have typically proved to be superior. When financial-market volatility is in the state it is currently, although the stock market has tended to be about 22% more volatile (i.e., the standard deviation of returns is about 21.4% versus 17.5%), the average annualized price performance of the S&P 500 has been [an] almost 21% gain Who knows what the next several weeks will bring for the stock market? A retest of its March lows? A new crisis low? Or a surprising grind higher? Nonetheless, facing such uncertainty with a rare VOL anomaly has historically proved comforting for the stock market.compared with only a little more than 7% the rest of the time.

10 Year Treasury Note Volatility Spike Last Month

FRED St Louis FED

https://fred.stlouisfed.org/series/VXTYN

6.Infection Curve State of Development.

This reduction in new cases is the result of a sharp drop in the number of susceptible targets (i.e., cutting new contacts), which means that curve control is working with both China and Korea now well into the recovery stage, while Germany, Spain and Italy are at or near the curve peak, with US, France, the UK and several other nations close behind.

This is certainly impressive considering what the curve looked like just two weeks ago:

ZERO HEDGE

https://www.zerohedge.com/health/where-world-corona-curve-moment-update

7.Sector ETF Comparison on Big Bounce Last Wed.

Bespoke Investment Group-Biggest Laggards Bounce

8.Peter Lynch-13 Characteristics of a Stock to Buy.

ValueWalk

Full Interview

9. New Report: 40% of Older Americans Rely Solely on Social Security for Retirement Income

Social Security Kept More Than 7.5 Million Households Out of Poverty, Reduced Public Assistance Costs by $10 billion in 2013

Pensions Kept Nearly One Million Retirees Out of Poverty, Reduced Public Assistance Costs by $4 Billion in 2013

WASHINGTON, D.C., January 14, 2020 – Only a small percentage of older Americans, seven percent, receive income from Social Security, a defined benefit pension, and a defined contribution account. Retirement income from these three sources is widely considered to be the ideal situation to ensure retirement security, particularly for the middle class. Retirees with these three sources of income are far less likely to face poverty and economic hardship.

A new report also finds that a large portion (40 percent) of older Americans rely only on Social Security income in retirement. Social Security alone is not considered sufficient for a secure retirement, and it was not intended to stand alone. Typically, benefits from Social Security replace approximately 40 percent of pre-retirement income. Most financial planners recommend at least a 70 percent income replacement rate for retirees, while others say this should be even higher given longer lifespans and rising health costs. In fact, the analysis indicates that if Social Security income had been ten percent greater in 2013, there would have been about 500,000 fewer older households in poverty.

These findings are contained in a new report from the National Institute on Retirement Security (NIRS), Examining the Nest Egg: The Sources of Retirement Income for Older Americans. The report is co-authored by Tyler Bond, NIRS manager of research, and Dr. Frank Porell, University of Massachusetts Boston professor emeritus.

Download the report here. Register here for a webinar scheduled for Wednesday, January 15, 2020 at 2:00 PM ET.

The analysis also finds that without income from Social Security in 2013, the number of poor older U.S. households would have increased by more than 200 percent to 11 million households. Absent income from defined benefit pensions, the number of poor older households would have increased by 19 percent to more than four million households in 2013. Defined contribution plans, however, are less powerful at keeping older households out of poverty than pensions and Social Security because fewer near-poor households have assets in 401(k)-style defined contribution accounts and income from those accounts provided a smaller portion of total income. Without income from defined contribution accounts, the estimated number of poor older households would have increased by five percent.

This report examines the sources of retirement income for older Americans to determine how many older Americans achieve the “three-legged stool” of retirement savings: Social Security; a DB pension plan; and individual savings, typically through a DC account. Additionally, this report considers how sources of retirement income vary by gender, race and education. The study also estimates how different sources of retirement income impact poverty status, hardship, and public assistance and Medicaid costs.

More specifically, the impact of retirement income on public assistance and Medicaid costs, Social Security again had the strongest impact. Without Social Security income in 2013, the number of older households receiving public assistance would have increased by nearly 45 percent, while the number of older persons receiving Medicaid would have increased by more than 40 percent. Without income from pensions, the number of older households receiving public assistance would have increased by almost 19 percent, and the number of older persons receiving Medicaid would have increased by more than 15 percent. The impact of defined contribution income receipt was smaller for both measures.

Without income from defined benefit pensions, the combined costs for public assistance and Medicaid benefits to older households would have increased by almost $13.5 billion in 2013. Without Social Security income, combined costs would have increased by nearly $34 billion in 2013.

10.A Crisis Can Make You Better. But Only If You Have This Mindset

Sign up for the Daily Stoic Alive Time Challenge—14 days of actionable challenges rooted in the best of Stoic philosophy—and emerge from this crisis stronger!

***

Before he was an oilman, John D. Rockefeller was a bookkeeper and aspiring investor—a small-time financier in Cleveland, Ohio. The son of a criminal who’d abandoned his family, the young Rockefeller took his first job in 1855 at the age of sixteen (a day he celebrated as “Job Day” for the rest of his life). All was well enough at fifty cents a day.

Then the panic struck. Specifically, the Panic of 1857, a massive financial crisis that originated in Ohio and hit Cleveland particularly hard. As businesses failed and the price of grain plummeted across the country, westward expansion quickly came to a halt. The result was a crippling national depression that lasted for several years.

It was a situation similar to what we’re in today with COVID-19. Business closed, the stock market plummeted, and bankruptcies skyrocketed.

Rockefeller could have gotten scared. Here was the greatest market depression in history and it hit him just as he was finally getting the hang of things. He could have pulled out and run like his father. He could have quit finance altogether for a different career with less risk. But even as a young man, Rockefeller had sangfroid: unflappable coolness under pressure. He could keep his head while he was losing his shirt. Better yet, he kept his head while everyone else lost theirs. “The more agitated others became,” biographer Ron Chernow wrote, “the calmer he grew.”

It echoed what Marcus Aurelius wrote in his Meditations nearly 2,000 years before:

“Be like the rock that the waves keep crashing over. It stands unmoved and the raging of the sea falls still around it.”

And so instead of bemoaning this economic upheaval, Rockefeller, like Marcus, observed the momentous events. Almost perversely, he chose to look at it all as an opportunity to learn, a baptism in the market. He quietly saved his money and watched what others did wrong. He saw the weaknesses in the economy that many took for granted and how this left them all unprepared for change or shocks.

The same choice we have in front of us today.

From the first crisis he experienced, Rockefeller internalized an important lesson that would stay with him forever: The market was inherently unpredictable and often vicious—only the rational and disciplined mind could hope to profit from it. Speculation led to disaster, he realized, and he needed to always ignore the “mad crowd” and its inclinations. There is always a countermove, always a way through, a path is always there for those willing to look for it then take it.

It was this intense self-discipline and objectivity that allowed Rockefeller to seize advantage from obstacle after obstacle in his life, during the Civil War, and the panics of 1873, 1907, and 1929. As he once put it: He was inclined to see the opportunity in every disaster. To that we could add: He had the strength to resist temptation or excitement, no matter how seductive, no matter the situation.

For the rest of his life, the greater the chaos, the calmer Rockefeller would become, particularly when others around him were either panicked or mad with greed. He would make much of his fortune during these market fluctuations—because he could see while others could not. This insight lives on today in Warren Buffet’s famous adage to “be fearful when others are greedy and greedy when others are fearful.” Rockefeller, like all great investors, could resist impulse in favor of cold, hard common sense.

Was he born this way? No. This was learned behavior. And Rockefeller got this lesson in discipline somewhere. It began in that crisis of 1857. In what he called “the school of adversity and stress.”

“Oh, how blessed young men are who have to struggle for a foundation and beginning in life,” he once said. “I shall never cease to be grateful for the three and half years of apprenticeship and the difficulties to be overcome, all along the way.”

Or as another stoic Epictetus said:

“The true man is revealed in difficult times. So when trouble comes, think of yourself as a wrestler whom God, like a trainer, has paired with a tough young buck. For what purpose? To turn you into Olympic-class material.”

Of course, many people experienced the same perilous times as Rockefeller—they all attended the same school of bad times. But few reacted as he did—without the pestilence of panic or fear. Few had the discipline in perception to see clearly that there is a proper course of action in every situation. Not many had trained themselves to see opportunity inside this obstacle, that what befell them was not unsalvageable misfortune but the gift of education—a chance to learn from a rare moment in economic history.

A rare moment much like we’re in now with COVID-19. The stock market has lost 30% in the past month. The US government announced an unprecedented $2 trillion bailout package. Many people will face real crises, many will not emerge from the other side stronger. We can see disaster rationally. Or rather, like Rockefeller, we can see opportunity in every disaster, and transform this crisis into an education, a skill set, or a fortune. Seen properly, everything that happens is a chance to move forward. If we are able:

· To be objective

· To control emotions and keep an even keel

· To choose to see the good in a situation

· To create opportunities

· To exercise patience

· To take advantage of the mistakes less disciplined people make

· To steady our nerves

· To embrace the present moment

· To focus on what we control

As many have said, we are living through history. It’s up to you if you’ll see this as just a crisis, or as an opportunity. Will you lose your emotions, or remain calm? Will you focus on playing the blame game, feeling sorry for yourself or on your response? What will you do next? That’s the question.

Desperation, despair, fear, powerlessness—these reactions are functions of our perceptions. You must realize: Nothing makes us feel this way, as the Stoics would say, events are objective. Our opinions make them “positive” or “negative.” We choose to give in to such feelings. Or, like Rockefeller, Marcus Aurelius, or Epictetus, choose not to.

And it is precisely at this divergence—between how Rockefeller perceived his environment and how the rest of the world typically does—that his nearly incomprehensible success was born.

This is your opportunity to develop your own cautious self-confidence. To perceive what others see as negative, as something to be approached rationally, clearly, and, most important, as an opportunity—not as something to fear or bemoan.

BY RYAN HOLIDAY