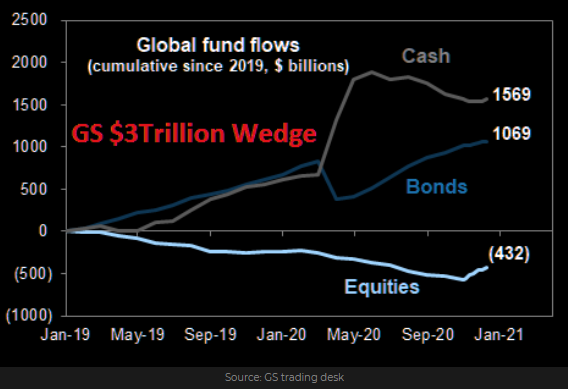

1. Textbook Investor Behavior…Largest 5 Week Period of Global Equity Flows Ever.

Global Equities logged +$133B worth of inflows over the past 5 weeks. This is the largest 5 week period on record by ~30% – GS Traders note January is right around the corner and this is when 37% of the YEARLY rebalances takes place. Potentially as much as $100bn of equity inflow is a guesstimate.

From Dave Lutz at Jones Trading

Continue reading