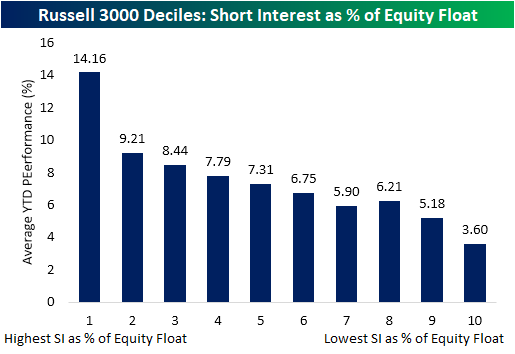

1. Best Performers 2021 -Decile of Stocks with the Highest Short Interest

Heavily Shorted Stocks Stand Tall in 2021-In the chart below, we show the average YTD performance of Russell 3000 stocks broken into deciles based on their short interest. The decile of stocks with the highest short interest as a percentage of float have by far been the best performers YTD, up for an average of 14.16%. Even excluding GME, the decile’s average YTD performance is a 13.93% gain. As you move across the deciles with lower short interest levels, performance gets worse. The tenth decile of stocks which consists of stocks with average short interest levels below 1% of float has only risen 3.6% on average.