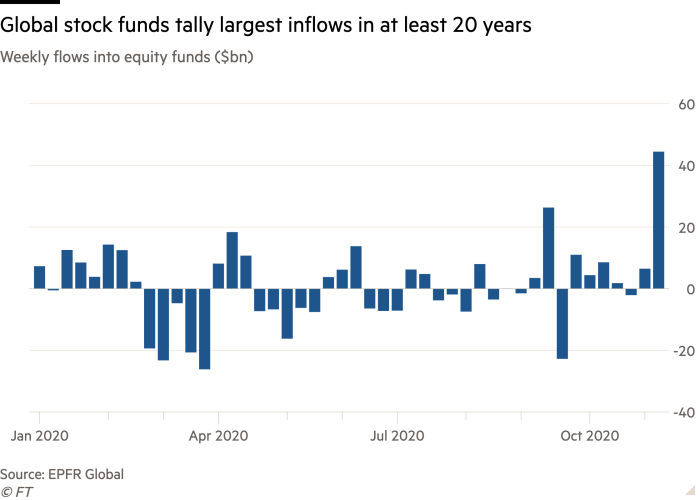

1. Everyone in the Pool…….The Last 2 Months of 2020 Saw the Largest Flow into Equity Funds on Record Over Such a Period

2. The Narrowing of Market Breadth Breaks 1999 Records

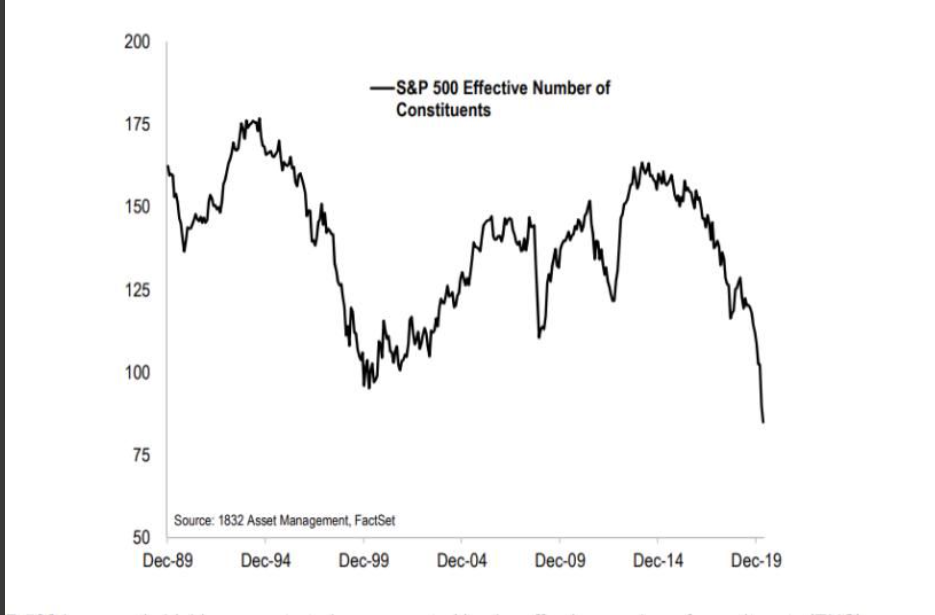

THE INCREDIBLE SHRINKING MARKET

The number of companies required to mimic the performance of the S&P 500 had fallen to an all-time low at year-end 2019 to just 83. The ensuing strength of the FAANGs, Microsoft, Tesla et al means the effective number is now even lower.

The narrowing of market breadth now exceeds the previous low reached at the peak of the internet bubble in 1999. The sharp decline of the number of companies required to replicate the performance of the S&P 500 over the past 5 years coincided with the accelerating popularity of passive investing strategies. These strategies diminish the effective number of index constituents by directing significant capital flows into the largest index components.

The downward pressure on the effective number of companies in the S&P 500 index is expected to continue if passive investing remains popular. The trend to fewer effective components increases the probability of increased volatility for the index in the years ahead as risk is distributed over fewer companies.

If you enjoyed this post, you’ll find the Global Investment Letter of value. To view free sample issues, videos and other content please visit: https://lnkd.in/eFcmX3v

#investing #markets #macroeconomics #economy #finance

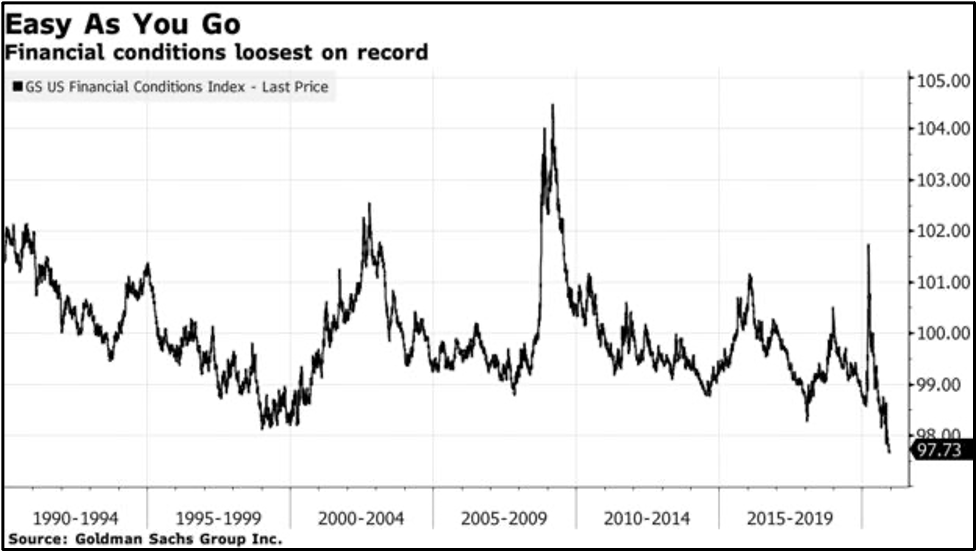

3. Goldman Financial Conditions Index at Record Low Levels.

“U.S. financial conditions are the easiest they’ve been in more than a quarter century as stock markets scale new heights on hopes of an end to the Covid-19 pandemic, according to an index compiled by Goldman Sachs Group Inc.” – Bloomberg 12/14/2020

The Fed Is Juicing Stocks

by Michael Lebowitz, 1/11/21

https://www.advisorperspectives.com/articles/2021/01/11/the-fed-is-juicing-stocks

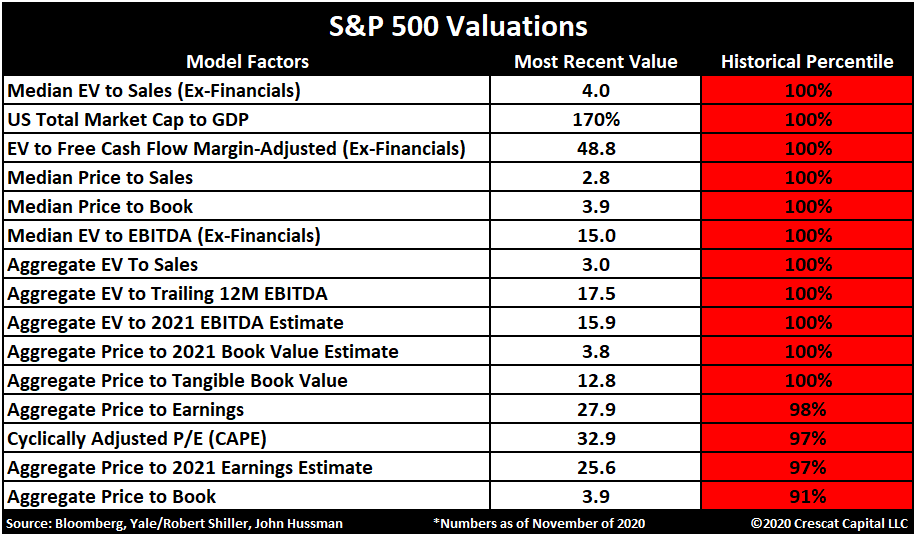

4. The Majority of Valuation Metrics are at 100% of Historic Percentile—The Market is Very Reliant on Rates Staying Low

Advisors Perspective BlogNotice that except for only 1929, 2000, and 2007, every other major market crash occurred with valuations at levels LOWER than they are currently. As shown in the table below from Tavi Costa at Crescat Capital, markets are currently trading in the top decile of valuations on many levels.

Yes, Virginia. There Is A Stock Market Bubble.-by Lance Roberts of Real Investment Advice, 1/11/21

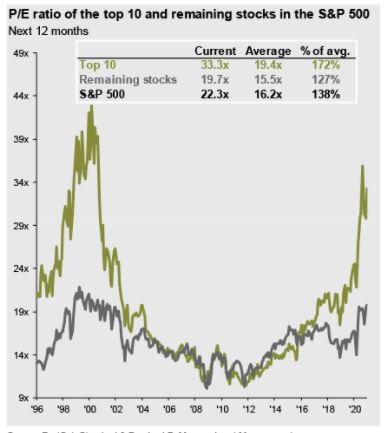

5. Here’s the Rub…From Michael Batnick…The Top 10 Stocks are Causing all the Over-Valuation

Let’s look at behavior, or price. The stock market is not going parabolic. The S&P 500 is up 3.6% over the last 30 days, which is in the 76th percentile going back to 1950. Warm? Sure. Hot? Not really.

A quick look at fundamentals also doesn’t support the bubble argument. At 33x earnings, you could make the case that there is froth in the top 10 stocks. I wouldn’t argue.

But what about the other 490 companies whose stocks trade at 19.7x earnings? Cheap? No. Bubble? Come on.

https://theirrelevantinvestor.com

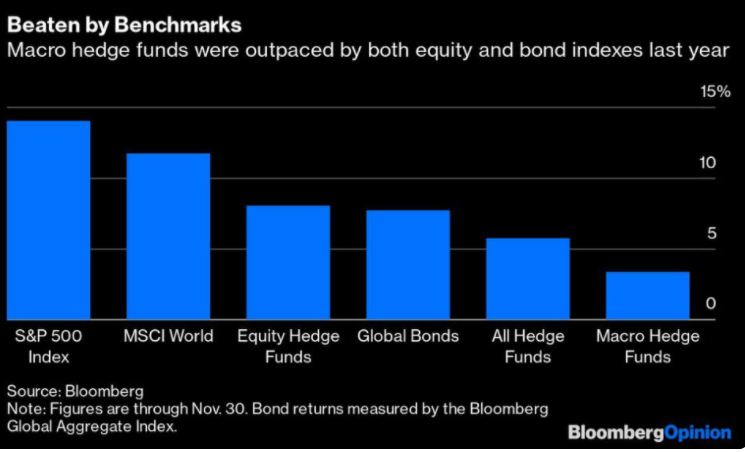

6. Bitcoin Prior to Crash was Getting Push From Hedge Funds Looking to Add Alpha After Tough Year

Bloomberg–After all, the cryptocurrency’s most vocal advocates nowadays aren’t plugged-in millennials but the hedge fund world’s baby boomers and Generation X-ers — Stanley Druckenmiller, Paul Tudor Jones — backing Bitcoin as the juice their global macro trade playbooks need. As an industry, hedge funds could use the help: While November saw them post their best collective performance for six years, according to data compiled by Bloomberg, that still wasn’t enough to match returns available from benchmark equity indexes. As a specific strategy, global macro funds lagged their peer group, the stock market and the returns from the global bond market.

What lures the “smart” money to Bitcoin as a trade is the very thing that makes it such a poor currency and an unreliable store of value in times of panic: It’s an illiquid, artificially scarce and volatile commodity whose price is driven by extreme sentiments of greed and fear. “Bitcoin is the perfect vehicle for exploiting mankind’s infinite stupidity,” says Julian Rimmer, a sales trader at Investec Plc. “A small percentage of one’s portfolio must be held in this ‘asset’ because gullibility never goes out of fashion.”

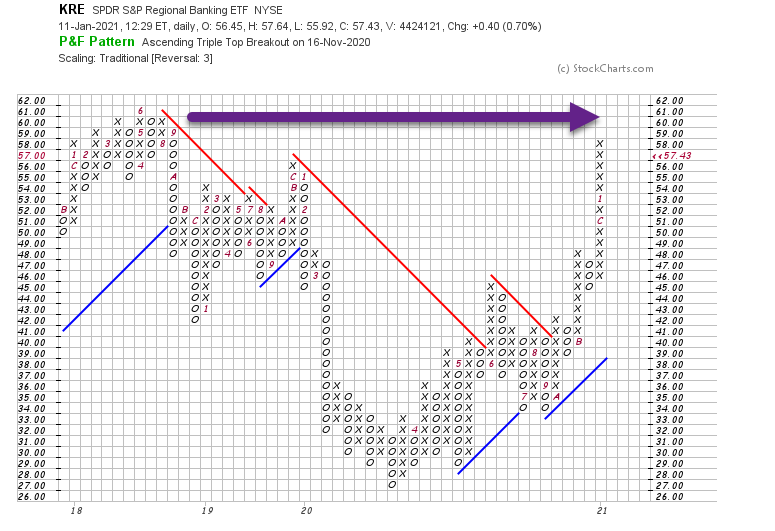

7. Bank Rally–KRE Close to Break-Out

Lagging Sector Regional Bank ETF making a run to 2017 highs

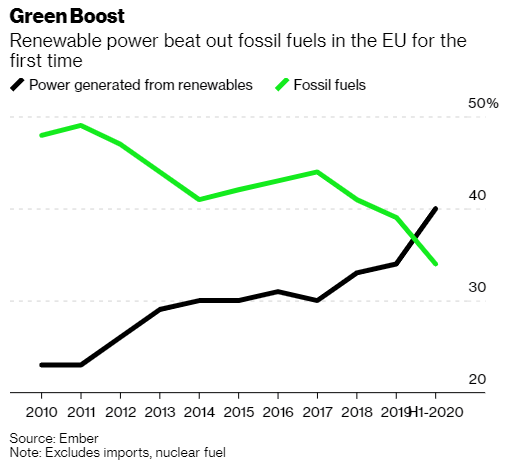

8. Renewable power beat out fossil fuels in the EU for the first time

Renewables top fossil fuels in European energy-During the height of the pandemic, when overall power demand sank, renewable power’s share of the grid surged in Europe. About 40% of the electricity in the first half of 2020 in the European Union came from renewable sources, compared with 34% from plants burning fossil fuels, according to environmental group Ember.

Green Boost

https://www.bloomberg.com/news/articles/2021-01-06/the-10-ways-renewable-energy-s-boom-year-will-shape-2021?sref=GGda9y2L

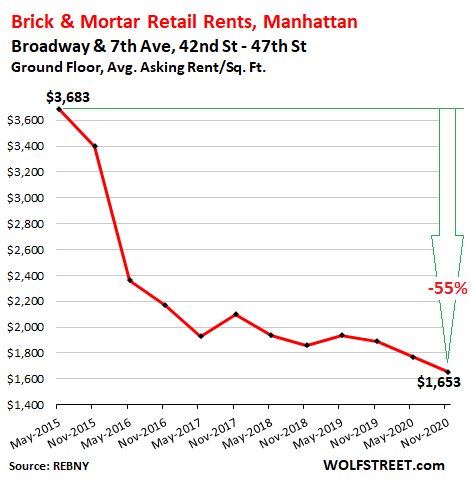

9. Brick and Mortar Retail Rents in Manhattan -40-50%

By Wolf Richter for WOLF STREET.

10. The Cone of Learning

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.