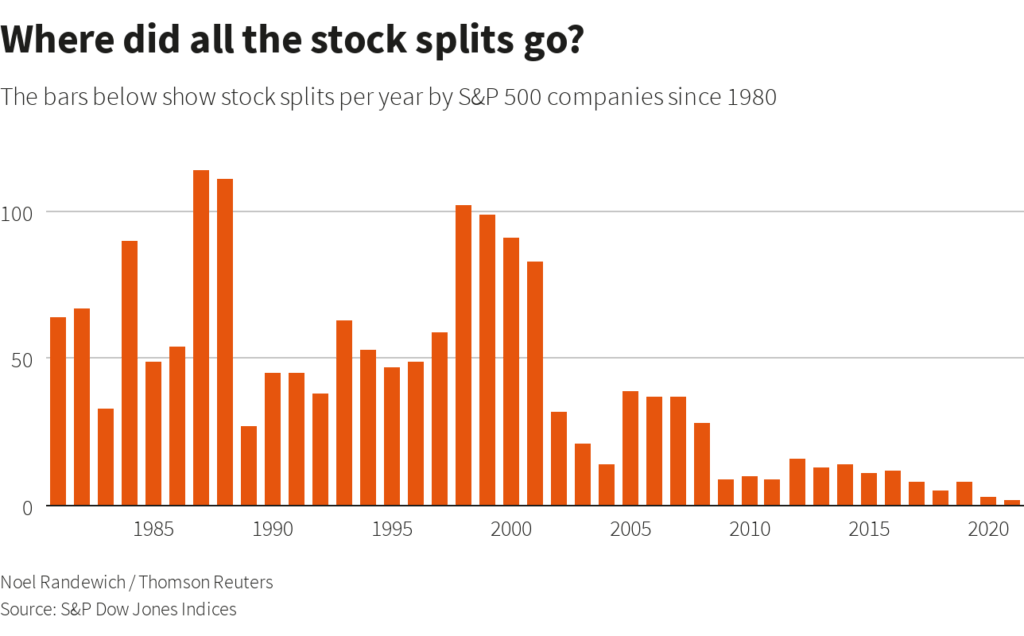

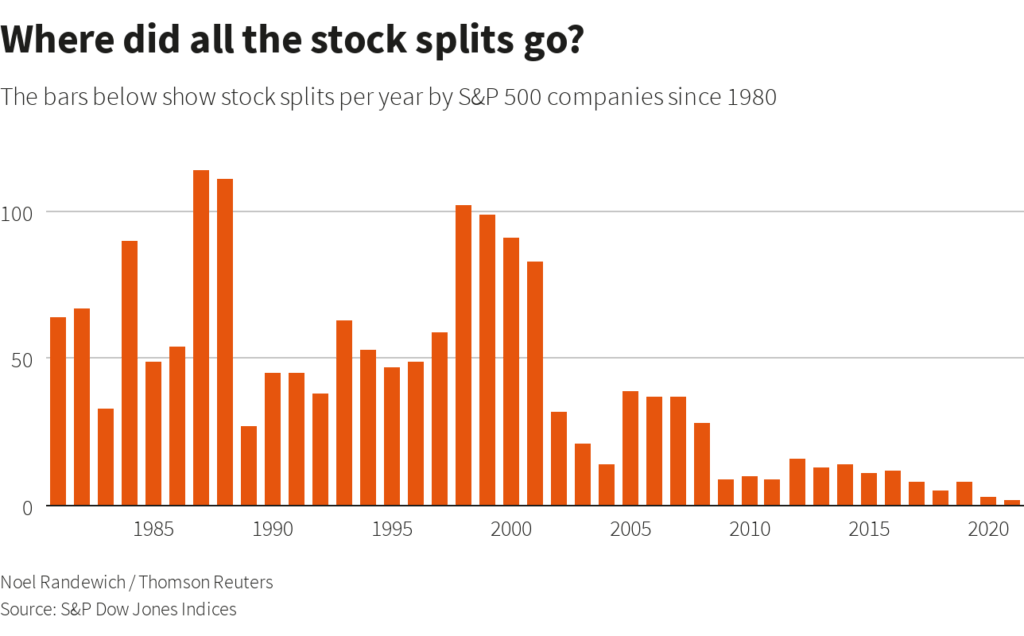

1. With Some 1999 Like Behaviors Starting to Perculate..It Will Be Interesting to See if we get a Spike in Stock Splits

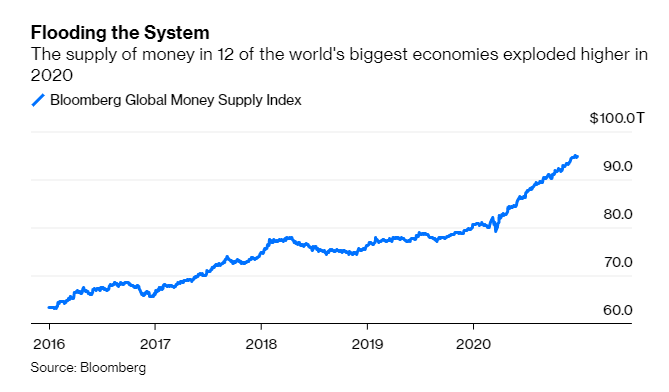

The answer is much simpler and comes down to one number: $14 trillion. That’s the amount by which the aggregate money supply has increased this year in the U.S., China, euro zone, Japan and eight other developed economies. To put the surge in perspective, the jump to $94.8 trillion exceeds all other years in data going back to 2003 and blows away the previous record increase of $8.38 trillion in 2017, according to data compiled by Bloomberg

“I can’t invest now. The stock market is too high.”

Everybody who has ever put a dollar into the market has had this thought at some point in time. But all-time highs are nothing to fear. In fact, returns are stronger after all-time highs because rising prices attract more buyers which leads to higher prices. This tends to continue until something comes along and knocks this cycle off of its course.